jroballo

Welcome to the October 2022 edition of the ‘junior’ lithium miner news. We have categorized those lithium miners that won’t likely be in production before 2023 as the juniors. Investors are reminded that many of the lithium juniors will most likely be needed in the mid and late 2020s to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

October saw excellent news with the USA government announcing US$2.8b “to supercharge U.S. manufacturing of batteries for electric vehicles and electric grid.” Australia followed in late October announcing “support for critical minerals breakthroughs.”

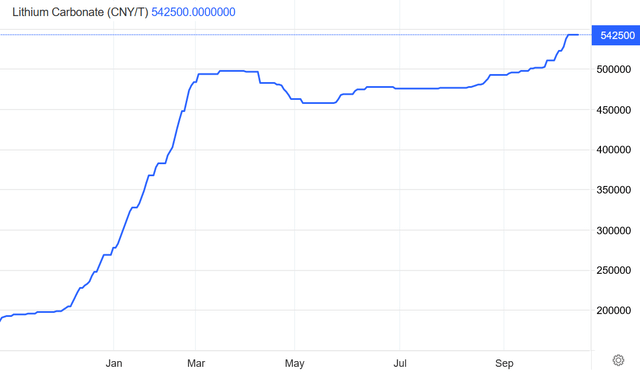

Lithium price news

Asian Metal reported during the past 30 days, the 99.5% China lithium carbonate spot price was up 6.05% and the China lithium hydroxide price was up 5.68%. The Lithium Iron Phosphate (Li 3.9% min) price was up 3.33%. The Spodumene (6% min) price was up 4.53% over the past 30 days.

Benchmark Mineral Intelligence reported lithium prices of (battery grade carbonate – RMB 529,000 ($73,525), hydroxide RMB 524,000 ($72,825), and Benchmark stated (paywalled): “In addition to robust demand growth from the EV industry, contacts reported to Benchmark that burgeoning demand from the energy storage sector in recent months has also acted to fill several lithium producers order books until 2023, placing upward price pressure on the lithium chemicals market.”

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 37,870 (~USD 5,227/mt), as of October 21, 2022.

China Lithium carbonate spot price – CNY 542,500 (~USD 74,891)

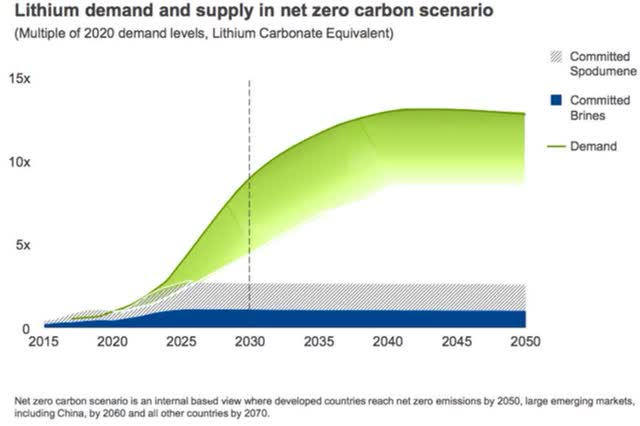

Rio Tinto forecasts lithium emerging supply gap (chart from 2021) – 60 new mines the size of Jadar needed

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read: “Lithium Miners News For The Month Of October 2022” article. Highlights include:

- Rio Tinto warns planned lithium production will fail to meet growth in demand for lithium-ion batteries.

- CATL plans $1.9 billion battery project in China’s Luoyang City.

- NASA solid-state battery is lighter & more powerful.

- Morgan Stanley: We expect the market to remain tight through 2022, especially when considering restocking needs.” “We still expect lithium prices to trend lower in 2023, as supply expands and market tightness eases…..”

- BMI: Lithium has to scale twenty times by 2050 (from 2021 levels) as automakers face generational challenge.

- Elon Musk stated: “We continue to believe that battery supply chain constraints will be the main limiting factor to EV market growth in the medium and long terms.”

- Biden-Harris administration awards $2.8 Billion of grants to supercharge U.S. manufacturing of batteries for electric vehicles and electric grid……The American Battery Material Initiative will coordinate domestic and international efforts to accelerate permitting for critical minerals projects.

Junior lithium miners company news

Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

On September 27, Sayona Mining announced: “Québec mining operator selected as NAL restart advances.” Highlights include:

- “Québec company, L. Fournier & Fils, awarded four year, approximately C$200 million contract for mining operations at Sayona’s North American Lithium (NAL) operation.….

- Works to commence from October 2022, as Sayona advances restart of production at NAL in Q1 2023.“

On October 4, Sayona Mining announced: “PFS launched for NAL lithium carbonate production.”

On October 5, Sayona Mining announced: “Moblan PFS targets Québec lithium expansion.”

On October 18, Sayona Mining announced: “Québec rail contract signed for NAL shipments.”

Upcoming catalysts include:

- Q1 2023 – Restart of NAL (SYA 75%: PLL 25%) operations.

Piedmont Lithium (Nasdaq:PLL) [ASX:PLL]

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of North American Lithium [NAL].

On September 27, Piedmont Lithium announced:

Piedmont Lithium partner Atlantic Lithium completes prefeasibility study for Ghana Project…..The PFS demonstrates a production target for the Ghana Project of approximately 255,000 tons per year of 6% lithium spodumene concentrate (“SC6”) over a 12.5-year mine life from Ore Reserves of 18.9 million tons at 1.24% Li2O. Estimated capital costs for the project increased as part of the PFS. However, Atlantic Lithium expects operating expenditures at the planned production plant to decrease. CAPEX increased from US$70 million to US$125 million. Of the increase, US$27 million is attributed to Atlantic Lithium’s decision to bring crushing in-house for improved operational control and reduced lithium losses.

On October 19, Piedmont Lithium announced:

Piedmont Lithium selected for $141.7 million grant by United States Department of Energy for Tennessee Lithium Project……The funding will support the construction of the Company’s approximately $600 million Tennessee Lithium project, which aims to expand the U.S. supply of lithium hydroxide by 30,000 metric tons per year (“tpy”).

Upcoming catalysts include:

- 2022 – Carolina Lithium – Possible further off-take, permitting or project funding announcements.

- Q1 2023 – NAL (25% PLL, 50% off-take PLL) production set to begin.

- Q3, 2024 – Ghana Project (50% PLL) targeted to begin.

You can view the company’s latest presentation here.

Atlantic Lithium Limited [LSE:ALL] [ASX:A11] (OTCQX:ALLIF)

Atlantic Lithium is progressing its Ewoyaa Project in Ghana towards production. Piedmont Lithium has a 50% project earn-in share.

On October 13, Atlantic Lithium Limited announced: “Mining licence application Lodged for Ewoyaa Lithium Project Ghana, West Africa.”

On October 20, Atlantic Lithium Limited announced:

Resource evaluation update multiple high-grade and broad drill intersections reported drilling Programme Now Completed Ewoyaa Lithium Project Ghana, West Africa……These results reaffirm our belief that the current Resource demonstrates significant growth potential, which we hope to unlock……”

Liontown Resources [ASX:LTR] (OTCPK:LINRF)

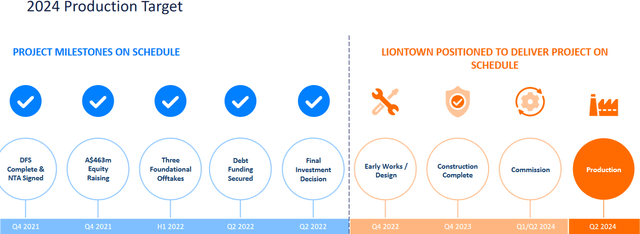

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia. DFS completed in November 2021.

On October 3, Liontown Resources announced: “Mining proposal and works approval paves way for start of construction and mining at Kathleen Valley.” Highlights include:

- “The WA Department of Mines, Industry, Regulation and Safety (DMIRS) has approved the Mining Proposal and Mine Closure Plan for a 4Mtpa lithium and tantalum mining operation at Kathleen Valley.

- In addition, the WA Department of Water and Environmental Regulation (DWERS) has approved the Works Approval to enable Project construction and operations.

- Together with other key permits already received (Native Vegetation Clearance Permit and 5C Water Extraction Licence, in close collaboration with Tjiwarl Aboriginal Corporation RNTBC (Tjiwarl AC)), these now represent the final primary approvals required to commence major site construction works and subsequent mining activities.

- Construction of the mine and processing plant will now move into execution phase in line with the Company’s development schedule, following the Final Investment Decision (FID) announced in June 2022……

- Two-thirds of construction tenders for Kathleen Valley have now been issued and are being progressively awarded, with contracts for all key long-lead items already executed and manufacturing commenced, and a Letter of Award (LOA) issued to commence development of the 95MW Hybrid Power Station in partnership with Zenith Energy.”

You can view the company’s latest presentation here.

Upcoming catalysts include:

- 2023: Kathleen Valley Project construction

- Q1, 2024: Commissioning with production set to begin Q2, 2024

Liontown Resources is fully funded for production start in H1 2024

Vulcan Energy Resources [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On October 24, Vulcan Energy Resources announced: “Vulcan produces highest grade, lowest impurity lithium hydroxide to date from Zero Carbon Lithium™ Project.” Highlights include:

- “…..The latest material produced graded 57.1% LiOH, easily exceeding the best-on-the-market battery grade specification of 56.5% LiOH required from offtake customers. Impurities were well below market specification minimums……

- Works on the containerised Sorption Demonstration Plant are progressing well, which will serve to train Vulcan’s operations team in a pre-commercial setting, prior to commercial production targeted for 2025.”

Upcoming catalysts include:

- Q1 2023 – DFS, potential permitting and project funding.

- H2 2024 – Target to commence production.

POSCO [KRX:005490] (PKX)

On October 11, The Korea Herald reported:

Posco unveils W1.5tr plan to speed up lithium production. Posco Holdings, the holding firm of steelmaking conglomerate Posco Group, on Tuesday announced a 1.5 trillion won ($1 billion) investment plan to speed up its lithium production both in Argentina and South Korea. The company said it had planned to make the investment next year but decided to advance the timeline in order to meet the growing demand for lithium, a key material for electric vehicle batteries…..The two new production plants will have a combined annual production capacity of 25,000 metric tons of lithium hydroxide from 2025, enough to power some 600,000 EVs. Posco aims to elevate the production capacity to up to 100,000 tons by 2028.

Upcoming catalysts include:

- 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Wesfarmers [ASX:WES] (OTCPK:WFAFY) (took over Kidman Resources)

The Mt Holland Lithium Project is a 50/50 JV between Wesfarmers [ASX:WES] (OTCPK:WFAFF) and SQM (SQM), located in Western Australia. There is also a proposal for a refinery located in WA. Wesfarmers acquired 100% of the shares in Kidman for A$1.90 per share, for US$545 million in total.

On October 11, The Canberra Times reported:

Earl Grey stirs solar into lithium project. A lithium mine half-owned by Wesfarmers is a step closer to joining the global battery supply chain after adding a renewable energy source to its plans.

You can view the latest company presentation here and news on the Mt Holland construction here.

Upcoming catalysts include:

- H2, 2024 – Mt Holland spodumene production and Kwinana LiOH refinery planned to begin and ramp to 45–50ktpa LiOH.

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 51% of its Manono Lithium & Tin Project in the DRC, after selling 24% of it to Suzhou CATH Energy Technologies for US240m. DRC-owned firm Cominiere has a 25% share.

On September 30, AVZ Minerals announced:

Extension of end date to the transaction implementation agreement….. The Company confirms that the parties to the TIA have agreed to amend the end date to 31 December 2022 to provide for completion of closure formalities.

On October 17, AVZ Minerals announced: “2022 annual report…..”

On October 20, AVZ Minerals announced: “Arbitration proceedings & legal update.” Highlights include:

- “The arbitration proceedings before the International Chamber of Commerce in Paris (ICC) instigated by Jin Cheng Mining Company Limited (Jin Cheng), a subsidiary of Zijin Mining Group Company Limited (Zijin) against AVZ’s wholly owned subsidiary AVZ International Pty Ltd (AVZI), as advised in its ASX Announcement dated 11 May 2022.

- As the DRC Tribunal correctly acknowledged, both Dathomir SPAs contain and are subject to arbitration agreements…… It follows that only a properly constituted arbitral tribunal has jurisdiction to overturn AVZI’s August 2021 acquisition of a further 15% interest in Dathcom from Dathomir. As far as AVZ is aware, no such arbitration proceedings have been commenced.

- …….As previously announced and consistent with the above statements, AVZ confirms that it retains legal title to a 75% interest in the Manono Project and its pre-emptive rights over the balance of the Project.“

Upcoming catalysts include:

- 2022 – Any arbitration news in the Manono Project dispute with Zijin Mining Group.

Note: July 2022 – AVZ Minerals ‘confident’ despite Manono dispute remaining unresolved

Standard Lithium [TSXV:SLI] (SLI)

No significant news for the month.

Leo Lithium Limited [ASX:LLL] (Firefinch Limited spinout 50/50 JV with Ganfeng Lithium)

No news for the month.

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

No news for the month.

Investors can view the company’s latest presentation here.

Upcoming catalysts include:

- 2022 – Rose Lithium-Tantalum Project provincial permitting. Possible off-take or financing announcements.

You can read the latest Trend Investing Critical Elements Lithium article here.

Global Lithium Resources [ASX:GL1]

On September 29, Global Lithium Resources announced:

MOU executed with major Korean battery maker SK On. Partnership to explore business opportunities including development of downstream lithium assets.

On October 25 Hot Copper reported:

GL1 agrees to acquire 100% of Manna Project and update…. Global Lithium has launched an underwritten institutional placement to raise up to approximately A$111.4 million together with a non-underwritten SPP targeting a further approximately A$10.1 million, for total Equity Raising proceeds of up to approximately A$121.5 million (before costs).

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources own the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

On October 6, Lake Resources announced:

Lake Resources and WMC Energy execute conditional framework agreement involving a 10 percent strategic investment in Lake Resources and offtake for up to 25,000 metric tons per annum (mtpa) battery grade lithium (LCE) from Kachi Project.

On October 12, Lake Resources announced: “Strategic investment and offtake agreement with SK On.” Highlights include:

- “Offtake of up to 25,000 tonnes per annum of high purity lithium from Lake’s Kachi Project.

- SK On to acquire 10 percent of Lake via strategic investment….

- Continued de-risking of the project for financiers and investors.”

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF) (IONR)

ioneer ltd. announced in September 2021 the sale of 50% of its flagship lithium boron project to Sibanye Stillwater for US$490m.

On October 24, ioneer Ltd announced: “Quarterly activities report for the period ending 30 September 2022.” Highlights include:

- “ioneer signs binding Lithium Offtake Agreement with Ford.

- ioneer signs binding Lithium Offtake Agreement with Prime Planet Energy & Solutions.

- ioneer and Caterpillar complete definitive agreement regarding autonomous haul trucks at Rhyolite Ridge.

- Plan of Operations resubmitted to BLM in early July. NOI to start NEPA process, expected December 2022 quarter.

- Detailed due diligence process continuing with US Department of Energy’s Loan Programs Office.

- Detailed engineering and procurement activities advancing.

- Dedicated Tiehm’s buckwheat greenhouse under construction.”

Upcoming catalysts include:

- Any debt funding deals on top of the existing Sibanye-Stillwater US$490m to fund Rhyolite Ridge.

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTCPK:ERPNF) (OTCQX:EMHLF)(OTCQX:EMHXY)

No significant news for the month.

Upcoming catalysts include:

- 2022 – Any off-take or project funding deals.

You can read a recent Trend Investing update article on EMH here.

European Lithium Ltd [ASX:EUR] (OTCQB:EULIF)

On October 27 the WSJ reported:

Upstart European Lithium is valued at $970 million in deal for U.S. listing. Potential supplier of electric-vehicle battery metal to BMW aims to raise cash to produce lithium in Austria……has reached a deal that will value it at $970 million and list its shares in the U.S., company officials said……The company will merge with a special-purpose acquisition company called Sizzle Acquisition Corp. SZZL….The deal could allow it to raise cash.

Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

On September 26, Savannah Resources announced: “Interim results for six months ended 30 June 2022.” Highlights include:

Corporate

- “Cash balance of £9.4m at 30 June (31 December 2021: £13.0m)….

- Dale Ferguson appointed as Interim Chief Executive Officer in July after David Archer stepped down; The search for a permanent CEO replacement has been initiated.”

Barroso Lithium Project (the ‘Project’):

Technical:

- “Agreed with the Portuguese environmental regulator (‘APA’) to progress its review of the Environmental Impact Assessment (‘EIA’) on the Project via the time-controlled and more interactive ‘Article 16’ process.

- A number of constructive meetings have already been held with APA; Savannah and its consultants are revising elements of the Project’s design for resubmission of the EIA.

- EIA resubmission deadline set at 17 March 2023; Savannah expects to make its resubmission during Q1 2023, APA will then have up to 50 business days to issue its Declaration of Environmental Impact (‘DIA’) decision.

- Design of process flowsheet finalised, based on standard plant and environmentally friendly reagent regime.

- Decarbonisation Study initiated, with initial results expected shortly.

- Definitive Feasibility Study (‘DFS’) to be completed once the Project’s final design has been agreed through the 2nd phase of the environmental licencing process (‘RECAPE’) and necessary fieldwork undertaken. DFS expected to take around 12 months from restart of fieldwork……”

Upcoming catalysts include:

H1, 2023 – EIA permit potentially due.

2024 – DFS due.

Galan Lithium [ASX:GLN]

Galan is developing their flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto salar in Argentina. In total Galan Lithium has 3.0m tonnes contained LCE @858mg/L.

On October 24, Galan Lithium announced: “Spectacular 2.5x increase in HMW resource – now 5.8mt LCE @ 866 mg/l Li (76% in measured category).” Highlights include:

- “HMW Mineral Resource increases 2.5 times to 5.8Mt contained lithium carbonate equivalent (LCE) @ 866 mg/l Li.

- HMW retains its high grade, low impurity profile.

- First time inclusion of a Measured Resource of 4.4Mt @ 883 mg/l Li.

- Enlarged and upgraded resource is driven by increased tenure scale and further drilling delivering increased aquifer size and porosity assays.

- Results to be incorporated into DFS, on track for delivery in Q1 2023 – potential production increase being explored.

- Total Galan Resource (including Candelas) is 6.5Mt @ 839 mg/l Li.”

Cypress Development Corp. (TSXV:CYP) (OTCQX:CYDVF)

Cypress Development owns tenements in the Clayton Valley, Nevada, USA.

No news for the month.

Frontier Lithium [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

On October 11, Frontier Lithium announced: “Frontier intersects 326.6m of pegmatite averaging 1.92% Li2O, including a 50m zone of 2.98% Li2O.”

On October 19, Frontier Lithium announced:

Frontier announces c$20 million bought deal prospectus offering….at a price of C$2.20 per Unit (the “Offering Price”), representing total gross proceeds of approximately C$20 million.

Patriot Battery Metals [TSXV:PMET] (OTCQB:PMETF)

Patriot Battery Metals own the Corvette Lithium Project in James Bay, Quebec. No resource yet but some great long length drill results.

On October 6, Patriot Battery Metals announced:

Patriot announces closing of $20m flow-through financing…..at a price of $13.27 per FT Share for aggregate gross proceeds of $20,000,145.90 (the “Offering”). The FT Shares are subject to a statutory hold period of four months and one day from the date of issuance.

On October 12, Patriot Battery Metals announced:

Patriot drills 104.5 m of 0.97% Li2O and 61.9 m of 1.42% Li2O, and extends strike length of mineralization to 2.2 km at the CV5 pegmatite, Corvette Property, Quebec…..

Lithium Power International [ASX:LPI] (OTC:LTHHF)

LPI is consolidating to own 100% of the Maricunga Lithium Brine Project in Chile, plus plans to demerge its Australian assets into a new company called Western Lithium Ltd.

No significant news for the month.

Upcoming catalysts:

- 2022 – Further developments with Mitsui re off-take partner and funding announcements for Maricunga Lithium Brine Project in Chile. Spin-out of Western Australian Greenbushes and Pilgangoora lithium assets.

American Lithium Corp. [TSXV: LI] (OTCQB:LIACF) (acquired Plateau Energy Metals Inc.)

No significant news for the month.

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars. Also the right to acquire a 100% interest in the Ignace REE Lithium Property in Ontario, Canada.

On September 28, Wealth Minerals announced:

Wealth Minerals provides operational update. Wealth’s drilling and field program at the project is now complete. The Company successfully drilled four holes for a total of 1,111m in total length. Hole depth varied from 194m to 350m. All the holes encountered brine, with the top of the brine level at 150m to 200m down-hole length and all holes ended in brine. Fluid samples were taken at regular intervals and sent to ALS (Chile) laboratory for analysis…..

On October 17, Wealth Minerals announced:

Wealth signs nondisclosure agreement with the National Mining Company of Chile – ENAMI……Mr. Van Alphen also said: “Wealth has a technology partner selected (see press release of August 9, 2022) and is moving forward with a major Chilean mining partner. ENAMI has extensive experience in successfully mining and processing resources in Chile, and that know-how will be needed in developing Ollagüe and Atacama. Chile is a prime mining jurisdiction, and all the pieces necessary for a successful lithium mining operation are being put in place.”

On October 19, Wealth Minerals announced: “Wealth Minerals closes $1.84 million flow-through financing.”

Investors can view the company’s latest presentation here.

E3 Lithium Ltd. [TSXV:ETL] [FSE:OW3] (OTCQX:EEMMF) (Formerly E3 Metals)

E3 Lithium Ltd. is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has an inferred mineral resource of 6.7 million LCE.

On October 4, E3 Lithium Ltd. announced: “E3 Lithium announces acquisition of Clearwater Royalty……”

You can read the company’s latest presentation here.

Iconic Minerals [TSXV:ICM] [FSE:YQGB] (OTCQB:BVTEF)/ Nevada Lithium Corp. [CSE: NVLH]

Joint Venture (Nevada Lithium Corp. earn in option to 50%) in the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

On September 29, Iconic Minerals announced: “Iconic intercepts lithium grades up to 5570ppm at Bonnie Claire Project…..”

Arena Minerals [TSXV:AN] (OTCQX:AMRZF)

On October 3, Arena Minerals announced:

Arena Minerals discovers 275 metre Aquifer averaging 441 mg/l lithium at Fortuna II Claim Block and provides Sal de a Puna Project drill update……

On October 6, Arena Minerals announced: “Arena Minerals to acquire 2,000 hectares adjacent to R-01 discovery in Pastos Grandes.”

On October 12, Arena Minerals announced:

Arena Minerals completes pond construction…. at its Sal de la Puna Project (“SDLP Project”) located in the Pastos Grandes basin within Salta province, Argentina. The evaporation pilot pond covers a total of 10,000 m2 and has been filled with raw brine from the Almafuerte claim block. The evaporation pond has been designed to produce >35% lithium chloride (“LiCl”) (6% lithium) from SDLP raw brine.

Investors can view a recent Trend Investing article on Arena Minerals here.

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

On September 29, Rio Tinto announced:

Rio Tinto starts demonstration plant for lithium concentration in Quebec…….The plant will demonstrate at industrial scale a new spodumene concentration process that provides lithium oxide (Li20) grades and recoveries well above the industry average.

On October 17, Kitco reported:

Rio Tinto says Argentinian lithium starter plant to market entry in 2024……”At the Rincon lithium project in Argentina, we are progressing early works including construction of a camp and airstrip. We are also developing a three thousand tonne per annum lithium carbonate starter plant to accelerate market entry by the first half of 2024, and de-risk the planned full-scale operation…..”

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

On October 6, Lithium South Development Corp. announced: “Lithium South resource expansion drill program advancing.”

Alpha Lithium [NEO: ALLI] (formerly TSXV: ALLI) [GR:2P62] (OTCPK:APHLF)

On October 12, Alpha Lithium announced: “Alpha Lithium files Preliminary Technical Report for Salar De Tolillar Project.”

Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF)

Avalon has three projects in Ontario, Canada, and five in total throughout Canada. Avalon’s most advanced project is the Separation Rapids Lithium Project in Ontario with a M& I Petalite Zone Resource of 6.28mt grading 1.37% Li2O, plus an Inferred Resource of 0.94mt at 1.3%. Avalon also has a Partnership JV Agreement with Indian conglomerate Essar to establish Ontario’s first regional lithium battery materials refinery in Thunder Bay.

No news for the month.

Snow Lake Lithium (LITM)

On October 4, Snow Lake Lithium announced: “Snow Lake Lithium hosts LG Energy Solution as part of collaboration to create a lithium hydroxide processing plant.” Highlights include:

- “Snow Lake Lithium welcomes LG Energy Solution to Winnipeg in Manitoba, Canada, to explore opportunities for a lithium hydroxide processing plant.

- Snow Lake Lithium is developing the world’s first all-electric lithium mine in Manitoba and has partnered with LG Energy Solution to establish a domestic lithium supply chain for the North American electric vehicle market.

- Domestically sourced lithium is essential to secure the future of the North American automobile industry.”

Essential Metals [ASX:ESS] (OTCPK:PIONF)

Essential Metals has 9 projects (lithium, gold, gold JV, and nickel JV) all in Western Australia. Their flagship Pioneer Dome Lithium (spodumene) Project has a JORC Compliant Total Resource of 11.2Mt at 1.21% Li2O.

On October 7, Essential Metals announced: “Positive results from additional metallurgical test work completed at Dome North.” Highlights include:

- “Previous metallurgical test work undertaken in 20201 on fresh rock mineralisation of the Cade deposit (‘Cade Fresh’) which represents the main component of the Dome North Mineral Resource, demonstrated high lithium recoveries (74%-82%) with the production of marketable concentrates….

- The Cade Weathered composite returned similar Heavy Liquid Separation (HLS) and batch Whole of Ore Flotation (WOF) results to the Cade Fresh test results, targeting a concentrate grade of 5.7% Li2O, whilst the Davy Fresh sample returned a similar HLS result but a slightly lower WOF result….

- The results will be incorporated into the ongoing Scoping Study for the Pioneer Dome Lithium Project, with the Study outcomes to be used to help finalise a framework for potential partner/s to be involved in advancing the Pioneer Dome Lithium Project to production.”

Green Technology Metals [ASX: GT1]

Green Technology Metals [ASX:GT1] (“GT1”) has several very promising lithium projects near Thunder Bay in Ontario, Canada. The current JORC Total Mineral Resource is 4.8Mt @ 1.25% with a projects (spodumene) wide target resource of 50-60 MT @ 0.8-1.5% Li2O.

On October 24, Green Technology Metals announced: “GT1 extinguish royalty on the Root Lithium Project.” Highlights include:

- “Extinguishment agreement executed with Landore to purchase and extinguish 50% of their pre-existing 3% net smelter royalty interest on the Root Project to further consolidate GT1 ownership.

- Transaction represents a significant further step towards GT1 building the pre-eminent vertically integrated lithium business in Ontario and North America.“

On October 24, Green Technology Metals announced: “GT1 increase to 100% ownership of Ontario Lithium Projects.” Highlights include:

- “Binding agreement executed with Ardiden to purchase its residual 20% free-carried interest in the Ontario Lithium Projects JV.

- Upon completion, moves GT1 to 100% ownership of the Ontario Lithium Projects, including its flagship Seymour Mine Development (currently in PEA phase).

- Transaction represents a significant further step towards GT1 building the pre-eminent vertically integrated lithium business in Ontario and North America.“

International Lithium Corp. [TSXV:ILC] [FSE: IAH] (OTCQB:ILHMF)

On October 5, International Lithium Corp announced:

International Lithium Corp. announces start of Phase 3 drilling at Raleigh Lake and reaffirms Maiden Resource Estimate in 2022…..

Lithium Energy Limited [ASX:LEL]

On October 19, Lithium Energy Limited announced: “Major lithium discovery confirmed in first drillhole of maiden programme at the Solaroz Lithium Brine Project.” Highlights include:

- “The first hole of the maiden 10 hole drilling programme at the Solaroz Lithium Brine Project in the Lithium Triangle in Argentina has confirmed a major new lithium discovery.

- Initial assay samples returned from conductive brines encountered in the upper aquifer returned significant lithium concentrations in excess of 400 mg/L…….

- Highly encouraging that significant lithium concentrations have already been encountered prior to reaching primary target zone of interpreted Deep Sandstone lower aquifer.

- Proposed drill hole depth now extended from ~300m to 400m as drilling progresses to test primary target Deep Sandstone lower aquifer.

- Brines encountered are contained mostly in sandstones, which are considered favourable (due to their porosity and permeability) for potential future brine extraction.“

Argentina Lithium & Energy Corp. [TSXV: LIT] (OTCQB:PNXLF)

On October 3, Argentina Lithium & Energy Corp. announced:

Positive lithium results continue at Argentina Lithium’s second drill hole on Rincon West. “The results of the second exploration hole demonstrate remarkably consistent lithium grades, when compared to the first. RW-DDH-002 results reveal an impressive concentrated brine aquifer, tested with packer sampling over ~77% of the interval between 182 and 305 metre depths, with lithium values ranging from 337 to 367 mg/litre. Additional concentrated brines with lower lithium contents were also recovered from above this 118 metre interval. Drilling thus far validates that the adjacent lithium salar extends under our properties, with consistently high lithium grades. The drill program will continue as planned with the aim of delineating an initial lithium mineral resource.” stated Miles Rideout, V.P. of Exploration.

On October 6, Argentina Lithium & Energy Corp. announced:

Argentina Lithium continues to build on property positions at the Rincon and Antofalla Salars. The Company has entered into an option agreement with a local vendor to earn a 100% interest in four contiguous mine concessions totalling 791.3 hectares at the Salar de Rincon (the “Paso de Sicooption”). The Company has also entered into a second option agreement with a second local vendor to earn a 100% interest in a single mine concession measuring 843.5 hectares at the Salar de Antofalla (the “Volcan option”)…….

Winsome Resources Limited [ASX:WR1] [FSE:4XJ]

On September 26, Winsome Resources Limited announced: “Stage 1 baseline environmental studies at Cancet completed.”

On September 30, Winsome Resources Limited announced: “Exceptional high grade lithium assay results uncover significant upside from Adina project ahead of drilling campaign.” Highlights include:

- “Rock chip Assay results through surface mapping from recent Jamar Discovery at Adina confirm lithium mineralisation is much larger than previously thought.

- Multiple Exceptional results up to 4.89% Li2O including: Sample C00279921 3.38% Li2O. Sample C00279929 4.89%Li2O. Sample C00279942 4.61%Li2O. Sample C00279945 3.87% Li2O. Sample C00279946 3.66% Li2O.

- Upcoming drill program to determine potential connectivity with previously discovered ore body at Adina.

- Discovery is a significant step towards co-development alongside the flagship project, Cancet.”

On October 5, Winsome Resources Limited announced: “Cancet exploration and drilling update: More strong results as rigs head to site.” Highlights include:

- “Samples show spodumene crystals, giving good indication of structural geology.

- Heli-portable RC drill rig due at Cancet and diamond rig at Adina this week.

- Extensive drill campaigns set to commence at both sites in next week.”

On October 14, Winsome Resources Limited announced: “New drilling campaigns underway at Cancet and Adina projects.”

On October 19, Winsome Resources Limited announced:

GEOPHYSICAL GRAVITY SURVEY REVEALS HIGH PRIORITY DRILL TARGETS AT CANCET……The customised gravity processing accurately delineates the known pegmatite intercepts and suggests the main Cancet pegmatite could extend beyond existing drilling over 700m to the east. Furthermore, a previously untested 1,100m-long feature analogous to the main Cancet pegmatite lies approximately 200m to the north under shallow cover…..

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium [CVE:RCK](OTCQX:RCKTF)

On October 7, Rock Tech Lithium announced: “Rock Tech Lithium completes 2021 – 2022 Drill Program at Georgia Lake.” Highlights include:

- “….Significant assay results from remaining 27 holes Rock Tech have been waiting for lab results include: MZSW Deposit: MZSW-21-02 9.1m (true width) at 0.96% Li 2O starting from 178m. MZN Deposit: NC-22-16 2.2m (true width) at 1.12% Li 2O starting from 344.26m…..

On October 11, Rock Tech Lithium announced:

European Investment Bank reviews a €150 million support for Rock Tech’s Guben converter…..The European Investment Bank financing looks to support the creation of capacities to produce lithium hydroxide as one of the key components of electric vehicle batteries, hence enabling the EU’s green transition.

On October 20, Rock Tech Lithium announced: “Rock Tech concludes lithium hydroxide supply deal with Mercedes Benz for EV ramp up.”

On October 24, Rock Tech Lithium announced:

Rock Tech and Transamine to form Joint Venture focused on securing supply of spodumene…..RTT shall identify, pursue, and secure the supply of and to establish a new route for lithium-bearing spodumene for the Company’s planned European lithium converters….

Neometals (OTC:RRSSF) (Nasdaq:RDRUY) [ASX:NMT]

No lithium related news for the month.

Nano One Materials (TSX: NANO) (OTCPK:NNOMF)

No news for the month.

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc [ASX:5EA] (FEAM), American Lithium Minerals Inc. (OTCPK:AMLM), Anson Resources [ASX:ASN] [GR:9MY], Ardiden [ASX:ADV], Arizona Lithium [ASX:AZL] (OTCQB:AZLAF), Atlantic Lithium [LON:ALL] (OTCQX:ALLIF), Bradda Head Lithium Limited [LON:BHL] (OTCQB:BHLIF), Bryah Resources Ltd [ASX:BYH], Carnaby Resources Ltd [ASX:CNB], Critical Resources [ASX:CRR], Electric Royalties [TSXV:ELEC], Eramet [FR: ERA] (OTCPK:ERMAF) (OTCPK:ERMAY), Foremost Lithium Resource & Technology [CSE:FAT] (OTCPK:FRRSF), Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF), HeliosX Lithium & Technologies Corp. [TSXV:HX] (formerly Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR], Infinity Lithium [ASX:INF], International Battery Metals [CSE: IBAT] (OTCPK:IBATF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], Jourdan Resources [TSXV:JOR] (OTCQB:JORFF), Kodal Minerals (LSE-AIM: KOD), Larvotto Resources [ASX:LRV], Latin Resources Ltd [ASX:LRS] (OTC:LAXXF), Lepidico [ASX:LPD] (OTCPK:LPDNF), Liberty One Lithium Corp. [TSXV:LBY], Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Corp. (OTCQB:LTUM), Lithium Energi Exploration Inc. [TSXV:LEXI](OTCPK:LXENF), Lithium Ionic Corp. [TSXV:LTH], Lithium Plus Minerals [ASX:LPM], Lithium Springs Limited [ASX:LS1], Metals Australia [ASX:MLS], MetalsTech [ASX:MTC], MinRex Resources [ASX:MRR], MGX Minerals [CSE:XMG] (OTC:MGXMF), New Age Metals [TSXV:NAM] (OTCQB:NMTLF), Noram Lithium Corp. [TSXV:NRM] (OTCQB:NRVTF), One World Lithium [CSE:OWLI] (OTC:OWRDF), Portofino Resources Inc.[TSXV:POR] [GR:POT], Power Metals Corp. [TSXV:PWM] (OTCQB:PWRMF), Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Spearmint Resources Inc [CSE:SPMT] (OTCPK:SPMTF), Surge Battery Metals Inc. [TSXV:NILI] (OTCPK:NILIF), Tantalex Lithium Resources [CSE:TTX], [FSE:1T0], Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] [FWB:0UL] (OTCPK:ULTHF), Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), Xantippe Resources [ASX:XTC], Zinnwald Lithium [LN:ZNWD].

Conclusion

October saw lithium chemicals prices and spodumene prices hit new record highs.

Highlights for the month were:

- U.S government awards $2.8 billion of grants “to supercharge U.S. manufacturing of batteries for electric vehicles and electric grid.”

- Sayona Mining advances restart of production at NAL for Q1 2023. Launches PFS for NAL lithium carbonate production and Moblan PFS for Québec lithium expansion.

- Piedmont Lithium selected for $141.7 million grant by United States Department of Energy for Tennessee Lithium Project.

- Liontown Resources Mining proposal and works approval paves way for start of construction and mining at Kathleen Valley.

- Vulcan Energy Resources produces 57.1% LiOH, exceeding battery grade.

- Global Lithium Resources (“GL1”) signs MOU with SK On. GL1 agrees to acquire 100% of Manna Project, plans to raise A$121m.

- Lake Resources signs strategic investment and offtake agreement with SK On. SK On to acquire 10% of Lake Resources as a strategic stake.

- Galan Lithium announces spectacular 2.5x increase in HMW resource – now 5.8mt LCE @ 866 mg/l Li (76% in measured category).

- Frontier Lithium intersects 326.6m of pegmatite averaging 1.92% Li2O.

- Patriot Battery Metals drills 104.5 m of 0.97% Li2O and 61.9 m of 1.42% Li2O.

- E3 Lithium announces acquisition of Clearwater Royalty.

- Iconic Minerals intercepts lithium grades up to 5570ppm at Bonnie Claire Project.

- Arena Minerals discovers 275 metre Aquifer averaging 441 mg/l lithium at Fortuna II Claim Block.

- Rio Tinto says Argentinian lithium starter plant to market entry in 2024.

- Green Technology Metals (“GT1”) extinguish royalty on the Root Lithium Project. GT1 increase to 100% ownership of Ontario Lithium Projects.

- Lithium Energy Limited announces major lithium discovery confirmed in first drill hole of maiden programme at the Solaroz Lithium Brine Project.

- Argentina Lithium & Energy Corp. drills lithium values ranging from 337 to 367 mg/litre at Rincon West, continues to build on property positions at the Rincon and Antofalla Salars.

- Winsome Resources reports exceptional high grade lithium assay results at Adina. At Cancet, a gravity survey discovers a 1,100m-long feature analogous to the main Cancet pegmatite 200m away.

- Rock Tech Lithium concludes lithium hydroxide supply deal with Mercedes Benz for EV ramp up.

As usual, all comments are welcome.

Be the first to comment