Aranga87/iStock via Getty Images

Electric vehicles are on an unstoppable upward march that will break the old transportation zeitgeist that has been in place for over a century. For fervent EV bulls, a future where internal combustion engine vehicles have been primarily replaced by EVs now looks like a clear, vivid, and distinctive possibility.

Indeed, and for those still in doubt, the historic growth of EVs has been dramatic. In 2012, just 120,000 EVs were sold globally. Last year saw this figure being sold on a weekly basis with 10% of cars sold in 2021 being electric, 4x the market share in 2019. More broadly, against strong sales momentum, EVs are forecasted to grow to at least 26.8 million by 2030, up from 6.6 million in 2021. Further, ICE sales have either flatlined or are in decline in several countries around the world.

This has come far ahead of dates for the phase-out of ICE cars now being instituted by US states and other economies around the globe. New York recently joined California in legislating to make all new vehicle sales zero emissions by 2035. This places two of the USA’s largest economies on the same policy step as the European Union, the United Kingdom, Japan, and South Korea.

Critically, such phase-outs have already sent a signal to consumers that the old zeitgeist is fast becoming obsolete in a world battling to reduce carbon emissions to try and restrict the global rise in mean global temperature to well below 3.6 °F above pre-industrial levels. Pledges for the phase-out of fossil fuel-based vehicle sales are still coming in as a response to the 2021’s United Nations Climate Change Conference’s Glasgow Declaration. This requires its signatories to ensure sales of all new cars and vans to be zero emission by 2035. Hence, as the list of states and countries on a planned phase-out of combustion engine vehicles continues to grow, so to does the total addressable market being pursued by Lucid (NASDAQ:LCID), Rivian (NASDAQ:RIVN), and Nikola (NKLA).

As though that was not enough, the recently signed Inflation Reduction Act represents an 800-pound gorilla that is set to hyper-accelerate the takeup of EVs. The act is going to be one of the most material climate-focused bills passed by Congress as it allocates $370 billion over 10 years to decarbonization initiatives. There will be a $7,500 electric vehicle tax credit running from January 2023 until December 2032, providing a boost for the fledging yet fast-growing US EV sector. The fundamental bull case driving all this activity is that anthropogenic climate change is real and so the entire automotive industry must evolve or die.

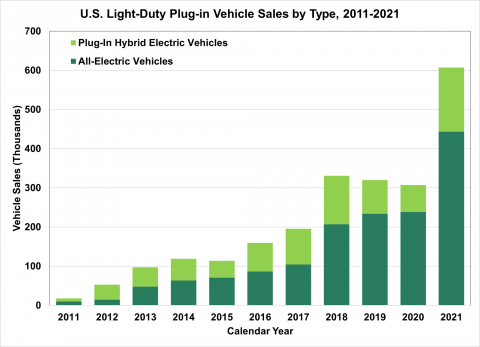

United States Department of Energy

We are still in the very early innings of the global shift towards EVs. For example, in the US plug-in electric vehicles still account for around 1% of all cars in the US. The slow pace of the traditional automakers to go all in on EVs has created a generational opportunity for these new companies to build brand recognition and recognize sales with the upcoming and fast-rising class of EV owners.

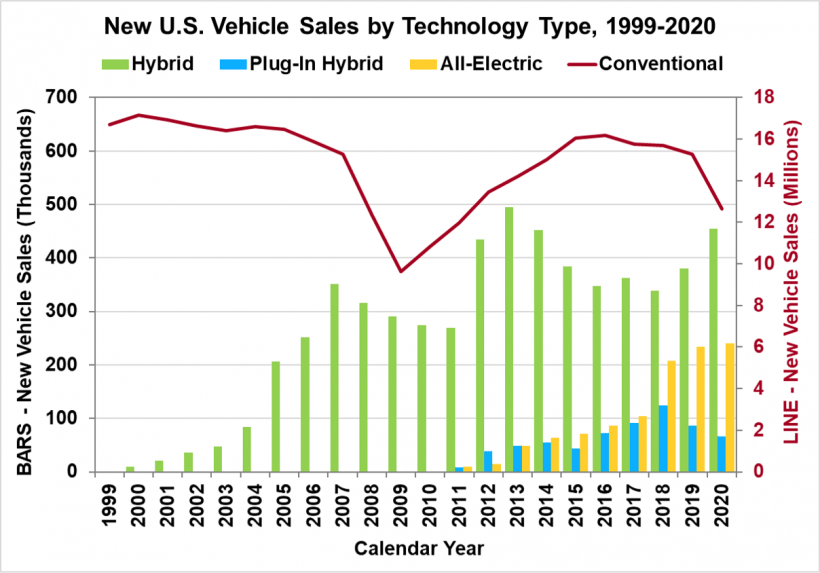

United States Department of Energy

EVs are now on the cusp of an incredible ascent and rise to dominance over their ICE peers. This has merged with strong investor enthusiasm and euphoria to create the capital market conditions that allowed Lucid, Rivian, and Nikola to go public in recent years and raise billions of dollars to pursue their respective EV dreams.

The healthy macro backdrop has extremely positive implications for the sales momentum of these companies. However, it is not all good news. Lithium carbonate prices have exploded upwards threatening to reverse what has been a more than decade-long decline in lithium-ion battery pack prices. This fell by 89% in real terms from $1,200 per kilowatt-hour in 2010 to $132/kWh in 2021.

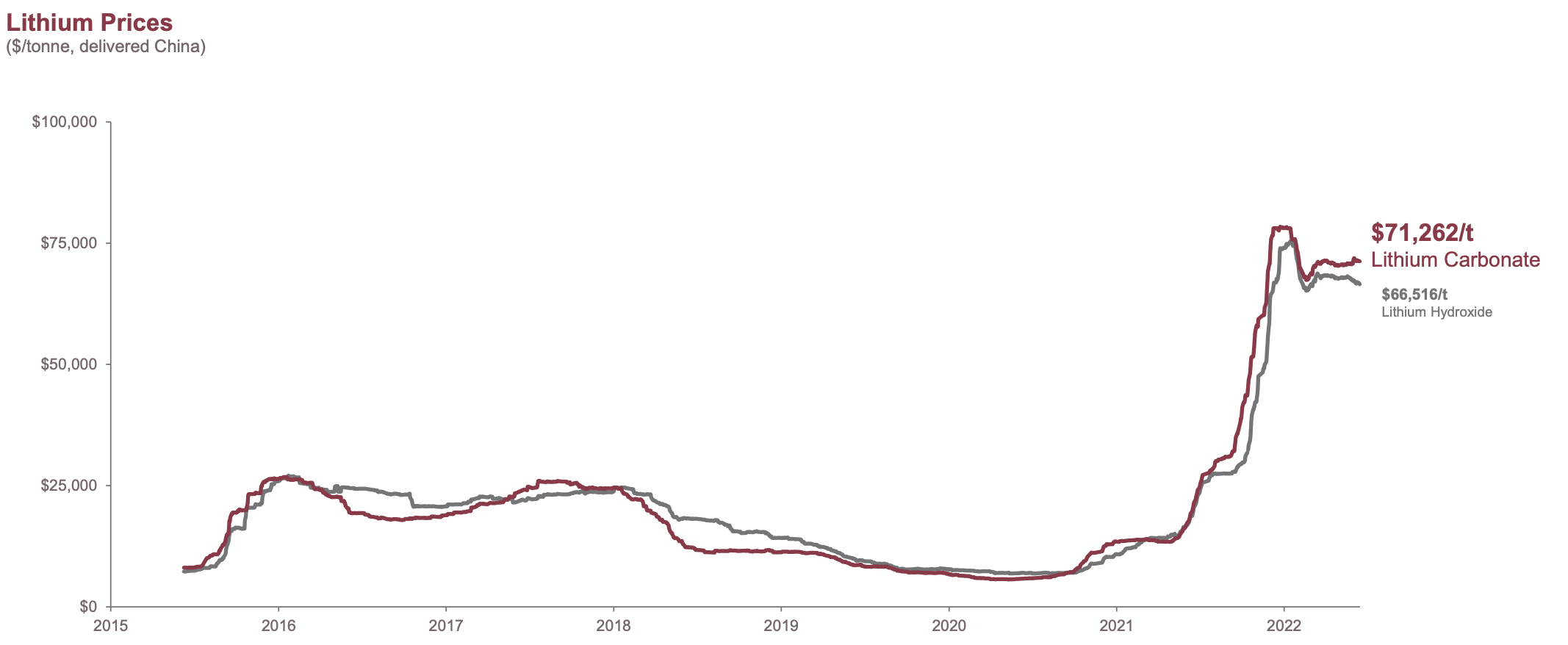

Lithium Americas

Lithium’s position as the dominant battery chemistry for everything from EVs to short-duration energy storage for utility-scale renewable projects has meant the alkali metal has enjoyed a highly viscous and dynamic demand profile. This has driven prices to record highs with lithium carbonate prices reaching over $70,000/t in China.

Lithium at these levels would seem unsustainable in the long-term as far as new supply comes online, but mining is not an enterprise that’s endearing to environmentalists. Hence, there has been a significant level of opposition to the development of new lithium mines globally. For example, Serbian environmentalists succeeded in blocking a lithium mine being proposed by Rio Tinto (OTCPK:RTPPF). This would have become the largest lithium mine in Europe. In the United States, the Thacker Pass lithium mine being developed by Lithium Americas Corp (LAC) is currently in a legal battle with environmentalists and indigenous groups. The mine sits on one of the largest known lithium deposits in the US.

As numerous lithium mines around the world fight for their survival against lithium demand that continues to explode upwards, there is a material demand and supply imbalance that will only serve to exacerbate the current price surge. This could potentially leave EVs beyond the reach of the mass market being targeted by these companies. Further, mass market adoption will simply not happen without a technology leap that addresses the perennial concerns of range anxiety and charging times. If these technological bottlenecks are addressed in the years ahead then a clear pathway for EVs to totally dominate the EV scene opens up as Lucid, Rivian, and Nikola stand to ride this demand wave to exciting new highs.

Be the first to comment