Makiko Tanigawa/DigitalVision via Getty Images

One of the oldest companies that you likely have never heard of that’s trading on the public markets is Lincoln Electric Holdings (NASDAQ:NASDAQ:LECO). This enterprise, which provides its customers with a large line of welding, cutting, and breezing products, has been around for more than a century and has an interesting operating history. Performance most recently has been quite impressive, both from a revenue and a profitability perspective. But a long history and strong performance does not necessarily translate to a great opportunity to buy into at this time. Given where shares are priced, the firm does look to be more or less fairly valued at this moment. But if growth does continue, it may not be long before the company becomes undervalued.

Impressive results

The last time I wrote an article about Lincoln Electric was in late May of this year. In that article, I said that the company’s financial performance had been really attractive as of late. However, I also said that shares look to be more or less fairly valued, both on an absolute basis and when considering how the company was priced compared to similar businesses. Since the publication of that article, the company has outperformed my expectations marginally. You see, when I rate a business a ‘hold’ like I did back then, my expectation is for its shares to generate returns that more or less match the broader market for the foreseeable future. However, shares of Lincoln Electric have since generated a profit for investors of 5.1%. That compares to the 1% decline seen by the S&P 500 over the same window of time.

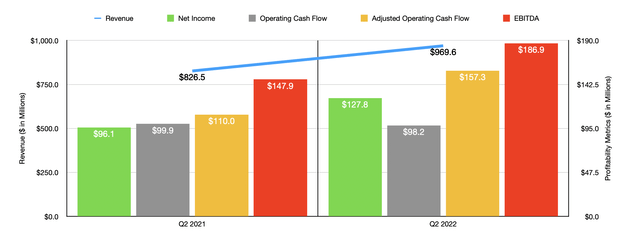

Author – SEC EDGAR Data

To be clear, I do think that some outperformance relative to the market was probably warranted. To see what I mean, we need only look at the most recent financial performance of the business. When I last wrote about the firm, we had data covering through the first quarter of the 2022 fiscal year. Today, that data now extends through the second quarter as well. During that time, sales came in at $969.6 million. That represents an increase of 17.3% compared to the $826.5 million generated the same quarter one year earlier. This increase, management said, was driven by a mix of factors. Increased product volume added $27.8 million to the company’s top line. Acquisitions added $23.8 million as well. But the real driver was a $141.5 million increase caused by price increases as management sought to pass on inflationary pressures to its customers. Running the math mentally in your head, you may recognize that the sum of all three of these categories adds up to more than the sales increase the company saw year over year. That’s because there was a contributor that hit the business in a negative way. That was foreign exchange translation, which hit the company to the tune of $50 million.

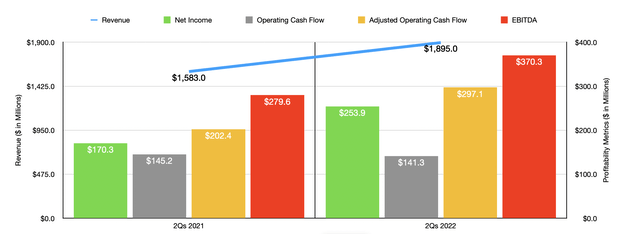

Author – SEC EDGAR Data

With the increase in revenue, the company also experienced a rise in profitability. Net income rose from $96.1 million in the second quarter of 2021 to $127.8 million in the second quarter of this year. This works out to a year-over-year increase of 33%. Management attributed this rise to a number of factors, including an increase of 21.7% to the firm’s gross profit thanks to higher volumes and the impact of cost reduction initiatives and pricing actions taken by the company. Operating cash flow, meanwhile, went from $99.9 million to $98.2 million. But if we adjust for changes in working capital, it would have risen from $110 million to $157.3 million. And over that same window of time, we also saw EBITDA for the company improve, climbing from $147.9 million to $186.9 million. Naturally, these strong results also had a positive impact for the year-to-date performance of the company as can be seen in the chart above. This rise in profitability encouraged management to buy back $25.1 million worth of stock during the first half of the year. That’s on top of the dividends the company continues to reward shareholders with.

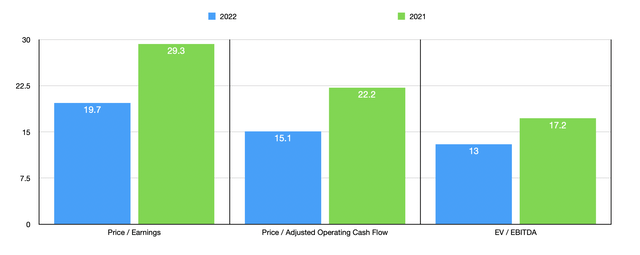

Although the company seems to be doing quite well for itself, management has not revealed financial expectations for the fiscal year as a whole. If we were to annualize results experienced for the first half of the year, we would anticipate net income of $412.2 million. That compares to the $276.5 million generated one year earlier. Adjusted operating cash flow would rise from $365.1 million last year to $535.9 million this year. Meanwhile, EBITDA for the firm would increase from $511.9 million to $678 million. Based on these figures, the company is trading at a forward price to earnings multiple of 19.7. The price to operating cash flow multiple would be 15.1, while the EV to EBITDA multiple of the business would come in at 13.

Author – SEC EDGAR Data

As you can see in the chart above, these numbers stack up favorably against what we would get if we compared the firm to its 2021 fiscal year. In short, these multiples would be 29.3, 22.2, and 17.2, respectively. Also, as part of my analysis, I compared the business to five similar firms. On a price-to-earnings basis, these prospects ranged from a low of 14 to a high of 165.9. Three of the five companies were cheaper than Lincoln Electric. The price to operating cash flow range for these companies was between 18.4 and 425.6, with our prospect being the cheapest of the group if we rely on data from 2022 and with two of the five companies being cheaper than it if we use the data from 2021. And finally, we have the EV to EBITDA approach, with multiples ranging between 11.6 and 49.5. Using our estimates for 2022, we find that three of the five companies are cheaper than our target. And that does not change if we use data from 2021.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Lincoln Electric Holdings | 19.7 | 15.1 | 13.0 |

| The Middleby Corporation (MIDD) | 17.8 | 24.9 | 12.7 |

| Pentair (PNR) | 14.0 | 18.4 | 11.6 |

| RBC Bearings (ROLL) | 126.2 | 38.8 | 40.3 |

| Chart Industries (GTLS) | 165.9 | 425.6 | 49.5 |

| Dover Corporation (DOV) | 16.5 | 21.3 | 11.9 |

Takeaway

The data available right now suggests to me that Lincoln Electric is doing quite well for itself and that the near-term outlook for the company should be quite favorable. I am cautious about the role that price increases have played in pumping up sales and, likely, profitability. After all, an eventual economic downturn could result in meaningful margin contraction for the business. That could take the company from looking fairly valued to potentially being overvalued, depending on the circumstances. Of course, continued growth on both the top and bottom lines could make the company cheaper and well worth an investment. But for now, I think a more appropriate rating, given the totality of the circumstances, would be the same ‘hold’ I had assigned to it previously.

Be the first to comment