da-kuk

Investment Thesis

LSI Industries, Inc. (NASDAQ:LYTS) is a company that manufactures non-residential lighting and display solutions headquartered in Greater Cincinnati. The company reported excellent quarterly results showing significant improvement on most parameters. In this thesis, I will be analyzing the company’s financial performance and future growth prospects. I will also talk about the company’s management and the steps they are taking to ensure the growth of the company. I believe LYTS is still undervalued, and looking at the company’s future growth potential, one can establish new positions in the company.

About LYTS

LYTS manufactures retail display solutions and non-residential lighting in the U.S., Canada, Mexico, Australia, and Latin America. Non-residential lighting consists of high, American-made lighting solutions, retail display solutions consisting of digital signage, and technically advanced food display equipment for strategic vertical markets. The company has 11 manufacturing plants in the U.S. and Canada and employs about 1400 people.

LSI Financials

LYTS recently published its first quarter results for FY2023, and it is pretty impressive. The company beat the market revenue estimates by 8% and the EPS estimates by a significant 47%. The lighting segment was the main factor behind this performance. The lighting segment witnessed a 32% Y-O-Y growth outperforming the other segments. I believe the company will continue this growth rate throughout FY23, given the consistent investment in R&D and improved performance by newly launched products.

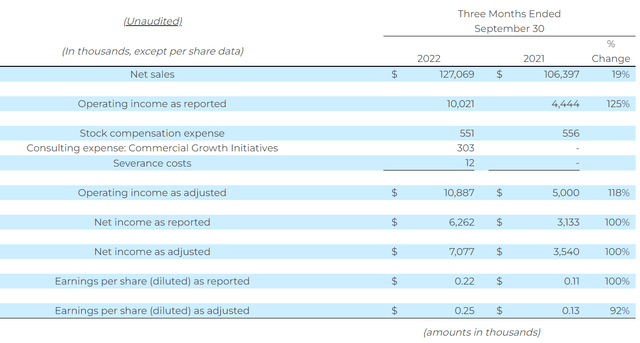

LYTS reported net sales for Q1 FY23 at $127.1 million, a significant rise of 19% compared to the corresponding quarter of last year. I believe this increase is mainly because of the rise in net sales of the lighting segment. This year LYTS launched a new product named REDiMount which proved to be a hit. Many customers and partners showed interest in it. This product is a lighting solution for refueling station/convenience store canopies that reduces installation time by 50%. New innovations, the launch of new products, constant efforts by the company, and the right market strategy lead to good quarterly results for the company. Improved pricing led to an increase in the orders for the display solutions, which were 12% above the prior year. The company’s adjusted net income for the Q1 FY23 stood at $7.1 million, an increase of 100% compared to the Q1 FY22, which was $3.5 million, which is quite impressive. The adjusted EPS (diluted) of Q1FY23 is $0.25, a significant increase of 92% compared to $0.13 EPS (diluted) in the same quarter of last year. The company also has a healthy free cash flow. LSI decreased its long-term debt by 2.6% in this quarter. Not only quarterly but also the annual results of LSI are impressive; the FY2022 yearly adjusted net income of LYTS is $18 million, an increase of 84% compared to the FY2021 annual adjusted net income of $9.7 million. The yearly EPS (diluted) of the company was $0.64, a significant growth of 83% from the previous year’s EPS. Overall, the financials of the company are excellent and looks quite impressive.

Technical Analysis

Currently, the stock is trading at $11 and is well over its 200 ema, which is at $7.10, and when a stock is trading above its 200 ema, it is considered bullish in an uptrend. After continuously forming lower highs and lower lows structures since January 2021, the stock has broken the structure and has formed a higher high and higher low and is currently trading at its 52-week high of $11. The stock is looking very bullish technically, and in the weekly time frame, it has broken out of a range, and one can enter at current levels for a potential upside of up to 20%, and I think it can be achieved in under three months. Looking at the solid financials and current bullish trend in the technical chart, LYTS can be a good bet for short- and long-term investment in my view.

LYTS’ Management

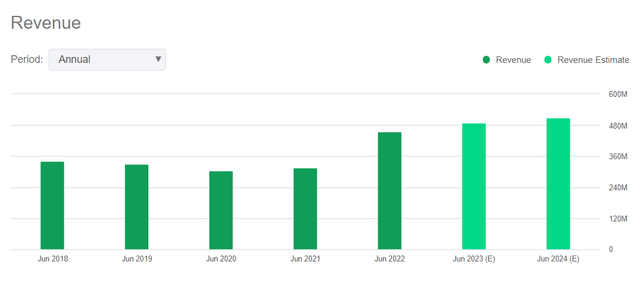

In my opinion, good management is of utmost importance for a company. We cannot judge a company only based on its financials and technicals because, in the long run, if the management is not able and dedicated to its work, then the company cannot excel even if the company has good financials. So, let’s take a look at the company’s management. James A. Clark is the president and CEO of LSI industries and has an experience of over 25 years as a senior operating executive officer in global manufacturing and product services. James is very popular for his leadership skills and is considered by many a visionary leader. He was also responsible for the strategic planning and activities for REXEL company’s $2.5 billion U.S. operations. Other than him, the rest of the management is also dedicated to their work, and they all appear to have a positive outlook for the company’s future. The management looks very promising and efficient to me. The annual revenue of LYTS for the year FY2022 stood at $455.12 million, an increase of 44% from the revenue of FY2021, which was $355.61 million. The estimated revenue of FY2023 is $489 million, an increase of 7.4% from the revenue of FY2022 and it can be achieved looking at the demand for the products of the company and the positive response from partners and the customers for the new products launched by the company. It shows the bright future of the company and the positive approach by the management.

Should One Invest In LYTS?

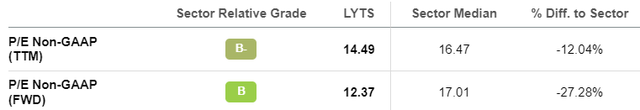

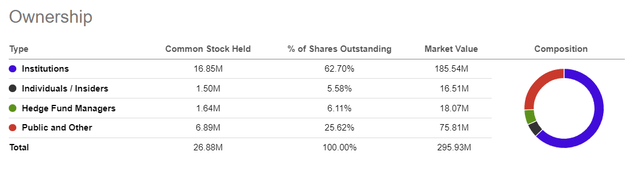

The shareholding pattern of a company says a lot about the company, and in LYTS, the Institutions hold 62.6% of the shares of the company. I think this shows that the company is very promising, and owners and big institutions probably have faith in their company which is a very positive sign and says a lot about the company. The company has a P/E (‘TTM’) ratio of 14.49x compared to the sector P/E (‘TTM’) of 16.47x. This shows that the company is undervalued. In the last one year period, the company has given a return of 43% and is still looking strong. I see more potential upside of 20% from the current levels. After looking at the fundamentals and technicals of the company, it is looking very strong.

The company can give good returns in the future in my opinion, and the company recently declared a cash dividend of $0.05 per share. LYTS is consistent in giving regular dividends, but the dividend yield is not much, which is considerate because the company uses its cash for creating new and innovative products and for research and development, which is very important in their business because of the high competition in the sector and continuous change in the demand of the customers and continuous change in the trend. LYTS uses most of its cash for R&D purposes. The company spent $3.6 million in the fiscal year, which ended on June 30, 2022. It shows that the company is dedicated to achieving growth and positive results in the future; by looking at all the facts, I am long on LYTS because I like companies that chase growth and are not defensive in their approach.

Risks

Constant Change In Trends

The constant change in customer demands, needs, and behavior makes this sector competitive. Every company in this sector constantly brings out new products and designs; even a single good product can bring a company to the top. Hence, LYTS has to make sure that it keeps pace with current trend and constantly do the required R&D to survive in this competitive market. If the customers disapprove of their new products, they could experience heavy losses and even lose their position as the market leader, so this makes this business very uncertain; as I think even a single product can decide which company will rule the market in the near future.

Bottom Line

LYTS has delivered strong quarterly results, and management is working efficiently for the company’s positive future. Constantly bringing new products and implementing the right market strategy helps ensure the future growth of the company. This also shows management’s positive attitude towards the company. After analyzing all the aspects and the risks, I believe the company will do very well in the future, and I assign a buy recommendation for LYTS.

Be the first to comment