SimonSkafar/E+ via Getty Images

Shares of Lucid Group (NASDAQ:LCID) have trended downwards after the company submitted its earnings card for the fourth-quarter. Lucid Group lowered its production guidance for FY 2022 by a significant margin, which helped to create pressure on the stock. Because of this drop, I believe Lucid Group’s prospects in the luxury segment EV market are now undervalued and a renewed engagement can make sense here!

Lucid downgrades production guidance

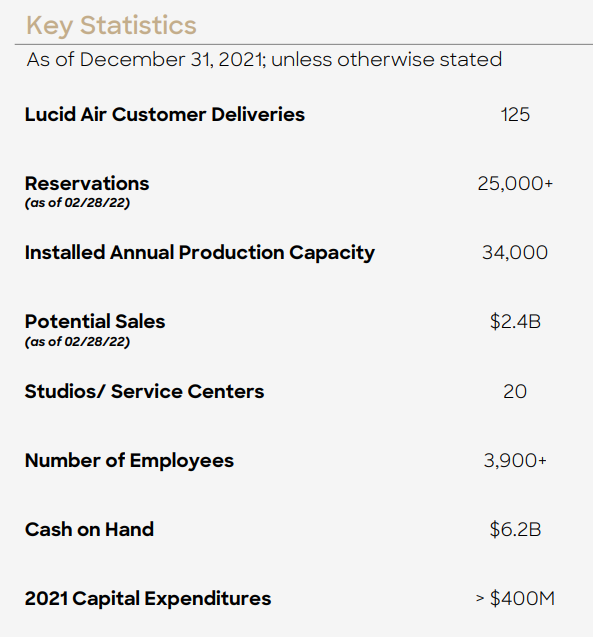

The EV startup disappointed lately by lowering its production guidance for the current fiscal year. The startup is looking to produce, according to its revised guidance included in last quarter’s earnings card, just 12-14 thousand electric vehicles this year, including the Lucid Air base model, the Lucid Air Grand Touring, the Air Dream Edition Performance and the Air Dream Edition Range. The company previously expected to produce about 20 thousand units this year, meaning the new production guidance for FY 2022 implies a decline of at least 30%. So far, Lucid Group delivered 125 electric vehicles and will, despite a revised production guidance, manufacture and produce a material number of EVs this year.

Lucid also said that it had amassed about 25 thousand reservations for its different EV models at the time of the earnings release at the end of February. In November, Lucid had about 17 thousand reservations. Total reservations now have a combined value of $2.4B.

Lucid

Lucid’s core strength: An impressive balance sheet

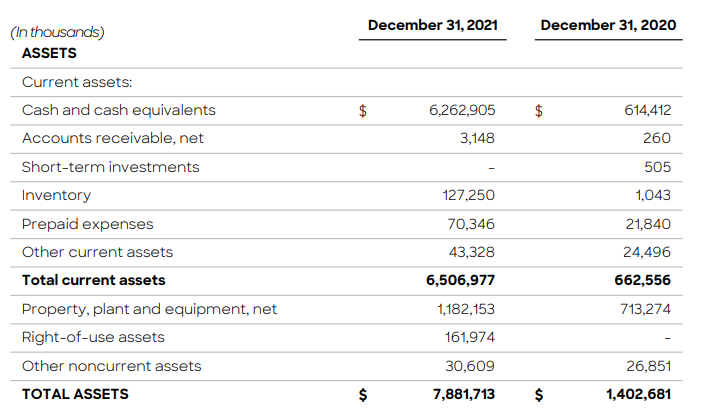

Besides an impressive first production car, Lucid has something that many other EV players don’t have: A cashed up balance sheet. Lucid had more than $6B in liquidity on its balance sheet at the end of the last fiscal year which gives the EV startup plenty of liquidity to finance the ramp of the Lucid Air and fund the expansion of its manufacturing facility in Arizona. Lucid’s AMP-1 production plant currently has a capacity of 34 thousand EVs, but the company targets to produce 90 thousand EVs annually longer term.

A $2.0B convertible senior notes offering added to Lucid’s resources in the fourth-quarter. Lucid has one of the best balance sheets in the EV sector and enough cash to see through the ramp of its first production car, the Lucid Air, even if it means production will initially be delayed.

Lucid

Free cash flow is going to ramp up significantly

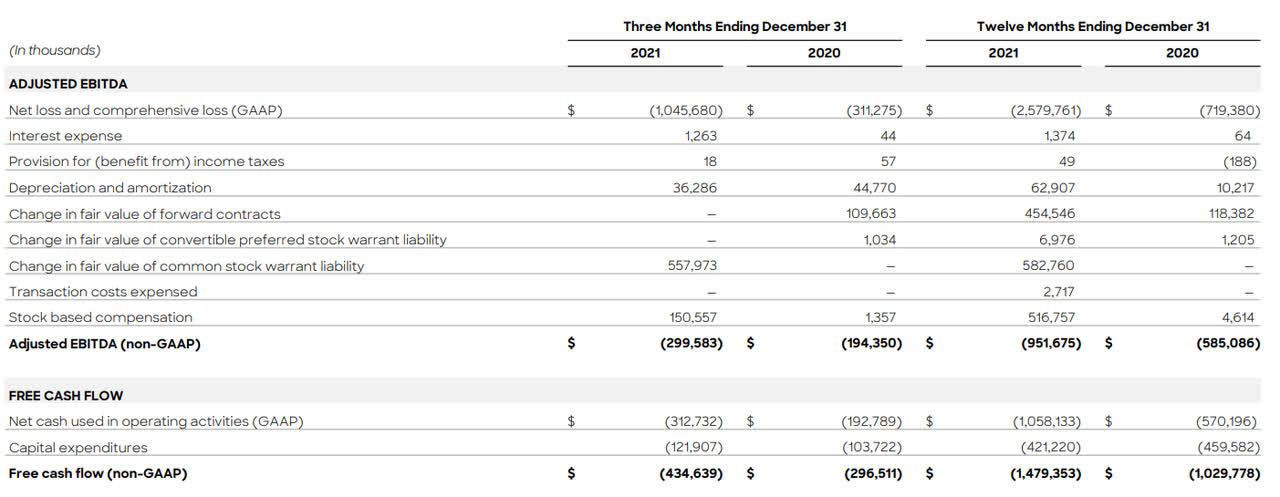

Companies that invest a lot of funds into their production capabilities, like Lucid Group, obviously are not profitable. Lucid has considerable negative free cash flow, but the current cash burn situation is not going to be one that lasts forever. Lucid’s free cash flow was $(434.6)M in the last quarter and $(1,479.4)M in FY 2021 due to the startup’s heavy investments into its production facilities. As Lucid ramps up production and deliveries in FY 2022 and FY 2023, free cash flow is set to improve drastically.

Lucid

Revenue prospects

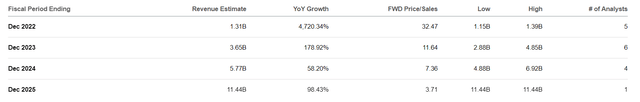

Lucid has attractive prospects for revenue growth, especially because the startup focuses on the luxury all-electric sedan market that does not have much competition right now. Lucid is expected to generate revenues of $1.3B this year and $3.7B next year as it ramps up Lucid Air production. Based off of next year’s sales of $3.7B, Lucid has a sales multiplier factor of 11.6 X. Considering the large size of Lucid’s balance sheet, the EV company is one of the best capitalized businesses in the sector. Just months ago, shares of Lucid sold at a significantly higher sales multiplier factor.

Risks with Lucid

Lucid is an EV startup and the company, given its current state of operations, has a high sales valuation factor. This is because the market is generally optimistic about Lucid being able to execute on its production and delivery ramp. However, as the recent production downgrade indicates, Lucid does not yet have the finely-tuned operations of a large auto manufacturer. Timeline risks do exist and pose a challenge for Lucid and the stock. Longer term, I believe Lucid will be rewarded for its entry into the luxury all-electric sedan market. What would change my mind about Lucid is if the company were to see a significant drop-off in reservations, which is probable but not plausible.

Final thoughts

Lucid went through a large drop in pricing lately, but the current price level I believe offers an attractive risk-reward because the company has made tremendous progress just in the last year. Lucid is not going to ramp FY 2022 production up as fast as expected, but as a startup that is still growing I believe the slower ramp is forgivable. Considering the large size of Lucid’s balance sheet, high reservation status and a much lower valuation based off of next year’s sales, the stock is very attractive today!

Be the first to comment