grbender

2022 has been a mixed year for Lion Electric (NYSE:LEV). The Quebec-based manufacturer of electric school buses and medium and heavy-duty urban trucks has seen its year-to-date stock price decline by 71%. This pullback remained dominant and near pertinent throughout 2022 on the back of record-high inflation and consecutively hawkish interest rate hikes. The capital markets have transformed from one of hope and hype to being characterized by despair and what some analysts have described as a now overdone risk-off sentiment.

However, the year has also been transformational for Lion with the company set to ramp up commercial production of the LionC school bus at its Joliet, Illinois manufacturing facility and with revenues forming new consecutive records as demand for their vehicles continues to blossom. Critically, the Made in America school buses will open the Canadian company up to a substantial amount of US government tax credits and pro-EV programs. The IRA is quite simply unprecedented, is already controversial with US allies, but most importantly is set birth an 800-pound gorilla that will accelerate the take up of EVs. The IRA is likely the most material climate-focused step ever taken by the US government as it allocates at least $370 billion over 10 years to decarbonization projects. There will be a $40,000 tax credit provided for commercial EV purchases over 14,000 pounds. This will be met with other incentive programs for the purchase of medium and heavy-duty zero-emission vehicles worth billions of dollars.

The IRA will be aggregated with a parallel EPA program that seeks to allocate $5 billion from 2022 to 2026 for the purchase of clean school buses. The first round of the Clean School Bus Program, worth $913 million, was completed in October and applications filed through Lion were awarded vouchers to purchase 207 electric buses for a total of $82 million. The Joliet facility allows Lion to tap into both these US government incentives which at their core aim to reduce the barriers to owning EVs and decrease the total cost of ownership to drive a structural shift in transportation that helps the US address its contribution to anthropogenic climate change.

Transformational Year Set To Drive Transformational Financials

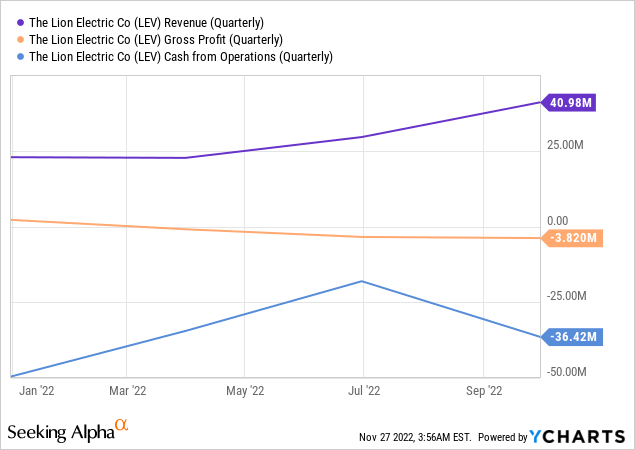

Lion last reported earnings for its fiscal 2022 third quarter saw revenue come in at $40.98 million. This was up 243.5% from the year-ago quarter but was still a miss by $320,000. The dramatic year-over-year growth came on the back of 156 vehicles delivered during the quarter, a nearly 4x increase from 40 in the comparable year-ago period.

The quarter marked the fourth straight period of sequential delivery growth, a trend which is set to accelerate on the back of the ramp of commercial production of its LionC school bus in Joliet. The company produced its first vehicles from the facility at the start of November and will ramp production at the site to fulfil deliveries to its Clean School Bus Program order book. This order book had grown to 2,400 at the end of the quarter and was also comprised of its medium and heavy-duty urban trucks like the Lion8. Highlighting just how severe the year-to-date pullback of the commons has been, the combined total order book value of $575 million is roughly in line with Lion’s current $568 million market cap.

An Industry-Wide Disruption

From a profitability perspective, the quarter left the bulls lacking. Gross profit was negative at $3.8 million, up from a loss of $1.2 million in the year-ago quarter. The company’s cash burn from operations also came in at $36.4 million which when aggregated with capital expenditure of $21.9 million drove a free cash outflow of $58.3 million.

Whilst Lion expects to incur a total CapEx of $65 million for Joliet, lower than the initial guidance of $80 million, the company’s cash and equivalents declined to $67 million from $83 million in the second quarter. Lion expects to be able to tap into a $125 million at-the-market equity program that’s had only $20 million issued as at the end of the third quarter. The company also has a $200 million asset-based revolving credit facility with $37 million drawn.

The combined total of the broader liquidity available to the company should allow management to see through the ramp-up of Joliet just as EV demand fervour moves towards its fever pitch. This will come far ahead of dates for the phase-out of gas and diesel-powered vehicles that have been brought in by New York and California. This incredibly bullish policy trend for Lion has unfortunately also happened against bankruptcies from the class of EV companies that came public last year. Electric Last Mile Solutions filed for Chapter 7 in the summer and other companies like Faraday Future (FFIE) have flagged material financial distress in recent months.

However, Lion is in a significantly better position than its peers with a strong order book and enhanced access to a mix of debt and equity capital. The IRA and Clean School Bus Program also form backstops for revenue growth in the years ahead as the US mobilizes to reduce its carbon emissions. I sold out my position a few months ago as part of a portfolio deleveraging transaction but will likely reenter in the new year on the back of all the positive macro factors Lion stands to ride.

Be the first to comment