MaYcaL

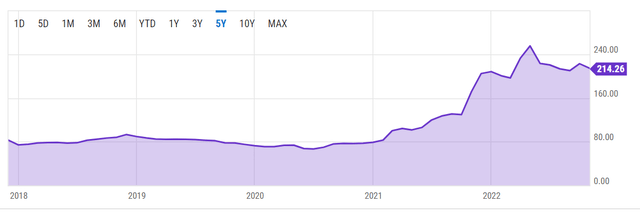

Global fertilizer availability is currently being hit on two fronts, due to the Ukraine conflict. EU fertilizer plants are shut in due to the high cost of natural gas, while Russian and Belarusian fertilizer is not making it onto the market, due to sanctions-related disruptions to shipping. CF Industries (NYSE:CF) is well-positioned to take advantage, by relying on cheap and plentiful U.S. natural gas as a feedstock for its operations, even as demand and fertilizer prices are set to remain high for the foreseeable future. While its stock price, within about 10% of an all-time high, does not seem like a bargain at this point, it’s worth keeping an eye on in case a better entry point arises in the near future.

CF Industries sees decent financial performance and a solid overall position

In the latest quarter, CF Industries saw an increase in revenue of about 80% compared with the same quarter from a year ago. Revenues came in at $2.32 billion, while profits came in at $438 million. The profit margin looks healthy, at almost 20%. These numbers are not a quarterly fluke by any means. For the first nine months of the year, net earnings came in at $2.49 billion, on revenues of $8.6 billion. Revenues more than doubled for the first nine months of 2022 compared with last year.

Debt declined from $3.47 billion at the end of last year, to $2.97 billion at the end of September. Total debt stands at around 30% of expected revenues for the year and is roughly equal to net profits for the year, assuming that the last quarter of 2022 will more or less mirror the results of the third quarter. Interest on debt was equal to about 4.3% of revenues for the first nine months of the year. I find this ratio to be on the high side and not entirely in my comfort zone. I tend to get cautious when interest on debt takes up more than 5% of revenues, and this is not far off – especially within the context of what seems like a good year, with many things happening in favor of CF industries.

CF Industries Seeing Demand Growth

The company is experiencing demand growth on the back of the increasingly permanent-looking demise of the European petrochemicals industry, as well as difficulties encountered by Russia and Belarus in exporting fertilizer products.

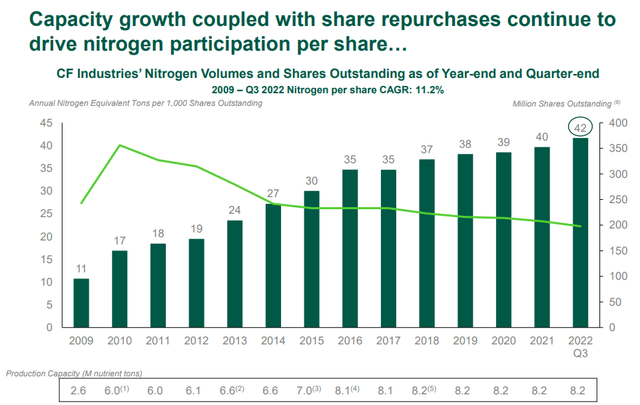

Aside from a modest presence in the UK, CF Industries is mostly a North American operation, with production locations often coinciding with areas that have an abundant flow of shale gas. Nitrogen fertilizer production has not increased much since 2016, but an interesting chart shows how production per shares outstanding did increase significantly.

It should be noted that the price of fertilizer also spiked since 2021, which adds to the positive revenues and earnings per share effect the company is experiencing.

Fertilizers price index (Yahoo)

There are two very obvious questions that arise. First, will the current fertilizers price environment last? Second, if CF Industries believes the higher price environment to be a new long-term normal, will it invest in new production capacities?

The answer to the first question is that the global fertilizer shortage issue is set to last as long as the economic conflict between Russia and the West does, whether over the Ukraine issue or arguably over other issues that underpin the Ukraine conflict. My view is that at this point, plenty of interests are invested in the conflict’s prolongation, ranging from environmentalist agendas to fears of certain factions of Europe having to continue to rely on Russia for energy, even as the current Putin regime and entourage of power continue to wield control of Russia’s resources, which are strategically and economically irreplaceable on a global scale, within the current context. The conflict will in turn continue to feed the global commodities bull market. Within the context of a prolonged global commodities bull market, Europeans are rightly seeing the threat of being exposed to the economic leverage that Russia has over them and over the world, given that it is mostly a commodity-importing region.

At the same time, countries like China, India, Saudi Arabia, and others can hardly afford to see a geostrategic triumph of the West, where a pro-Western regime is installed in Russia. The thought of the U.S. and EU having control over access to Russian resources cannot sit well with most Asian net exporters of resources. Nor can Saudi Arabia feel comfortable with the idea of regime change in Russia, where its own position is far more exposed to a similar potential move down the line. I, therefore, see this conflict continuing for a very long time since it seems no one can live with a resolution, either way. Europe’s fertilizer industry will mostly disappear as a result, even as Russia will probably see an increase in its share of the global export market. The overall global market will remain tight, however, because I don’t believe that Russia will be able to fully replace the lost production that we are seeing in the EU.

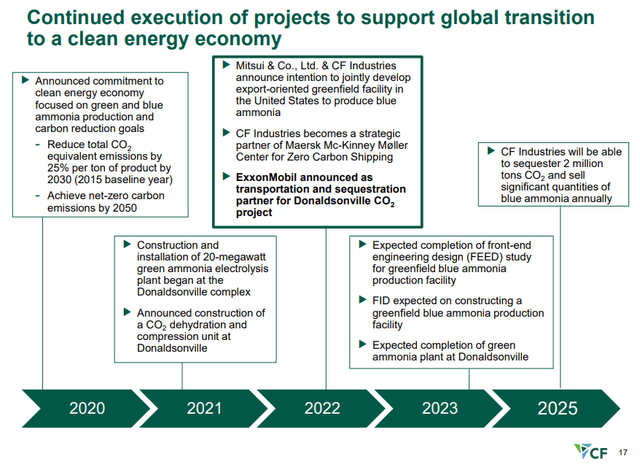

The second question that arises is whether CF industries will respond to the situation by increasing production capacity and whether that would be wise and beneficial for investors. At the moment, CF Industries is mostly highlighting its green-driven expansion plans.

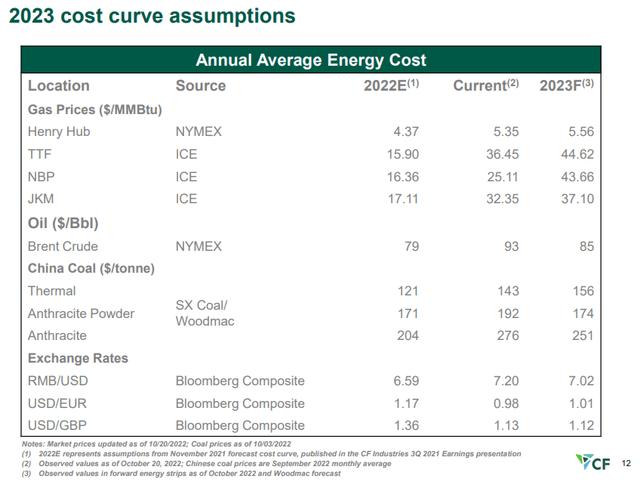

For some insight into the view at CF Industries, the energy price forecast that it is operating under would suggest that it expects the U.S. natural gas price advantage relative to Europe to persist at current differential levels.

Management seems to be operating under the assumption that natural gas prices in the US will see a further widening in the price differential compared with the EU TTF spot price. This might lead to a temptation to expand production capacity. It remains to be seen in coming quarters whether that will be the case or not.

In my view, expanding based on the price assumptions we are seeing in the chart is a very risky potential bet. I think U.S. and EU natural gas prices will converge rather than diverge, as LNG is increasingly tying the two markets to each other. CF Industries will still enjoy a very significant price differential between the two markets, but U.S. natural gas prices are likely to rise significantly going forward, which can cut into current profitability assumptions. On the other hand, without expansion, CF Industries is likely to see stagnated revenues and shrinking profits in the long run.

Investment Implications

On the one hand, the Ukraine conflict dividend that CF Industries is currently collecting due to the demise of the EU fertilizer industry, as well as difficulties faced by Russia in getting fertilizers to the global market makes for a compelling bullish case. On the other hand, American LNG exports will have to go full-throttle if the economic war with Russia is to be sustained. Europe cannot be allowed to outright collapse economically, therefore a convergence in natural gas prices between the two markets should be expected. This hypothetical outcome has the potential to cut the ability of CF Industries to expand revenues, while profits can get squeezed.

There is also the possibility that the conflict will come to a swift end, and what will be left of the EU fertilizer industry will reopen, while Russia’s own fertilizers will flood the global markets. In that case, fertilizer prices could collapse back to recent normal historical trends. If that were to happen, investors can get caught out by events, as CF Industries stock would see a significant slide, along with fertilizer prices. For this reason, I remain cautious, with the company definitely on my watch list, but keeping an eye out for a more favorable potential entry point.

Be the first to comment