VioletaStoimenova/E+ via Getty Images

Lincoln National Corporation (NYSE:LNC) faces market headwinds, hammering its growth. But it remains an industry staple, a durable giant promising a rebound. For now, it must deal with macroeconomic storms and navigate the market. Interest rate hikes are both a growth driver and a hindrance for the company. Thankfully, it has adequate cash reserves to sustain the operations Also, borrowings and dividends stay well-covered with a better-than-market index average yield. However, the stock price continues to dip. It matches the contracting tangible book value and stock buyback ability of the company. But it is already a good bargain and may rebound when the company’s performance and the economy improve.

Company Performance

The insurance industry has seen a sudden yet long-lasting market boom in the last two years. With the increased hospitalizations and mortalities, life insurance and annuities became a staple. The unprecedented events have pushed many people to recognize their importance. Proper financial planning and protection have become popular trends. And even today, more people are turning to the insurance industry.

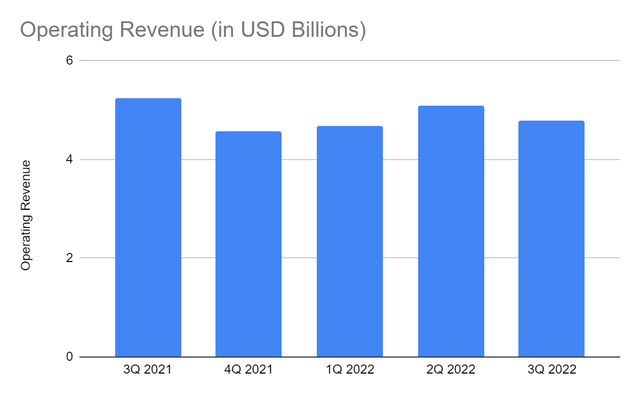

Lincoln National Corporation, a Pennsylvanian Giant, also benefited from the situation. The near-zero prices and interest rates attracted more customers and raised security yields. Now, it sees mixed market impact as interest rate hikes persist. Its operating revenue is $4.78 billion, a 9% year-over-year decrease. It is below the five-quarter average of $4.84 billion. But given the market conditions and the near-average value, revenues remain relatively stable. Life insurance and annuities remain the primary revenue segments. Yet, hindrances are visible in them. Various factors contribute to these changes. I will focus on the two.

Operating Revenue (MarketWatch)

First, interest rate hikes convey mixed results. Historically, insurance has been one of the most interest-sensitive industries. Although insurers and reinsurers are not created equal, a positive correlation exists. And Lincoln is not an exemption from this. In essence, higher interest rates mean more enticing insurance policy pricing. And since it anticipates higher interest rates, policy pricing is more strategic today. We can see how pricing and inflows changed in 3Q 2022. In turn, it enjoys higher premiums with an 11% year-over-year growth. Indeed, it is well-positioned against potential recessionary headwinds. It continues to optimize its sales mix by focusing more on viable products and segments. Again, new and renewed policy pricing is more strategic, aiming at a mid-single-digit growth rate. It offsets policy decreases due to market pessimism, lower purchasing power, and increased claims of policyholders.

However, interest rate increments do not always work in LNC’s favor. It lowers yields on securities and other assets, leading to more asset dispositions. We can observe it in the substantial increase in realized gains. Even more challenging, most of its investment securities are not inflation-linked. For instance, the majority of investments are AFS securities. Almost 80% of AFS securities are corporate bonds. Only 5% of AFS are government-backed securities and are the only inflation-linked securities. Hence, LNC can’t hedge security risks and lower valuation, leading to lower investment income.

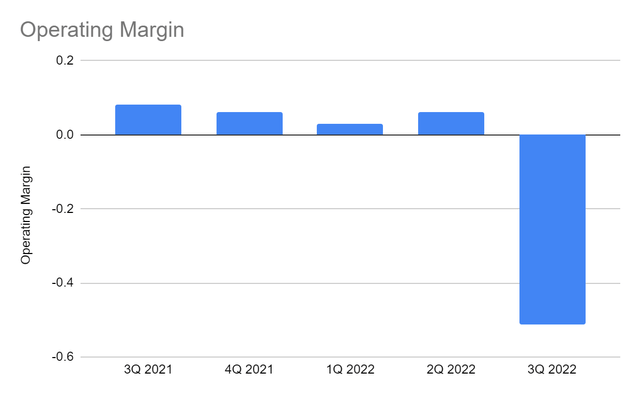

Second, LNC faces lapses in the GUL insurance segment, lowering the RBC ratio. Unsurprisingly, there have been substantial changes in fees and claims. They drive lower revenues and an operating margin of -51% this quarter. Even so, the remaining portion of core operating expenses is stable. Also, LNC remains well-capitalized, although it must rebuild it to the 400% target next year.

Operating Margin (MarketWatch)

Lincoln Risks And Opportunities

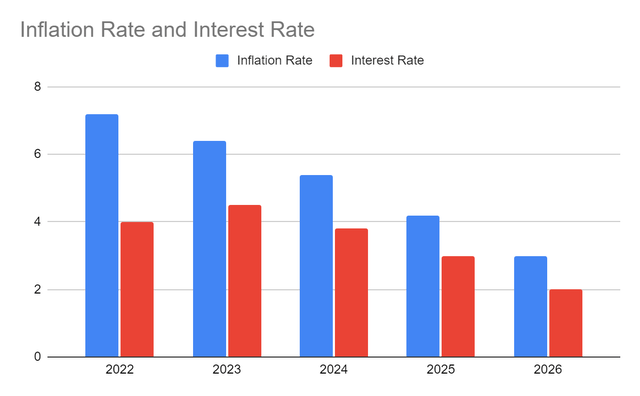

Inflation and interest rate hikes are both growth drivers and hindrances to LNC. However, they hamper the company’s growth more than drive it. Even if we exclude the impact of claims, the efficiency ratio will still be lower at 41% versus 48% in 3Q 2021. It must improve security yields, maintain strategic policy pricing, and stabilize expenses. So, it is a good thing that inflation has been cooling down as it dropped to 7.1% recently. Hopefully, it indicates that the 9.1% inflation is the peak. It can slow down interest rate increments to avoid racing 5% in the next twelve months. My estimation is also optimistic, expecting a continued decrease.

Inflation Rate And Interest Rate (Author Estimation)

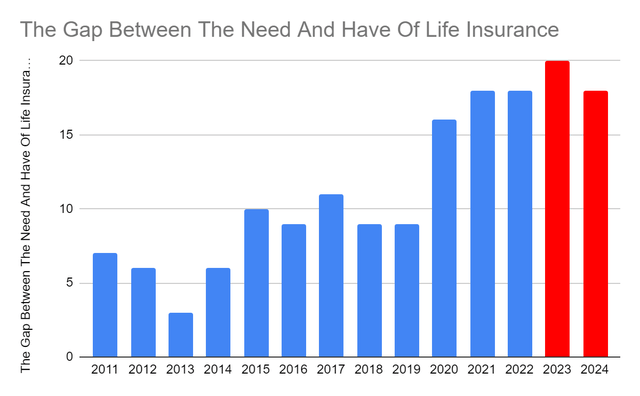

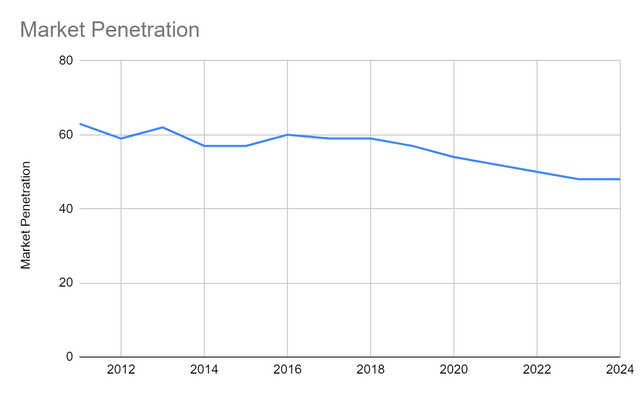

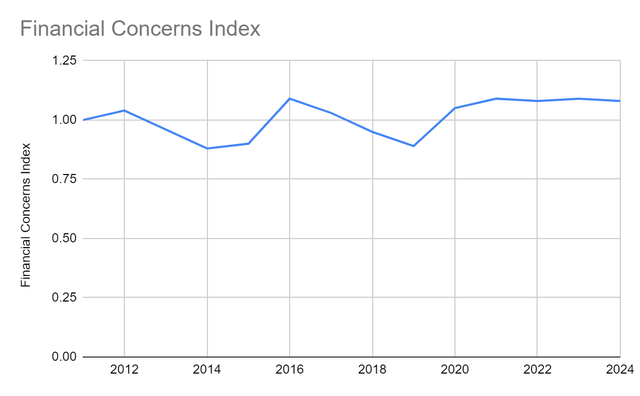

Moreover, LNC has more challenges and opportunities to face and take. The gap between the insurance ‘need and have’ remains wide. It was in a lull in 2015-2019. We can attribute it to the US economic recovery and income stability after the Great Recession. But in 2020, the 9% gap almost doubled to 16%. Today, it is even higher at 18%, twice as much as pre-pandemic levels. It shows that more people need insurance and annuities with a low policyholder population. Recessionary headwinds, pandemic fears, lower purchasing power, and overestimation of costs are the contributors. Also, the market penetration of life insurance and annuities remains low at 50%. The same factors can be attributed to the decrease in percentages. Nevertheless, it shows opportunities for the insurance industry to capture more customers. I expect a more sluggish industry gap and penetration in 2023 for the same reason. But rebounds may take place in 2024 as I expect a more manageable economy. Even better, there is increased financial literacy and concerns across all demographics. Before the pandemic, the financial concern index was only 0.89-0.95. Today, it is way higher at 1.08%, showing the increased importance of insurance and annuities. Despite being a giant, Lincoln still has a long way to go but more opportunities to seize. It can capture more policyholders.

The Gap Between The Need And Have Of Life Insurance (LIMRA And Life Happens)

Market Penetration (LIMRA And Life Happens)

Financial Concerns Index (LIMRA And Life Happens)

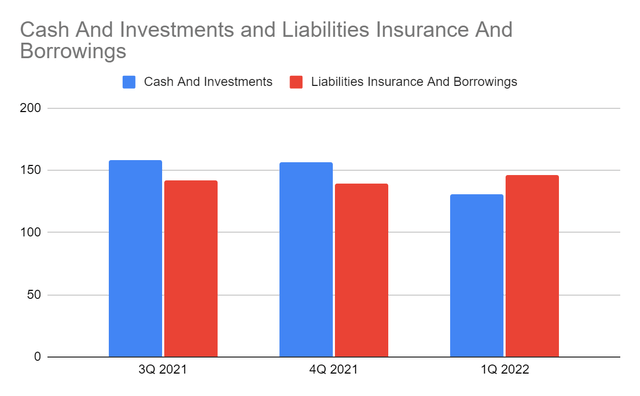

On a lighter note, LNC is well-capitalized, with a stellar Balance Sheet as its cornerstone. It can withstand market blows and take opportunities to its advantage. Cash and investments remain high despite the lower value due to lower investment yields and higher claims reserves. They comprise 41% of the total assets, allowing LNC to cover liabilities. It still has massive funds to cover insurance claims and borrowings. Cash inflows are also positive, showing impressive working capital management. Indeed, it knows how to adjust to sudden changes, such as the lapsed behavior of policyholders. It remains a liquid and sustainable company. But again, growth may stay hammered since the economy has yet to bounce back.

Cash And Investments And Borrowings (MarketWatch)

Stock Price Analysis

The stock price of Lincoln National Corporation remains hammered after losing about half its value. I believe it is adherent to fundamentals, driven by the 3Q performance. At $29.17, it has already been cut by 57% from the starting price. With the current PE Ratio of 9x, the price appears reasonable. If we multiply it by the NASDAQ EPS estimates, the target price will remain low. Its current PTBV of 4.5x is more than thrice as much as the 1.4x average in the previous years. If we use this to find the target price, the value will drop by over three times.

Meanwhile, dividends are attractive for a dividend investor. They have a yield of 5.9%, which is way better than the S&P 500 average of 1.84%. They are well-covered by adequate cash reserves. Also, the cash inflows are enough to suffice dividend payments.

The EV/Revenue of 2.4x agrees with the reasonability of the stock price. If we adjust the stock price to the maximum ideal ratio of 3x, the highest value it can reach is $35.58. The EV/EBITDA Ratio adheres to it. After using the (EV-Net Debt)/Common Shares Outstanding, the derived value increases to $36.95. Given all these, we can see contrasting findings as we delve into the earnings and intrinsic value of LNC. However, we also have to take its ability to repurchase shares. Given its decreasing tangible book value and common shares, share buybacks may contract. It may be another driving force to hinder the stock price from bouncing back. We can now observe the adherence of the stock price to earnings and intrinsic value. And even if it stays well-capitalized, it must still rebuild its capital to its 400% RBC ratio target. Until then, shares may stay at a discount, and market confidence may not be regained. Despite all these, I am optimistic about the capacity of the company to rebound. The fundamentals of the company and the untapped market potential can stimulate further growth. They may pay off once the economy becomes more stable. The current stock price may be a good entry point to make a position.

Bottom Line

Lincoln National Corporation faces hammered growth and may take some time to rebound. Despite this, it remains a sustainable and well-capitalized company. It must still improve to rebuild its capital base target and regain market confidence. But it has adequate reserves to suffice the business and borrowings. Also, dividends have impressive yields and are well-covered by the stable FCF. Although there’s more to a stock than dividends, LNC is something to hold on to. The stock price is a good bargain, given its capacity to bounce back and the market opportunities. The recommendation is that Lincoln National Corporation is a buy.

Be the first to comment