Pgiam/iStock via Getty Images

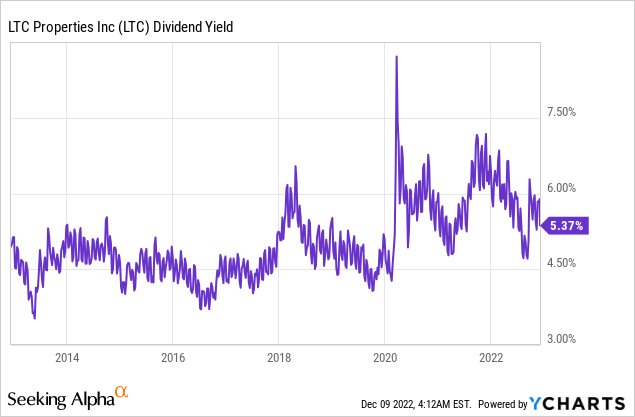

Almost a year ago, I recommended purchasing LTC Properties (NYSE:LTC) for its attractive valuation and dividend yield. Since my article, the stock has outperformed the S&P 500 and the Real Estate Select Sector SPDR ETF (XLRE) by an impressive margin, as the stock has rallied 11% whereas the S&P 500 and the REIT ETF have declined 10% and 19%, respectively. Nevertheless, LTC Properties remains attractive, as its business is recovering after many years while the stock is offering a nearly 10-year high dividend yield of 5.8%. Therefore, investors should not take their profits yet.

Business overview

LTC Properties is a self-administered REIT that invests in senior housing and healthcare properties. It currently holds 204 investments in 27 states, with about 50% senior housing and 50% skilled nursing properties.

LTC Properties has been facing significant business headwinds during the last five years. The trust was hurt by the bankruptcy of Senior Care Centers, the largest skilled nursing operator in Texas, which filed for Chapter 11 in 2018. In addition, some other operators have been struggling to meet their obligations during the last three years due to the coronavirus crisis. Due to these issues, LTC Properties has failed to grow its funds from operations [FFO] per unit over the last five years.

However, it is important to note that the REIT has just begun to recover from the prolonged downturn in its business. In the third quarter, it grew its FFO per unit 33% over the prior year’s quarter, from $0.45 to $0.60, mostly thanks to increased rental income from transitioned properties, i.e., properties that were transferred from operators with liquidity issues to healthy operators. The bottom line was also helped by the acquisition of some properties.

Even better, LTC Properties is just in the early phases of its recovery. Management recently provided guidance for a further sequential increase of $0.09-$0.10 in FFO per unit. Most of this increase will result from the resumption of payment of agreed rent by Anthem, which received temporary rent reduction in recent quarters. If management proves correct in its guidance, the REIT will post FFO per unit of $0.69-$0.70 in the fourth quarter.

If this level of FFO per unit is annualized ($2.80), it is just 10% lower than the all-time high FFO per unit of $3.11, which were achieved in 2017. As the REIT has just begun to recover from the liquidity issues of its operators, it is likely to soon approach its record results. Analysts seem to agree on this view. They expect the REIT to grow its FFO per unit by 8%-9% per year in 2022, 2023 and 2024.

Some investors may be concerned over the consequences of 40-year high inflation, which has led the Fed to raise interest rates aggressively. As most REITs carry appreciable amounts of debt, their interest expense has greatly increased due to the interest rate hikes implemented by the Fed. Due to this strong headwind, the REIT sector has underperformed the S&P 500 by a wide margin this year, as mentioned above.

However, LTC Properties has a solid balance sheet, with no imminent debt maturities and no secured debt. It has a strong interest coverage ratio of 3.3 and its net debt (as per Buffett, net debt = total liabilities – cash – receivables) stands at $0.7 billion, which is less than half of the market capitalization of the stock. In addition, the REIT has essentially all its debt fixed at much lower rates than the prevailing ones, with its credit line being its only floating rate debt. To cut a long story short, the strong balance sheet of LTC Properties and its conservative financial strategy offer great protection to the REIT from the exceptionally adverse environment of high interest rates.

Dividend

LTC Properties has rallied 11% this year but it is still offering a nearly 10-year high dividend yield of 5.8%.

This yield is nearly 4 times the 1.6% dividend yield of the S&P 500 and higher than the 4.7% median dividend yield of the REIT sector.

There are only two concerns regarding the exceptionally high dividend yield of LTC Properties. First of all, its AFFO payout ratio is elevated, at 89%. However, as the REIT is in recovery mode, its payout ratio is likely to improve in the upcoming quarters. Management recently stated that it expects the payout ratio to revert to its long-term target of 80% in 2023 or 2024.

The other point of concern is the freeze of the dividend for 6 consecutive years. This is a clear sign that LTC Properties has been somewhat struggling to fund its dividend. However, thanks to its solid balance sheet, the REIT has been able to endure the prolonged downturn in its business and can wait patiently for its recovery to play out. If the REIT meets the aforementioned analysts’ estimates for its FFO per unit, its payout ratio will improve to 82% by 2023 and 76% by 2024. Overall, LTC Properties has successfully defended its generous dividend for years and is not likely to cut its dividend now that it has begun to recover from the pandemic.

Valuation

LTC Properties is currently trading at a price-to-FFO ratio of 15.3. This is only marginally higher than the average price-to-FFO ratio of 14.9 of the stock over the last decade. Therefore, the stock is not as cheap as it was about a year ago but it remains reasonably valued, especially given that the REIT is expected to grow its FFO per unit in the upcoming years. To provide a perspective, the stock is trading at only 13.0 times its expected FFO in 2024.

Risk

As mentioned above, the 5.8% dividend of LTC Properties appears safe under normal business conditions. The only material risk is the adverse scenario of a severe recession. The Fed is trying to cool the economy in order to restore inflation to its long-term target. Some investors are worried that the aggressive interest hikes implemented by the Fed may cause a deep recession.

However, the Fed is much more active nowadays than it was in the distant past and hence it is not likely to let a fierce recession materialize without taking action. A mild recession is likely to occur next year but a severe recession is highly unlikely. Whenever the economy greatly deteriorates, the Fed is likely to lower interest rates drastically and thus stimulate the economy, just like it has successfully done in the past.

Final thoughts

LTC Properties has outperformed the REIT sector by about 30% since my article but it remains reasonably valued. In addition, the stock is still offering a 5.8% dividend, which has a wide margin of safety in the absence of a prolonged recession. Therefore, investors should not take their profits yet.

Be the first to comment