alvarez/E+ via Getty Images

Dear readers,

In this article, we’re going to take a look at the KION Group (OTCPK:KIGRY). This is an undervalued business in materials handling, automation, and intralogistics solutions. It’s a capital goods segment that’s usually overlooked by many – but shouldn’t be.

In this article, I’ll show you why you shouldn’t ignore KION at the right price – which really is “Now”.

Let’s get going.

KION Group – What Does The Company Do?

So, KION Group is a company formed by the company Linde (LIN) back in 2006, following its M&A of the BOC Group. KION Group was already a division of Linde Materials handling and was known as the materials handling segment, which included STILL, OM Carelli Elevatori, and other small sub-brands, which operated as the KION Group.

This was sold to a partnership including Goldman Sachs Capital Partners at a price tag of €4B at the time. The business then went and formed a number of JVs with Indian and Chinese partners, expanding its market reach. It sold off most of the “heavier” products, such as empty container and laden container handling products, sold them to Konecranes (OTCPK:KNCRY), and streamlined its business more into handling advanced materials and logistics workable with smaller machines.

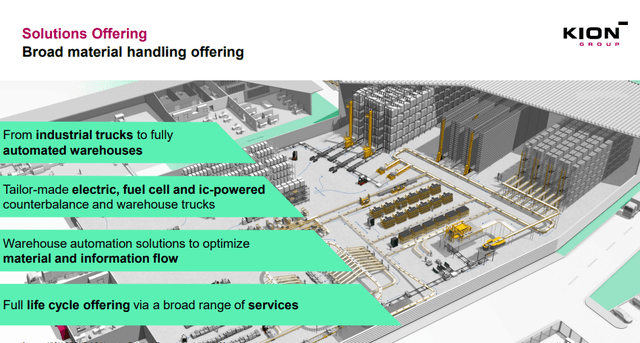

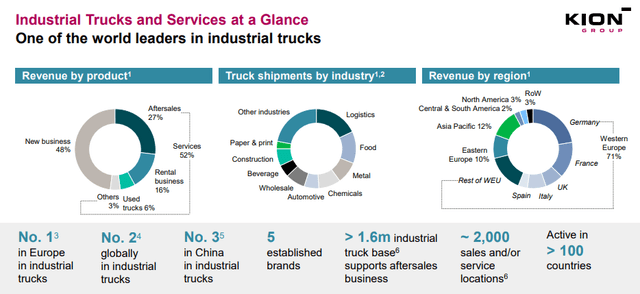

Kion Group Presentation (Kion Group IR)

KION also moved into lithium-ion batteries for its own trucks, producing them at the BMZ HQ with a 50/50 JV. The company’s M.O is forming JVs with local specialists in order to get the capacities or expertise they need for their business.

The company’s products are sold under the following brand names:

- Baoli

- Fenwick

- Linde Material Handling (still a working brand)

- OM STILL

- STILL

- Voltas

- Dematic

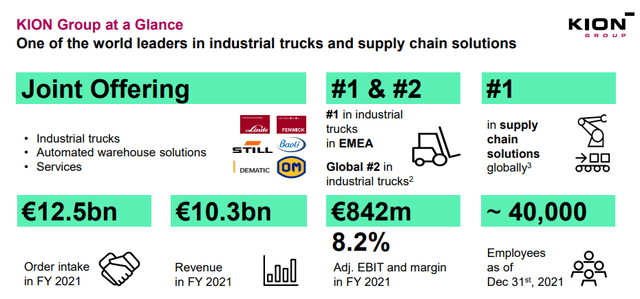

Kion Group Presentation (Kion Group IR)

The company is a worldwide business with international diversification, and it has been expanding its offering to a new generation of fully connected trucks, and complementing this with software offerings that simply digital transformation for its customers. KION Group is a relatively R&D-heavy company for a business in the capital goods sector, with specific focus in Energy, Digital, and Automation technologies. It’s also one of the major players in turning these vehicles into EVs with Li-on batteries and fuel cell technologies. The R&D spend for KION will expand from 2021 to 2023E, with expected spend increases in software development. Total R&D as a percentage of revenue has stayed at around 3%.

KION Group is also in the midst of a savings and efficiency program, which is expected to deliver close to €100M in accumulated total savings by the end of 2022E, of which close to €50M has already been captured.

The reasons for investing in KION are, on a fundamental level, relatively simple to me. Kion is a cyclical capital goods business in a segment that’s relatively un-cyclical because it’s tied closely to logistics as opposed to simple automotive demand. It benefits directly from trends such as e-commerce, ESG, energy, and new automation trends.

It’s also a global leader in the field – among the best in the world at what it does, and it’s proven for years that it has a working business model with attractive customers.

KION Group sells products and services for over €10B in revenues since 2021, which is an annual growth rate in sales of 23.4%. From this, the company tends to stick to gross margins of around 23-26%, and makes around 6-8% operating margin on those products, putting them in the same box as some luxury car manufacturers and similar companies.

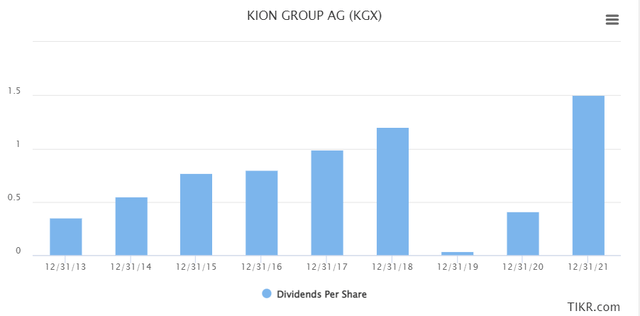

Dividend stability does not really exist. As a company that works in a cyclical sector, with none of the shareholder traditions of the US, KION structures its dividend in accordance with its earnings. While the company tries to stay attractive and grow the dividend – and has also fully restored the pre-pandemic DGR, the company did cut the dividend to the bone in 2019 and only slightly bumped it in 2020. It has also only paid a dividend since fiscal 2013.

KION Group Dividend (Tikr.com)

Aside from this, KION carries a BBB credit rating from Fitch and is investment-grade rated. Its current dividend means that an investment in KION yields around 3.52% – not the highest, but certainly not a bad yield for a company that’s among the world leaders in this field.

The company’s order intake has shifted significantly towards its electrified portfolio. 87% of 2021 orders are now electrified, and 100% of the supply chain solutions are electrified as well. The company works with an impressive 99% recyclability of its trucks, and 1 out of 6 trucks sold in 2021 was actually “used”. Several of the components crucial to the products are made from scrap metal exclusively, and KION is among the world leaders in using recycled materials as opposed to sourcing new, which of course impacts the company’s reliance on input costs and inflation.

In terms of products, end industries, and regions, the sales split look something like this.

On the basis of its expertise, meaning it sells among the best trucks and products in the field, its full-lifecycle service offering, and its ongoing efficiency improvements, the KION Group seeks to continue to dominate parts of the market. The efficiency increases will support the ongoing price premiumization that we’re seeing, and there’s plenty of room to improve the pricing as truck purchases, on average, represent less than 13% of the total operating costs for many of its customers. Trends are going the way of the KION Group, with an estimated 70% of all trucks being powered by Li-ion batteries – and this is what KION is currently focusing on.

There are a large number of megatrends that come with positive demand implications for KION. First off, we have the demand for automated warehouse solutions from E-commerce, is expected to grow by about 10% annually until 2023. Secondly, emerging market growth demand from geographies like China is expected to continue to grow by 6% annually. Sustainable solution demand and demographic changes are expected to drive things yet by another 25% and 51% annually respectively, for mobile automation and Li-On powered trucks.

Overall, the company is a major player in a market that seems to be going in only one direction – and that direction is positive. The company manufactures globally, and its ownership structure is consolidated in that 54.7% of the shares are free float, and 45.2% are owned by Weichai Power Co, which is a strategic partnership with advantages in the supply of parts and the like.

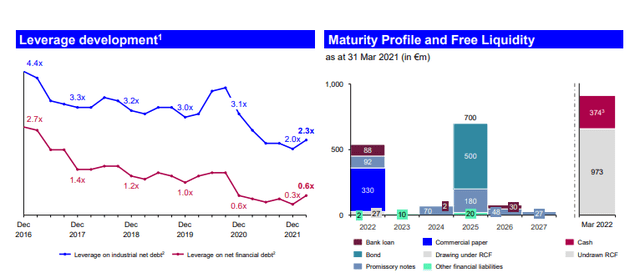

Leverage and maturities are well structured and have been trending down since 2016.

KION Group Presentation (KION Group IR)

This gives us a positive picture of what we might expect from the company here. The company has very limited Russian exposure. KION has no major production whatsoever in the region, and revenue shares are lower than a single percent.

What about risks – are there any?

KION Group – The Risks

Of course, every company has risks – here are some of KION Group.

The positive expectations for growth are based on very dynamic 2022-2025 numbers, which the company and other analysts are currently viewing as valid. Despite the current economic climate, I tend to agree with these assumptions for the reason that the company’s products often can’t be viewed as discretionary, but rather as standard operating costs. However, in the case of a gradual or even sudden slowdown that’s faster than expected, the KION Group would of course see significantly lower results and valuation as follows.

The company has also quite recently seen significant multiple contraction, to where it’s gone down well below 15X P/E. I don’t view this as valid given company 2021 results, which were excellent – but it’s almost impossible for a capital goods company like KION to completely decouple from war-incited market dynamics. Inflationary headwinds are also unlikely to affect KION significantly, as they just recently bumped their pricing quite significantly.

Still, the primary concern I have with KION relates to profitability – and late-2022 order intakes. Challenges related to supply chains will remain, and this has the very real potential of causing havoc with the company’s orders and its profit, driving the margins down below 5-6%. The war has caused dramatic shortages in parts, as well as massive energy cost increases. KION itself is expecting good margins – I tend to be somewhat more cautious, guiding to around 6% on an operating level with potential downward headwinds.

However, this does not impact the overall positive view of KION – and I will show you the reason for this.

KION’s valuation

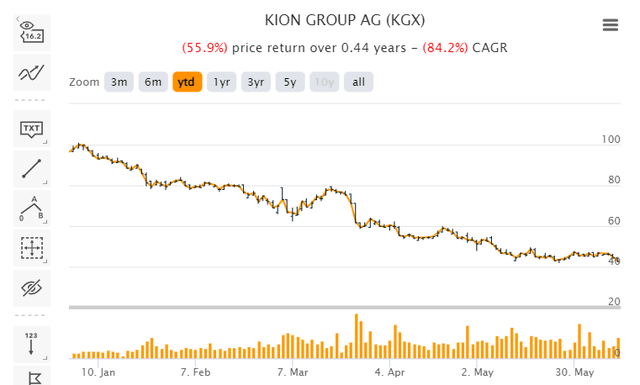

KION is significantly undervalued at this point – there is no way around this. Following significantly positive FY21 numbers, KION has underperformed massively by dropping over 56% in 6 months.

This is a combination of the company coming down from pandemic highs, which it saw for its results, and going well below where it should be, to close to COVID-19 pricing levels.

Is this justified by the expectations for the company? I would answer this with a firm “no”. Current analyst estimates call for the company to deliver revenues 10% above 2021. While margins will go down, with EBIT expected to touch 6-7%, this does not to my mind justify a 50%+ price drop. The company will sell more, but at lower profit margins, but still more than 1.5X the profit we saw in 2019, and back to a 2016-2018 EPS level. Beyond 2022, the company is expected to grow earnings and revenues to around double that of 2022E by the time of 2026. (Source: FactSet)

For my DCF, I employ a 6.75% WACC with a 2.0% risk-free rate and a 5% market risk premium with a beta of around 1.1. Based on that, and expecting sales growth around 4-5% and EBIT growth around 9-10% based on strong trends, we reach an implied EV value of close to €17B, which net of debt comes to a fair-value share price of around €106. This is obviously a massive upside to where the company is currently trading – more than twice as high – but in case we do see this growth, that’s what the company, to my mind is worth.

Peers also look very overvalued compared to KION. KION is trading at an NTM revenue multiple of 0.66X, while we look at peers like Toyota (OTCPK:TYIDF), Jungheinrich (OTC:JGHHY), Cargotec (OTC:CYJBY), and others which are trading at higher multiples – with Toyota close to twice that. EBITDA multiples show similar undervaluation, with KION trading no higher than 4.3X, with the lowest peer at 6X. The company’s average P/E ratio is below 10X, while others are significantly above 10X, with Toyota trading at 13X.

The expectation here is based that the company’s operating EBIT margin actually increases once these troubles are over, from 2024 and onward, and we assume a 1% FCF growth rate for the period beyond 2026 and onward.

KION trades at material discounts to any historical multiple or number. S&P Global analysts give the company a target range of €52 on the low point to €130/share on the high point. I combine my peer targets, book/NAV targets, and DCF targets and come to around €90/share, but that’s as low as I’m willing to go on the KION Group. The company is too good to go lower, and I don’t really see how any serious analyst could give the company as low as €52, unless you believe that there’s material deterioration in the company’s near-term future.

The average S&P Global target for the company is €84, which implies a current upside of 99%. I consider, as I said, the company upside to be higher. €84 is a bit conservative even for me. 12 out of 19 analysts have either “BUY” or “Outperform” ratings on this company here.

I personally come in at a rating for the business of €90/share. We have an unsponsored ADR that’s equal to 0.25X of a share, and that trades under the symbol KIGRY. It would be my stance, based on the liquidity and appeal here, to buy the native share through IBKR or one of the other brokers that allow for native international trading.

This brings me to my thesis for KION Group.

Thesis

KION Group is an attractive capital goods play with an emphasis on intralogistics solutions, automation, and warehouse technologies – things like forklifts, to put it simply.

This business has been around for a very long time if you take into consideration the roots of the components that make up KION – and it has shown us, through pandemic numbers, that it’s upside and appeal is very much intact here. Part of the drawdown in share price is without a doubt related to KION pulling its 2022E guidance, and expecting higher headwinds in 2022. These impacts are mostly in the form of supply chain bottlenecks, but also in increased logistical costs. COVID-19 lockdowns also impact Asia.

So a mix of short-term and longer-term pressures are ensuring that KION is in the middle of a negative trend here – but I believe not only that it will turn around, but that we also can see a massive upside based on my target price, which is based on realistic forecasts. Profitability is likely to take a hit, but the fundamental upside is, to my mind, very much intact, even if EBITDA climbs no higher than we saw in 2022.

I, therefore, consider these my targets for KION Group and consider the business a “BUY” with a €90/share price target for the native share.

Be the first to comment