ivanastar

Back in 1990, seventh graders at the St. Agnes School in Arlington, Massachusetts, were asked to put together a portfolio of stocks for a model portfolio. The goal was to see if they could beat the brightest minds on Wall Street. The rule was that they had to pick companies whose products they could readily explain to the class. Naturally, they selected companies like Disney (DIS), Nike (NKE), Walmart (WMT), and McDonald’s (MCD) which were highly visible (think moats) and were easy to understand (simplicity is key).

To the surprise (or not so surprise) of observers, their stock portfolio produced a 70% return in the subsequent 2 years, far surpassing the 26% return of the S&P 500 (SPY) over the same timeframe. What’s more impressive is that during the same time period, the students’ portfolio outperformed 99% of all equity mutual funds managed by Wall Street professionals.

This brings me to one such easy-to-understand company, Lowe’s (NYSE:LOW), which fits the traits of those stocks that the seventh graders of the St. Agnes School picked. In this article, I highlight why the low price of this great stock sets it up for potentially very strong returns for value investors, so let’s get started.

Why LOW?

Lowe’s is the second-largest home improvement retailer in the world, sitting behind Home Depot (HD), with nearly 2,000 stores in North America (U.S. and Canada). While retail ‘do it yourself’ customers account for the majority (75%) of its sales, it also does substantial business with commercial and professional clients, who account for the remaining quarter of sales.

Lowe’s stands out for having a very large store footprint and a strong resonance with consumers. This has resulted in economy of scale, which is especially important for the competitive retailer space. Moreover, unlike growth companies that have to shell out large amounts of growth capex every year just to “feed the beast”, Lowe’s already mature footprint enables it to drive more capital returns to shareholders.

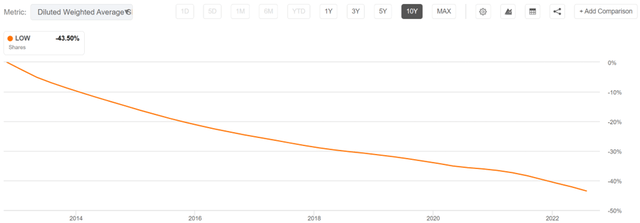

This is reflected by aggressive share repurchases that the company has done. As shown below, Lowe’s has retired an impressive 43.5% of its outstanding shares over the past decade.

LOW Shares Outstanding (Seeking Alpha)

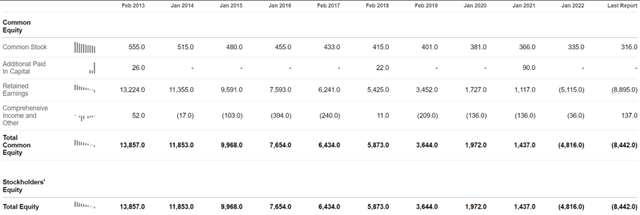

For those who are familiar with how a balance sheet works, companies that aggressively buy back stock ends up with negative shareholder’s equity. This simply means that the stock has returned more value to shareholders than the original equity with which it started. As shown below, this impressive feat was achieved during Lowe’s last fiscal year.

LOW Shareholder’s Equity (Seeking Alpha)

It goes without saying that Lowe’s business is tied to the health of the overall housing market, and it’s come under pressure as rising interest rates and inflation have put a strain on household home improvement budgets. This was reflected by the 0.3% decline in comparable store sales during the second quarter. However, while DIY sales (accounting for 75% of Lowe’s business) were pressured, it appears to be winning Pro customers, as this segment saw 13% YoY growth.

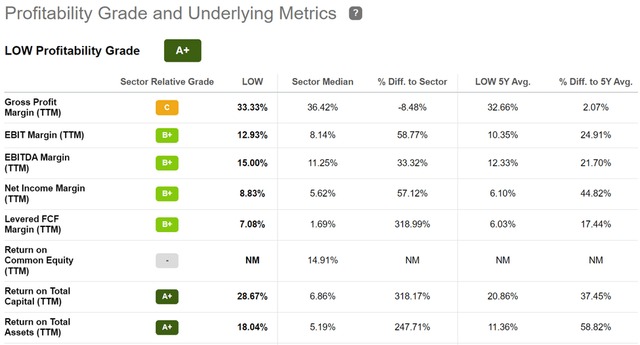

Encouragingly, Lowe’s hasn’t had to sacrifice much margin, as gross margin sits just 54 basis points lower than last year, at 33.2%. As shown below, Lowe’s maintains strong margins relative to the sector, with 15% EBITDA and 8.8% Net Income margins, sitting above the 11.3% and 5.6%, respectively, for the overall retail industry.

LOW Profitability (Seeking Alpha)

Looking forward, I expect to see continued pressures on the DIY segment as interest rates have continued to climb with stubbornly high inflation, putting pressure on household budgets. Nonetheless, I see the long-term thesis as being intact, and management continues to evolve the business as reflected by the recent unveiling of same-day delivery via Instacart (ICART). The home improvement marketplace also has plenty of remaining greenfield, as noted by management during last month’s Goldman Sachs (GS) Global Retailing Conference:

Looking out over the next few years, Lowe’s is focused on growing both Pro and DIY through our continued execution of our total home strategy to deliver continued topline and productivity. And as a reminder, home improvement is a $900 billion marketplace in the U.S. And if you combine Lowe’s and our largest competitor, we equate to roughly $250 billion of the marketplace. So as a result of this fragmented environment, we see a tremendous opportunity for continued growth in both Pro and DIY.

Meanwhile, Lowe’s maintains a strong BBB+ rated balance sheet, and the more conservative bond market seems to acknowledge that Lowe’s will be around for many, many years, as it was recently willing to lend the company money through 2062 at a 5.8% interest rate.

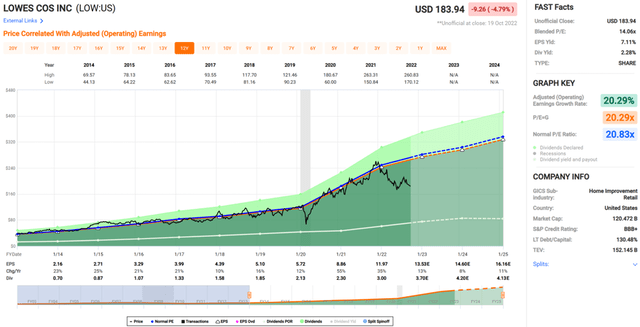

It also shouldn’t be ignored that Lowe’s is a dividend king with 59 consecutive years of raises under its belt. While its 2.3% dividend yield isn’t particularly high, it does come with a very high 19.5% 5-year CAGR and is very well protected by a 27% payout ratio.

Lastly, I find Lowe’s to be attractively valued at the current price of $184 with a forward P/E of just 13.6, sitting well below its normal P/E of 20.8 over the past 10 years. Analysts estimate 7% to 14% annual EPS growth over the next 2 years, and have a consensus Buy rating with an average price target of $243. Lowe’s could see double digit annual returns just by a return to its mean valuation.

Investor Takeaway

All things considered, I believe Lowe’s is an attractive long-term investment at the current price. The company has a strong balance sheet, impressive margins, and a long runway for growth. While near-term headwinds from higher interest rates and inflation will pressure comparable store sales, Lowe’s is making the necessary adjustments by growing its Pro business and expanding its same-day delivery capabilities.

I believe the market is underestimating Lowe’s long-term prospects, and the stock could see substantial upside from current levels. Lastly, Lowe’s fits the mold of high-quality company that a 7th grader can understand, and is currently trading at a cheap price!

Be the first to comment