Ozgu Arslan/iStock via Getty Images

Ligand Pharmaceuticals (NASDAQ:LGND) has been an intriguing biotech/pharmaceutical name, as my last take on the business dates back to August 2020, when I concluded that there were many moving parts to the business and the investment case.

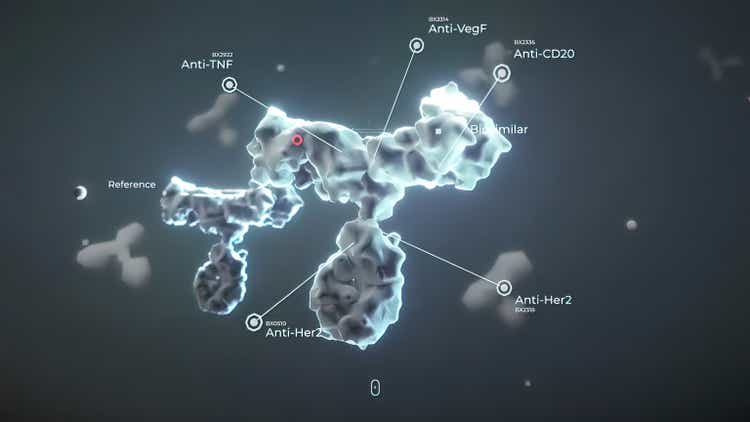

Part of the controversy and interest around the company stems from its very interesting business model. This is driven by the belief that while the biopharmaceutical industry has seen many blockbusters, not all of these are created through equal risk-reward research programs.

The company aims to collaborate with many other players in the ecosystem, as it believes that a connection of patents, data, and know-how creates a better set-up to succeed in the industry. The role of Ligand is to provide critical knowledge in this process, often in exchange for royalty steams, although often all options are on the table.

The Thesis

Ligand has seen a huge rise in the share price in recent years, with shares up from $10 in 2011 to a high in the $300s in 2018. This was driven by rapid growth in the business, as the company generated $2.3 billion in underlying product sales, while it has nearly 200 potential drugs in development as well.

The company itself generated $251 million in revenues, comprised of $129 million in royalty revenues, $29 million in material sales, and $94 million in lumpy license and milestone payments. The company earned adjusted profits of $167 million, marking incredible margins, with profits reported at $7 per share, although some declines were seen in 2019.

Arguably the valuation at $300 was far too high in relation to this earnings power, yet we have seen many moving parts ever since. In 2019, the company acquired Viking in a $100 million deal, but later in the year, it sold its IP rights of Promacta in an $827 million deal.

Following the sale of Promacta, the 2019 results showed a big decline with revenues down to $120 million, on which adjusted earnings of $61 million, or just over $3 per share were reported. This, however, excluded a big net cash position, as the company benefited from the pandemic with Captisol being used as part of Gilead´s (GILD) remdesivir solution. The company furthermore acquired Pfenex in a $438 million deal, a deal with little imminent contribution to the overall results, but of course, carried a price tag.

With shares trading at $112 in Augustus 2020, I was leaning cautious. The company has sold its cash cow at a decent price, but most of the proceeds have been used for buybacks and dealmaking. I furthermore pegged earnings around $4 per share, but that is including the pandemic boost (from Gilead´s remdesivir), as the valuation was not compelling yet. Amidst all this uncertainty, I believed that Ligand remains a show-me story with the large Pfenex deal having quite an uncertain contribution profile (both to the up and downside).

Steady And Uncertain

Since my take in August 2020, shares initially rose to a high of $200 at the start of 2021 amidst momentum seen in meme stocks, as shares have largely traded in a $100-$150 range ever since. The momentum early in 2021 coincided with the release of the 2021 results.

Full-year revenues rose from $120 million to $186 million, which looks compelling, but we have to understand that Captisol sales (largely relating to the pandemic) rose from $31 million to $111 million, as otherwise, sales would have been down. The company posted adjusted earnings of $76 million, or $4.50 per share.

The 2021 guidance was comforting with revenues seen around $291 million and adjusted earnings seen above the $6 per share mark. A $411 million cash position was offset by a similar amount of convertible securities outstanding. With the pandemic fading, the company cut the midpoint of the sales guidance to $270 million by the second quarter of 2021, but still saw earnings come in close to $6 per share, as the company maintained this guidance alongside the third quarter results.

In the end, the company generated $277 million in sales in 2021, including $164 million in Captisol revenues, or $113 million in non-Captisol revenues. Adjusted earnings came in at $6.42 per share, but that excludes more than $2 per share in stock-based compensation expenses, for a more realistic number around $4 per share.

The 16.7 million shares now represent a $1.9 billion equity valuation at $114 per share, as the net cash position (adjusted for the convertibles) comes in close to zero. Total revenues for 2022 are seen between $147 and $172 million, which suggests modest growth as the hype in Captisol is a thing of the past already, but no earnings guidance has been given, unfortunately.

OmniAb

In the second half of 2021, the company has announced its intention to spin off OmniAb, the discovery platform, as Ligand indicates that OmniAb is likely responsible for $40-$50 million in revenues this year. Just after the release of the annual results, the company has reached a deal to spin off the OmniAb business through a merger with a SPAC called Avista Public Acquisition Corp. II (AHPA).

Its sponsor will contribute $115 million to the business, Ligand itself another $15 million, as the pre-money equity valuation stands at $850 million. Ligand will spin off its shares to equity owners in a direct manner, as this valuation works down to $50 per share in terms of Ligand´s shares, that is based on the assumption that Ligand owns 100% of the company at the reported equity valuation, but likely the stake will carry a slightly lower value.

Final Thoughts

Trading at $114 per share, we have an unleveraged business, or actually holding a small net cash position, while a minor part of the business is just sold through a SPAC at valuation equal to nearly $50 per share. All of this looks quite compelling, as the company keeps its product sales and still has other development platforms (like Pelican) in its portfolio, while OmniAb is sold now.

The issue is that despite the promise, Ligand seems to be super-active in making transformative changes to its portfolio and sustainable growth is hard to find now. This creates a very volatile performance, both in terms of the operations and the financial performance of the business, which is the drawback if you ask me.

A modest speculative position here seems warranted on the back of a simple sum-of-the-part calculation, with a minor part of the business sold at a big price, yet the volatility of the business and performance prevents me from having great conviction just yet.

Be the first to comment