Anastasiia Makarevich/iStock via Getty Images

After the bell on Wednesday, we received second quarter results from electric vehicle maker Lucid Group (NASDAQ:LCID). The luxury vehicle maker has been all hype to date with little actual results, a pattern that has continued throughout this year. Yet again, management announced another disappointing quarter and slashed its production forecast for the year, sending shares sharply lower.

For Q2, the company announced that it had delivered 679 vehicles, up from 360 in Q1 of this year. While that seems like nice growth in percentage terms, it’s not really a great result as investors have been expecting much more. In total, revenue came in at $97.3 million, well below the more than $157 million that street analysts were expecting on average. Don’t forget, analysts have been cutting their numbers since late last year after the company slashed 2022 production guidance back in February.

As delivery volumes and revenues remain low, Lucid continues to lose a lot of money. Gross margin dollars weakened sequentially to around negative $195 million, an increase of nearly $7 million. The company reported an operating loss of nearly $560 million for Q2, several times the quarter’s total sales number. Overall, GAAP net losses per share of $0.33 did beat street estimates a bit, but that’s hardly good news when you are still losing over $550 million a quarter.

The worst part of Wednesday’s report was updated guidance for the year. As supply chain issues continue, management has cut its production forecast in half to just 6,000 to 7,000 vehicles. Remember, the company was originally calling for 20,000 vehicles this year, so this new guidance is quite terrible. It’s hard to celebrate reservations now being over 37,000, up from more than 30,000 at the Q1 report, because the company just can’t deliver many vehicles right now.

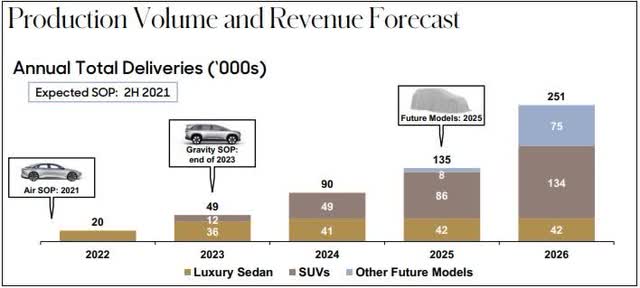

At some point, these customers might give up on Lucid and just order another vehicle instead. Remember, it was just over a year ago that the company was expecting to do another roughly 36,000 units of production for the Air sedan in 2023 as seen in the graphic below. That number looks extremely optimistic at this point. Given the continued issues we’ve seen and lowered guidance for this year, anyone placing a reservation now (depending on the vehicle’s variant) could easily be looking at a 2024 delivery timeline.

Lucid July 2021 Delivery Forecast (Company Presentation)

With large losses ongoing, Lucid continues to burn large amounts of cash, just like fellow startup Rivian (RIVN). Free cash flow in the three-month period was negative $823 million, and topped $1.5 billion for the first half of 2022. The company did end Q2 with $4.6 billion in cash, against about $2 billion in debt, so it does have the money to continue growing for the near term. However, it is logical to wonder if another capital raise will be needed late next year if cash burn doesn’t improve materially in the next couple of quarters. We’ve seen from the likes of Tesla (TSLA) and others that it can take quite a while for these electric vehicle infants to get to cash flow neutral territory.

Shares of Lucid had staged a nice recovery lately, recovering from their 2022 trading low of $13.25 to more than $20 in recent weeks. Unfortunately, shares were down 12% in Wednesday’s after-hours session, trading back down to around $18. As the chart below shows, that would mean that the stock is back under its 50-day moving average (purple line). Without a quick recovery for this name, its key technical trend line could rollover and that might provide additional resistance in the coming months.

Lucid Last 6 Months (Yahoo! Finance)

It’s also pretty obvious that we will see a number of analysts cutting their price targets in the coming days given the massive guidance reduction. Going into this year, the average price target was $42.75, but that number was a little under $30 going into the Q2 report on Wednesday. I’m sure the street will still see some upside given the company’s expected growth in the coming years, but it wouldn’t surprise me if the average street valuation falls into the low $20s moving forward.

In the end, Lucid announced another very disappointing set of results after Wednesday’s close. Revenues fell dramatically short of street estimates as Q2 deliveries didn’t even top 700 vehicles, and management cut its yearly production forecast in half. With the company now only expecting to deliver about a third of its original forecast for 2022, investors have pounded the sell button yet again, and Lucid’s near term growth story has certainly taken a hit.

Be the first to comment