vm/E+ via Getty Images

Never put off till tomorrow what may be done day after tomorrow just as well.”― Mark Twain

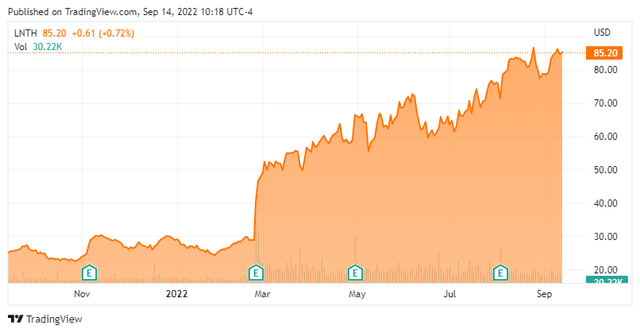

Today, we take our first look at Lantheus Holdings (NASDAQ:NASDAQ:LNTH). I had a decent sized position in Progenics Pharmaceuticals (PGNX) prior to it being acquired by Lantheus. I also own a decent amount of Lantheus within covered call positions initiated when the shares were trading just over $60 a share in spring of this year. Those holdings look like they will expire deep in the money in November. Should I initiate a new covered call position in LNTH now that they are over $80.00 a share? An analysis follows below.

Company Overview:

Lantheus Holdings is based just outside of Boston. The company is focused on developing and commercializing diagnostic and therapeutic products that assist clinicians in the diagnosis and treatment of heart, cancer, and other diseases worldwide. Currently the stock trades just over $85.00 a share and sports an approximate market capitalization of just south of $6 billion.

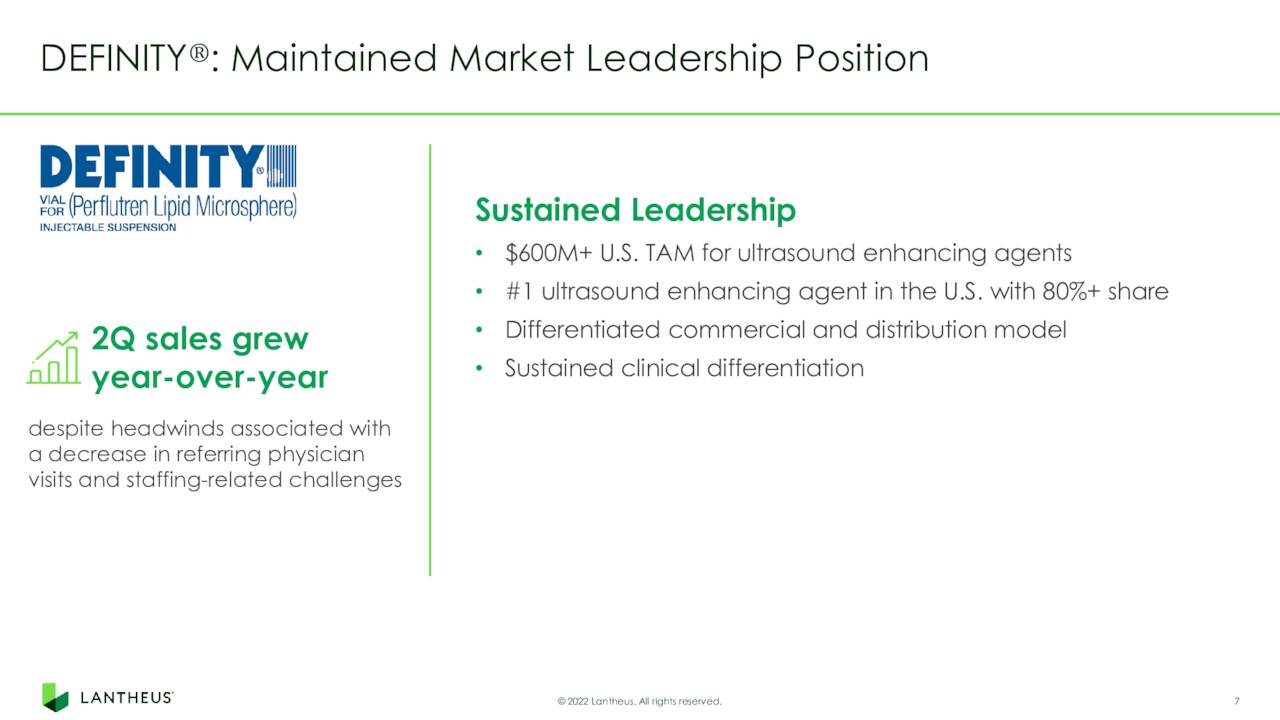

The company has several imaging agents on the market. The two most important ones are Pylarify a recent launched prostate-specific membrane antigen (PSMA) targeting positron emission tomography (PET) imaging agent and DEFINITY, an ultrasound imaging agent.

Second Quarter Results:

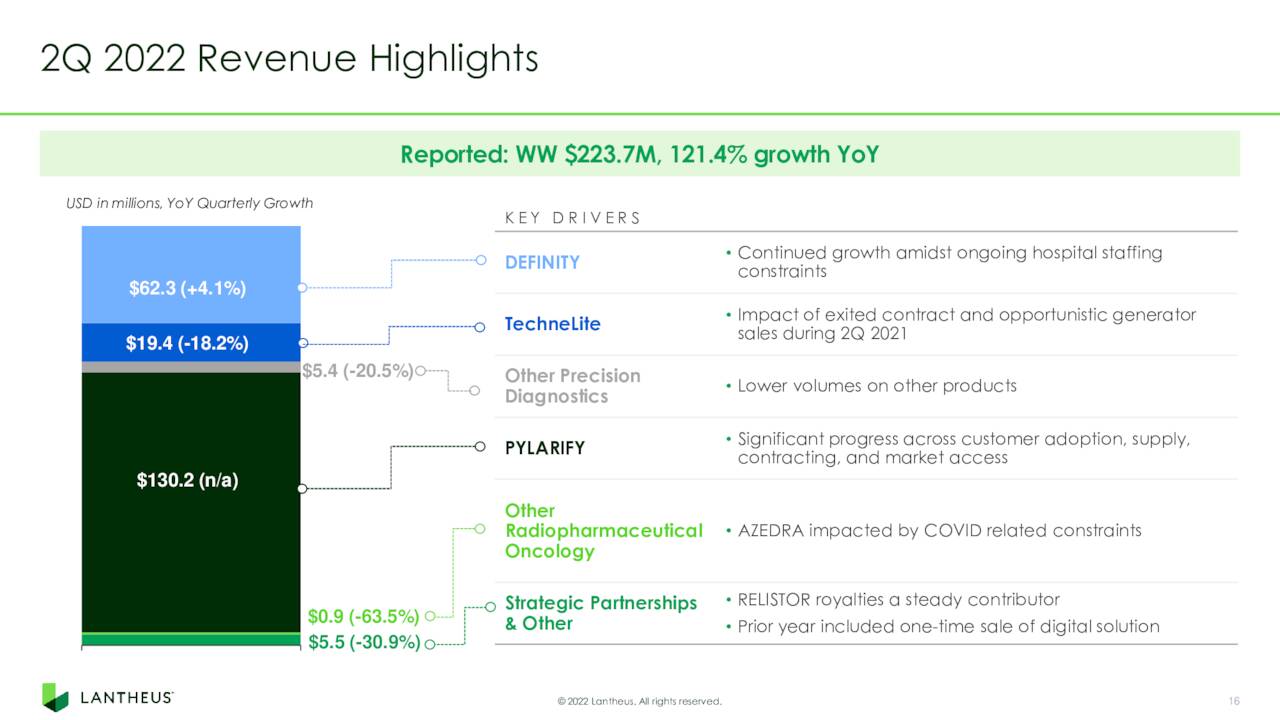

The company posted second quarter numbers on August 4th, and they were impressive. The company delivered 89 cents a share of non-GAAP earnings as revenues soared just over 120% on year-over-year to $223.7 million. Both numbers handily beat the analyst consensus. GAAP net income came in at $43.1 million compared to GAAP net loss of $26.7 million in the prior year period.

August Company Presentation

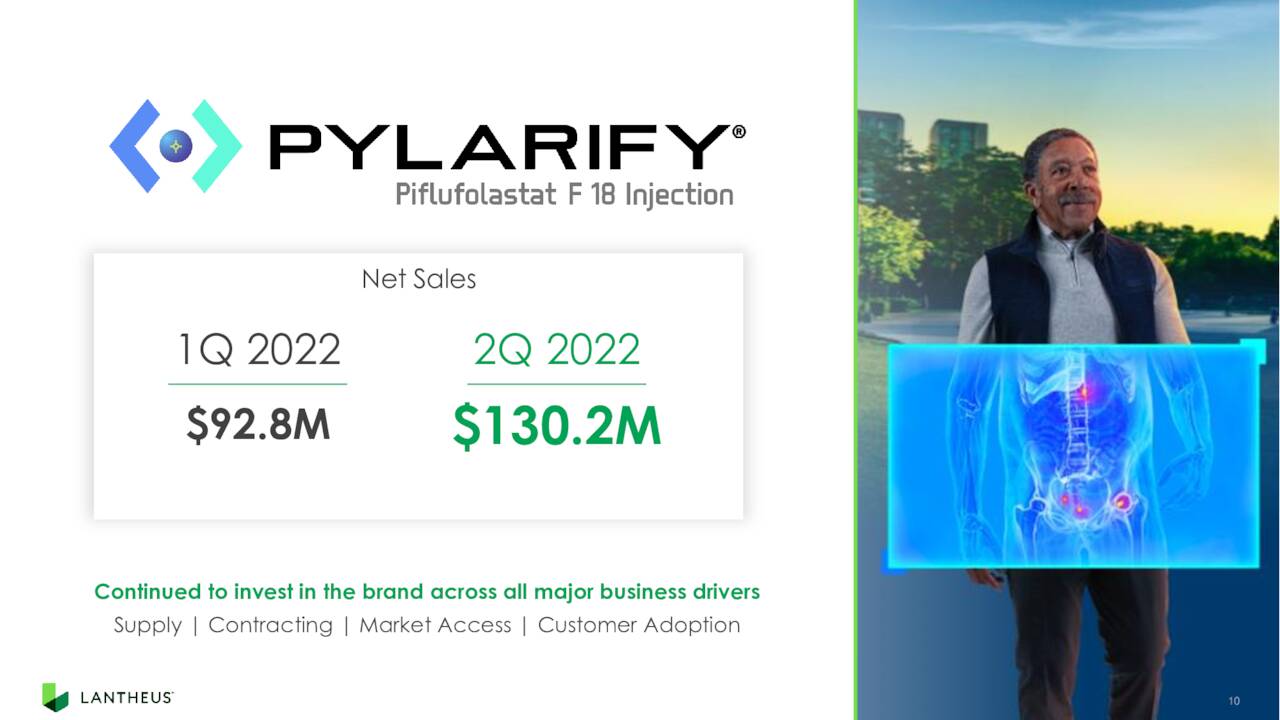

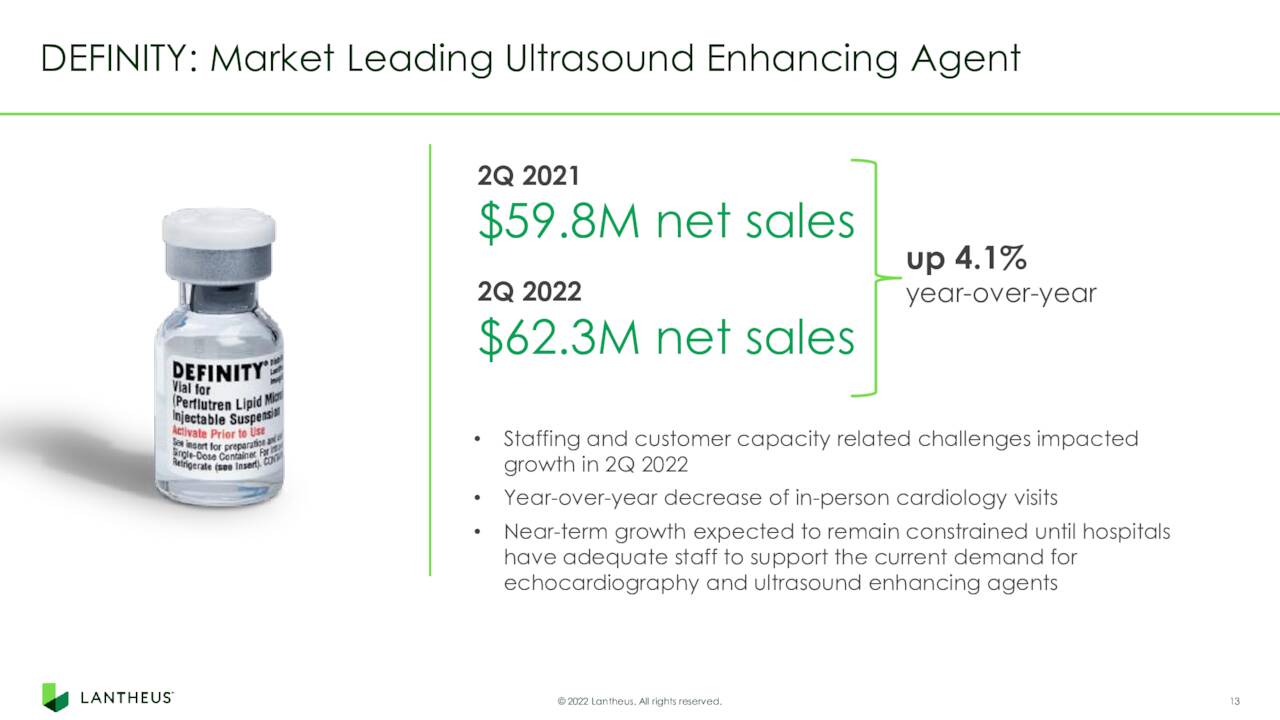

Revenue growth was powered by the recent launch of Pylarify which delivered just over $130 million of sales in the second quarter, up from just under $93 million in the first quarter of this year. DEFINITY accounted most of the rest of sales in the quarter as revenues were up four percent from a year ago.

August Company Presentation

The rest of the company’s product portfolio showed declines in sales for various reasons.

August Company Presentation

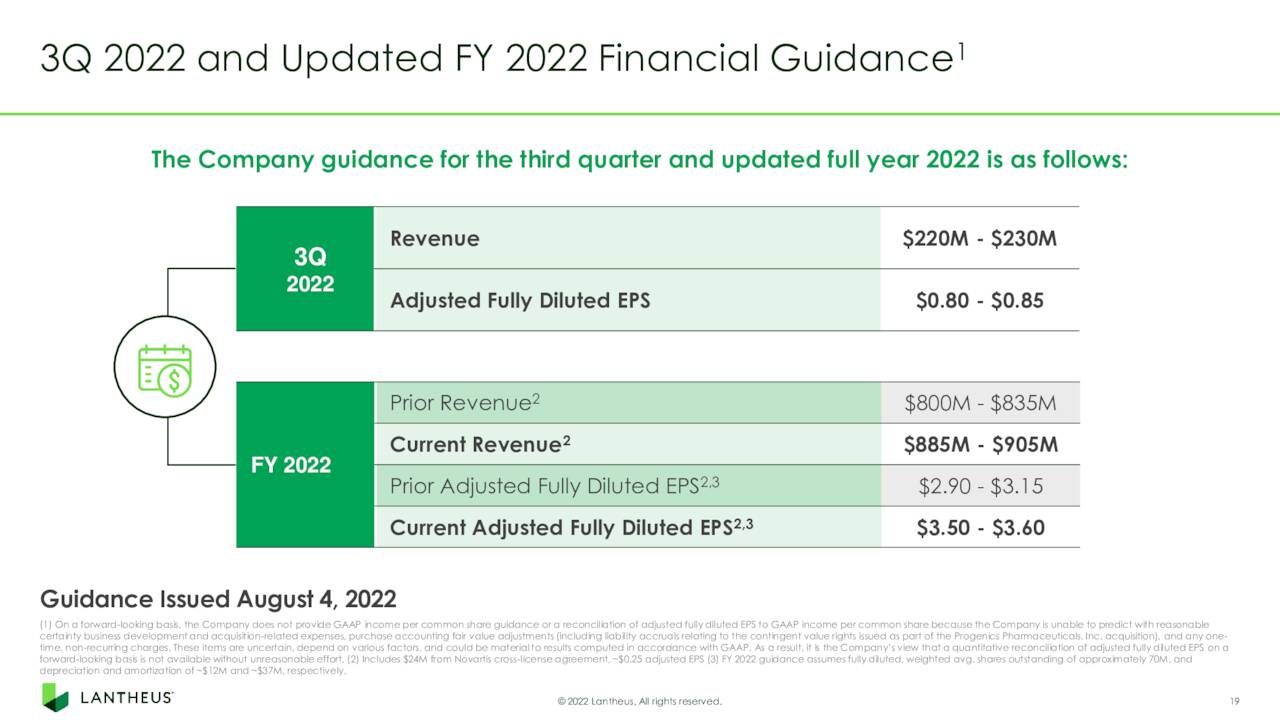

Management also boosted forward guidance as you can see below, both for the third quarter and the fiscal year.

August Company Overview

Analyst Commentary & Balance Sheet:

Since second quarter earnings came out, both SVB Securities ($110 price target) and Truist Financial ($100 price target) have maintained Buy ratings while B.Riley Financial ($102 price target) initiated the stock as a new Buy citing the company’s growth trajectory due to the launch of Pylarify.

Approximately four percent of the outstanding float in LNTH is currently held short. Numerous insiders have done some profit taking throughout 2022 on the nice rally on the stock. They have disposed of nearly $6 million worth of stock in aggregate so far here in third quarter.

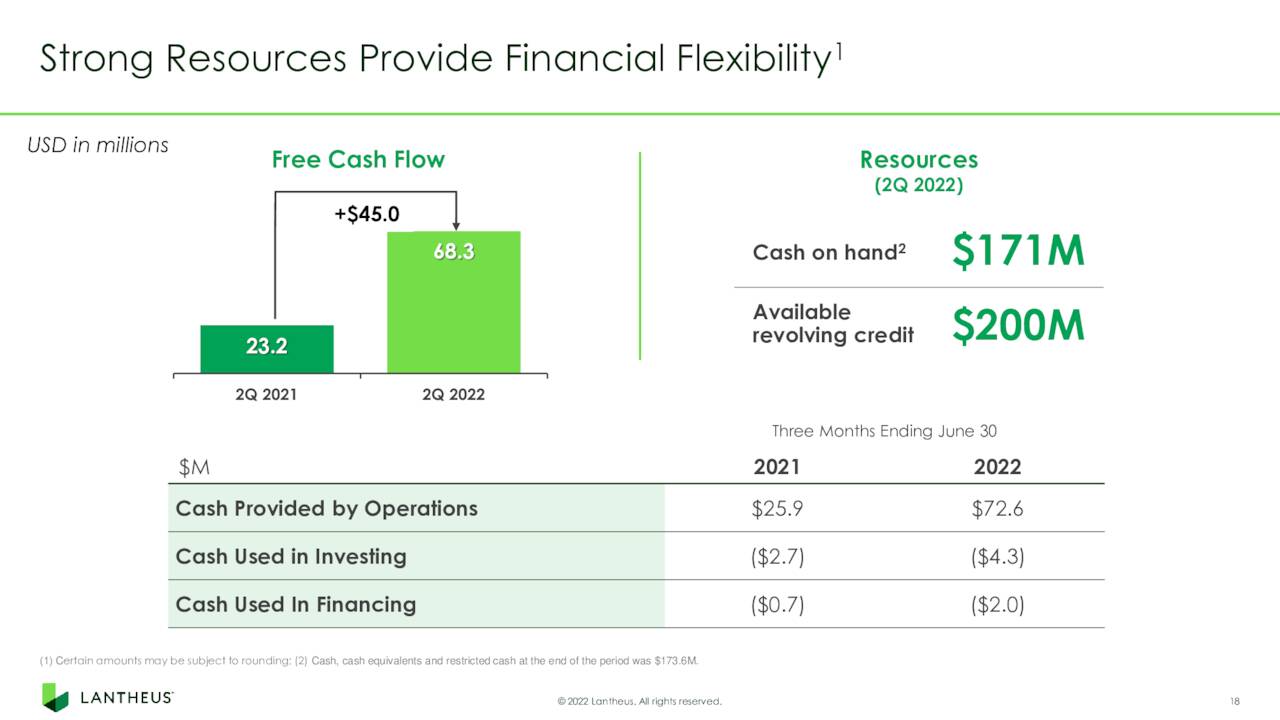

August Company Presentation

The company’s balance sheet is in good shape with just over $170 million of cash and marketable securities on hand as of the end of the first half of 2022. The company had $68.3 million worth of free cash flow in the second quarter as well. Lantheus has long term debt of just over $150 million.

Verdict:

The current analysis consensus has the company earning just over $3.55 a share in FY2022 as revenues rise more than 110% to nearly $900 million. Sales growth is projected to slow to the low teens in FY2023, however as earnings rise to $4.05 a share according to the analyst community.

August Company Presentation

The company is delivering impressive results primarily as the result of the rollout of Pylarify, which management believes has a potential market of approximately $1.2 billion. DEFINITY has 80% market share of what the company believes can be a $600 million annual market.

August Company Overview

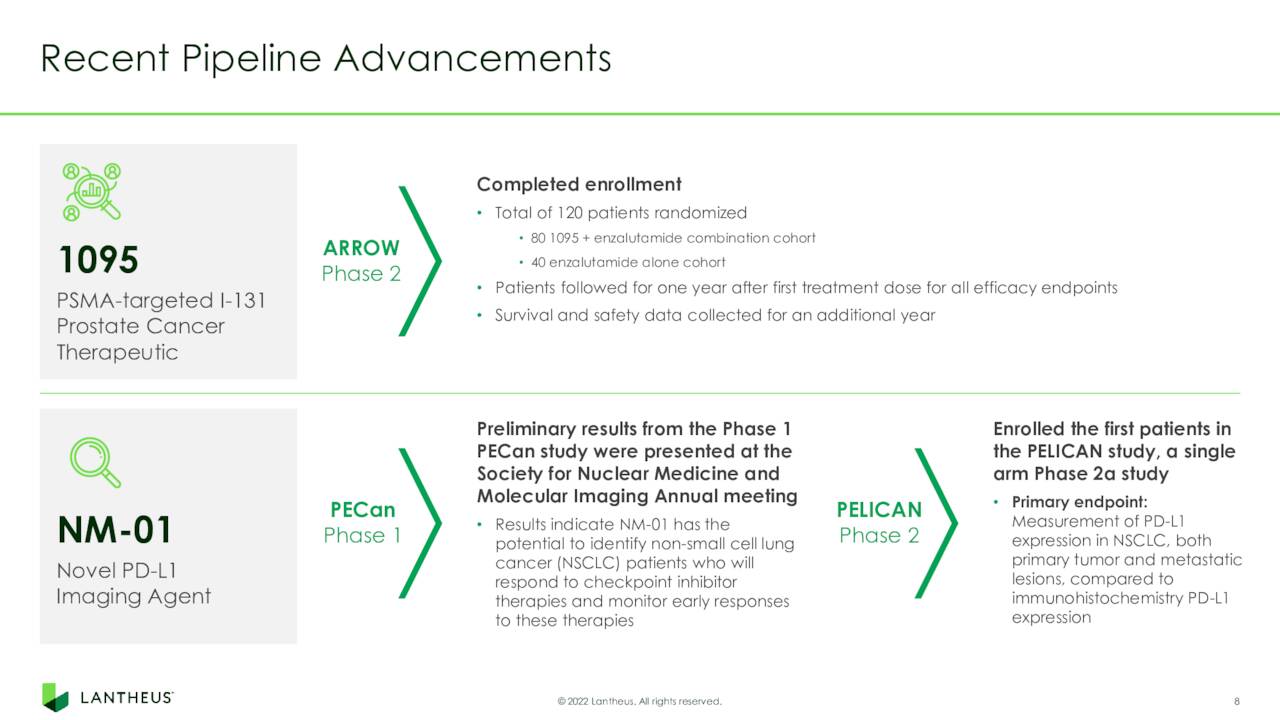

Pylarify should soon be approved in Europe and also will be included in most late stage trials in the United States for PSMA targeted therapeutics. The company also has other imaging agents in various stages of development.

August Company Presentation

That said, sales growth will slow substantially in FY2023 as comps get much tougher. We are in an extremely uncertain economic environment and higher interest rates put growth stocks under pressure. There also has been some significant insider selling of late as well in this equity. The stock trades at roughly six times next year’s sales and over 20 times next year’s projected profits.

That means I am probably not a buyer of LNTH as my options expire if the stock trades at current levels. However, if an overall market pullback brings the stock down into the $70 to $75 range when my options expire, I will probably pick up some more LNTH via covered call orders once again.

You may delay, but time will not.”― Benjamin Franklin

Be the first to comment