Fahroni

Investing can be scary sometimes, especially if you are taking a contrarian stance. For instance, right now, anything even tangentially related to the automotive space is considered scary to many market participants. However, shares of these companies are often trading at very low levels from a valuation perspective. Although certainly not the most appealing player in the market, Lithia Motors (NYSE:LAD) is trading at cheap levels and definitely warrants some consideration. While I do think that there are better places to put your money if you like this market segment, I do still believe that the company is worthy of a ‘buy’ rating.

Performance remains strong

Back in April of this year, I wrote an article that looked upon Lithia Motors in a favorable light. The company’s strong fundamental performance leading up to the publication of that article, combined with its low share price, led me to rate it a ‘buy’, even though management had reported weaker-than-anticipated financial results for the first quarter of the 2022 fiscal year. Since then, shares have declined by 30.9%. That compares to the 20.1% decline experienced by the S&P 500 over the same window of time.

To some, the idea of buying stock in a company that owns car dealerships may seem crazy when the economy might very well suffer moving forward and at a time when interest rates and inflation are both rising. But even if financial performance for the enterprise were to worsen, I remained confident that the company would not be any worse off than fairly valued. Although shares have fallen since then, I remain confident in my analysis. And to illustrate for you exactly why, I need only look at the data provided by the company for the second quarter of its 2022 fiscal year. This is the only quarter for which we did not have data when I last wrote about the company but do have data today.

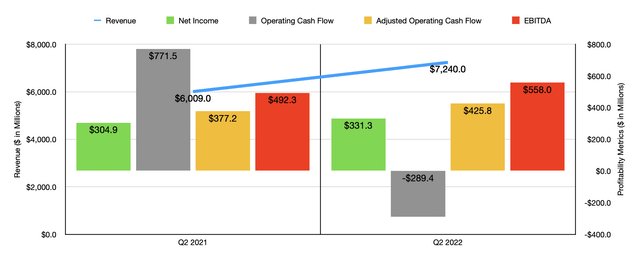

During that quarter, sales to the company came in at $7.24 billion. That’s 20.5% higher than the $6.01 billion generated the same quarter one year earlier. The biggest driver for the company seems to have been used vehicle retail revenue. Revenue there jumped by 38.3%, surging from $1.80 billion to nearly $2.50 billion. This increase came as the number of used vehicles sold under its retail operations jumped by 15.3% from 70,254 to 81,026. The company also benefited from a 19.9% increase in the average used vehicle sale price, a number that rose from $25,691 to $30,814. New vehicle retail sales rose a more modest 3.3%, climbing from $3.15 billion to $3.25 billion. Total units sold dropped by 8.5%, but average pricing jumped by 13%. The company saw revenue growth in other respects as well. Finance and insurance revenue rose by 22.6%, from $269.6 million to $330.4 million. Meanwhile, service, body, and parts revenue also increased, rising 31% from $521 million to $682.6 million.

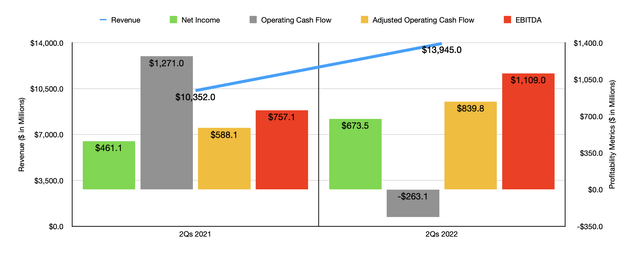

This increase in revenue brought with it a rise in profits for the company. Net income in the latest quarter totaled $331.3 million. That compares favorably to the $304.9 million recorded just one year earlier. We do need, however, to dig a bit deeper to understand why this took place. For instance, used vehicles sold by the company actually saw their profits drop by 11.1%. At the same time, new vehicle gross profits per unit rose by 43.1%. The company also benefited from a 19% rise in gross profit per retail unit under the finance and insurance side of the enterprise. Despite these improvements, operating cash flow fell from $771.5 million to negative $289.4 million. But if we adjust for changes in working capital, it actually would have risen from $377.2 million to $425.8 million. This disparity makes a lot of sense when you consider that the company has been paying more to stock up its inventories. And this is where one legitimate concern from bears comes into play. In the event that the market does weaken considerably, can the company offload its vehicles without incurring losses? But I digress. Over the same window of time, we also saw EBITDA for the company improve, climbing from $492.3 million to $558 million. In the chart above, you can see not only the profitability side of things but also the revenue side for the entirety of the first half of the 2022 fiscal year relative to the first half of the 2021 fiscal year. In this case, you can see similarly strong results year over year.

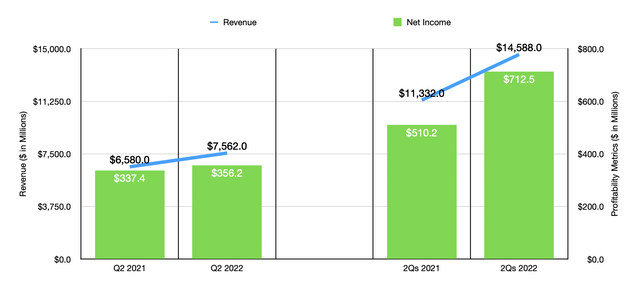

We should also pay attention to pro forma financial results. The fact of the matter is that Lithia Motors has historically been active in growing by means of acquisitions. The company, as a result, posts pro forma financial results assuming that the acquisitions it has engaged in were effective over the entire timeframe examined. This data for both the latest quarter and for the first half of the 2022 and first half of the 2023 fiscal years as a whole, can be seen in the chart above. Unfortunately, we don’t really have anything other than revenue and net income here. Management has not provided cash flow data on a pro forma basis.

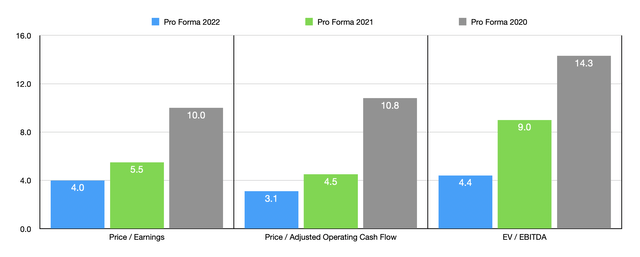

Given these pro forma figures, and relying on the assumption that we can annualized results experienced so far for each year, I was able to value the company effectively. On a forward basis, the price-to-earnings multiple would come in at 4. The price to adjusted operating cash flow multiple would be 3.1, while the EV to EBITDA multiple would be 4.4. If we instead use the data from the 2021 fiscal year, these numbers would be 5.5, 4.5, and 9. For those who are particularly bearish about the industry as a whole, I also priced the company under the assumption that financial performance were to revert back to what the company achieved during its 2020 fiscal year. Even in this case, shares don’t look poorly priced, with multiples of 10, 10.8, and 14.3, respectively.

As part of my analysis, I did also compare the company to five similar firms. In this case, I used data from the 2021 fiscal year for each of these firms and compare them to the pro forma 2021 results for Lithia Motors. On a price-to-earnings basis, these companies ranged from a low of 6.1 to a high of 7.2. In this case, our prospect was the cheapest of the group. Using the price-to-operating cash flow approach, the range was between 2.7 and 7, with two of the five companies being cheaper than Lithia Motors. And when it comes to the EV to EBITDA approach, the range is between 5.6 and 9.6. In this scenario, four of the five prospects were cheaper than our target. Even if we use the official 2021 results instead of the pro forma figures, the placement of Lithia Motors compared to the other firms remains unchanged when looking at it through the lens of the price-to-earnings multiple and the price-to-operating cash flow multiple. The placement for the company only changes when it comes to the EV to EBITDA multiple, with three of the five firms now being cheaper than it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Lithia Motors | 5.5 | 4.5 | 9.0 |

| Penske Automotive Group (PAG) | 7.2 | 6.6 | 6.7 |

| Sonic Automotive (SAH) | 6.1 | 7.0 | 7.3 |

| Asbury Automotive Group (ABG) | 6.5 | 3.0 | 9.6 |

| Group 1 Automotive (GPI) | 6.5 | 2.7 | 6.2 |

| AutoNation (AN) | 6.3 | 5.4 | 5.6 |

Takeaway

From a purely pricing perspective, shares of Lithia Motors look very appealing. This is true even though the pricing relative to similar firms is all over the place. I have no doubt that the industry itself will face some significant headwinds in the near term. That could alternately punish shareholders further. But for those focused on acquiring a company on the cheap that has attractive long-term potential, I do think Lithia Motors makes for a solid ‘buy’ prospect, even if it’s not the most appealing in its space.

Be the first to comment