Editor’s note: Seeking Alpha is proud to welcome Noah Robins as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

fcafotodigital/E+ via Getty Images

Background on the Business and Qualitative Attribution

Sovos Brands (NASDAQ:SOVO) is a simple company to understand. They own four fantastic brands: Rao’s, noosa, Birch Benders, and Michael Angelo’s.

The CEO, Todd Lachman, focuses on what’s most important: How the brands taste. Unlike many CEOs in the CPG industry, Mr. Lachman doesn’t become overly obsessed with financial metrics. He lets the CFO do that. Instead, he talks about acquiring brands with fantastic tasting products that use natural, fresh ingredients. This will serve him and his shareholders well in the long run.

US retailers sell the brands: Their largest customers include Walmart (WMT), Costco (COST), and United Natural Foods, Inc (UNFI). Now, approximately 1% of sales are international. Sovos will look to further expand into international markets in the future.

The private equity firm Advent owns just over 60% of the company. Mr. Lachman owns about 3% of the company.

Sovos held an IPO in late 2021. Before the IPO, a $400 million dividend recap, which was paid for primarily by debt, was issued to Advent. On the 4Q21 earnings call, CFO Chris Hall clarified the proceeds of the IPO went to pay down the debt so Sovos could get closer to their leverage target of around 3x.

Competition

Sovos identifies many competitors in the CPG industry. Competitors include Barilla Holding S.p.A., Campbell Soup Company (CPB), and Chobani, LLC. One area where Sovos might struggle against the competition is in their supply chain, specifically with packaging and distribution. Certain CPG companies, like Pepsi (PEP), control their entire packaging and distribution process. Most smaller CPG companies, including Sovos, need to use third-party distributors and co-packers, which could make Sovos more vulnerable to rising input costs relative to the competition in the future. However, I believe Sovos holds great brands with superior customer loyalty that should help protect against the competition.

Standard of Living

Our social lives somewhat revolve around eating. Great company and great food lead to memories that last a lifetime. In the CEO’s Letter to Shareholders, Mr. Lachman states,

I think there are fewer things better in life than enjoying delicious food surrounded by family and friends. There was nothing like the joy of a delicious pumpkin pie at Thanksgiving as a child, or now as an adult sharing steak pizzaiola with Rao’s Arrabbiata sauce with my family. Good food is often at the heart of so many memories.

I’m proud to back a company that helps create our fondest memories.

Qualitative Summary

I look for four main qualitative characteristics when screening a business:

- I look for companies that enhance the standard of living.

- I look for companies that achieve revenue from everyday, small-ticket, repeat, predictable transactions.

- I look for companies that enjoy competitive advantages in the form of patents, high switching costs, and strong brands.

- I look for companies that employ exceptional, incentivized business leaders that have an alignment of interest with shareholders.

I argue that Sovos Brands possesses all the above characteristics. These characteristics help enable the management team to run an economic model that is and will continue to be beneficial for shareholders. Continue reading for my thoughts on the quantitative characteristics of the business and why I consider Sovos Brands to be a strong buy at its current price.

Quantitative Attribution: Long-Term Growth Around 10%, Project Gross Margins of ~33%, Projected ROIC of 10%

Sovos’ sustainable top-line growth, combined with its returns and margins, will enable the business to compound its earnings and book value. Therefore, shareholders should be returned an attractive amount of cash in the future and grow wealthier through their equity in the business over the long term.

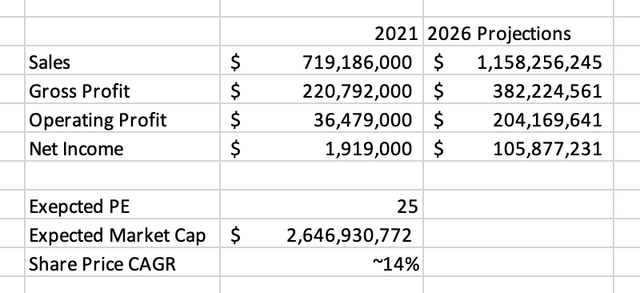

In 2021, Sovos achieved revenue of $719 million against $2 million in earnings. The $2 million earnings figure was unusually low due to about $30 million in expenses related to the IPO. Sovos employs about 608 people.

Growth Prospects

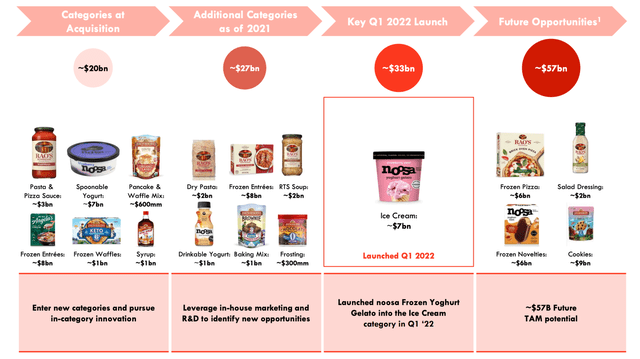

Growth prospects are exciting for Sovos. It undoubtedly has a large TAM, illustrated below.

TAM (Sovos Brands 4Q21 Presentation)

Given the 2021 revenue of $719 million, Sovos has plenty of room to grow its market share. I’m confident Sovos can grow sales in its identified “Additional Categories” and “Future Opportunities” by placing its highly respected labels (brands) on any product it desires. Sovos demonstrated they have the ability to do this with Rao’s. Rao’s, which is mainly a sauce brand, has enjoyed growth in the dry pasta category. Mr. Lachman clarified on the 4Q21 earnings call, “[The] dry pasta business [was] up 53% in volume.” Sovos will now try their luck with noosa. In early 2022, noosa launched a frozen yoghurt gelato, and Mr. Lachman clarified on the earnings call it’s selling stronger than expected.

Sovos has demonstrated the ability to “leverage its playbook” to grow its household penetration and market share. Combining years of expertise in packaging, distribution, and marketing, the executive team has grown household penetration of Rao’s, Sovos’ largest brand, significantly since its acquisition in 2017. Mr. Lachman clarified on the 4Q21 earnings call, “We’ve more than doubled our household penetration [for Rao’s] over the last several years.” If Mr. Lachman and the rest of the Sovos team can continue to execute their strategy with Rao’s and their other brands, they should be able to match or better their target of ~10% growth per year.

The TAM also seems to be growing. Sovos’ TAM was updated from $54 billion two quarters ago to $57 billion this past quarter. Also, according to Grand View Research, “The U.S. packaged food market size was valued at USD 996.56 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2021 to 2028.”

The combination of Sovos’ growing TAM and ability to grow its market share will, I believe, lead to sustainable double-digit growth.

Also, approximately 1% of sales come from international customers. Mr. Lachman stated on the 4Q21 earnings call,

“Amongst many growth levers that we look forward to unveiling in the coming year, this program will be inclusive of international, where we plan to begin with expansion into neighboring North American markets, such as Mexico and Puerto Rico, as well as optimizing our route-to-market in Canada.”

If Sovos can break into international markets, revenue growth should further accelerate.

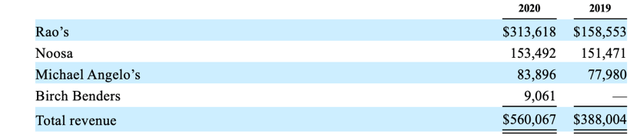

I think it’s almost suspiciously incredible that Rao’s sales grew nearly 100% from 2019 to 2020. That’s nearly 100% organic growth for a brand that has existed for 30 years. Panic shopping probably caused this occurrence. Given that Rao’s has a long shelf life, people probably decided to load up on Rao’s just in case they were locked up for weeks in their homes. Sales probably will not grow as quickly going forward, but at least Rao’s acquired new customers during the panic shopping.

Brand sales (Sovos Brands Form S-1)

Rao’s net sales increased 34% from 2020 to 2021. If Rao’s can keep its growth rate relatively similar over the next few years, the Rao’s brand alone will be able to keep the entire Sovos company growing around 10-15%. I think it’s achievable. As I alluded to, I believe that Rao’s can place its label on anything it desires and clear the shelf.

Margins and Return Metrics

Sovos achieves respectable margins. In 2021, gross margins were 30.7%. I expect this figure to elevate to around 33% in the future, closer in line with gross margins in 2020. The net profit margin was 0.3%. I expect the net profit margin figure to gravitate towards 10%, which is approximately what other established CPG companies achieve.

I expect the ROIC figure to gravitate towards 10% over the next five to ten years, with Sovos reaching just over $1 billion of invested capital and net income of over $100 million. Invested capital is currently just under $1 billion, and I expect it to slightly increase as cash, inventories, and PP&E are built up. I will explain why I think net income will rise to over $100 million later.

Wherever there are fantastic returns, there is fierce competition. I believe an incredibly capable management team runs the company and will fend off competitors by continuing to build and honor the brands. Further, I commend the current management team’s brilliant and effective acquisition process; they truly chose strong, one-of-a-kind brands to acquire.

Risks

Sales were strong during Covid. If I’m not mistaken, sales grew 42% organically from 2019 to 2020. My arithmetic was $560,067,000 in sales less the $9,061,000 in sales from Birch Bender’s, which was acquired in 2020, over the $388,004,000 in sales from 2019.

One issue with Sovos is that I think they are one of the more vulnerable companies with respect to inflation. They might struggle to price their products higher, and input costs might increase. Rising input costs in 2022 will be glass, protein, dairy, and shipping. 2022 will be a good indicator of how Sovos handles an inflationary environment.

Sovos maintains a healthy balance sheet. Current assets of $195 million exceed current liabilities of $92 million. Interest coverage was low in 2021 (~1.2X). However, this figure should grow over time as Sovos’ interest payments decrease and EBIT increases. In 2022, Sovos is expecting to pay about $8 million less in interest compared to 2021 and is expecting to earn higher EBIT compared to 2021.

Sovos’ revenue comes from non-durables. Businesses like Sovos that earn revenue from repeat, predictable, small-ticket transactions tend to be easier to model. Therefore, revenue and cash flow for Sovos can be discounted into the future relatively accurately.

Valuation

To date, Sovos is worth $1.4 billion. I think a reasonable estimate for 2026 would be $2.6 billion, or roughly $25.30 a share. I arrived at this target price by using management’s expectations to model out operating figures over the next five years. The inputs for the model below, except the “Expected PE” figure, are all roughly in line with the figures management has presented to analysts in their publicly released materials. The model assumes 10% revenue growth over the period. For the “2026 Projections”, the model assumes 33% gross margins, SG&A costs at ~15.5% of revenue, $40 million in depreciation and amortization, $23 million in interest expense, and a 25% tax rate. I chose an “Expected PE” of 25. I chose a PE slightly higher than that of the Invesco Dynamic Food & Beverage ETF (PBJ), which was 18.34, because I believe Rao’s has more growth potential than the underlying securities in PBJ. The model also assumes no dilution of shares.

Conclusion

Sovos Brands has built a portfolio of fantastic brands with superior customer loyalty. As they continue to grow their top and bottom line, shareholders should be returned an attractive amount of cash in the future and grow wealthier through their equity in the business over the long term. The management team has put together an effective “playbook” and will continue to execute on behalf of shareholders. Therefore, I consider Sovos Brands to be a strong buy at its current price.

Be the first to comment