natasaadzic/iStock via Getty Images

Introduction: What Are The Long Leading Indicators?

I have several systems for forecasting the economy. One is the high-frequency “Weekly Indicators,” which, as the name implies, is updated weekly and is thus very timely. For the short term, up to about 6 months out, a second, K.I.S.S. method, relies on the Index of Leading Indicators, is a perfectly adequate tool with the inconvenient habit of being right more often than most highly paid Wall Street forecasters.

To forecast the period over 6 months out, I turn to “long leading” indicators, relying for that on monthly and quarterly data which has been extensively vetted in for decades already, and as during that time going back 50 years has a sustained record of turning one year or more before the onset of a recession.

Before I go further, let me reiterate something I wrote in connection with my short term forecast. Most of what you read which seeks to forecast the economy falls into two categories of leading you astray:

1. Most observers simply project existing trends into the future, overlooking that there are some data-points that reliably turn before others, and thus completely miss turning points until they are already in the rear view mirror.

2. A great deal – perhaps most – of what you read about the economy starts off with an ideology and a conclusion based on that ideology already baked into the cake. The writer then marshals a series of data-points that confirm that already-determined conclusion. The very same utterly decisive economic metric from last year that was moving in one direction is completely ignored this year when it is moving in the opposite direction, and vice versa.

By contrast, my method is to look repetitively at a bank of indicators that have decades – in a few cases, over a century – of history, and a demonstrable record of being reliable harbingers of the continuation or reversal of an existing trend.

Now let’s return to my main topic at hand. Geoffrey Moore, who for decades published the Index of Leading Indicators, and in 1993 wrote “Leading Economic Indicators: New Approaches and Forecasting Records,” identified 4:

- Housing permits

- Corporate bond yields

- Real money supply

- Corporate profits adjusted by unit labor costs

A variation of the above is Paul Kasriel’s “foolproof recession indicator,” which combines real money supply with the yield curve, i.e., the difference in the interest rate between short- and long-term treasury bonds. This turns negative a year or more before the next recession about half of the time.

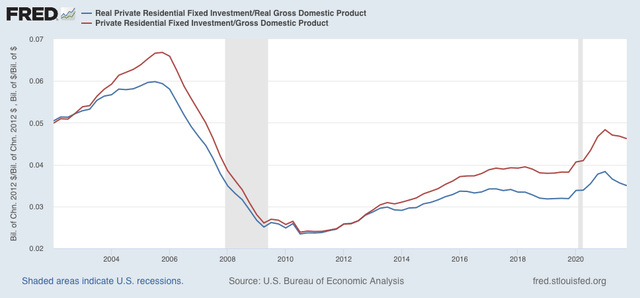

Another long leading indicator has been described by UCLA Prof. Edward E. Leamer, who wrote “Housing IS the Business Cycle.” In that article, he identified real residential investments as a share of GDP as an indicator that typically turns at least 5 quarters before the onset of a recession.

Several other series appear to have merit as long leading indicators as well. Real retail sales in several forms also have value as a long leading indicator and, in particular, real retail sales per capita. Additionally, the tightening of credit conditions also appears to have merit as a long leading indicator.

That gives us a total of 7 categories of long leading indicators. All of these economic series have a long-term history of turning a year or more before a recession.

Previous forecast

When I last looked at these indicators in August 2021, I concluded that:

“The long leading indicators confirm a firm, even strong expansion through the remainder of 2021, by spring of 2022 they are neutral, suggesting a much softer economy, although not a recession before the midyear limit of this forecast.”

With Thursday’s +6.9% nominal and +1.7% real Q4 GDP report, it is safe to say this forecast has panned out so far.

In this article, I will look all the way ahead through the end of 2022.

Current Trends In The Long Leading Indicators

Corporate Bond Yields

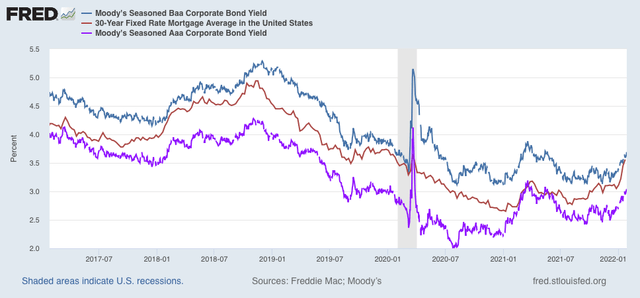

On a monthly basis, corporate bond yields data goes back over 100 years to 1919. With the exception of the 1981 “double-dip,” the fiscal contractions underlying the 1938 and 1945 recessions, 1926, and – excusably I think! – 2020’s pandemic – corporate bond yields have always made their most recent low over 1 year before the onset of the next recession. The below graph shows both AAA and BAA corporate bonds for the last 5 years, together with 30-year mortgage rates (red):

Corporate and mortgage interest rates FRED

AAA-rated bonds have not made a new low since July 2020. BAA-rated bonds last made a low in December 2020, while mortgage rates reached all-time lows in early January 2021. Thus corporate interest rates, according to Prof. Moore’s system – more than one year out from lows – are now negatives.

Housing

Housing, which typically follows interest rates with a few months’ lag, very much followed this pattern in 2021.

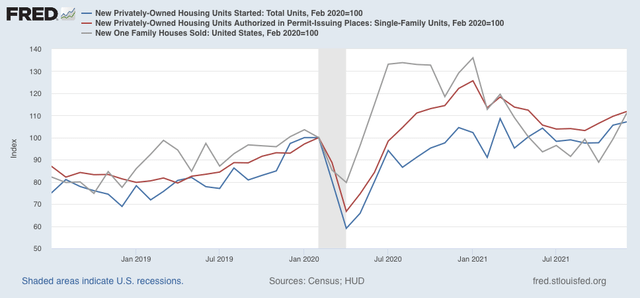

Housing permits, both total (not shown) and single family (red in the graph below) as well as new home sales (violet) peaked early in 2021, declining nearly 20% by early autumn before recovering somewhat. By contrast, and importantly, the three month moving average of housing starts (blue) only declined -3.3%, and closed at a new 10+ year high:

Housing permits, starts, and sales FRED

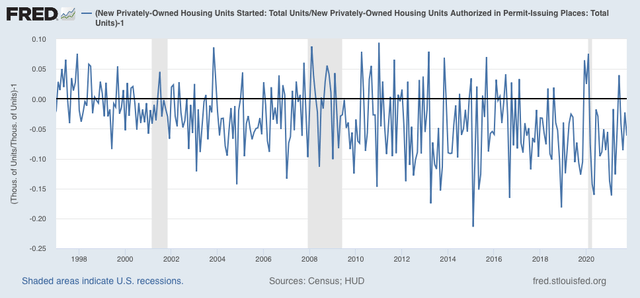

While on a long-term basis the percentage of houses actually started vs. permits obtained has been declining, January and February of 2021 marked among the 10 biggest divergences ever:

Housing permits vs. starts divergence FRED

Since it is starts that constitute real economic activity, I am according them extra weight in this forecast.

On the other hand, housing as a share of GDP has declined for three quarters in a row after making a 3-year high in Q1 of 2021:

Real private residential investment as a share of GDP FRED

This is a clear negative. Taking the caveat about housing starts into account, overall housing is a weak negative.

Corporate Profits

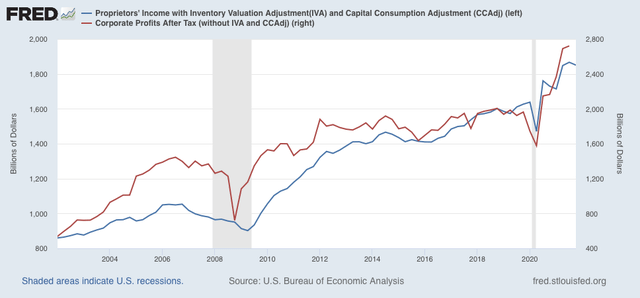

Corporate profits for Q4 will not be reported for at least one more month, but the placeholder of proprietors’ income was reported in the initial Q4 GDP on Thursday, declining -0.9% even without an inflation adjustment. Below I show profits calculated both before and after adjustments deflated by unit labor costs compared with proprietors’ income (gold, right scale):

Corporate profits and proprietors’ income FRED

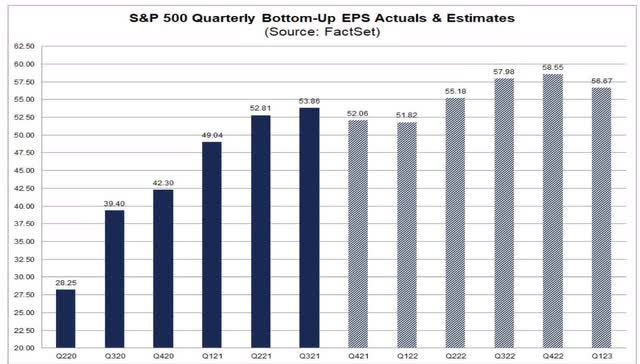

Further, as of its most recent report on Friday FactSet also shows that reported and estimated earnings of the S&P 500 made a new high in Q3, but are also anticipated to falter in Q4 2021:

S&P 500 actual and estimated profits FactSet.com

This forecast indicator is neutral.

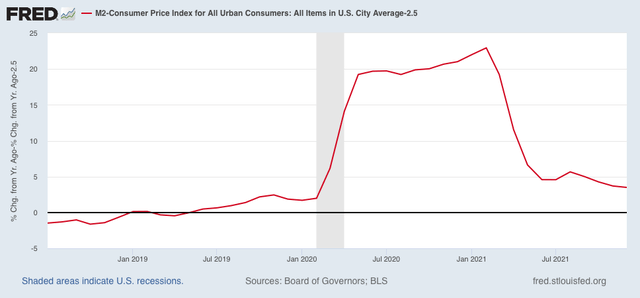

Real Money Supply

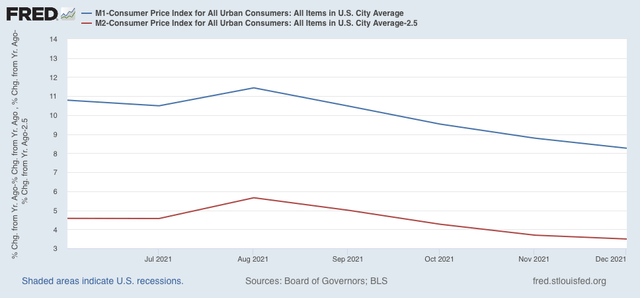

No recession has ever started without at least real M1 turning negative or real M2 declining to under +2.5%. Real M2 crossed this threshold at the beginning of 2018, and during the autumn, real M1 did so as well briefly, before both turned up considerably in 2019. Since the beginning of the pandemic, the Fed has flooded the market with money in an unprecedented fashion:

Because of the huge distortion in 2020, here is a close-up on 2021:

Real money supply in 2021 FRED

Needless to say, money supply is extremely positive.

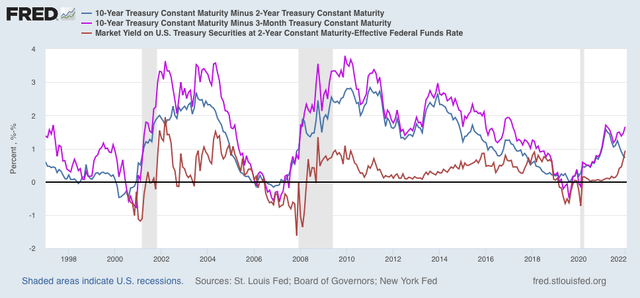

The Yield Curve

This has been an excellent long-range forecasting tool in times of inflation (although I do not think a positive yield curve is definitive in low interest rate deflationary environments). In the last 60 years, typically, a recession has begun after the Fed raises rates to combat inflation, and sufficiently so that the yield curve inverts.

Needless to say, an inverted yield curve was not a concern ever since the Fed moved aggressively to move the Fed funds rate back to zero at the beginning of the pandemic. In the past 10 months, the 10 year minus 2 year yield has decreased sharply, but the 10 year minus 3 month yield has continued to widen. The 2 year minus Fed funds rate has also expanded:

This is similar to what happened in 2003 and 2014. It also demonstrates the importance of not “forecasting the forecast.” If the Fed raises rates and the yield curve inverts, *that* will be the time this indicator’ signal changes, not now. The yield curve has been normal for the past year, and remains a positive.

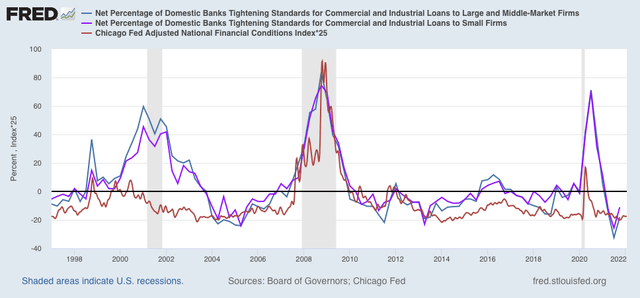

Credit Conditions

The loosening or tightening of credit also appears to be an important component of changes in the economy over one year out. Although it only has a 30-year track record, the Senior Loan Officer Survey is promising. The Q3 report is the most recent one (Q4’s will not be released until February), but as of that time conditions were quite loose. (Note that a “positive” number actually means tightening. Don’t blame me!) Meanwhile, the more timely weekly Chicago Fed Adjusted Financial Conditions Index (Red) has also been positive for many months, and has remained so through its most recent report this past week:

Percentage of banks tightening credit FRED

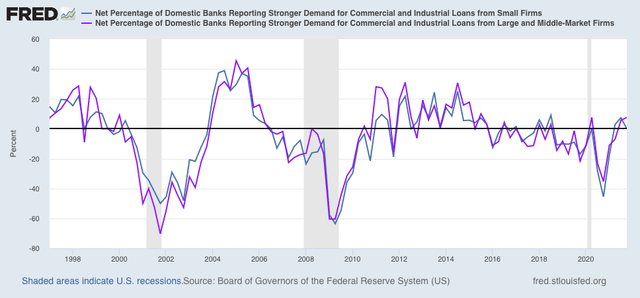

Another metric from the Senior Loan Officer Survey, demand for loans by all-sized firms, which had been negative for many quarters before the recession, also reversed during 2021 and has also become positive:

Demand for commercial loans FRED

As a result, this indicator is also a positive throughout this forecast period.

Real Retail Sales Per Capita

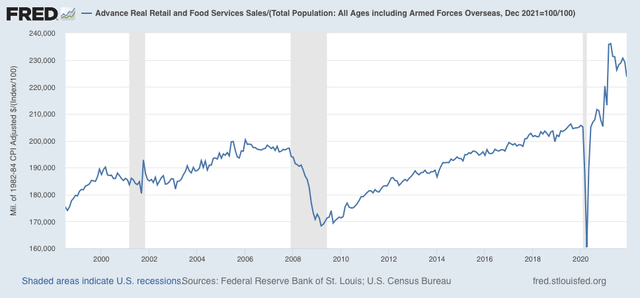

These peaked more than a year before the onset of the last two recessions, but made troughs within six months of each recession bottom.

These most recently made record highs in March and April, due to the second round of pandemic stimulus, but have declined sharply since:

Real retail sales per capita FRED

This indicator is decisively negative throughout this forecast period.

Summary And Conclusion

Let me point out, first of all, that this is a more comprehensive set of indicators, and in some cases, indicators with longer and better track records than are found in my more timely “Weekly Indicators” columns.

The indicators have almost all moved in the wrong direction in the past 6 months. But as of now, three are still positive: money supply, the yield curve, and credit conditions.

One is neutral: corporate profits.

Three are negative: corporate bonds, housing, and real retail sales per capita.

If 6 months ago the long leading index forecast a weakening, but still positive, economy by roughly midyear this year, they forecast an outright stall by year end 2022. It would not take much – an inverted yield curve, or a further softening of business profits – to tilt the forecast negative (for 2023). But we’re not there yet.

Be the first to comment