Julie Bennett/Getty Images News

Introduction

Sometimes, things just work out according to plan. While the market is truly challenging this year, my investment in Lockheed Martin (NYSE:LMT) is paying dividends – literally. Last year, I made the decision to make Lockheed my largest investment, as I believe in its ability to maintain what has become a long-term increase in shareholder distributions through buybacks and dividends. In this article, we’re discussing why Lockheed Martin is such a great dividend stock. However, we’ll also discuss recent developments, which confirm my expectations. The company is finally seeing light at the end of the tunnel. While 2023 is likely to be flat in terms of sales, 2024 will see higher growth. The company’s order books are rapidly growing, fueled by a boost in global defense spending, and its ability to innovate. This is putting the company in a terrific spot to do what it does best: make money for its shareholders on the back of a terrific business model.

Or to put it differently, I will explain why I believe that the company’s volatile and prolonged sideways trend is finally over.

Why LMT’s Earnings Mattered

Long-term investors who’ve held LMT for a while know that LMT earnings weren’t that kind to investors in the past two years. The company was prone to large post-earnings sell-offs. That’s actually why I was able to buy the company so aggressively, making it my largest position. I now have close to 8% of my entire net worth invested in Lockheed, which shows how serious I am about this investment.

Anyway, the past two years were tough on the company. Like its peers, the company faced supply chain issues. A high-tech company like Lockheed is dependent on affordable and reliable streams of electronic equipment, advanced materials, and skilled labor. That was simply not the case, which pressured margins and its ability to turn backlog into finished products.

Moreover, while Lockheed engages in a wide variety of defense projects, the company remains dependent on the F-35 program. This program generates close to 30% of total sales and almost 70% of Aeronautics’ sales.

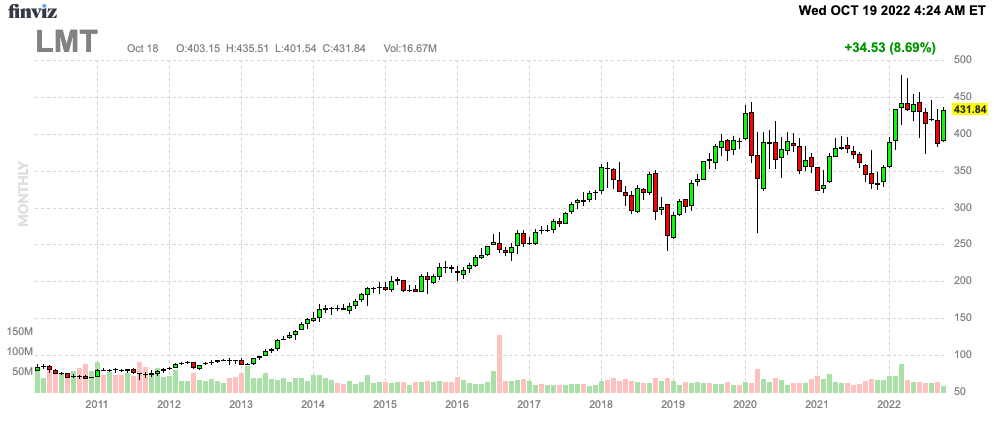

Despite these headwinds, the company’s stock price remains in a long-term uptrend, although it has become very volatile.

FINVIZ

While market uncertainties are persistent, I believe the LMT ticker is about to break out, starting a stronger long-term rally.

The just-released earnings seem to be the starting point as the company revealed massive improvements across the board.

Looking at the headline numbers, we don’t see anything special. The company did $16.58 billion in revenue, a miss of $110 million. Non-GAAP EPS came in at $6.87, that’s $0.15 above expectations.

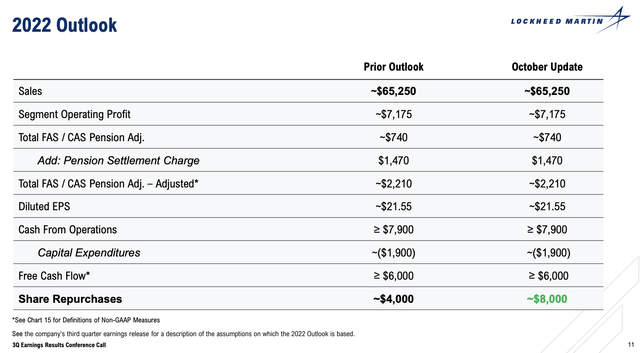

On a full-year basis, the company sees $65.3 billion in net sales, that’s roughly $260 million less than expected. Diluted EPS is expected to be $21.55. Analysts were looking for at least $26.71.

The last part doesn’t sound that good. Yet, the company rallied. Why is that?

Essentially, the company commented on a few key topics. I discussed all of them in recent articles on Seeking Alpha.

- When can we expect the company to grow again?

- What’s up with supply chains?

- Can we expect higher shareholder distributions?

- What about the defense budget?

- What’s the impact of the Ukraine war?

- Are F-35 orders back on track?

So, here’s what happened:

Why LMT Rallied

Defense companies are back on track. Lockheed alone was able to grow its backlog by $5 billion in the third quarter. Its total backlog is now close to $140 billion.

To give you another number, Lockheed’s book-to-bill ratio is now 1.30, which basically means it gets 30% more orders than it can produce in a given period. This means future revenues are expected to rise.

However, growth won’t return in 2023. The company is expected to deal with the “residual pandemic impacts and supply chain challenges”, which will prevent it from accelerating output.

However, according to CEO Jim Taiclet:

We are confident in our four pillars to drive growth in 2024 and beyond. Importantly, we expect to deliver solid growth and free cash flow per share in 2023 and thereafter through a combination of cost reductions throughout the business, improved working capital management, and an expanded share of purchase program.

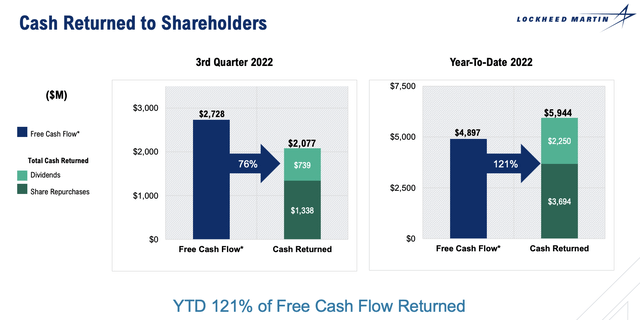

The company isn’t just publicly excited about its future, it’s also proving its confidence by boosting its total annual buybacks from $4 billion to $8 billion. On top of that, Lockheed announced a 7% dividend increase. The company is now on track to deliver $11 billion to its shareholders this year. So far, the company has returned $5.9 billion, or 121% of its YTD free cash flow.

One of the drivers of bottom-line growth will be efficiencies. LMT is working with One LMX. One LMX is basically a giant magnifying glass used to find company-wide inefficiencies. It…

…will create a model-based enterprise with a fully integrated digital thread throughout the design, build, and sustained product lifecycle. As part of our ongoing corporate stewardship approach, we are conducting an internal review to identify potential synergies between our four business areas, further cost reduction opportunities, and a general portfolio review with the goal of increasing operating efficiency in anticipation of our future growth.

Lockheed also commented on its expectations that 2023 free cash flow will not be impacted by inflation. The company believes that cost reduction and business area synergy actions can limit downward pressure. That’s an incredibly important takeaway as the company struggled with these issues in the past.

With that said, it is important to mention that the company’s top line is also in a good spot. For example, the Swiss government ordered 36 F-35A jets. Switzerland is now the 15th customer to order jets from the advanced F-35 program.

Moreover, the company (finally) received contractual authorization from the Joint Program Office, which allows it to book a Lot 15 order (of F-35 jets) of over $7.5 billion and recognize revenues and earnings from the second quarter as well as from the third quarter.

Lockheed also got a 12 Seahawk helicopters order from the Australian government. The company is also looking at a $2.2 billion deal to sell two THAAD (Terminal High Altitude Area Defense) systems, including 96 interceptors to the United Arab Emirates.

The above-mentioned deals (especially Lot 15) are important as it fuels the company’s top line. These aren’t minor programs and deals that will come with a lot of future demand.

Moreover, the new 2023 Department of Defense budget enjoys strong bipartisan support for increased funding. Final legislation will have to be passed. Until that happens, the government continues to operate under a short-term continuing resolution of FY23, which limits DoD funding to prior FY20022 levels. In other words, higher government spending will be a factor next year, and beyond.

As part of the continuing resolution, Congress approved additional support for Ukraine. They added $3 billion in funding, bringing the total defense support to $9 billion.

There is also a total of $14 billion available to replenish US stocks of equipment, to make up for equipment sent overseas.

And that’s still not everything. One of the things we have discussed is global defense spending. Lockheed put a number on it. So far, allied nations have increased their five-year funding plans by $60 billion, which is a big deal for Lockheed as it is THE key supplier of NATO nations.

Shareholder Value And Valuation

As I already briefly mentioned, I believe that LMT is now poised to start a “steeper” uptrend in the years ahead. Peak supply chain issues are behind us and orders are improving.

Hence, I believe it is important to focus on what matters: receiving dividends while waiting for capital gains.

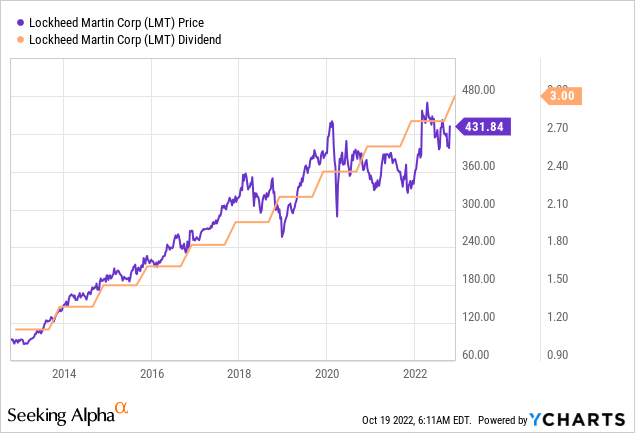

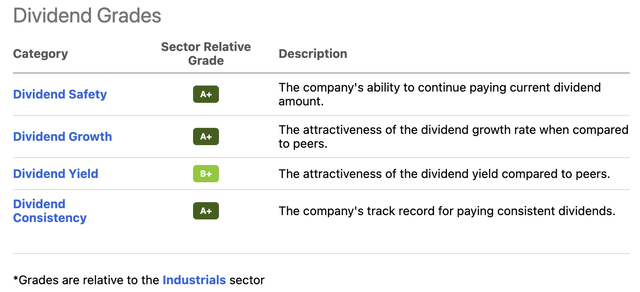

Compared to its industrial sector peers, the company has a terrific dividend scorecard. It scores very high on safety, growth, and consistency.

The company currently yields 2.8%, which is based on quarterly dividends of $3 per share.

Over the past 10 years, the average annual dividend growth is 10.8%. I expect that dividend growth rates will rise to 10% again after 2023. After all, that’s when we can expect the top and bottom lines to improve again. During the past few years, investors saw annual hikes close to 7-8%, which I believe isn’t bad either – especially considering the circumstances.

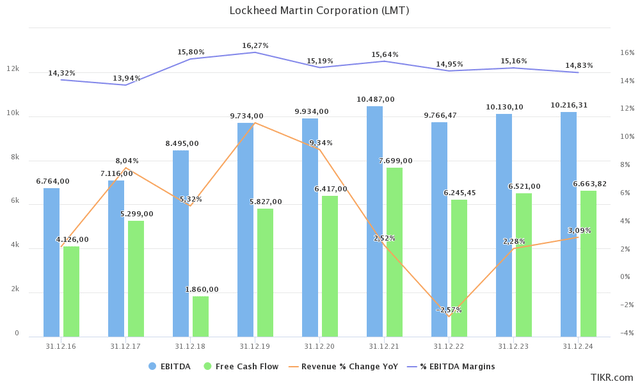

So far, the company’s outlook doesn’t look spectacular. However, there is good news. Based on what we just discussed, revenue growth is improving. After two years of unchanged sales (on average), 2023 and 2024 are expected to see rising sales growth. If the company is able to improve EBITDA margins to 15-16% again, we could be looking at a steeper uptrend in EBITDA and free cash flow after 2024.

Note that even small improvements in FCF have a major impact. For example, in 2023, FCF is expected to be $6.5 billion. That’s 5.7% of the company’s market cap.

Not only that, but the company will increasingly focus on free cash flow. According to CEO Taiclet:

And if some of you might have been around when I was at American Tower, we focused completely on free cash flow per share generation. And that got us through 18 years of up and down cycles, the Great Recession and a few other issues that happened along the way. That’s the right metric for this company, too, and that’s why Jay and I are so — so much emphasizing it today.

So, we’re positioning ourselves for anticipated growth inflection in the next few years, investing in innovative technologies for our customers’ missions, as I said, and strong repurchases along the way to amplify the per share value creation as we go.

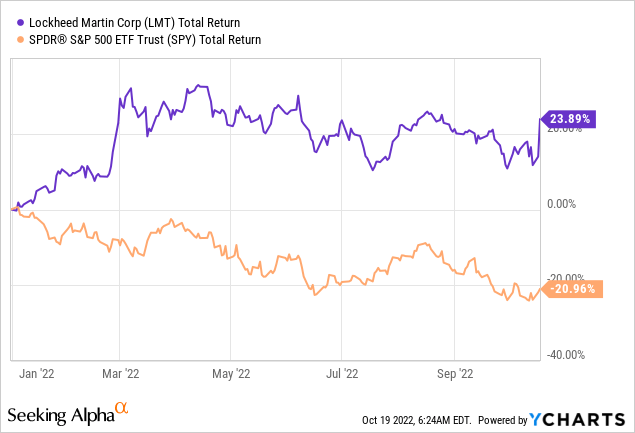

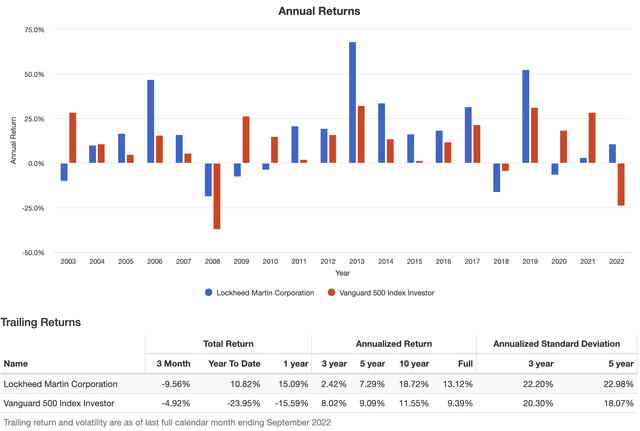

As a result, the company has consistently outperformed the S&P 500 as the data below shows. Going back to 2003, LMT shares have added 13.1% per year, including dividends. This beats the S&P 500 by almost 400 basis points per year. The standard deviation is subdued, which makes LMT great for low-volatility dividend growth portfolios.

Year-to-date, LMT shares have returned 24%, beating the market by 45 points. This helps my portfolio a lot as LMT is my largest position. I also have close to 25% of my entire portfolio invested in LMT and its defense peers.

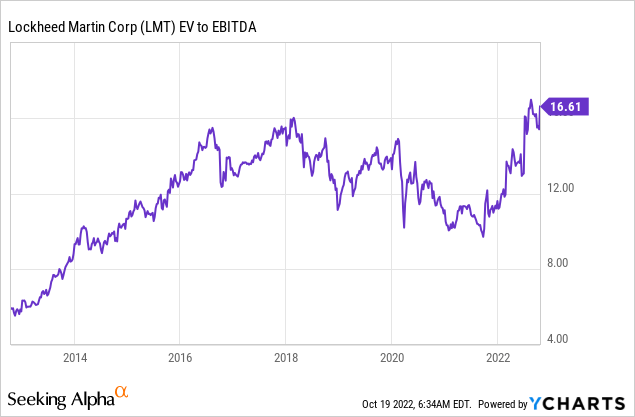

With that said, the company is trading at 12.8x 2023E EBITDA of $10.1 billion. That’s based on its $130 billion enterprise value, consisting of its $114.5 billion market cap, $9.8 in 2023E net debt, and $5.7 billion pension-related liabilities.

12.8x EBITDA isn’t deep value, but as I said in recent articles, it’s still a good price. The company has a high free cash flow yield of close to 6% and the ability to significantly boost free cash flow and EBTIDA on a long-term basis.

In other words, I remain very bullish and consider every major dip to be a buying opportunity.

Takeaway

Sometimes things just work out according to plan. The just-released LMT 3Q22 earnings are a great example of this.

If I had to summarize this article using one sentence, it would be: LMT is back on track.

Supply chain issues are fading, allowing the company to resume its growth after 2023. Global defense spending is accelerating, creating new demand for its major defense programs like THAAD, the F-35, its Sikorsky aircraft, long-range missiles, and everything that makes LMT the backbone of NATO defense forces.

On top of that, the CEO is now increasingly focused on free cash flow (per share), which is even better news for shareholders. The company has the ability to boost free cash flow without growing its top line by focusing on efficiencies. One LMX is expected to significantly contribute to this.

As a result, LMT is already boosting buybacks and its dividends, which I expect to continue – if not get even better – in the years ahead.

Moreover, the stock price should also benefit as a lot of headwinds of the past 2-3 years are rapidly fading.

So, long story short, LMT remains one of my all-time favorite dividend growth stocks. The valuation is good, headwinds are fading, and I see a lot of room for LMT shares to grow in the years ahead. Outperformance is very likely.

(Dis)agree? Let me know in the comments!

Be the first to comment