D3signAllTheThings

The lithium sector has been red hot, yet demand for lithium has only started as electric vehicle production ramps up. Lithium Americas (NYSE:LAC) is a pre-revenue lithium producer working on constructing multiple mines around the world. My investment thesis is Bullish on the stock with lithium mining production around the corner right as prices have surged.

Supply/Demand Imbalance

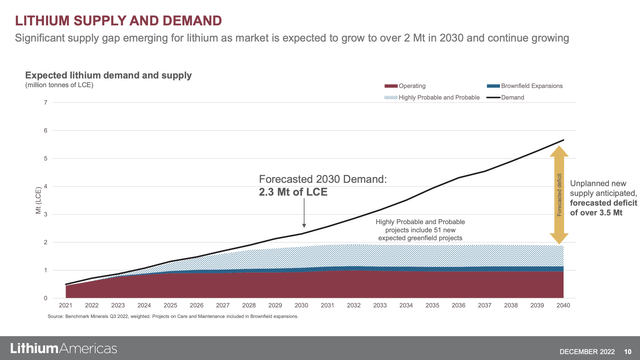

The lithium mining sector is appealing due to the massive growing demand for lithium used in the batteries of electric vehicles. Unlike other commodity markets, lithium isn’t in ready supply to meet the future demand from growing BEVs.

Data from Rho Motion provided by Lithium Americas suggests battery demand is set to grow 2,000% by 2040 as EV demand grows from ~10 million units in 2022 to 86 million by 2040. The battery demand from these EVs is expected to increase over 2,000% by 2040.

The problem is that forecasted demand is expected to exceed existing planned supply by 3.5 Mt in 2040. The world has brownfield supplies and up to 51 new greenfield projects expected to reach only 2.0 Mt of LCE production leading to a deficit by 2030 with new supply needed to ramp to meet soaring demand in the next decade.

Source: Lithium Americas Dec. ’22 presentation

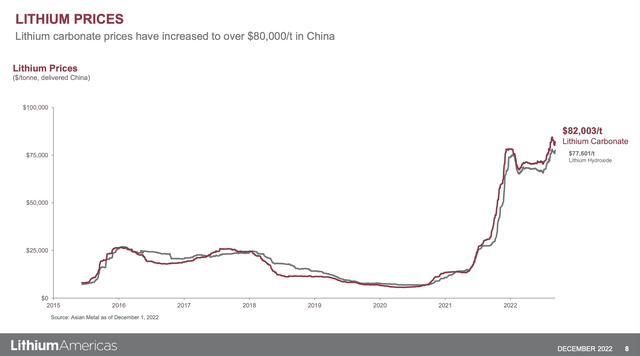

Due to the supply concerns, lithium prices have soared in the last few years. Lithium carbonate now trades at over $80,000/t with prices soaring above normalized levels around $20,000/t to $25,000/t in prior years.

Source: Lithium Americas Dec. ’22 presentation

The company originally forecast operating costs below $4,000/t and EBTIDA of $307 million based on a lithium carbonate price of only $12,000/t for battery grade product. The current prices are substantially above those original price estimates.

Lithium Production Around The Corner

These higher prices for lithium are definitely driving more supply to hit market. Lithium Americas falls into the category of companies with plans to join the lithium production ranks in the next year with mines in both Argentina and the U.S.

The company has production capacity in Cauchari-Olaroz, Argentina nearing startup. The Stage 1 production plan is for 40,000 tpa battery-quality lithium carbonate. The Stage 2 expansion will add another 20,000 tpa in the following years.

In addition, Lithium Americas is working on a plan to develop the Thacker Pass in the U.S. and Pastos Grandes in Argentina. These mines are 100% owned by the company while the initial Cauchari-Olaroz mine is below a 50% ownership position.

The Thacker Pass mine targets a similar 40,000 tpa lithium carbonate capacity (Phase 1) and incorporating Phase 2 expansion scenario for total capacity of 80,000 tpa. Lithium Americas is pushing forward with a plan to separate the entities into somewhat similar operations in Norther America and Argentina.

Source: Lithium Americas Dec. ’22 presentation

The separation move doesn’t make a lot of sense here. The combined mines offer a diversified way to invest in a lithium producer with multiple mines in different countries. Even worse, company executives are now focused on splitting up the company versus mine production and expansion.

The new Argentina mine would produce about $3.2 billion in annual revenues based on just getting the original Stage 1 production to market with lithium carbonate market rates at $81,000/t. The company is entitled to 49% of Stage 1 production.

The company has a market cap of $3.5 billion making the stock appealing at these levels, though Lithium Americas only has a cash balance just below $400 million. The lithium miner will need to raise additional funds to pursue the construction of new mines and expansion of existing mines.

The Stage 1 cost of the Cauchari-Olaroz mine has reached over $850 million based on higher exchange rates. The company would need to spend similar amounts for these other mines where Lithium Americas actually owns 100% of the business.

The lithium miner knows the demand exists for the supply. The biggest question is obtaining feasible capital and the timing of regulatory approvals to move forward with construction of the new projects.

All of these assets have the potential for 60,000 to 80,000 tpa of lithium carbonate placing Lithium Americas in a strong asset position with soaring demand due to EVs.

Not Without Risks

While lithium demand growth seems a slam dunk, the investment story isn’t without risk. The biggest concern is that new battery technology pops up to replace the need for lithium. Or of course, EV demand could fail to live up to the hype. The lack of key supplies, such as lithium, could force the world to pull back from ambitious EV adoption goals.

Under any of these scenarios, lithium prices could fall back to previous levels where Lithium Americas wouldn’t see much, if any, upside. The stock could actually fall substantially, if the company spends aggressively on building new mines without demand hitting forecasts.

Takeaway

The key investor takeaway is that Lithium Americas is an appealing stock trading near the yearly lows despite lithium prices soaring. The lithium miner is on the verge of moving from a story stock to a legitimate miner.

Investors should use any market weakness to build a position in Lithium Americas.

Be the first to comment