Black_Kira/iStock via Getty Images

By Sam Korus, Associate Portfolio Manager

In tandem with their rapid penetration of the electric vehicle (EV) market, we believe lithium-ion batteries are gaining mind share. The recent spike in commodity prices has highlighted the dependency of batteries on raw materials. Lithium-ion batteries have two electrodes: an anode and a cathode. In EVs, the dominant cathode chemistries are lithium nickel manganese cobalt (NMC) and lithium iron phosphate (LFP). For the past five years, most battery experts had expected that NMC cells would gain share at the expense of LFP cells.[1]

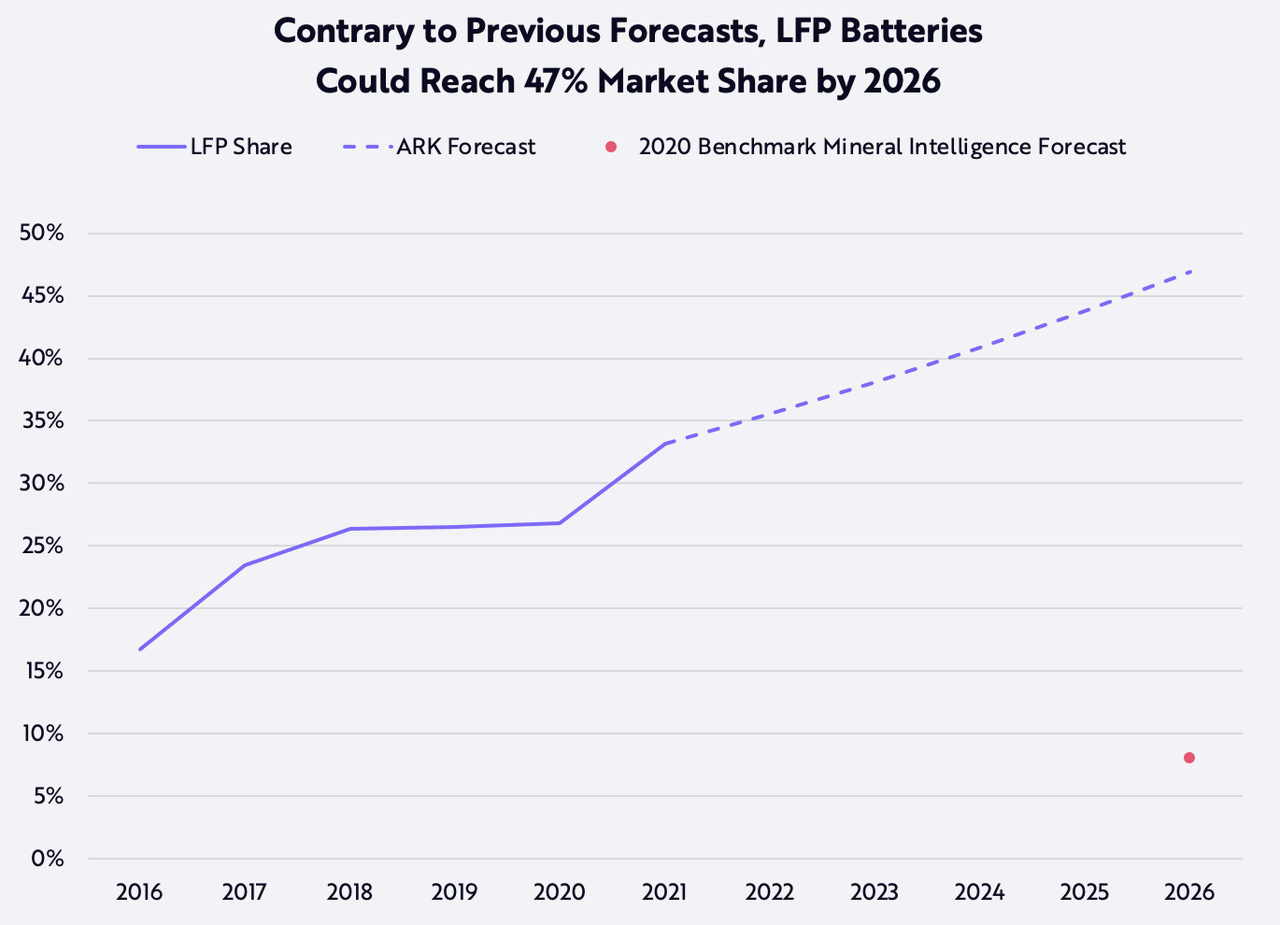

ARK’s research suggests that continued cost declines, nickel supply constraints, and improving EV efficiency should continue to propel the market share of LFP cells from roughly 33% in 2021 to ~ 47% by 2026, as shown below. Important to watch from a competitive point of view will be the rate at which automakers shift toward LFP batteries while meeting the range that consumers demand. Auto manufacturers with superior drivetrain efficiency should be able to shift to LFP batteries and save thousands of dollars per car.

ARK Investment Management LLC, 2022

Forecasts are inherently limited and cannot be relied upon.

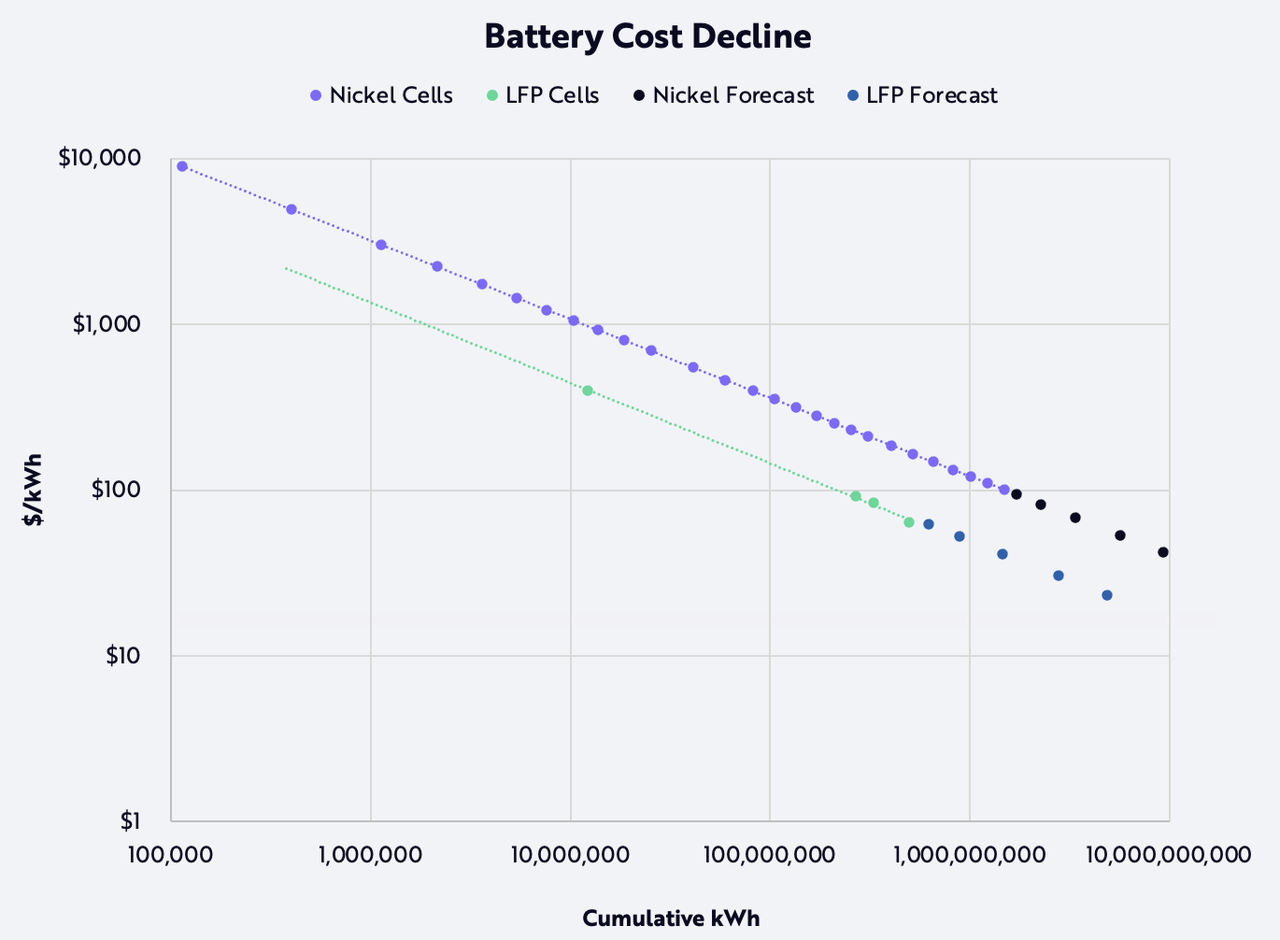

Why will LFP batteries gain share? Simple: they are less expensive today and on course for faster cost declines than NMC batteries. According to ARK’s research based on Wright’s Law, the cost of both NMC and LFP batteries will decline by ~28% for every cumulative doubling of production. The important differences between the two are: 1) LFP cells already cost ~$70/kWh, 30% less than NMC cells’ ~$100/kWh, as shown below, and 2) the production necessary to hit a cumulative doubling of LFP-based EVs is ~7 million, one-third that of the ~20 million necessary for NMC-based EVs.[2]

ARK Investment Management LLC, 2022; Data derived from: EV Volumes; Bloomberg New Energy Finance; Snow Bull Capital; ICCSino; GGII; JP Morgan; CIAPS

Forecasts are inherently limited and cannot be relied upon.

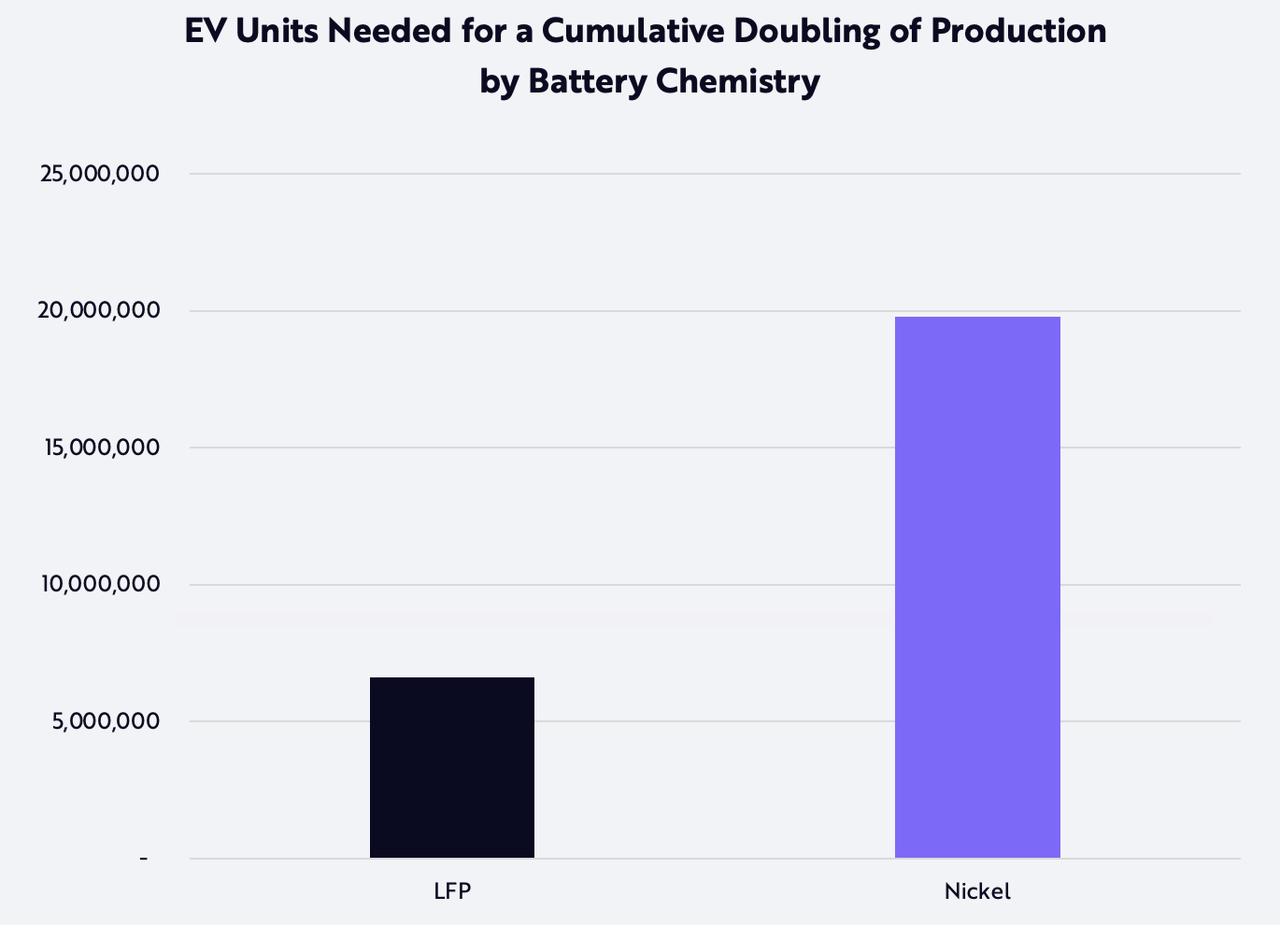

Last year, the number of EV sales hit 4.8 million, suggesting that the time necessary for a cumulative doubling, if all vehicle production shifted to LFP batteries, would be 1.4 years, as opposed to more than 4 years if the shift were to NMC batteries, as shown below.

ARK Investment Management LLC, 2022

Forecasts are inherently limited and cannot be relied upon.

Behind the slow share gain in LFP-based EVs is the tradeoff between energy density and cost. All else equal, an EV with LFP batteries costs less but offers a lower range than the same EV with NMC batteries. Range anxiety has been one of the most important factors in EV consumer purchasing behavior, which is why NMC-based EV manufacturers have focused on and developed more energy-dense cells.

For two reasons, NMC batteries are losing share to LFP batteries: nickel and cobalt have become bottlenecks for NMC battery production, and EV drivetrain efficiencies have improved enough so that less energy-dense LFP batteries can meet consumers’ range needs. ARK’s research also suggests that shorter-range neighborhood EVs will gain share, reducing the need for energy-dense NMC batteries that much more.

According to our research, companies with superior drivetrain efficiency should be able to save thousands of dollars by switching to LFP batteries. Those savings will be passed on in several ways: lower EV prices for the consumer, higher research and development to increase competitiveness, and/or higher profits. The transition to LFP batteries probably won’t prevent future material bottlenecks, as lithium itself could become a constraint but, if history is any guide, battery chemistry will evolve further in the quest for the lowest cost way to meet end market demand.

- 1 https://www.benchmarkminerals.com/wp-content/uploads/20200608-Vivas-Kumar-Carnegie-Mellon-Battery-Seminar-V1.pdf

Benchmark Mineral Intelligence does note that LFP is a “dark horse” despite forecasting a loss in share. ARK’s research suggests LFP gaining share is no longer a long shot.

- 2 Prices do not reflect the recent spike in commodity prices.

Disclosure: ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For a list of all purchases and sales made by ARK for client accounts during the past year that could be considered by the SEC as recommendations, click here. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this list. For full disclosures, click here.

Disclaimer: ©2021-2026, ARK Investment Management LLC (“ARK” ® “ARK Invest”). All content is original and has been researched and produced by ARK unless otherwise stated. No part of ARK’s original content may be reproduced in any form, or referred to in any other publication, without the express written permission of ARK. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence.

Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice. All statements made regarding companies or securities or other financial information on this site or any sites relating to ARK are strictly beliefs and points of view held by ARK or the third party making such statement and are not endorsements by ARK of any company or security or recommendations by ARK to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that ARK’s objectives will be achieved. Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. For full disclosures, please go to our Terms & Conditions page.

The Adviser did not pay a fee to be considered for or granted the awards. The Adviser did not pay any fee to the grantor of the awards for the right to promote the Adviser’s receipt of the awards nor was the Adviser required to be a member of an organization to be eligible for the awards. For full Award Disclosure please go to our Terms & Conditions page. Past performance is not indicative of future performance.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment