Arturo Holmes

Fears of a recession have become palpable in the stock market in the past several weeks, with names that are economically-sensitive being sold off. That includes things like home furnishings, which are notoriously susceptible to recessions, given they are fairly large purchases, so customers on the margin can just punt on such things.

However, one furnishings company that has been sold off with the rest that I don’t agree should have been, is Lovesac (NASDAQ:LOVE). The company makes modular sofa components (and a few other things) that can be endlessly reconfigured by the customer to fit whatever space they’re in. I think this sets Lovesac apart from the sea of also-ran furniture retailers with used-car lot sales pitches and three-month lead times. I also happen to think the stock is very cheap, and that the chart looks quite favorable for the bulls right now.

Let’s dig in.

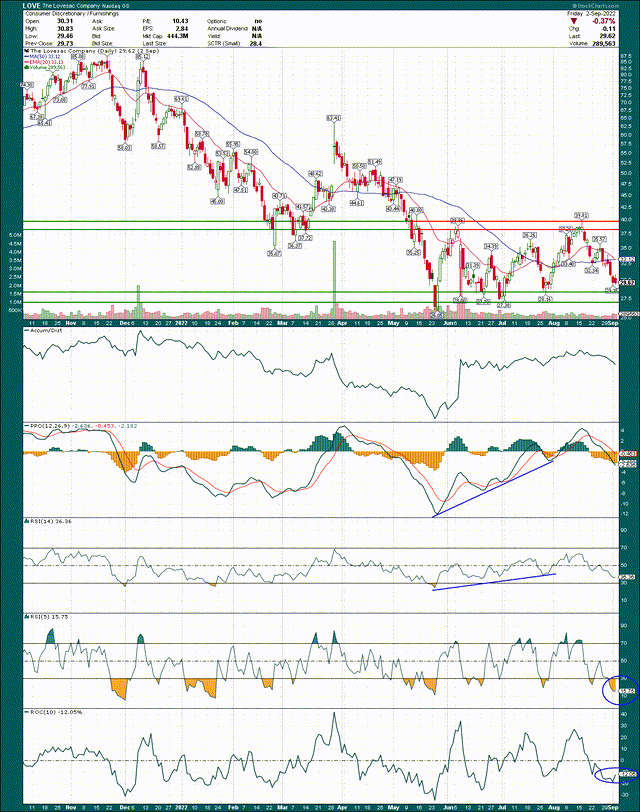

Immediately we can see there’s been a multi-month channel consolidation pattern that has formed, with the bottom near $28 and the top near $39. There’s been a lot of action, and a bunch of tests of the lower bound of the channel, but the bulls have held thus far.

What I find interesting here is not just that the channel has held, but have a look at the PPO; there’s a huge amount of improvement during a period when shares have simply bounced around. This looks like seller exhaustion, so that’s a good start.

Second, the 15-day RSI put in a big positive divergence earlier this year, similar to the PPO. It’s come off during this last move down to support, but that is to be expected.

The 5-day RSI, which is a very short-term momentum indicator, is showing extreme oversold conditions at just 16. That doesn’t mean it can’t go lower, but the odds are very much in favor of a bounce.

Finally, the 10-day rate of change in the bottom panel is -12%, meaning the stock has fallen that much in the past 10 trading days. That’s about the area it’s been bouncing during selloffs lately, so again, the evidence suggests we’re much closer to the bottom that the top.

Because we have a well-defined channel, the playbook is pretty simple. I like Lovesac so long as it doesn’t violate support in the area of $28. Note that support is a zone, not one single price, so plan accordingly, but thus far, it’s been rock solid.

Now, Lovesac is due to report Q2 2023 earnings later this week, so that is next very obvious catalyst we have for the next move. None of us knows what Lovesac is going to say on Thursday morning, but I will say the chart is implying very low expectations from investors. The fact that it’s oversold heading into earnings means big investors are likely pricing in a guidance cut or some other form of disappointment. We’ll see, but I love low expectations heading into earnings; it just makes it easier for the company to surprise to the upside.

Why Lovesac is different

I mentioned above that I think Lovesac is different to other furniture retailers, and in a good way. The company has small showrooms with almost no inventory, because the products are scalable to any space and any budget. Traditional furniture showrooms are cavernous spaces filled with florescent lights and overly eager commissioned salespeople; it’s not a nice experience. Lovesac is looking to change that.

In addition, the product itself, as I mentioned, offers infinite possibilities for the customer. If you go buy a couch from a traditional furniture store, you may get to choose the color, but that’s about it. You will almost certainly have to compromise on something, be it size, shape, color, etc. Then you have to wait 8 to 12 weeks to get it, and pay someone to deliver it because it weighs as much as Mars.

Lovesac’s model is just better, and I’m not sure how anyone could dispute that.

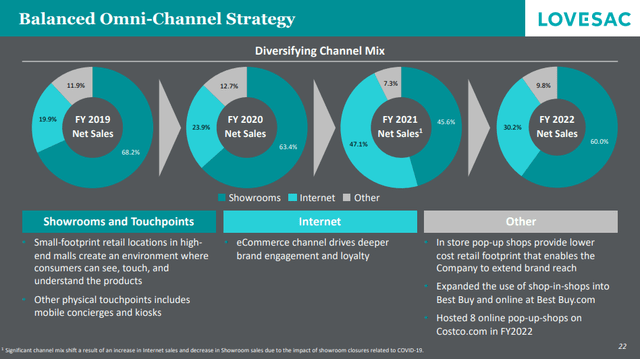

Part of the model is the fact that the showrooms are just the advertisement for the company’s products, and it does a sizable portion of its business online. This is particularly handy with repeat buyers – of which Lovesac has many – because once you’ve been to the showroom, you don’t need to go again. Just order it and get it shipped to your house. This company gets it in terms of understanding the customer experience, and that’s critical long-term.

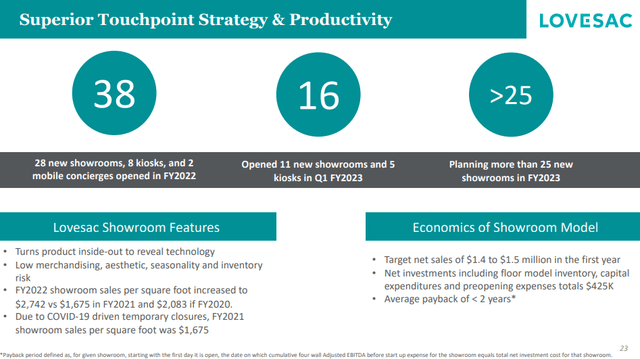

Lovesac is also growing quite rapidly, and its stores are extremely productive.

Sales per square foot for its showrooms in fiscal 2022 were $2,742, and the company targets ~$1.5 million in net revenue the first year. That’s an average payback of less than two years, so as it scales more and more stores, it becomes easier and easier to pay for new stores, and the cycle continues. Lovesac only has about 160 stores today, and it plans to open at least 25 more this year, so the growth opportunity is quite sizable.

Lovesac is also being creative with its touchpoints with customers, including a pop-up-shop on Costco’s website, and 21 Best Buy shop-in-shops. These partnerships are good for both parties, as Lovesac gains access to customers that may not have a Lovesac store near them, and are associated with well-respected consumer brands that people already know.

Let’s talk numbers

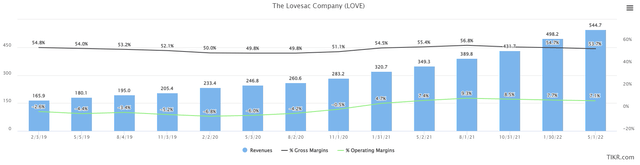

Lovesac has experienced extraordinary growth in the past few years, and that includes the years that were COVID-impacted. Countless industries – including furniture – are still COVID-impacted to an extent, but you wouldn’t know it by looking at the below.

Here we have revenue in millions, as well as gross and operating margins as percentages of revenue, since early 2019. Values are trailing-twelve-months.

Revenue has gone up every single period basically forever, which is very impressive considering COVID almost shut the world down for months in 2020, and has disrupted supply chains ever since.

Margins have fluctuated, and operating margin has come down in the past four quarters from 9.3% to 7.1%. That’s obviously not ideal, but the point here is that even in what should be a pretty challenging environment, Lovesac is delivering on both growth and profitability.

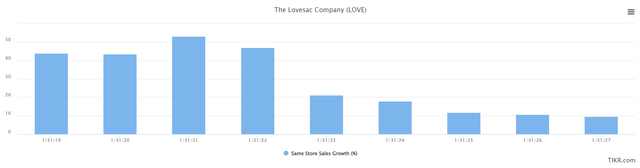

Speaking of growth, the company isn’t just opening a lot of new stores, the ones it has are performing tremendously well.

The 40%+ comp sales numbers of a few quarters back are obviously unsustainable, but if we look out into fiscal 2024+ above, we see analysts are still looking for double-digit annual gains years from now. I don’t know of a lot of retailers with that sort of growth profile, and keep in mind that expectations for furniture purchases are low right now given the recession fear. In other words, I think there’s some measure of bad news priced in here.

Inexplicably cheap stock

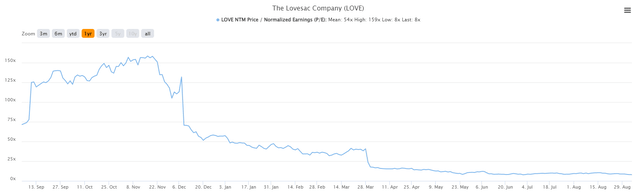

I love the growth story here, but it in no way is reflected in the current valuation. Growth is great on its own; growth with a cheap valuation is a dream. We’ll start with price to forward earnings to get a sense of the kind of valuation we’re looking at.

Lovesac is trading for less than 8X forward earnings today, for a company with outstanding growth expectations and a highly differentiated product. I can’t explain that other than investors fear a recession is going to obliterate earnings expectations. However, with earnings looming on Thursday, if the company says anything besides that, I think we have a great shot at an upside breakout of the channel we looked at earlier.

If it’s price to forward sales you fancy instead, Lovesac has you covered there as well.

We’re at 0.7X forward sales today, down from 2.6X less than a year ago. If you’re keeping score at home, it’s also about half the average P/S ratio from the past year. Again, it’s just way too cheap.

Final thoughts

I think there’s a huge amount to like here. The company has a highly differentiated product, a sales model that fixes what is broken about buying furniture the traditional way, enormous growth historically and looking forward, and an absurdly cheap valuation. Lovesac ticks all the boxes here, if you can stomach the risk of a recession keeping a lid on valuations for the time being. That’s a real threat I see to the bull case for Lovesac given how cheap it is, and that’s a risk I’m willing to take. To know more about risks, please read Lovesac: An Exceptional Growth Story Is Playing Out

Be the first to comment