Pgiam/iStock via Getty Images

Investors are facing a perfect storm this year due to the surge of inflation to a 40-year high and the increasing risk of an upcoming recession. The Fed is doing its best to restore inflation to normal levels but inflation has remained surprisingly high. Even worse, while central banks initially characterized inflation as transitory, no-one can predict how long it will remain at excessive levels. As a result, some investors are looking for stocks that are resilient to inflation. This is certainly the case for LKQ Corporation (NASDAQ:LKQ). As the stock is also reasonably valued, investors should consider purchasing the stock around its current price.

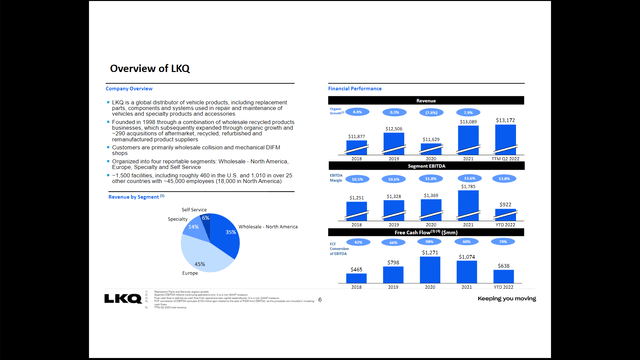

Business overview

LKQ is a global distributor of spare parts for vehicles, including components and systems used in the repair and maintenance of vehicles.

LKQ Business Overview (Investor Presentation)

It was founded in 1998 but has grown immensely thanks to organic growth and nearly 300 acquisitions of small suppliers of spare parts for vehicles. LKQ generates approximately 35% of its revenue in North America and 45% of its revenue in Europe.

LKQ has proved remarkably resilient throughout the coronavirus crisis. While many companies have not recovered yet from this crisis, LKQ posted blowout earnings in 2020 and 2021. It grew its earnings per share by 8% in 2020 and by 55% in 2021, to a new all-time high. It is also important to note that the company has grown its earnings per share every single year throughout the last decade. This is a testament to the strength of its business model and its reliable growth trajectory.

LKQ is currently facing another headwind, namely extremely high inflation. The surge of inflation to a 40-year high has greatly increased the costs of raw materials, labor costs and other expenses of most companies and thus it has pressured their operating margins. Even gigantic retailers, such as Walmart (WMT) and Target (TGT), have incurred a sharp contraction of their operating margins this year. Moreover, consumers have become somewhat conservative in spending due to the impact of inflation on their actual purchasing power.

However, LKQ has proved nearly immune to this headwind so far. In the second quarter, its revenue dipped 3% over the prior year’s quarter but only due to the strengthening of the dollar. If the effect of currency is excluded, organic revenue from parts and services grew 4% and adjusted earnings per share dipped only 3.5%. LKQ managed to offset the strong headwind from increased cots with material price hikes. These price hikes had a minimal effect on the sold volumes, thus confirming the robust demand for the products of the company.

Moreover, LKQ is likely to continue to enjoy favorable business trends for the foreseeable future. Due to the 40-year high inflation and the pronounced economic slowdown in recent months, consumers are likely to tighten their wallets. As a result, new vehicle sales are likely to decrease significantly and thus the average age of existing vehicles will keep growing. Therefore, the demand for the spare parts of LKQ is likely to remain on the rise.

Analysts seem to agree on this view. They expect LKQ to grow its earnings per share by 8% next year and by 4% per year in 2024-2025. Notably the company has exceeded the analysts’ consensus for 13 consecutive quarters. Given also the consistent growth record of LKQ and its resilience in the highly inflationary environment prevailing right now, the company is likely to meet or exceed the analysts’ estimates.

Financial strength

Most companies tend to use a significant amount of financial leverage to grow their business but LKQ is a bright exception, with a rock-solid balance sheet. To be sure, its interest expense consumes only 4% of its operating income while its net debt (as per Buffett, net debt = total liabilities – cash – receivables) currently stands at $5.1 billion. This amount is only 4 times the annual earnings of the company and only 37% of the market capitalization of the stock. It is thus evident that LKQ has an exceptionally strong balance sheet.

Valuation

LKQ is currently trading at a price-to-earnings ratio of 12.6. This is a fairly attractive valuation level for a stock with a consistent growth record and positive business momentum. It is also remarkable that the stock is trading at only 11.2 times its expected earnings in 2024. Given also its exceptionally strong balance sheet, LKQ appears attractively valued right now.

The only caveat is the fact that the stock has outperformed the broad market by a wide margin this year. While the S&P 500 has declined 25%, the stock of LKQ has shed only 11%. This means that the market has already appreciated, at least in part, the superior resilience of LKQ in the adverse economic environment prevailing right now. Therefore, the investors who would like to enhance their margin of safety should probably wait for an approximate 5%-7% correction of LKQ, towards its technical support of $46-$47.

Risks

The primary risk of LKQ is the adverse scenario of persistently high inflation for years. The company is likely to offset a great part of this headwind with material price hikes and thus it will probably prove less vulnerable than most companies in such a scenario. However, if inflation remains excessive for years, it will probably exert sustained pressure on the valuation of LKQ, as high inflation significantly reduces the present value of future cash flows. Therefore, the stock is suitable only for those who are confident that inflation will soon begin to subside thanks to the coordinated efforts of central banks around the globe.

Moreover, investors should be aware that LKQ is likely to underperform the broad market whenever the global economy recovers from its latest slowdown. A global economic recovery is not likely to occur anytime soon due to the aggressive interest rate hikes implemented by most central banks. However, whenever inflation reverts to its normal level, around 2%, central banks are likely to lower interest rates and the global economy will probably recover. In that phase of the economic cycle, LKQ is likely to underperform the broad market, as it will not be able to match the returns of more cyclical companies.

Final thoughts

LKQ has a mundane business model and thus it passes under the radar of most investors. However, the stock is remarkably attractive in the ongoing bear market. While most companies are significantly affected by excessive inflation and the latest economic slowdown, LKQ has proved resilient to these headwinds. As it is also attractively valued, it deserves a position in the portfolios of risk-averse investors.

Be the first to comment