Explorer in the Field Maartje van Caspel/E+ via Getty Images

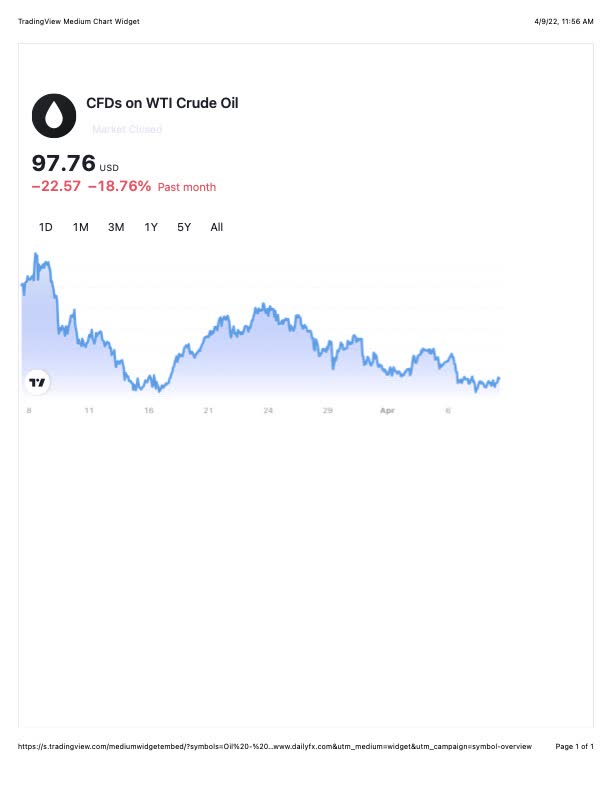

With the volatility in crude oil (CL1:COM) pricing being unprecedented, professional traders have been stepping aside. Gary Ross at Black Gold Investors LLC noted, “The market is un-tradable, given the volatility, . .” Analysts Martijn Rats and Amy Sergeant at Morgan Stanley wrote, “To say that oil prices have been volatile recently would be an understatement, . .” The short term movement in oil pricing continues almost unstrained. The following one-month chart shows the continued volatility.

A second indicator, proving the difficulty in trading, is the CBOE Volatility Index (INDEXCBOE: OVX), which recently jumped 80% year over year.

Several factors are driving this unpredictable situation.

Adding The Russian Quandary

We begin with the Russian quandary. The Russian oil story begins with some world nations banning imports of Russian oil for its behavior in Ukraine. For the United States, which is one of the nations, it’s small in percentage, 7%-8%, but huge in effect.

Two factors drive the quandary. On a worldwide basis, it is different with Russia producing 10% of the world’s oil already in a tight supply. Second, a comment from Scott Sheffield, chief executive of Pioneer Natural Resources, adds this, “Our refineries in the U.S. Gulf Coast (USGC) import heavier crude and unfinished oils from Russia that our complex refineries can transform into other products including gasoline, diesel and jet fuel.” Complementary replacement crude can be found in four places: Saudi Arabia, Iran, Venezuela and Canada, in particular Western Canada. Two of the possibilities are enemies, another has turned its allegiance elsewhere, leaving only Canada. A little over a year ago, the United States government canceled a key pipeline for transporting heavy crude into the southern refineries, the Keystone Pipeline. Arguments about real effects continue from what would now be an operating pipeline. The con side focuses on it’s a pipeline, not supply. In reality, it was really about increased transportation capacity into a full capacity market. From our own internal data, we noticed, for example, that when pipeline capacity was shut down in November between the two countries, the WTI/WCS spread jumped from $14 in October to over $20 in November and early December. The message is clear, Keystone adds to the bullish supply case opening capacity. Simply, without transportation capacity improvements, Canada can’t add supply.

Inventories

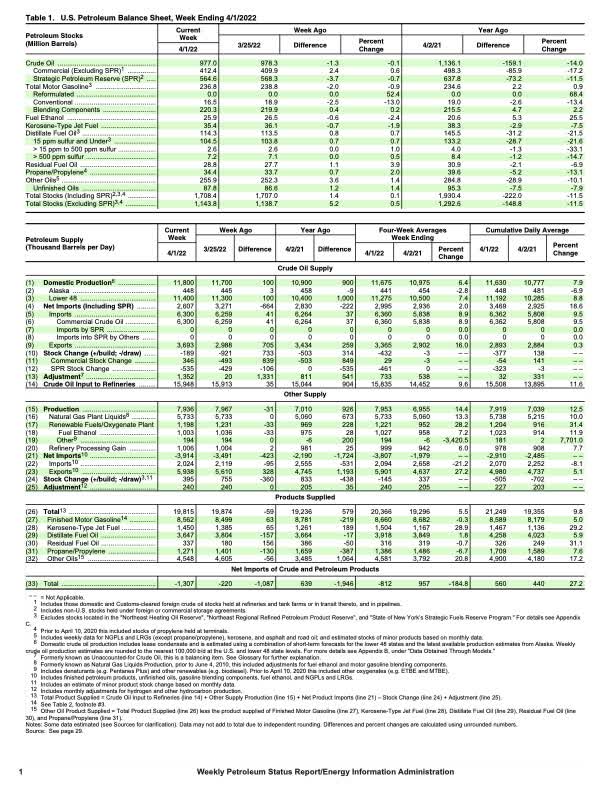

The bullish message continues. Charts can be worth more than a thousand words. The following illustrates the shortage of United States Inventories. From June 2020 to April of this year, crude oil stocks dropped from 540 million barrels to just under 420. The average weekly drop represents a 1.4 million barrels shortage. Last week’s EIA oil report states, “At 412.4 million barrels, U.S. crude oil inventories are about 14% below the five year average for this time of year.”

The Reserve Release Band-Aid

Attempting to attack volatile oil prices, the administration decided to use an unprecedented level of crude from the emergency reserve with its 180 million barrel release over the next 6 months. This ends right before the November election. It’s a band-aid and perhaps nothing more than a political band-aid. What really happened is shown in the next figure from the EIA oil report.

This weekly report contains a grand amount of valuable information, but for us the most important is found in the first few lines. Although the report states that crude inventories increased minus the Strategic Petroleum Reserve, when included, crude levels fell by an additional 1.3 million shown at line 1. The bullish case continues with this comment from the weekly report, “Over the past four weeks, crude oil imports averaged about 6.4 million barrels per day, 8.9% more than the same four-week period last year.” In essence, during a slower usage rate seasonal period, the United States produced at a deceit of 800K barrel per day less than last year. Inventories continue to fall. And this results comes even with refineries involved in seasonal refinery shutdowns for the winter to summer catalyst changes. Higher summer refinery operating rates will follow.

The bullish news still continued with this news later in the week, “”OPEC does not have the additional spare capacity to lift crude oil production much more than it is doing today,” Nigeria’s Petroleum Minister Timipre Sylva told Anadolu Agency on Friday.”” Translated, don’t expect additional production from OPEC anytime soon to fix the price and supply issue.

Long-Term Investment Potential Continues

America’s peak production reached 13 million barrels per day in crude 2019. Today, the country produces 11.5+ daily. With drilling increasing, it’s possible that in the next several months, production might increase toward that 13 million. This is an unknown. But, even with this huge increases, production within the United States, equals basically consumption. Any blip in the system results in continued inventory draws.

In our case, we continue to own pipelines such as MPLX (MPLX), Antero Midstream (AM), Plains All American Pipeline (PAA) and NuStar (NS). Producers might also be included. With respect to producers, we quote from our recent Seeking Alpha article, Sorting Sources Of Energy; we noted, “To wit, the legendary investor has added new shares in red-hot E&P companies Occidental Petroleum Corp. (OXY) and Chevron Inc. (CVX) despite both currently trading at multi-year highs.” Each of these two approaches seem viable paths.

This article is the second in a series about traditional fossil fuels and energy. Noted above, the first laid out a likely path for energy, which includes more than ample doses of fossil fuel. Energy news, in our view, is full of thoughts referencing a transition of energy sources to renewable, but in reality it is much better described, additive. Our thesis supports a long-term, short-term approach of investing in the old sources of energy.

Risks

Energy risks exist and include world health shutdowns similar to the one recently experienced. It was short lived. Risk continues with overheated price and demand changes, similar to what is now being experienced. Energy is the heart beat driving modern society and without reasonable pricing, the modern society ceases to exist. Governments will do about anything to keep its cost manageable including playing games. Yet, when the basic factors ring bullish, it is a good time to enter long at opportunistic moments. Buying on weakness might be the opportunity created between government invention and locating mis-located crude. So let’s put on the spy-glasses and look for savvy, lucrative entrances.

Be the first to comment