jetcityimage/iStock Editorial via Getty Images

Lucid Group (NASDAQ:LCID) has seen its valuation cut by roughly three-quarters in 2022 as the investment landscape shifts and investor sentiment shifts away from electric-vehicle companies. As a result, Lucid’s valuation has been reduced by 74% this year.

Having said that, the electric-vehicle company has reaffirmed its 2022 annual production forecast and plans to open reservations for its latest luxury electric-vehicle, the Lucid Gravity SUV, in 2023. Given the significant decline in Lucid’s valuation, I believe Lucid’s stock is an ideal Thanksgiving gift for investors.

Lucid Is On Track To Meet Its Production Target

The supply chain is no longer as problematic as it was earlier this year, allowing Lucid to reaffirm its November production target of 6-7K electric-vehicles. The Lucid Air all-electric EV is now being manufactured in accordance with the company’s plans, after Lucid had to scale back its earlier annual production target twice this year due to supply-chain and logistical issues.

The initial forecast called for the production of 20K electric-vehicles, but that figure was reduced to 12-14K in February. Due to ongoing supply-chain issues, Lucid cut its annual production forecast in half again in August (to a current range of 6-7K). Taking both revisions into account, Lucid reduced its original production forecast by 65-70%.

With that said, Lucid’s production situation is improving, and it appears that Lucid has finally found a level of production from which it can grow. The electric-vehicle manufacturer produced 2,282 vehicles in the third quarter, more than tripling its output from the previous quarter.

Lucid Is Opening Reservations For The Lucid Gravity SUV

Beginning in 2023, prospective buyers of luxury electric-vehicles will be able to reserve Lucid’s newest creation: the Lucid Gravity SUV, a high-performance luxury SUV seating up to seven people. Little is known about the company’s latest electric-vehicle’s technical specifications, but the upcoming SUV is expected to have a segment-record travel range of 450 miles and cost well over $100,000.

Even though the Lucid Gravity won’t be available until 2024, given the company’s success with the Lucid Air, I believe demand for the SUV will be strong. The Lucid Gravity will go up against Tesla’s Model X and Mercedes Benz’s EQS SUV.

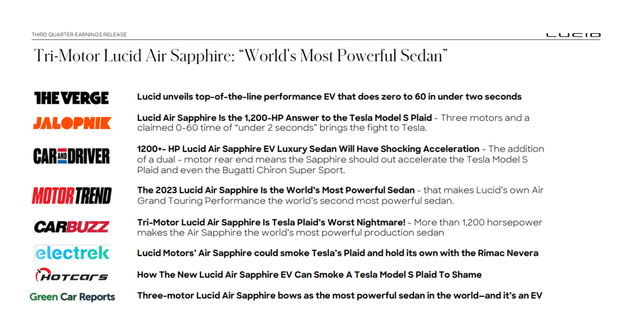

The Lucid Air (sedan) has 34K pre-orders, which equals a full year’s worth of production for the EV company. The Lucid Air has received rave reviews (see a few examples below), and the company cannot complain about a lack of customer interest in its electric-vehicle portfolio.

What makes things even more interesting for Lucid is that, as previously stated, the EV company will open reservations in early 2023, which means that reported reservation numbers beginning in 1Q-23 will include reservations for all of the Lucid Air models as well as the Lucid Gravity SUV.

Rave Reviews (Lucid Motors)

Despite the fact that much about the Lucid Gravity is unknown (on purpose), the brand’s strong interest suggests that the Lucid Gravity could make an equally impressive splash in the SUV segment in 2021 as the Lucid Air did in the sedan segment.

Huge Sales Growth Expected As Company Moves Towards Mass Production

Lucid is expected to have strong sales momentum in 2023, with expectations of 257% YoY growth. Lucid is still a newcomer to the EV market (it only made $196 million in sales in 3Q-22), so I believe the company deserves time to demonstrate to the market that it can successfully scale its EV business. Lucid is valued at 5.5x sales multiple based on 2023 average sales expectations.

Why Lucid May See A Lower/Higher Valuation

I believe that the volatility and unpredictability of production-related news make forecasting what will happen to Lucid’s stock price impossible.

If Lucid fails to meet its production targets in 2023, the stock may suffer even more in the short term. Having said that, the company has made a good impression with the Lucid Air thus far, and customer interest in the brand and the Lucid Air remained strong in the third quarter.

Moving forward, the release of reservation numbers for the Lucid Gravity SUV, as well as a strong production forecast for 2023, could be powerful catalysts for Lucid’s stock to rise.

My Conclusion

Lucid, in my opinion, is the best Thanksgiving gift you can buy for yourself right now. Sentiment remains a major negative for EV companies, and it has significantly lowered Lucid’s valuation.

This year, Lucid has taken a 74% valuation hit, and Lucid was not without fault: cutting guidance twice is not a good way to keep or win investors’ interest.

With that said, I believe the EV company has now found a sustainable production level that it can leverage to support steady production growth in the future.

The introduction of the Lucid Gravity SUV is a powerful catalyst for Lucid’s stock, which is now much cheaper based on sales than it was last year.

Be the first to comment