Colin Temple

Introduction

In a previous article, I already explained why Loblaw Companies (OTCPK:LBLCF) seems to be trading at its fair value considering the stock is trading at a multiple of about 25 times its anticipated earnings for this year. The share price increased by over 70% since my previous article in March 2021 and I thought it was time to move to the sidelines. I am still keeping an eye on this well-run family-owned company and the recent increase in interest rates caused the preferred shares to drop below the C$25 par value and this has piqued my interest.

The company’s primary listing in Canada is more liquid with an average daily volume of roughly 600,000 shares, so I recommend using the primary listing in Toronto as the preferred trading venue. The ticker symbol in Canada is L. Unfortunately, the investor relations section of the website still mainly contains download-only links, but you can find all relevant reports and releases here, and I will refer to those documents.

Loblaw is a consistent performer, but it is trading relatively expensive

Loblaw’s premium valuation is likely caused by two elements. On the one hand, it is a very consistent performer as its strong market share in the Canadian grocery landscape protects its financial results. But on top of that, I think the PC Optimum loyalty program has value as well as ‘big data’ remains very important. And as Loblaw also issues credit cards it is in a good position to fully understand its customer base and consumer behavior. With the loyalty card, it can track what an investor is purchasing and provide tailor-made discounts while the credit card will tell the company if a customer is shopping elsewhere and what else one is spending money on. So I would argue Loblaw is more than ‘just’ a grocery chain as the Weston-family has thought out the structure pretty well.

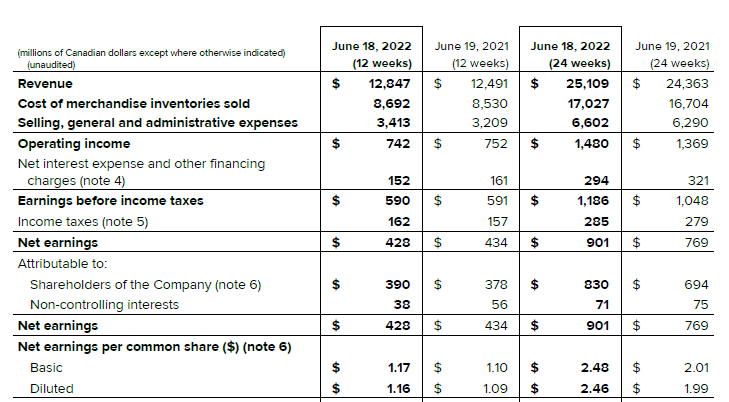

The total revenue in the second quarter came in at C$12.85B resulting in an operating income of C$742M and a pre-tax income of approximately C$590M. We see a higher tax pressure in the second quarter as the company owed C$162M on a C$590M pre-tax income while it owed just C$123M in a similar pre-tax income in the first quarter of this year. The difference could be explained by certain non-deductible items that were recorded in the second quarter of this year while there was a recovery of income taxes from the Glenhuron Bank in the first quarter of this year after a positive ruling from the Supreme Court of Canada.

Loblaw Companies Investor Relations

This means the tax pressure in the second quarter was pretty normal and although the EPS came in at C$1.17, roughly 10% below the Q1 EPS, keep in mind a non-recurring C$33M tax benefit in Q1 had an impact of approximately C$0.10 on the EPS. This means that on an adjusted basis, the EPS results are pretty stable.

I’m starting to like the preferred shares again at the current levels

The Loblaw Group also has one series of preferred shares outstanding, trading on the TSX as well. As you can imagine, these preferred shares will show a good correlation with interest rates as this basically is an income security. The preferred dividend is fixed and cumulative, and the securities are paying C$1.325/year in four equal quarterly tranches. This means the yield at the current preferred share price of C$23.21 is approximately 5.7%.

TMX Money

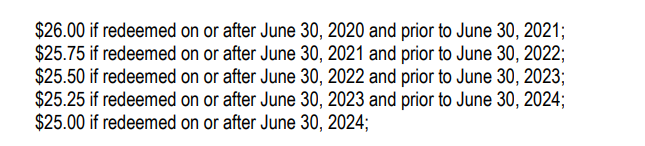

These preferred shares are redeemable, but Loblaw would have to pay a premium if it redeems the shares before June 2024 and I think that is unlikely to happen.

Loblaw Companies Investor Relations

If you would have asked me a year ago if Loblaw would call the shares in 2024, my answer would have been ‘yes’. But I’m not so sure anymore as the 5.3% cost basis is actually pretty cheap for a security that has no end date. It basically is cheap money for perpetual equity. And as there’s only a very limited amount of shares outstanding (9 million), the net income attributable to the common shareholders is barely impacted. If Loblaw would call the preferred shares, its EPS would increase by just C$0.01 on a quarterly basis. So it would hardly make a dent.

I consider these preferreds quite safe exactly because of the very impressive coverage ratio. In the second quarter of this year, the net income attributable to the shareholders of Loblaw was C$390M of which C$3M had to be paid to the preferred shareholders. This means the preferred dividend was covered by a factor of 130. That’s 13,000%.

Investment thesis

While I understand 5.7% is not extremely exciting, I consider the 5.7% yield from the preferred shares to be pretty safe given the excellent coverage ratio of the preferred dividend and considering Loblaw is one of the largest grocery chains in Canada by market share, likely to report a net income of C$1.5B this year.

I am not keen on paying almost 25 times earnings for the common shares, but the 5.7% preferred shares seem to be a pretty good deal right now.

Be the first to comment