adaask

Both Main Street Capital (NYSE:MAIN) and Blackstone Secured Lending (NYSE:BXSL) are investment grade high yield business development companies (i.e., BDCs) (BIZD). MAIN has a tremendous track record whereas BXSL pays out a much higher dividend yield. In this article, we will compare them side by side and offer our take on which one is a better buy.

Main Street Capital Vs. Blackstone Secured Lending – Balance Sheet

Both MAIN (BBB- with a stable outlook) and BXSL (Baa3 Stable from Moody’s) have investment grade credit ratings which implies they both have solid balance sheets.

MAIN’s leverage ratio is 0.98x and its liquidity is $518.4 million. Furthermore, it has little exposure to floating rate debt as only 20% of its total debt is floating rate.

BXSL’s leverage ratio is 1.34x and its liquidity is $890 million. Furthermore, 45% of its debt is floating rate, indicating that the majority of its debt is fixed rate.

While both businesses have solid balance sheets, MAIN’s has significantly less leverage and less than half the exposure to floating rate debt that BXSL does. As a result, we give the edge to MAIN here.

MAIN Vs. BXSL – Investment Portfolio

MAIN’s portfolio is 69% invested in senior secured debt and 59% positively exposed to rising interest rates. It also has a more defensive weighting with its top sectors including among them more defensive industries like software, commercial services, and diversified consumer services. The portfolio underwriting has been pretty good thus far, with non-accruals at just 0.7% at fair value.

BXSL’s portfolio is 97.6% invested in first lien senior secured debt, only 1.7% of its portfolio is invested in equity, and its average loan to value ratio is 46.4%, making it quite conservative in nature. Unsurprisingly, it enjoys a 0% non-accrual rate on its debt investments at the moment, reflecting its emphasis on first lien senior secured debt and its relatively low loan to value ratio.

Both businesses appear very well positioned to benefit from rising interest rates. 100% of BXSL’s debt investments are floating rate and management stated on its most recent earnings call:

we expect material growth in net investment income from the recent increase in short-term interest rates… we expect the benefit from higher rates to largely begin this quarter, given the timing of base rate resets. Our macro view from Blackstone’s Chief Investment Strategist, Joe Zidle, is that base rates should go higher and stay elevated for longer than the curve suggests, driven in large part by continued near-term economic momentum and inflation that could prove more persistence and consensus expects, with pressures across wages and shelter costs. In short, we believe interest rates represent a meaningful near-term tailwind to the earnings power of BXSL and our ability to pay dividends.

Meanwhile, MAIN’s CEO stated on its Q2 earnings call:

One additional item that I wanted to touch on is the impact of rising interest rates. During the quarter, LIBOR rates increased by approximately 130 basis points from those in effect as of March 31st to June 30th. At the end of the second quarter, 80% of our outstanding debt obligations maintain fixed interest rates. On the other hand, approximately 75% of Main’s debt investments for interest rates at floating rates with weighted average contractual interest rate floor of low current market index rates. As a result, in a rising interest rate environment, our exposure to higher interest expense is largely mitigated and over time, increases to our interest income will exceed the increases to our interest expense. It is important to note that the majority of our variable interest rate investments are based on contracts which reset quarterly, whereas our credit facility resets monthly. As a result, we generally will have a quarterly lag in the realization of benefits from rate increases in our interest income and net investment income.

While MAIN’s portfolio has proven to be exceptional during an economic boom with record low interest rates, we favor BXSL’s senior secured debt heavy portfolio with greater exposure to rising interest rates in the current stagflationary environment. As a result, we give BXSL the edge here.

MAIN Vs. BXSL – Dividend Safety

BXSL’s dividend coverage appears to be satisfactory for the time being, given that management highlighted its “well-covered dividend” on the earnings call and backed up that talk with actual money due to the three special dividends paid out in the first half of the year. In Q2, BXSL out-earned its dividend by 17% and management stated:

We believe our dividend coverage is poised to grow in the near-term as portfolio yields benefit from higher interest rates. Something we discussed last quarter and are now seeing play out across the portfolio…We have now out-earned our regular dividend for 13 straight quarters.

MAIN’s dividend coverage was also quite strong during its most recent quarter. Distributable net investment income out-earned total regular monthly dividends paid during the quarter by 21%. Management used some of the excess earnings to pay out a special dividend to shareholders, which was highlighted on the Q2 earnings call:

Based upon our results for the second quarter and the positive performance of our existing portfolio of companies, combined with our favorable outlook in each of our primary investment strategies and for our asset management business and the benefits of our efficient operating structure, earlier this week, our Board declared a supplemental dividend of $0.10 per share payable in September and an increase in monthly dividends for the fourth quarter of 2022 to $0.22 per share payable in each of October, November and December. These monthly dividends represent a 4.8% increase from the fourth quarter of 2021 and a 2.3% increase from the third quarter of 2022.The supplemental dividend for September is due to our strong performance in the second quarter, which resulted in DNII per share, it was over $0.13 or 21% greater than the monthly dividends paid during the quarter. This represents our fourth consecutive quarter of paying a supplemental dividend and result in total supplemental dividends paid over the last year of $0.35 per share, representing an additional 13% paid above our monthly dividends and an increase in total dividends paid for the trailing 12-month period of 18.5% over the prior year. We are pleased to have been able to deliver this significant additional value to our shareholders.

Given that both companies have solid coverage ratios of their regular dividends, we are making this a draw. MAIN’s coverage ratio is slightly better, but the fact that BXSL’s portfolio is much more concentrated in debt than MAIN’s is and also has greater exposure to floating rates, we expect its coverage ratio to improve relative to MAIN’s in the coming quarters as we enter an economic downturn and interest rates continue to rise.

MAIN Vs. BXSL – Track Record

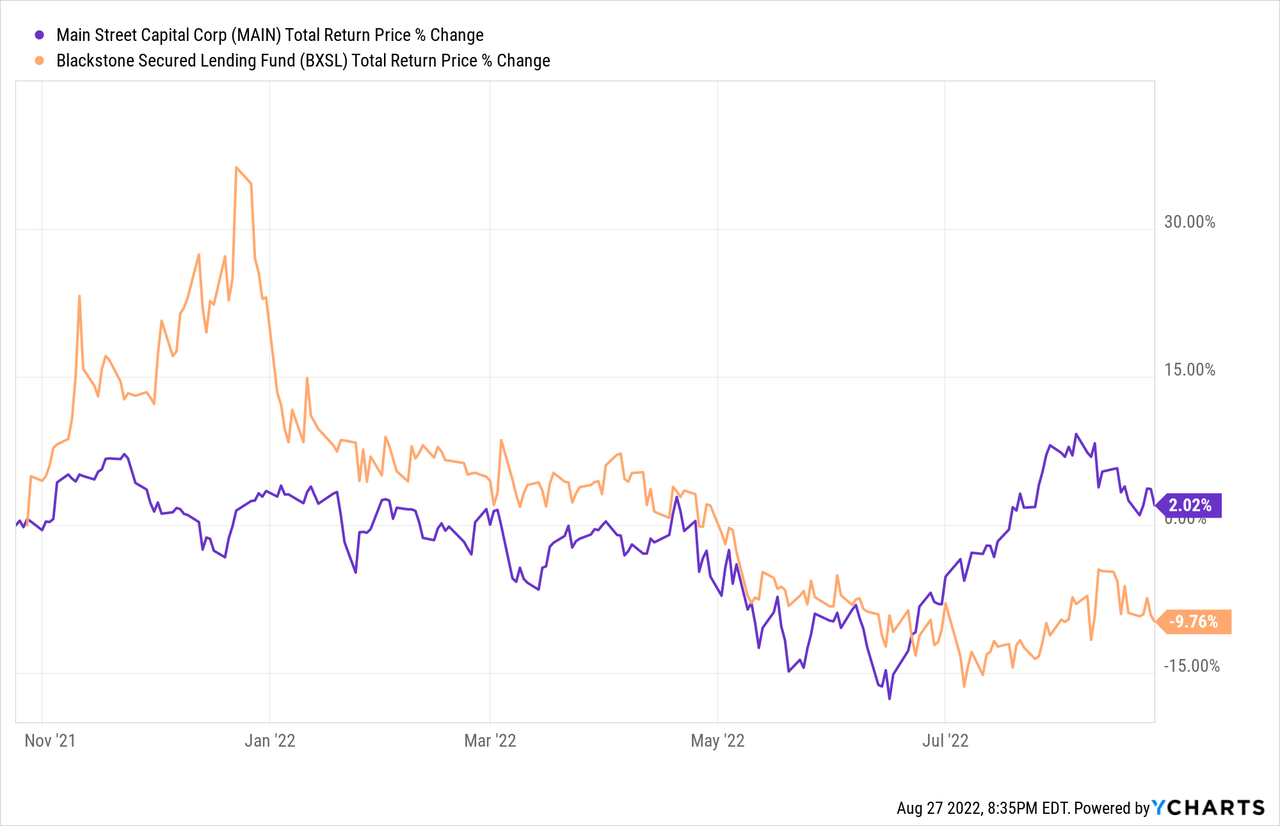

When it comes to track record, MAIN has outperformed BXSL over a very short time period of comparison:

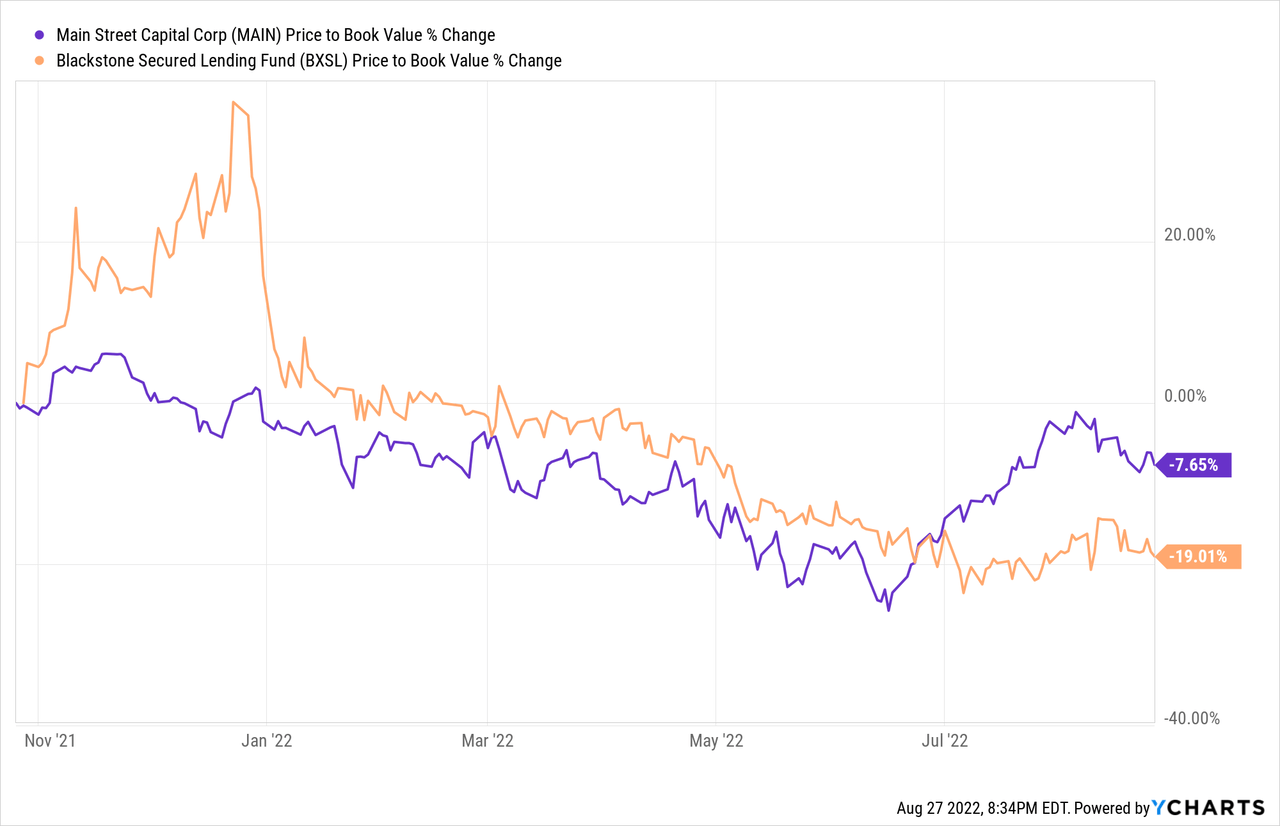

However, when looking at the adjustments in the companies’ price to NAV ratios, we see that this performance delta is almost entirely accounted for in the market’s adjustments in the price to NAV ratios for each company:

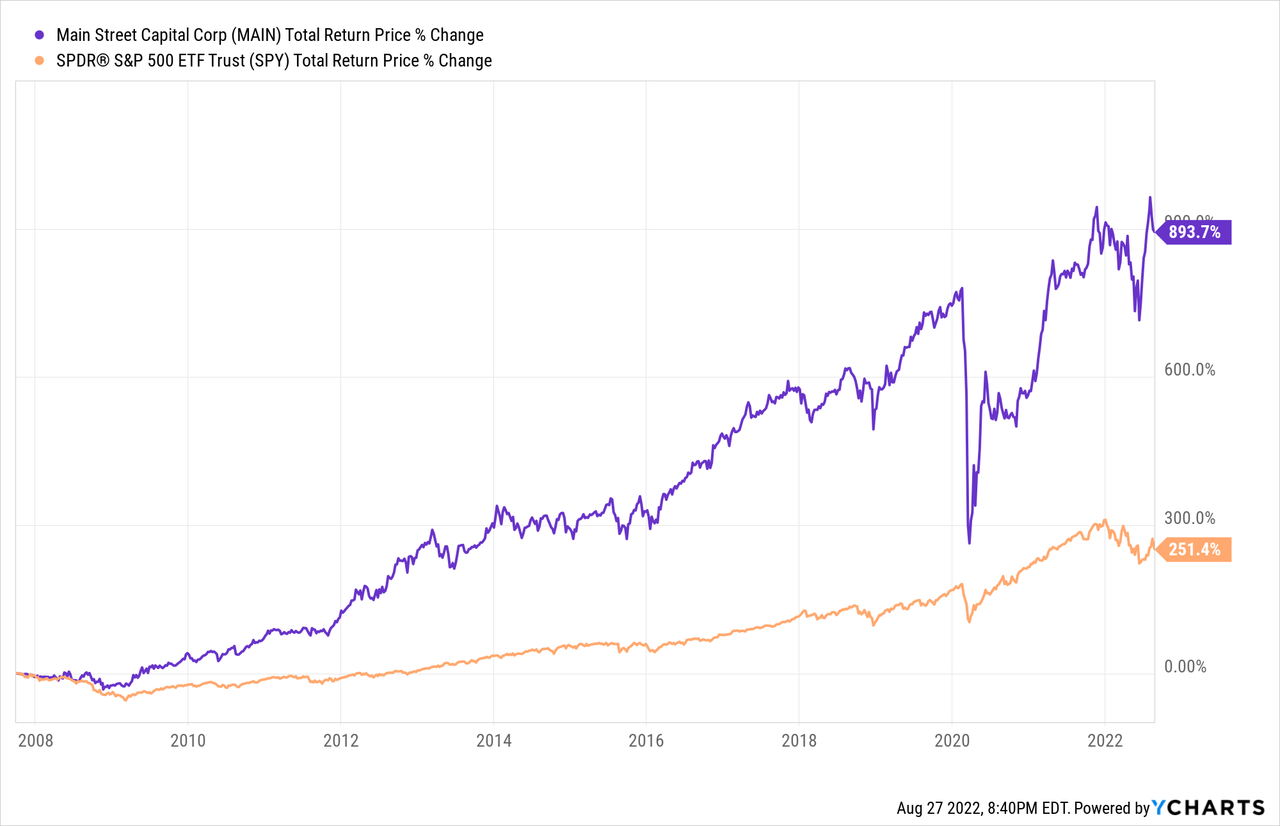

As a result, the two BDCs have had virtually identical NAV plus dividend total returns. That said, we give MAIN the edge in this category given its impressive long-term track record of crushing the S&P 500 (SPY):

Another factor that favors MAIN here is that MAIN is internally managed and has lower management costs, whereas BXSL is externally managed and views BXSL primarily as a source of hefty fees for its parent Blackstone (BX).

On the other hand, BXSL does benefit from the data, experience, and deal flow that comes from having the world’s largest alternative asset manager (with nearly $1 trillion in assets under management) as its parent. This is likely a driving factor behind its 0% non-accrual rate and bodes well for its fundamental performance across market cycles. The question will be if BXSL’s superior fundamental performance thanks to its parent will generate more alpha than it loses via excess management fees.

MAIN Vs. BXSL – Risks And Catalysts

As BDCs, the risks and catalysts facing MAIN and BXSL are very similar. Given that BXSL is laser-focused on senior debt and floating rate debt whereas MAIN has a greater relative exposure to equity, BXSL is poised to outperform in a stagflationary environment whereas MAIN will outperform if interest rates decline and the economy grows rapidly again. MAIN will likely suffer some steep NAV losses if we enter a prolonged period of elevated interest rates and poor economic performance whereas BXSL will likely lag MAIN and the broader market if interest rates fall and the economy grows rapidly. A severe recession and/or depression would likely hurt both businesses, though MAIN would likely suffer more.

MAIN Vs. BXSL – Valuation

When it comes to their relative valuations, BXSL looks clearly cheaper. Its dividend yield is substantially higher and its price to NAV is massively cheaper. Meanwhile, MAIN is trading at a premium based on both its dividend yield and its price to NAV ratio. As a result, we give a decisive win to BXSL here.

|

Valuation Metric |

MAIN |

BXSL |

|

Dividend Yield |

6.50% |

9.73% |

|

Dividend Yield (Average) |

7.96% |

9.44% |

|

P/NAV |

1.67x |

0.92x |

|

P/NAV (Average) |

1.52x |

NA |

Investor Takeaway

MAIN’s track record is extraordinary and should not be minimized. Furthermore, its balance sheet is one of the strongest in the BDC space and its monthly dividend looks as solid as any among its peers. That said, it does have outsized exposure to equities relative to other BDCs, which is likely one of the main factors behind its outperformance during the recent prolonged economic boom.

Moving forward, given the macroeconomic environment, we favor BXSL right now. Its near 100% exposure to senior secured first lien debt with fairly low loan to values and heavy exposure to floating rate debt make it a very appealing investment for a stagflationary environment. Furthermore, the fact that it is managed by BX and has a 0% nonaccrual rate is very impressive. On top of that, it is currently trading at a meaningful discount to NAV. As a result, we rate it a Buy and MAIN a Hold right now.

Be the first to comment