Audacy is betting big on podcasting, but the next few years should be spent focusing on deleveraging the balance sheet.

LordHenriVoton/E+ via Getty Images

Over the last year, we have highlighted a number of media names that we like, with a fair number of legacy radio companies included. We made some really good calls on these names during the COVID-19 sell-off and although we have taken some profits, this is an area we think can see further gains. We have left no stone unturned as we have researched nearly every publicly traded player, and while there are a number of stocks we really do like, there are probably just as many that we find perplexing.

We have been asked numerous times about our thoughts on Audacy, Inc. (NYSE:AUD) as some view it as a leveraged play on ad sales and/or the Federal Reserve having to do a relatively quick about-face on rates. While we would agree that the stock could move strongly higher if one, and especially both, of those items were to work out in Audacy’s favor, we think that a more thorough look is required before rushing to buy shares.

First Problem: Reverse Stock Split

On August 4, 2022 Audacy announced via a press release that the company had been notified by the New York Stock Exchange that the company’s Class A common stock was not in compliance with the 30 consecutive day $1/share minimum average closing price rule. From that time, Audacy can regain compliance within a 6-month “cure period” by having a $1/share average closing price over a 30 trading day period while also closing at $1/share on the last trading day of that month. This is not a hard rule to get back into compliance with, especially when a company has good material news that it can report on. However, the easiest way to regain compliance is for a company’s Board of Directors to approve a reverse stock split.

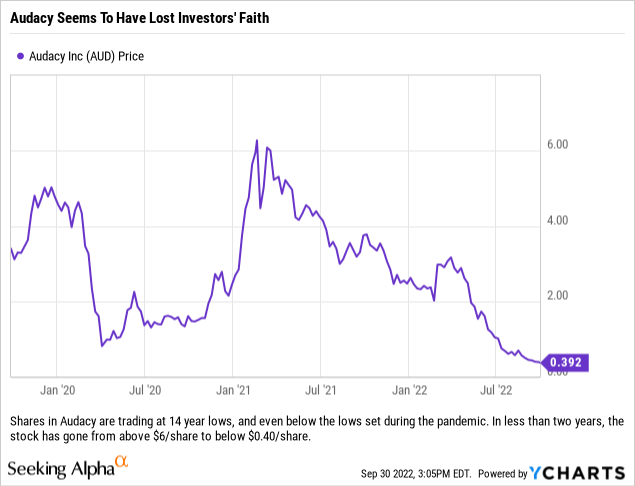

Audacy’s management team has stated that it believes that the company can get back into compliance, preferably with the share price rebounding on its own. With shares currently trading just under $0.40/share and the stock recently hitting 14-year lows, our bet is that the company will have to do a reverse stock split unless it finally starts getting serious about the debt load and fixing the legacy business while slowing spending on M&A for the podcasting division.

The Debt Load: A Problem Management Wants To Ignore

Currently, Audacy has a significant debt load. The company has, by our last count, $1.86 billion in total debt with the weighted average coupon just over 6.60%. The good news about the debt is that there is not much that has to be repaid in 2022 or 2023. The bad news is that 2024 is when the company will have to begin to roll maturing debt, and refinancing that debt could be a problem – especially if management wants to create some breathing room from the 2027 and 2029 maturities.

The maturing term loan (it matures on 11/17/2024) should be easy enough to refinance in a normal market, but if the Federal Reserve continues to raise rates, companies such as Audacy might not be viewed favorably from a credit standpoint which could in turn force them to issue bonds at wider spreads for the portion they may not be able to roll over into a new loan. We doubt this turns into a problem, but regulators could make it a problem if there are cracks in the market with companies that have a large amount of debt.

A reading of the most recent conference call seems to support our thinking on the 2024 debt maturities, with management (during Rich Schmaeling’s opening remarks) discussing its thoughts on all maturities in 2024 (emphasis ours):

“Again, assuming any recession that we face is not severe and that the recovery commences in the second half of 2023, we believe we ought to be able to refinance our $767 million of outstanding first-lien debt well before this debt matures in about two years.”

So the company is banking on being able to roll that first-lien debt and hoping to take care of that prior to 2024. It would be good news if they could accomplish that; however, we do wonder what the spread would be as well as the corresponding increase in interest payments.

While all of that is good, what we found troubling was that Audacy has spent less time, and resources for that matter, addressing its capital structure over the last few years and has fallen behind certain names in the industry. The debt is a problem and, in my view, the company is really dropping the ball by not addressing that issue right now. The company’s CBSR 6.5 05/01/27 bonds are trading just over $0.25 on the dollar right now (and the 2029 maturity is trading at just over $0.24 on the dollar); for those keeping track that is a 48.44% yield. Rich Schmaeling stated that, “at the moment, we’re not focused on or interested in using cash to buyback our bonds.” If management truly believes that it will be able to refinance the company’s first-lien loans before maturity in 2024, and its business runs at 30% margins like the rest of the industry, then the management should finally address Audacy’s capital structure and begin buying back its debt which is trading at distressed levels. Using $25 million in cash, Audacy could repurchase about $100 million (face value) of its bonds, or nearly 22% of the outstanding bonds in that issuance (the bonds that mature in 2027), and save $6.5 million per year in interest expense. That would certainly show debt investors that the company is serious about addressing its leverage, probably help stabilize the bonds, greatly reduce leverage by using less cash to retire debt at a huge discount, and increase earnings moving forward due to lower interest costs.

Our Final Thoughts

We would stay away from this name for the foreseeable future and wait for management to demonstrate that it can either grow earnings, and more importantly free cash flow, or start reducing debt in a significant manner. Some of the things stated on the last conference call gave us hope until we started digging, such as the asset sale of real estate in Houston. Speaking to investor relations, we were told that the transaction would not be material, so we have no idea why that was specifically mentioned in David Field’s (the President, CEO and member of the controlling family) opening remarks on the conference call. Maybe he was trying to appear to be using a play from Cumulus Media’s (CMLS) playbook, where they have been selling real estate assets to deleverage their balance sheet.

We suspect that a reverse split is coming, which will only put another dark cloud over the stock and think that the company may have to stop kicking the can down the road as it pertains to its debt. If the economy has a prolonged recession, Audacy is one of the names ill-prepared for that scenario and would then be faced with some difficult decisions.

At the end of the day, we suspect that the company will not file bankruptcy as the Fields family does not want to get wiped out. However, we do think it is possible that the company is forced into some asset sales to hasten its deleveraging… and if it moves to sell terrestrial radio assets, we would guess it would have to sell some prized assets in order to make the numbers work. We would recommend avoiding shares unless one is using purely speculative capital that they can afford to lose, or have recently purchased shares and can afford to lose all of those funds.

Be the first to comment