Nikada

Investment Thesis

At this moment in time, Apple (NASDAQ:AAPL) has a Free Cash Flow Yield [TTM] of 5.13%. This implies that, in theory, the company would be able to pay its shareholders a Dividend of 5.13%. However, this is not actually the case for Apple. Instead, the company uses a large amount of the Free Cash Flow it produces year over year to buy back its own shares. For example, in 2022, Apple spent about $90B on buying back its own shares. In fact, since the beginning of the program in 2013, the company has spent $550B in buying back its own shares.

By doing so, the number of outstanding Apple shares has decreased significantly in the past decade while the percentage that each investor holds on the Apple stock has increased significantly. The same has contributed to the company managing to significantly increase its EPS. Apple has shown an Average EPS Diluted Growth Rate [FWD] of 15.71% over the past 5 years.

The company’s Free Cash Flow Yield [TTM] of 5.13% makes Apple an attractive choice when it comes to risk and reward and contributes significantly to my buy rating on its stock.

Apple’s Performance within the past 12 Months

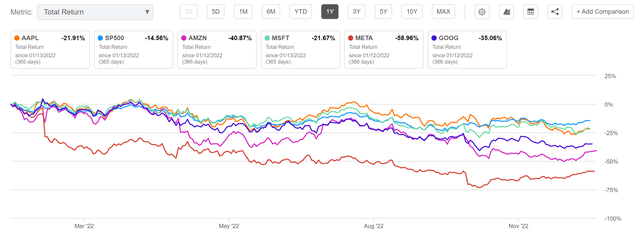

Within the past 12-month period, the S&P 500 has shown a Total Return of -14.56%. Apple, however, has shown a lower Total Return of -21.91%. Even though the company’s Total Return in the last 12 months has been negative, it has still been significantly better than its competitors such as Amazon (NASDAQ:AMZN) (-40.87%), Meta (NASDAQ:META) (-58.96%) and Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) (-35.06%) and similar to Microsoft (NASDAQ:MSFT) (-21.67%). Apple’s better performance when compared to some of its competitors, underlines the company’s robust business model.

Source: Seeking Alpha

The Valuation of Apple

Discounted Cash Flow [DCF]-Model

My DFC Model calculates a fair value of $147.87 for Apple. Its current stock price of $134.00 gives Apple an upside of 10.3%. For the calculations of my DCF Model, I assumed a Revenue and EBIT Growth Rate of 6% in the upcoming 5 years and calculated with a Perpetual Growth Rate of 4% afterwards, since I expect the company to grow slightly above the GDP of the U.S.

My calculations are based on these assumptions as presented below (in $ millions except per share items):

|

Apple |

|

|

Company Ticker |

AAPL |

|

Tax Rate |

16.2% |

|

Discount Rate [WACC] |

8.5% |

|

Perpetual Growth Rate |

4% |

|

EV/EBITDA Multiple |

16.1x |

|

Current Price/Share |

$134.00 |

|

Shares Outstanding |

15,908 |

|

Debt |

$132,480 |

|

Cash |

$23,646 |

|

Capex |

$10,708 |

Source: The Author

Based on the above, I have calculated the following results for Apple:

Market Value vs. Intrinsic Value

|

Apple |

|

|

Market Value |

$134.00 |

|

Upside |

10.3% |

|

Intrinsic Value |

$147.87 |

Source: The Author

Internal Rate of Return for Apple

Below you can find the Internal Rate of Return for Apple as according to my DCF Model (while assuming a Revenue and EBIT Growth Rate of 6%) where I assumed different purchase prices for its stock.

At Apple’s current stock price of $134.00, my DCF Model indicates an Internal Rate of Return of approximately 11% for the company. (In bold you can see the Internal Rate of Return for Apple’s current stock price of $134.00.)

|

Purchase Price of the Apple Stock |

Internal Rate of Return as according to my DCF Model |

|

$110.00 |

15% |

|

$115.00 |

14% |

|

$120.00 |

13% |

|

$125.00 |

12% |

|

$130.00 |

12% |

|

$134.00 |

11% |

|

$135.00 |

11% |

|

$140.00 |

10% |

|

$145.00 |

9% |

|

$150.00 |

8% |

|

$155.00 |

7% |

|

$160.00 |

7% |

Source: The Author

Apple’s Fundamentals in comparison to its competitors

At the time of writing, Apple has a market capitalization of $2.12T, which is slightly above the one of Microsoft ($1.78T) and significantly higher than Alphabet ($1.18T), Amazon ($971.91B), Meta ($358.48B) and Netflix (NASDAQ:NFLX) ($146.91B).

When it comes to Valuation, it can be stated that Apple’s P/E [FWD] Ratio of 21.54 is below that of competitors such as Microsoft (25.02) or Netflix (32.25). However, it should also be noted that it’s slightly higher than Alphabet (P/E [FWD] Ratio of 19.34) and Meta (15.05).

In my opinion, the Cupertino headquartered company should be rated with a premium when compared to competitors such as Alphabet, Meta and Netflix due to its even stronger brand image, its broader and more diversified product portfolio as well as its high customer loyalty. In my opinion, all of this contributes to Apple having an even higher economic moat than those competitors.

In addition, Apple’s Price/Cash Flow [TTM] Ratio of 17.37 is lower than the likes of Microsoft (20.28), Amazon (24.50) or Netflix (124.60), thus strengthening my investment thesis that Apple is an attractive buy due to the Free Cash Flow it produces year over year.

It can also be highlighted that Apple’s Price/Sales [TTM] Ratio of 5.49 is below the one of Microsoft (Price/Sales [TTM] Ratio of 8.79). Furthermore, Apple’s Payout Ratio of 14.73% is significantly lower than Microsoft’s (Payout Ratio of 27.37%), indicating that the company has plenty of room for dividend enhancements in the decade ahead.

When comparing Apple to other companies from the Technology Hardware, Storage and Peripherals Industry, such as Dell (NYSE:DELL) or HP (NYSE:HPQ), it can be stated that the company has a much higher EBIT Margin: while Apple has an EBIT Margin of 30.29%, the EBIT Margins of Dell (5.88%) and HP (8.34%) are significantly lower. This higher EBIT Margin provides proof of the company’s excellent position within its industry and once again supports my investment thesis.

Apple is also superior to these two competitors when it comes to Revenue Growth: while the company has shown a Revenue Growth Rate [CAGR] of 11.46% over the past 5 years, Dell’s is 6.41% and HP’s is only 3.88%.

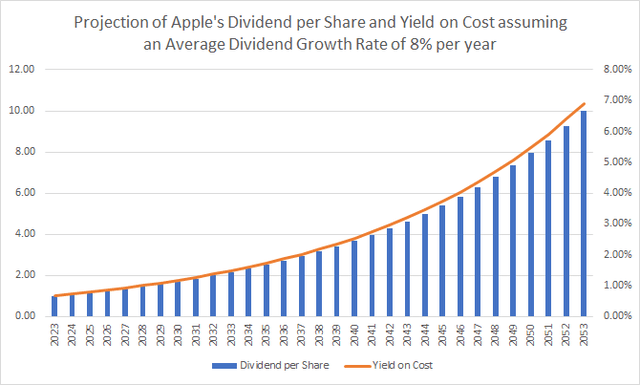

Projection of Apple’s Dividend per Share and Yield on Cost

Apple pays an Annual Dividend [FWD] of $0.92. At the company’s current stock price of $134, this results in a Dividend Yield [FWD] of 0.69%. Furthermore, the company has shown a Dividend Growth Rate [CAGR] of 8.15% over the past 5 years.

The graphic below shows Apple’s Dividend per Share and the company’s Yield on Cost when assuming that you would invest at its current stock price of $134 as well as assuming it would be able to raise its Dividend by 8% on Average in the following 30 years.

Source: The Author

The High-Quality Company [HQC] Scorecard

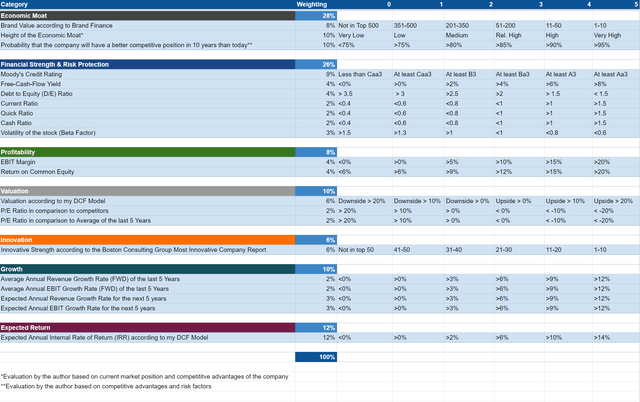

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

Source: The Author

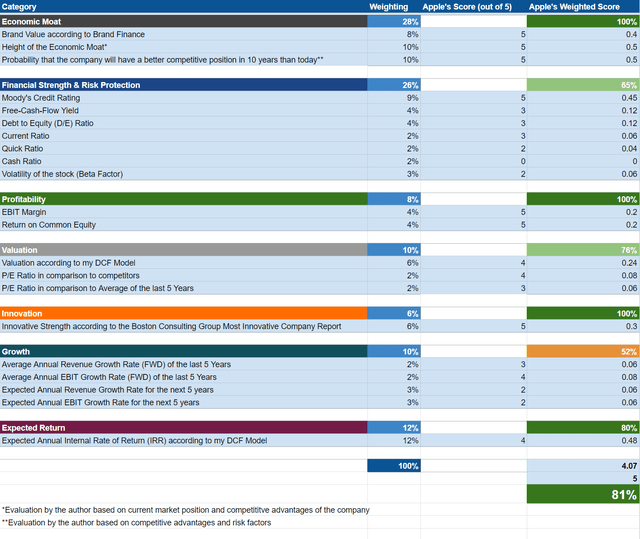

Apple According to the HQC Scorecard

Source: The Author

According to the HQC Scorecard, Apple is rated as very attractive in terms of risk and reward. The company reaches 81/100 points.

Particularly in the categories of Economic Moat (100/100), Profitability (100/100), Innovation (100/100) and Expected Return (80/100), the company is rated as very attractive. For Valuation (76/100) and Financial Strength (65/100) Apple is rated as attractive. Only in the category of Growth, is the company rated as moderately attractive (with 52/100 points).

Apple’s excellent results as according to the HQC Scorecard strengthen my opinion to rate it as a buy at this moment in time.

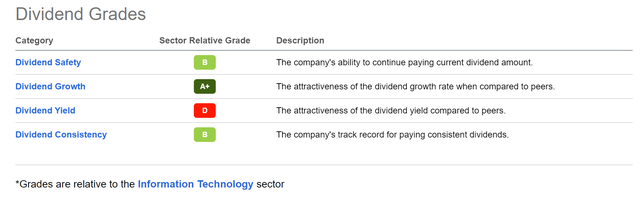

Apple According to the Seeking Alpha Dividend Grades

The Seeking Alpha Dividend Grades underline that Apple is an attractive pick for those seeking Dividend Growth: the company gets an A+ rating for Dividend Growth and a B for both Dividend Safety and Dividend Consistency. These results once again strengthen my belief to rate Apple as a buy.

Source: Seeking Alpha

Risk Factors

In a previous analysis on the company, I discussed that I see the biggest risk factor for Apple investors being if the brand image got damaged:

“If Apple’s brand image were to be damaged, this could lead to the fact that its customers would no longer pay premium prices for its products, which in my view would have an enormous impact on the company’s financial results and ultimately on the price of the Apple stock.”

In the same analysis, I discussed Apple’s Macroeconomic and Industry Risks:

“Apple’s financial results depend significantly on global economic conditions and adverse macroeconomic conditions, such as inflation or a recession, can adversely affect the demand for its products. In addition to that, consumer spending can decline as a response to a decline in customer’s income. Apple investors should be aware of these risks and should expect that the company will probably no longer show such high growth rates in the following years compared to recent ones.”

Apple’s 24M Beta of 1.25 indicates that an investment in the company comes with less risk attached than investing in competitors such as Amazon (24M Beta of 1.40), Alphabet (1.28) or Netflix (1.63).

This assumption is further underlined by Apple’s high EBIT Margin of 30.29%, which is significantly above both Amazon’s (2.58%) or Netflix’s (18.16%).

I continue to see Apple as a very attractive investment when considering risk and reward. My opinion is underlined by the results of the HQC Scorecard, in which the company scores 81/100 points.

The Bottom Line

In this analysis on Apple, I have shown that I continue to consider the company to be an attractive buy: Apple provides its shareholders with a relatively high Free Cash Flow Yield [TTM] of 5.13%, which it can use to pay a Dividend and to buy back its own shares. Apple’s shareholders benefit from both.

In addition to that, Apple’s low Payout Ratio of only 14.73% can be interpreted as a clear signal that there is plenty of scope for future dividend increases. This strongly benefits investors that have a long investment horizon.

In my opinion, Apple is an excellent fit when considering risk and reward: my theory is supported by the results of the HQC Scorecard, which rates the company with 81/100 points at this moment of writing.

The Apple stock continues to be the largest position of my own investment portfolio and I don’t plan to change this in the near future.

I would be glad to hear your opinion on the Apple stock. Do you agree with my opinion to rate the company as a buy?

Be the first to comment