wdstock/iStock Editorial via Getty Images

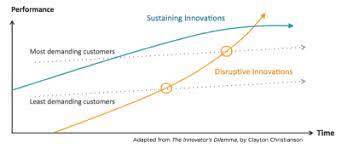

Thesis summary: Wise (OTCPK:WPLCF) is the disruptor in the international money transfer market while Western Union (NYSE:WU) is struggling to remain relevant as Wise is disrupting Western Union’s markets from a bottom to top perspective. It is only a matter of time until Wise will disrupt Western Union’s last profitable value networks which can cause a significant decline in profitability at Western Union. Wise’s valuation does not give it adequate credit for the disruptor it is.

Wise

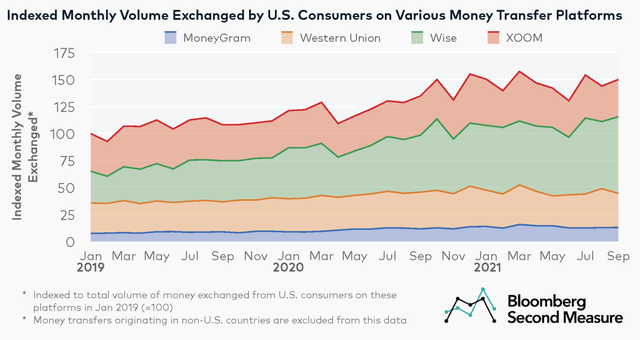

Wise is disrupting the international transfer market with its lower fees and digital approach. Wise has especially experienced significant growth as remote work significantly accelerated due to the pandemic. It is interesting to note that Wise alone has taken a majority of the growth in the money transfer market since the COVID pandemic. With remote work here to stay, this is very positive for Wise’s long-term growth rate.

Wise has grown market share by offering what matters to customers: low transaction fees, transparent costs, ease-to-use, fast processing times and reliability. There is little discussion that since its founding; the platform has experienced exponential growth from a small disruptor to a scaled market leader.

Wise is also showcasing that it is becoming more than just an international transfer option. The popularity of storing money on Wise accounts in dozens of different currencies is growing: and is now at 20% of the customer base. Essentially, Wise is becoming the international bank for remote workers and the like.

Wise is expanding its moat by growing money volume. As money volume grows, it can better predict better fraudulent activity, and provide services at lower costs and better performance. Growing money volume that accelerates operational leverage is the holy grail of fintech and Wise is a prime example.

The Disrupted

Western Union’s customer proposition is focused on higher transaction speeds, retail locations and higher country coverage. I deem this as the typical pitfall of a company being disrupted. Western Union is focusing on improving its existing proposition, but the question is how many customers actually care about this expanded proposition. Most customers care much more about transparency and lower fees but offering this will break Western Union’s profitability; Western Union is stuck in a vicious spiral.

Google

The market dynamics speak clearly and show that Wise is much better at growing market share and benefiting from the trend of remote work. Wise has started by acquiring easier customers like US to Europe transfers, and as its offering expands to more obscure places like Africa, it can steal the more demanding customer from Western Union with its better value proposition. There is very little reason to believe that Western Union can turn this around. Western Union has not been able to grow revenues during the last ten years while remote work provided the biggest growth opportunity ever in international money transfer. Western Union seems like a company in terminal decline that seeks a turnaround by expanding propositions that customers care little for.

Wise: Attractive Valuation

Particularly interesting is Wise’s relatively valuation to Western Union. Western Union’s enterprise value is $7.7 billion, while Wise is at $3.3 billion. These differing valuations reflect the fact that Western Union today is a much more profitable company while Wise is still in growth mode and so its profits lay more in the future. Wise is selling at 7.7 EV/EBIT for 2027 estimated profits while Western Union is selling also at 7.7 EV/EBIT for 2027 too. Yes, Wise is much more expensive on an earnings basis today with an EV/EBIT ratio of 23, and yes as discount rates have expanded it is logical that Wise’s valuation has contracted. Still, it seems like the market has been awfully pessimistic about Wise’s prospects; the market is valuing Wise at similar future multiples while Wise is objectively a company with a better moat and more growth opportunities.

Takeaway

Wise is disrupting international money transfer, and the market is awfully pessimistic in its valuation of the company. Since Western Union is a company in terminal decline in international money transfer, I find the pair trade short Western Union and go long Wise particularly compelling.

Be the first to comment