Drew Angerer

About four months ago, I detailed how short interest in plant-based meat company Beyond Meat (NASDAQ:BYND) had just risen to a new high. The naysayers were placing large bets against the name, expecting that the company’s yearly revenue forecast was just way too high. Since that article, shares have lost more than half of their value as those bears were correct, yet there is still reason to believe that shares could go quite a bit lower from here.

Overall, there hasn’t been a major change in the past four months in terms of net short interest. A bunch of shorts did cover in July and August, but then bets against the company jumped in September and October, so we’re only down a couple of percent since my previous article. Beyond Meat is still one of the most highly shorted names in the market today, with almost 45% of its float short according to Yahoo! Finance.

The reason why so many shorts remain is that the company continues to struggle with its overall sales picture. This week, management reported a more than 22% drop in Q3 revenues over the prior year period. At $82.5 million in total, the number missed dramatically reduced street estimates by more than $2 million. Worse yet, management took down its full year forecast for revenues to a range of $400 million to $425 million versus a street consensus of nearly $427 million.

Given we are in the final quarter of the year now, that range is extremely disappointing when you realize what it means for Q4 revenues. Also, this is a company that just six months ago called for revenues this year in a range of $560 million to $620 million. That certainly seems like an extremely fast deterioration in the business, but skeptics might argue that management was being overly optimistic earlier this year.

One of the main problems here is the company’s expense structure. Things were so bad in Q3 that Beyond Meat reported a negative gross profit of $14.84 million. While this did include some one-time items, it did mean that the company’s products cost $1.18 for every dollar of revenue generated. This very bad number was even before considering operating expenses, which in total (including restructuring costs) were another roughly 90% of revenues in the period.

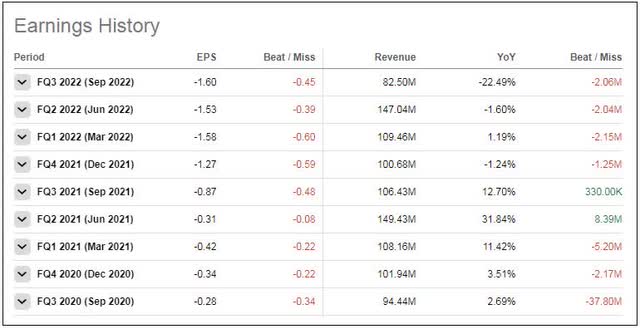

In the end, the company lost over $101 million in the third quarter, nearly double the loss from the year ago period. On a per-share basis, the $1.60 loss was significantly higher than the $1.15 loss that the street was expecting. As the graphic below shows, Beyond Meat has missed on the bottom line in each of the last nine fiscal quarters. There are only two revenue beats over that time, with one of those being extremely small.

BYND Revenue / Earnings History (Seeking Alpha)

Last month, the company announced a reduction in its workforce, aimed at improving the overall loss picture. Unfortunately, management only expects these job cuts to save around $40 million over the next year, which isn’t that much when you are losing around $100 million a quarter at the current pace. The street doesn’t see this name being profitable anytime soon.

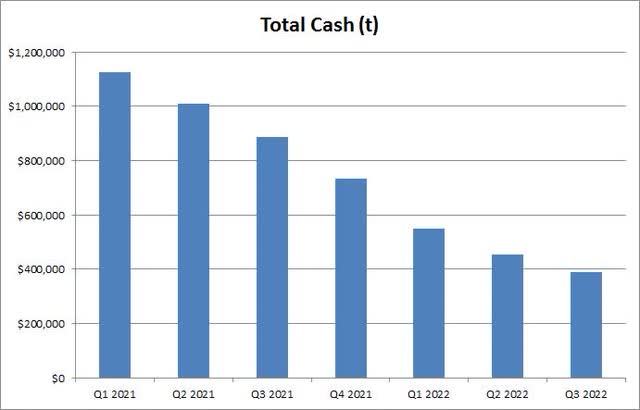

Primarily as a result of these large losses, the company has been burning through a lot of cash. In Q1 of last year, Beyond Meat issued $1.15 billion of zero coupon convertible notes, a capital raise that was definitely needed. As the chart below shows, most of that cash has been used up already, with the cash balance dropping by almost half a billion dollars in the last 12 months (ending this September).

Beyond Meat Total Cash (Company Filings)

In the Q3 earnings release, management said it is targeting cash flow positive operations within the second half of 2023. Of course, that metric excludes capital expenditures, which means free cash flow could still be negative. Even if the cash pile decline rate drops in half over the next four quarters, that would only leave the company with about $142 million in cash at the end of Q3 2023. It seems likely that another capital raise is in the cards, and given what we’ve seen with the revenue situation this year, it’s very hard to trust this management team’s guidance currently.

Unfortunately, this is not the market environment you want to be raising money in. With interest rates on the rise, the company would likely be facing a significant coupon on any debt issued, further adding to the expense base and potential cash burn. Even with the 20% plus rally on Thursday thanks to inflation numbers coming in cooler than expected, the stock remains only a few dollars from its 52-week low of $11.56. The 52-week high was more than $85 a share, and back in July 2019, and the all-time intra-day peak was just under $240. An equity raise would likely results in meaningful dilution for current stockholders.

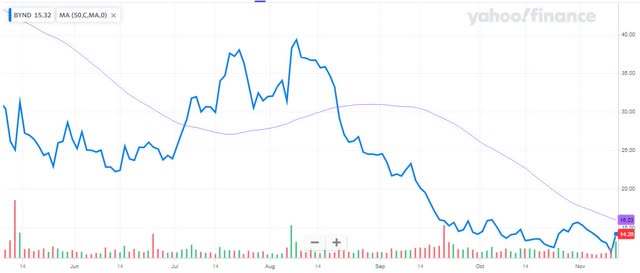

What’s amazing at this point is that the street still believes in the name to a point. While there are more sell recommendations than buy ratings at the moment, the average price target of $18.30 does represent almost 29% upside from Thursday’s close. Of course, the average analyst valuation started this year around $77, and look where we are now. We could see more price target cuts in the coming weeks as analysts update their models after this week’s bad report. Additionally, the stock could soon be facing resistance from its 50-day moving average, the purple line seen in the chart below, which is currently heading lower.

BYND Last 6 Months (Yahoo! Finance)

In the end, Beyond Meat had another terrible earnings report this week, making me believe single digits are certainly possible for the stock. While we did see a dead cat bounce on Thursday thanks to the overall market surge, management again took down its 2022 revenue forecast. With losses and cash burn piling up, another capital raise will likely be needed by this time next year, and it is likely to be rather painful. Until this name gets its act in order, I don’t see a bottom anytime soon unless the overall market continues to surge higher from here.

Be the first to comment