Chris Ryan/iStock via Getty Images

How to fly without wings

I’m sure that everyone who lives outside of the city or somewhere at the outskirts, far from his or her office, has had a strong desire to acquire a pair of wings or at least a flying car so they wouldn’t have to suffer gridlock or overcrowded public transport during peak hours. I have dreamed of it before myself. In fact, I do it every morning.

I was glad to learn that I’m not alone in my wishes. Electric vertical take-off and landing vehicles (eVTOL) have become a hot topic recently. Top eVTOL producers are crying for the moon to create a taxi-airplane that allows customers to travel long distances. They also promise that such a means of transport will be affordable enough to be used on an everyday basis. One of the companies listed via SPAC that successfully plunged into this race during the pandemic is Lilium N.V. (NASDAQ:LILM). It’s a German eVTOLs producer founded in 2015 that is known for its Lilium Jet, a promising aircraft said to be able to fly 155 miles. That’s halfway from New York to Washington. Just imagine! You could travel from one city to another or, for example, fly to the beach to have some rest after a tough working day.

However, the company has occasionally been questioned over its initiatives. Could Lilium really fly its customers to the moon? My team doesn’t think so, and has identified many red flags. The recently announced $119 million fundraiser will certainly help the company survive the difficult times. That being said, we see too many risks in the business and prefer avoiding the stock altogether.

A promising takeoff, but not a flight

Lilium was listed via SPAC in 2021 and was met with high enthusiasm among investors. You know who energized investors are when the money is as cheap as it was. Besides, as one of the few European start-ups, Lilium appeared as an interesting project. Lilium could have become the rebirth of the country’s aviation or a favorite child considering the airbuses produced in Germany, the company’s Mutterland.

I’m sure that many of you have heard the well-known idiom, “If God had intended for us to fly, he’d have given us wings.” But in this case, the one that wasn’t meant to fly— at least in the nearest future— was brought high on the wings of a good start. It turned out that the manufacturer’s idea was too raw to enter the market with a tough competition. The lack of capital for the product’s development may have put the entire business on the brink of death. In fact, Lilium was more a venture capital baby rather than an adult prepared to enter the stock market.

Taking a step back, I need to explain for non-accounting-savvy readers what venture capital is. Early-stage start-ups like Lilium look for an investor that would give money to them along with other small companies anticipating that at least one of them will blow up and turn into a unicorn. Lilium was a classical venture capital story that shouldn’t have been listed. It had a strong idea, bright engineers, and was very far from creating a flying machine for long distances. But cheap money distorted the market so much that early-birds like Lilium managed to get a lot of money from equity investors. It obtained a valuation between $750 million and $1billion.

Since then, the Lilium N.V. stock price has plummeted. Initially, the company planned to achieve a complete aviation certification in 2023 and launch vehicles in 2024. However, it postponed its initial timeline and only completed half of the tests. Plus, there are significant doubts about its technology.

According to the Iceberg Research, in March of 2022, the mentioned 155 miles distance was apparently way too far to reach because the energy-consuming vertical takeoff dubbed as hover took more time than announced. At the time, the Lilium Jets’ hover time was estimated by the research team to be at least 2.5 minutes— much longer than the officially claimed 60 seconds with 10-25 seconds for takeoff and 20 seconds for landing. Such values may seem to have no difference to a non-specialist, but it is a huge struggle for a producer since it takes a lot of energy to make a jet move vertically in the air.

Due to another report by the same research group published in late August, Lilium’s hovering time amounted to “approximately 2-3 minutes” instead of the stated 1-1.5. And if we consider that the held tests were taken in ideal conditions far from reality, then it is possible that the flight distance might be cut to almost 66%. The flight range plays a crucial role for the company because of its market positioning.

The market of eVTOLs consists of several segments. Lilium decided to choose regional flights as its niche where private jets are currently mostly used. They are expensive and cause a lot of pollution, but Lilium aims to offer cheap and eco-friendly flights available for everybody. It could disrupt the jet business, but one must-have for regional flights is a sufficient range. Imagine that you’d like to get to the countryside by your electric car. Suddenly, the battery runs out of energy. It’s not that big a deal for you, as you can charge the car at the charging station (unless you are far in the woods). And now imagine the same situation with a jet. What would you do if the battery runs out of energy in the air halfway to your destination? Since no scientist has yet to create an air-charger— apart from the President’s Air Force One— only a miracle could help you then. Waiting for Zeus to give you a charged lightning bolt would be the only way out.

Lilium’s test results were meager taking into consideration another jet manufacturer, Joby Aviation, Inc. (JOBY), that managed to create a taxi-prototype showing 154.6-mile range during test flights at the beginning of 2022. And this isn’t the only achievement of Joby! The company has accomplished over 1,000 tests and gifted its investors with the news of becoming the producer of the fastest aircraft. Targeting jet aviation certification in 2023 (the same as Lilium), Joby seems on track to meet the timeline.

The competitive field in the market is pretty dense, as Lilium has to greatly improve its production unless it wants to crack under the pressure of its peers: Archer Aviation Inc. (ACHR), Blade Air Mobility, Inc. (BLDE), Embraer S.A. (ERJ), Joby Aviation, and Vertical Aerospace (EVTL).

The rejected child

Although the founder and first CEO of the company, Daniel Wiegand, was a bright inventor who graduated from Technical University of Munich, he didn’t have any experience in airplane construction. The University also didn’t believe in the business’ prospects and rejected the company, wanting to have no association with the startup. An inexperienced CEO, poor progress, and disapproval of the Munich alma mater negatively reflected on the company’s public perception. To restore trust, the company changed the CEO for more seasoned industry professional Klaus Roewe, an ex-executive of Airbus (OTCPK:EADSF, OTCPK:EADSY).

The company won’t be able to fly if its vehicles don’t get approved by regulators in the U.S. and Europe. As Lilium’s management says, the completion of this step can be a milestone for the company because it indicates the possibility to certify and commercialize their aircraft. While regulatory approval is ongoing in Europe (the second Design Organization Approval audit was completed in April 2022), it remains in the infant phase in the U.S. Hopefully the new CEO will accelerate the certification process. The positive thing is that there are plans to sign a partnership agreement with Saudi Arabia, implying that the country will become Lilium’s certification partner. This is only further supported by the recent order for 100 Lilium jets announced by Saudi Arabia under this agreement.

The new CEO came in at a very tough time for the company. Lilium urgently needs capital for product development, as it doesn’t generate any revenue and instead burns around $60-70 million cash per quarter. Because it only had $230 million in cash and $75 million equity line in Q2 2022, the company won’t have sufficient funds to commercialize the model by 2024. Lilium, therefore, needs new money.

Between Scylla and Charybdis

Anticipating further market turmoil, Lilium decided to fundraise about $120 million to increase its cash position. Fundraising at the current stock price is a terrible decision, but probably the best one given the looming recession. From the press release, it’s clear that the new CEO, Klaus Roewe, as well as three additional board members, Barry Engle, David Wallerstein, and Niklas Zennström, are putting their money into the company. It means that Lilium is currently struggling to find money at the market without additional “signs of confidence” from management.

The company didn’t really find money from institutional investors, as the main investors are Honeywell (HON) and Aciturri, companies working in the aerospace field. I also like how it is called “fundraising” and not an equity raise. Can a public company do fundraising? I didn’t know.

Considering the current LILM market cap of around $500 million, $120 fundraising equals over 20% dilution. Initially, the market reacted with a 7% stock price decrease, meaning that the overall market cap goes up by roughly 13%. Quite a positive reaction from the market. And I agree that it is smarter to raise money now than to wait when the market is lower and you need to issue equity at worse terms.

But $120m won’t solve all the problems. If the certification is delayed, then the company will need more money again. I was wondering if there are any other ways to secure money outside of fundraising.

One option would be to get financing from banks or bond issuance. But Lilium has to be sure that it will have money to pay back the debt. But then again, how it could be possible to pay back if the company itself doesn’t have enough money generation to repay the debts and is still a long way before commercializing the product?

The next possible fundraising option is gaining money via partners. But at the moment, the aviation industry is rather turbulent and still struggling from COVID-19 fallout. Airlines haven’t managed to recover from the huge decrease in demand due to the pandemic’s restrictions. What’s more is that, in the case of a looming recession, the airline industry will be affected. For example, during the 2008-2009 crisis, the industry was severely hit.

Another option is taking money from future orders, but this may turn out to be unrealistic in Lilium’s case. Even if they manage to commercialize jets in 2024, there is little sense for customers to pay 2 or 3 years in advance. Especially when you note that Lilium hasn’t had any convincing achievements yet. So buying products from a manufacturer several years before the planned roll-out with no evidence that you will get your purchase in time (if you get it at all), isn’t a thing you would normally do, unless you were really devoted to the eVTOL.

The final opportunity that remains for Lilium is subsidies from the government. I think that this option would have been possible in the past, but has been darkened by the fact that the company has faced too much criticism in Germany. The mere fact that even Lilium’s management alma mater rejected it doesn’t do any good for its manufacturer, either. So its spoiled reputation may ruin the last chance for Lilium.

Bulls say

Lilium remains one of the most popular companies among investors. When searching the best eVTOLs companies’ stock, you will likely find it in line with its rivals. So, even despite rumors about Jet’s underperformance and a biased attitude towards Lilium in Germany, there is still a chance that the manufacturer could get over the financing problems and be able to show exciting results of the product’s development. Making progress with the aircraft’s test values could cheer investors and potential clients up, and stabilize the ground under Lilium.

Valuation

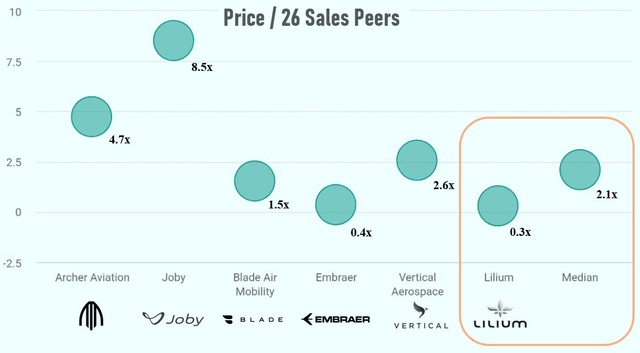

Comparing Lilium to its peers, we can see how cheap its value is. I guess the market has correctly factored in that Lilium has a lower chance of success than its peers, such as Joby.

Conclusion

Lilium might have been a good start-up, but now isn’t the right time for it. If the company manages to optimize its costs and show a strong track record, it can get through these difficult times. However, the company seems to have serious issues with the jet’s battery efficiency, which is insufficient for securing the required mileage. Plus, obtaining regulatory approval may take longer than currently expected.

Risks can be in your favor, but I’m not hungry enough to play a risky game with Lilium N.V. stock. There are plenty of better opportunities in the market. My team and I are constantly working on identifying them and will soon share our new analysis with you, so keep an eye out.

Be the first to comment