Lucid Prototype On Display At Art Miami Eugene Gologursky/Getty Images Entertainment

The reviews of Lucid Group Inc. (LCID) Lucid Air battery-powered sedan by several automotive publications have been nothing short of sensational.

InsideEVs called the Lucid Air’s Dream Edition “one of the most technologically advanced electric cars ever created” while Cars.com noted the model’s “eye-popping performance and range numbers that eclipse anything else on sale today, Tesla included.”

Given the remarkable adulation that Tesla’s (NASDAQ:TSLA) vehicles have received from automotive journalists as well as clean-air advocates in recent years, that’s saying something. And the praise for the Lucid Air, the startup’s first model, must be especially encouraging to investors in LCID shares, who would have been justifiably disappointed to hear faint praise or negativity from the experts.

Reviews Are Not Enough

Naturally, the prospects for LCID shares rest on far more than a thumbs-up from reviewers. According to Kelley Blue Book the 2022 Lucid Air starts at $77,400 and can cost as much as $169,000. The 2022 Lucid Air competes against Tesla Model S, Mercedes-Benz EQS, Audi e-tron GT, and Porsche Taycan – so its high price isn’t entirely out of line. Still, a relatively small number of new vehicles are sold in this price category, so Lucid is fighting against some mighty strong incumbent brands.

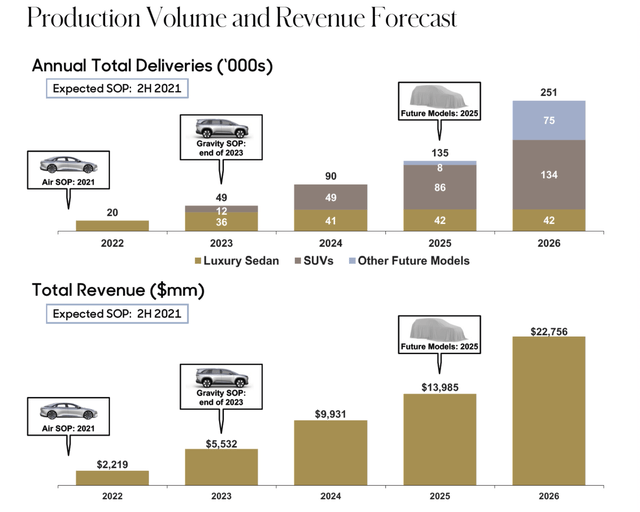

Indeed, Lucid says it expects sales of only about 20,000 in 2022, which translates to revenue of roughly $2 billion against a current market capitalization of about $74 billion – clearly the shareholders are expecting big things from the company.

Skeptics said the same of Tesla in its early days. Or so goes the line of pro-Lucid investment rationale in chat and comment platforms. Lucid (like Tesla), the thinking goes, starts its journey toward massive market capitalization in the luxury consumer category and eventually will move its way down market toward the $40,000 to $50,000 range where the larger numbers of BEVs, like Tesla’s Model 3, are expected to sell. One risk factor Lucid and all BEV investors face is the relative novelty of large lithium-ion batteries used for BEV propulsion. The relatively short real-world record of lithium-ion batteries, which today are used increasingly in EVs, laptops and other electronic consumer items, has been marked by instances of overheating and difficult-to-extinguish fires. General Motors Co. (GM) and Hyundai Motor Company (OTCPK:HYMTF) each have undertaken costly recalls to replace batteries with suspected manufacturing defects that can cause runaway “thermal events.”

Li-Ion Diversity

The number, type and size of lithium-ion batteries vary widely according to the materials used in the anode and cathode as well as the chemistry of the electrolyte and the structure of the separator, across which charged ions pass. Newer, more innovative lithium-ion batteries are designed to cram more energy into a smaller package, thereby enabling more energy for the vehicle, which will translate into longer range between charges or faster acceleration or both.

Since public chargers are few and far between – and because consumers are worried that their car might be stuck somewhere with a discharged battery – the pressure by automakers to increase energy density with new battery designs and chemistry is intense.

But new lithium-ion battery designs require extensive testing, sometimes taking years, to ensure consistent performance and safety. The temptation to cut corners on testing is huge.

“Batteries are like living organisms. You’ve got billions of particles packed together in electrode sheets. The layers keep getting thinner, and everyone is trying to pack in more energy, making systems more and more difficult to predict,” says Eli Leland, chief technical officer of Voltaiq, a software startup whose data analytics assess battery function, future performance and product risk.

“Tiny variations, whether it’s nano-structural defects or contaminants, are going to have enormous, often counterintuitive effects. And it’s even worse when you’re thinking about behavior over a lifespan. The way that batteries are operated, and even stored, can determine how they behave down the road. That’s why batteries need to be tested for so long under so many different conditions.”

In no way is the preceding caution with regard to lithium-ion batteries meant to imply that Lucid has cut corners on testing or that its battery is suspect.

Another issue Lucid shareholders could face in the relatively short term is persistent price inflation in the U.S. and the determination of the Federal Reserve to bring inflation under control. Tech stocks such as Lucid and other EV companies and other early-stage enterprises that typically rely on external capital for growth will be vulnerable. Tech stocks in particular have been under pressure for the past month as the Fed has clarified its intention to raise interest rates.

Rotation Likely

Capital has been available in abundance since the Great Recession in part because investors couldn’t find adequate returns from low-yielding bonds. If market analysts and seers are right, higher interest rates in 2022 will result in higher bond yields; consequently, relatively less capital may be available for high-tech and other early-stage companies. (The NASDAQ Composite Index is down about 8% in the past month. Fortunately for Lucid, one of its biggest backers is the lavishly-endowed Saudi sovereign wealth fund.)

Headed by Peter Rawlinson, a onetime chief engineer for Tesla’s Model S, Lucid will face substantial competition by a host of BEV startups as well as a proliferation of BEV models from incumbents. Nevertheless, the company has big plans: Andrew Liveris, the former chairman and CEO of chemical giant Dow, serves as Lucid’s chairman; he announced this week that Lucid is planning a second assembly plant in Saudi Arabia in addition to its current facility in Casa Grande, near Phoenix.

Lucid Production and Revenue Forecast Lucid Group

Lucid is definitely an EV venture that bears watching. And it may prove to be one that justifies an investment. The prudent strategy is to monitor how the company’s batteries withstand a few more years and several millions of miles of real-world use by its owners. This period will also show how well BEVs from this new brand will compete against those built and marketed by the Teslas, GMs, Fords, Audis and Mercedes-Benzes of the world.

Tesla shares bumped along for nearly a decade before taking off to their current stratospheric value. BEV tech is still in early days – and LCID shares are speculatively frothy. If Lucid’s promise evolves into solid, consistent performance, plenty of opportunities will remain for prospective shareholders to capitalize.

Be the first to comment