anouchka/E+ via Getty Images

Co-produced with Treading Softly

Do you have a safe place? Somewhere you go when you’re hurting emotionally, upset, or just need to be alone?

“Safe places” have become the focus of jokes among many in recent years, mainly due to colleges setting them up for students instead of students making or discovering them for themselves.

Yet, in all honesty, most of us have a safe place in our lives.

It could be on your boat where you can go fishing alone and undisturbed. It could be out in the woods, on a challenging hike, getting out your frustration through exercise. It could be sitting alone in a rocking chair, listening to a wood fire crackle, and watching the sunset paint the sky brilliant colors.

It could also be found in a warm, delicious plate of Cinnabon goodness.

What About Investors?

Investors have their safe places too. Many like to call them “safe havens”, or they call them “SWANs” or the more dramatic “Super-Mega-Uber Blue Chip SWAN”.

When the market seems on the edge of a correction or stumbling into a Bear market, these safe havens see an influx of investors’ money. Like running your ship to the safety of a harbor when a storm is coming. Safer waters for your precious cargo – your retirement savings.

So, are we seeing an influx to those places?

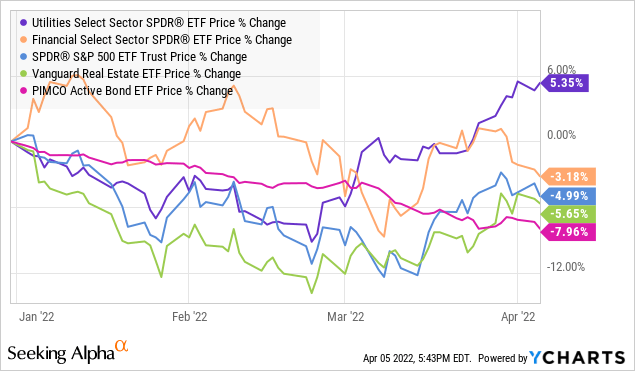

When one thinks of safe havens from a recession, there are a few places many like to run to – Bonds (BOND), REITs (VNQ), Banks (XLF), and perhaps utilities (XLU). Other frequent places are U.S. Treasury notes, gold, and cash.

Looking over 2022, most of the “safe havens” have outperformed the S&P 500 (SPY). Looking towards the right side of the chart, we see something peculiar occur. Bonds (the red line) keep falling as other safe havens climb. Why?

Well, now we’re not playing with simple market volatility concerns. When the oceans get stormy, money moves to calmer waters – we’ve seen that all year. So, what changed in March?

Rate Hikes Are Making A Mark

The issue with so many of the safe havens is their yield. As many of you know, I am an income investor at heart. I created my unique Income Method as a guiding light and philosophy for my portfolio. My portfolio targets an average yield of 8-9%.

When investors move cash into bonds and low-yield investments, they become sensitive to rate hikes. Honest question, why would you own a 2% yielding investment in a company’s bonds when you could hold a 1.5% yielding risk-free Treasury note? The answer for many is they wouldn’t. So, when rates rise, investment-grade low-yield bonds take it on the chin. Likewise, other low-yielding safe havens are taking body shots.

So, what is an investor to do? There’s a storm brewing at sea, and the harbor is on fire? Do you pack up and go home? Call it quits on investing. Go 100% cash and hide?

That has a problem too.

A Clear And Present Danger – Inflation

We’ve been hammering you all about inflation for a long time. We called it before it was vogue to say inflation was happening. Look at this from 2019:

So, let me tell you, I saw it coming and prepared myself and the members of High Dividend Opportunities for the impacts of inflation long before it was trendy. Maybe you did as well. Perhaps you didn’t. Either way, you live, learn and move on. What’s important today is “now what?” Let’s talk about the issue in the present.

If the stormy sea of the market is problematic and the safe haven harbors are burning due to rate hikes, going to cash might seem like an excellent idea. By pulling your cash out of the market, you instantly start losing value at a record rate. Inflation is a spectral enemy, you don’t see it reducing the dollar value in your savings account. No, it doesn’t hit you head on there. It gets you at the gas pump. It finds you at the grocery store. It meets you on your bills.

So, if safe havens are not so safe due to rising rates, running to cash is a poor choice due to inflation. Where can we run? Great Question.

Climb Higher, Young One, Climb Higher

An old story told of a young child who lived deep in a valley between two mountains. He never got to see the sun for most of his life, as the mountains blocked it when it rose and set. Clouds formed from the mountains blocked it out during the day. His desire to see the sun in all its glory grew as he aged. He discussed this with an elderly man and was given a simple piece of advice: To climb higher.

If you’ve ever flown in an airplane or climbed a high mountain top, you know the other-worldliness of being above the clouds. The clouds, rain, and storms only impact those below them. When you are above the clouds, you enter a serene world without their impacts. The sun no longer needs to pierce the clouds to reach you, and you see the cloud tops.

So, what am I suggesting? Quit the race to the bottom. By moving to safe havens, then to cash, you are racing down the yield ladder instead of climbing higher. The risks facing those investments – inflation and interest rates – burn the bottom of the ladder, not the top.

Furthermore, we’re seeing selling impacting the top of the ladder as people scramble towards the risks and not away from them.

So, with others selling and moving towards risk, I suggest you take the other course, move higher up the yield ladder. Someone will cleverly quip, “High yield equals high risk” but the knowledgeable investor knows this to be untrue on its face. The risk is not determined by the yield but by the company’s fundamentals.

Consider Fortress Transportation & Infrastructure Investors, Reset Rate Cumulative Series C Preferred (FTAI.PC). Its price was depressed due to selling, offering an excellent opportunity to snag it below PAR prior to an article we released highlighting it. It still yields 8.0% at this time and is uncallable until 2026. Well worth buying and holding. Its dividend is well covered, allowing investors the security of knowing the dividend is safe and not having to worry about daily price movements.

Another example of “rate reaction” sell-offs we saw was RLJ Lodging Trust, $1.95 Series A Cumulative Convertible Preferred Shares (RLJ.PA). This beauty cannot be called, and it is a “busted convertible”, meaning that the conversion price for a forced conversion is so high it’s practically impossible to occur. RLJ-A yields 7.1%. It can be easily higher if you can snag it on a dip in the future. RLJ Lodging Trust (RLJ) is an excellently run Hotel REIT and carries a large sum of cash on its balance sheet. They are positioned to be a consolidator in their sector. As a cherry on top, RLJ-A never missed a dividend through all of 2020.

I’ll toss in Two Harbors, 7.25% Fixed-to-Float Series C Cumulative Redeemable Perpetual Preferred Stock (TWO.PC) which currently trades under PAR and has a yield of 7.7% and an annualized yield-to-call of 10.5%. Two Harbors (TWO) took a big hit in 2020 but came out carrying an Agency MBS portfolio, removing its credit risk and allowing them to rebuild the company. TWO-C is an excellent preferred trading below PAR. Providing an opportunity for capital gains AND high yield dividends for your portfolio. Starting in 2025, TWO-C will convert from a fixed dividend rate to a floating rate at 3-month LIBOR + 5.011%. Since future rate hikes is one of the risks the market fears, floating rates are where you will want to be.

Last I’ll mention an easy way to get a ton of excellent preferred exposure: Virtus InfraCap U.S. Preferred Stock ETF (PFFA). It is an ETF that yields 8.1% and focuses on holding preferreds with a high YTC. Unlike most ETFs, PFFA uses active management. Instead of just blindly following an index, PFFA’s management actively decides which stocks to buy and which to avoid. PFFA raised the monthly dividend to $0.1625 for 2022. They also scored a big win on their holdings in South Jersey Industries (SJI), with the equity units SJIV up 25% year to date. I have frequently said that if High Dividend Opportunities were to operate our own preferred ETF, it would look remarkably like PFFA does. It is our “go to” option to increase preferred equity exposure quickly, while you take time to do due diligence on your individual picks.

Shutterstock

Conclusion

Instead of joining the race to the bottom, buy shares at big discounts to their prior prices. I once said that I only visit the flea market of the Stock Market when I want to. That’s the benefit of being an income investor.

For many of you, you’re selling off holdings in a race to safety but in doing so, you’ve left perfectly good holdings behind in fear and inadvertently run towards the real danger. Safe Havens are being negatively impacted. Cash is rapidly losing value. I am here to suggest a better way.

Climb higher investor, climb higher. You can rise above the storms we’re seeing and bask in the warm and bright light of income. As an irrevocable cash infusion into your account, it pours in and gives you the ultimate level of flexibility. Spend it on what you need, reinvest for future income growth, buy more of the same stock or diversify and invest somewhere else – the choice is yours. Unrealized gains come and go. Income is here to stay.

I believe you can have a retirement entirely paid for by your portfolio’s dividends. It’s not something that only the extremely wealthy can achieve. It’s achievable by the average person. You can do it.

To do it, you need to think on your own two feet and avoid following the crowd. They’re racing towards danger in the belief that it’s safer.

Climb higher, my friend. There’s plenty of room up here for you.

Be the first to comment