milan2099

A Quick Take On Life Time Group Holdings

Life Time Group Holdings (NYSE:LTH) went public in October 2021, raising approximately $702 million in gross proceeds from an IPO that priced at $18.00 per share.

The firm provides fitness services through its network of athletic resort destinations.

While I’m on Hold for LTH in the near-term, the stock is one to put on a watch list for future consideration.

Life Time Overview

Chanhassen, Minnesota-based Life Time was founded to develop, acquire and operate premium athletic health and wellness locations via a recurring membership subscription business model.

Management is headed by founder, Chairman and CEO Bahram Akradi, who has been with the firm since inception and was previously co-founder and EVP of U.S. Swim & Fitness Corporation.

The company was taken private in 2015 by private equity firms Leonard Green & Partners and TPG.

The firm seeks customers via an omni-channel approach, involving both online and offline media.

LTH says it also is focusing on delivering ‘live streaming fitness classes, remote goal-based personal training, nutrition and weight loss support and curated award-winning health content and wellness data monitoring on the go.’

Life Time’s Market & Competition

According to a 2021 market research report by Mordor Intelligence, the global health and fitness club market was an estimated $81 billion in 2020 and is forecast to grow at a CAGR (Compound Annual Growth Rate) of 7.21% from 2021 to 2026.

The main drivers for this expected growth are a continued rise in the benefit of health awareness and increasing incidence of obesity, leading medical caregivers and governments to encourage exercise as a regular feature of individual habits.

Also, the North American region will continue to dominate the health and fitness center market in the coming years.

Major competitive or other industry participants include:

-

Equinox

-

The Bay Club Company and Club Corp

-

LA Fitness International

-

24 Hour Fitness Worldwide

-

YMCA

-

Anytime Fitness

-

Snap Fitness

-

Planet Fitness

-

Orange Theory

-

Barre3

-

Others & Independents

Life Time’s Recent Financial Performance

-

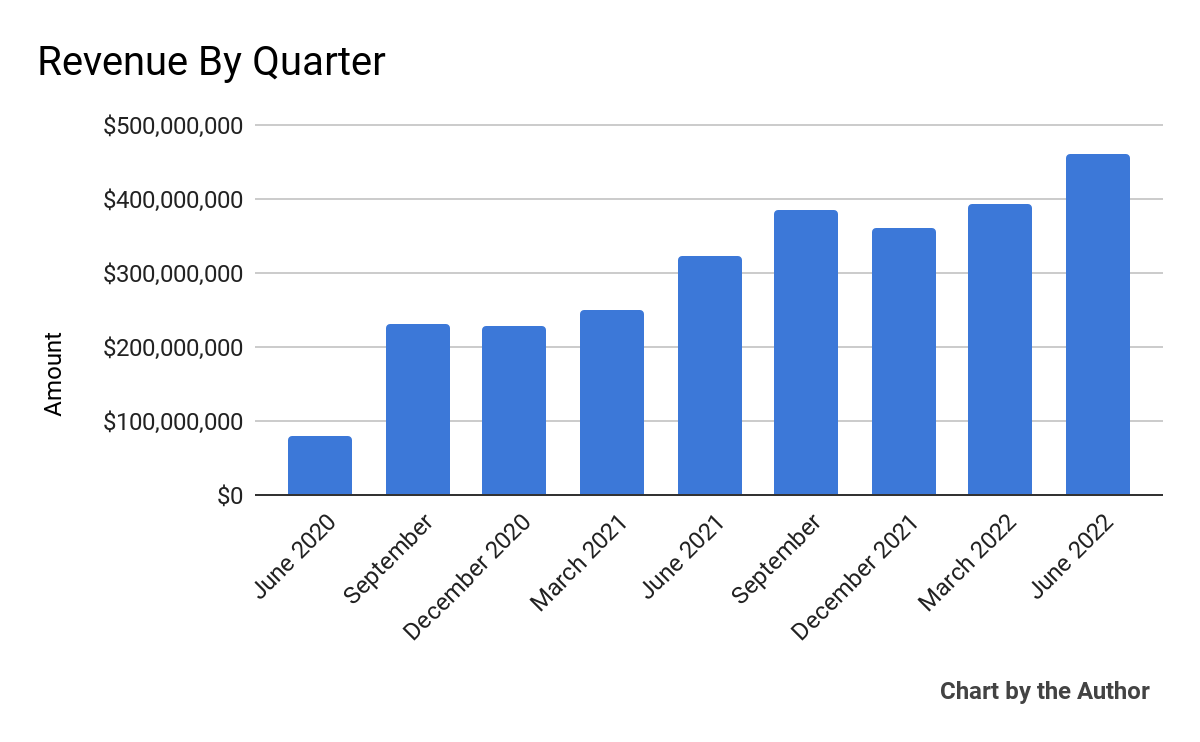

Total revenue by quarter has risen according to the following trajectory:

9 Quarter Total Revenue (Seeking Alpha)

-

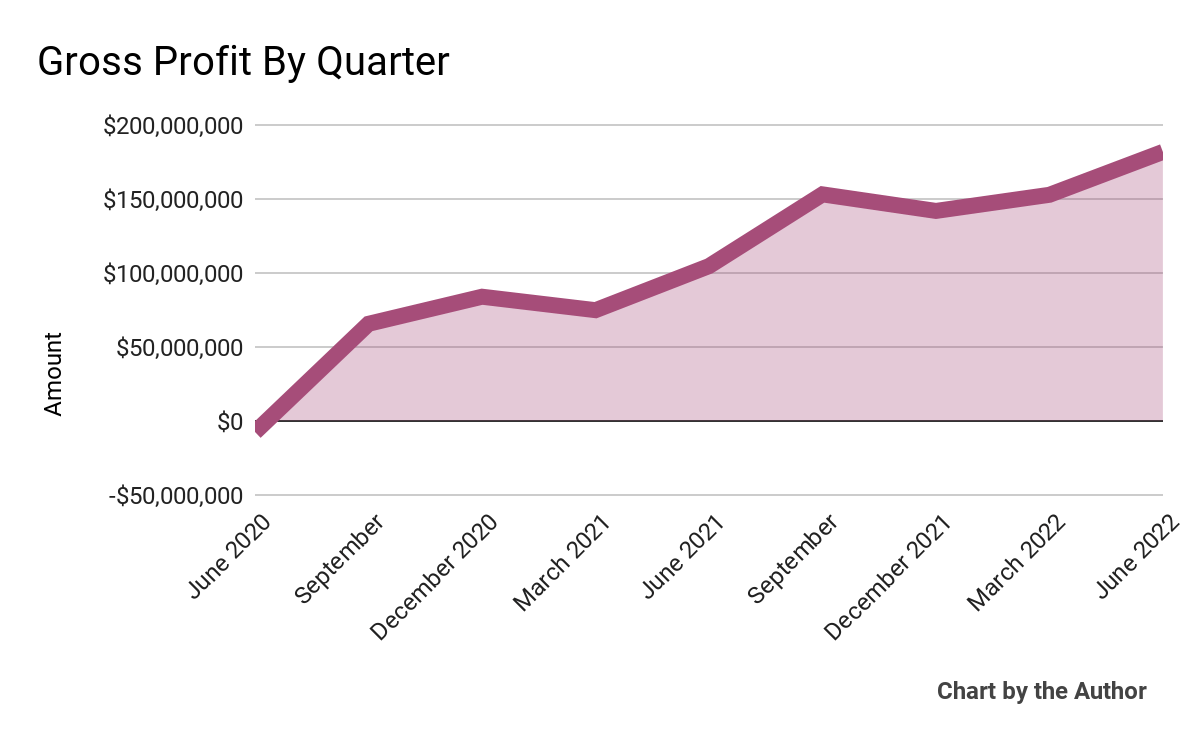

Gross profit by quarter has also stepped up over time:

9 Quarter Gross Profit (Seeking Alpha)

-

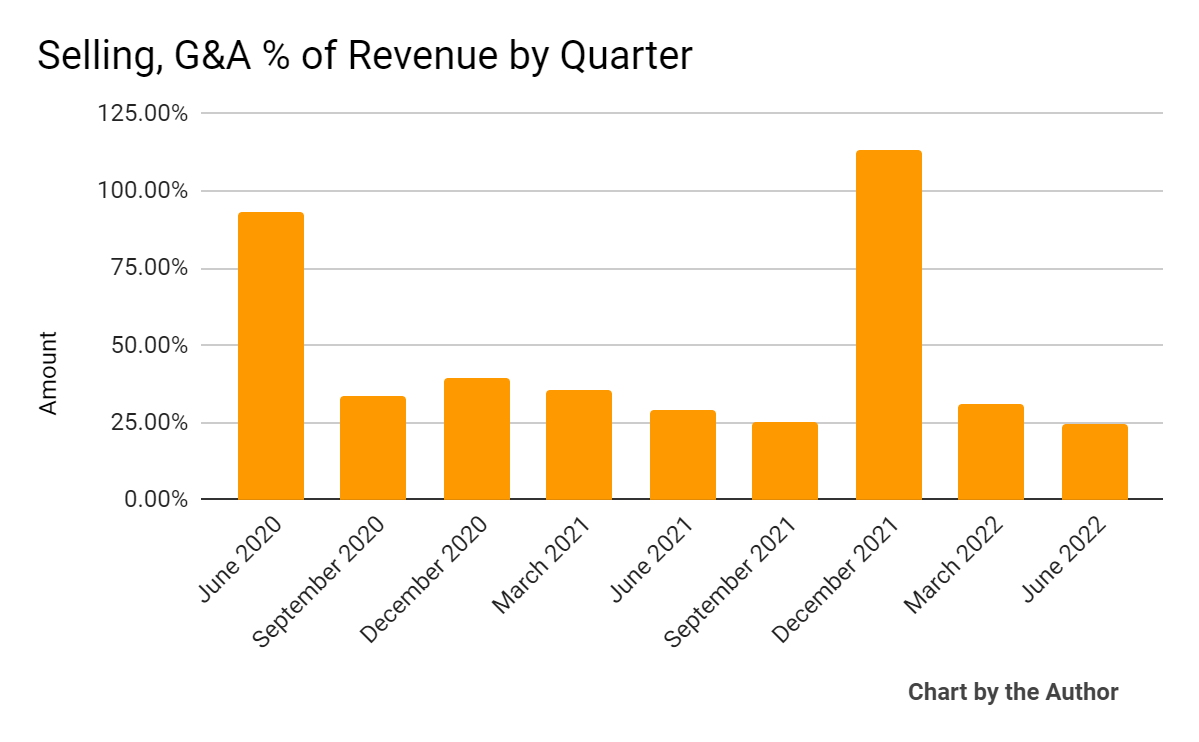

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower, with the exception of Q4 2021 which likely included stock-based compensation associated with its IPO:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

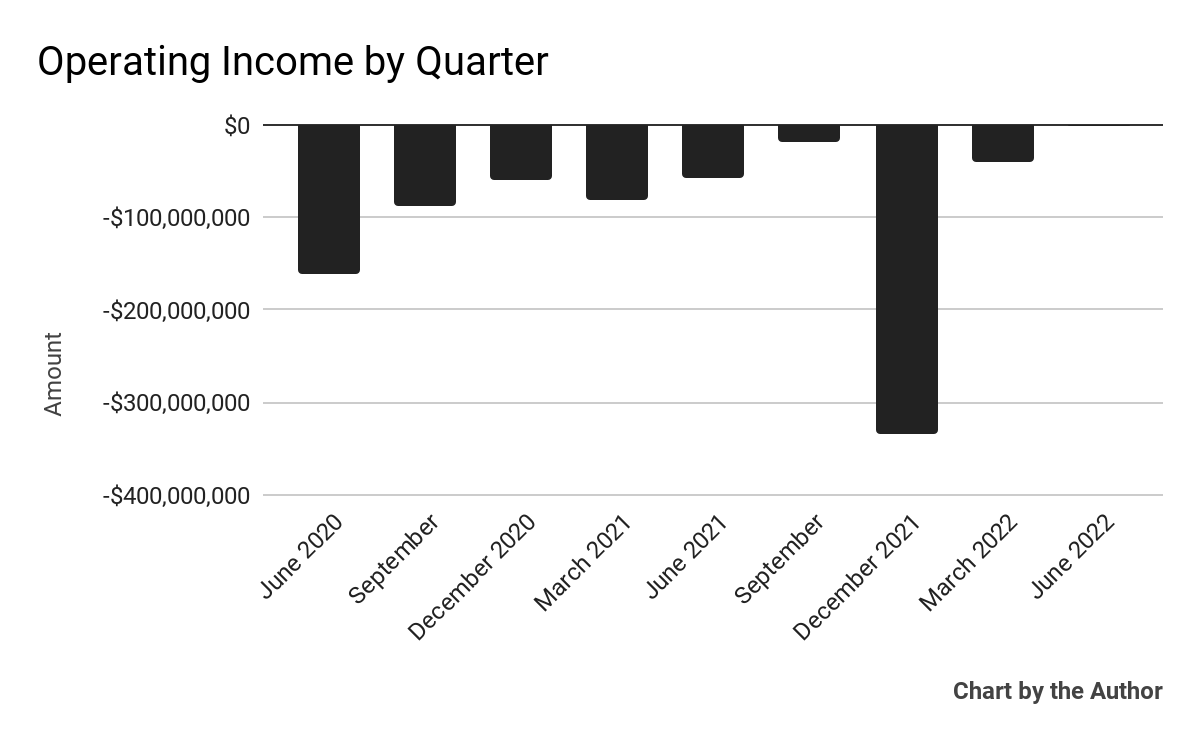

Operating income by quarter has remained negative in most of the last 9 quarters:

9 Quarter Operating Income (Seeking Alpha)

-

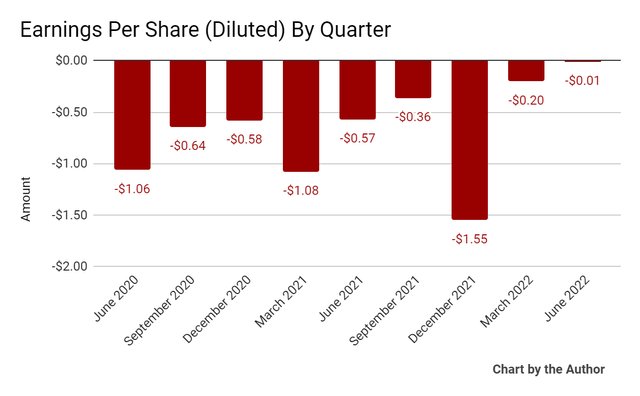

Earnings per share (Diluted) have followed a similar trajectory to that of operating income:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

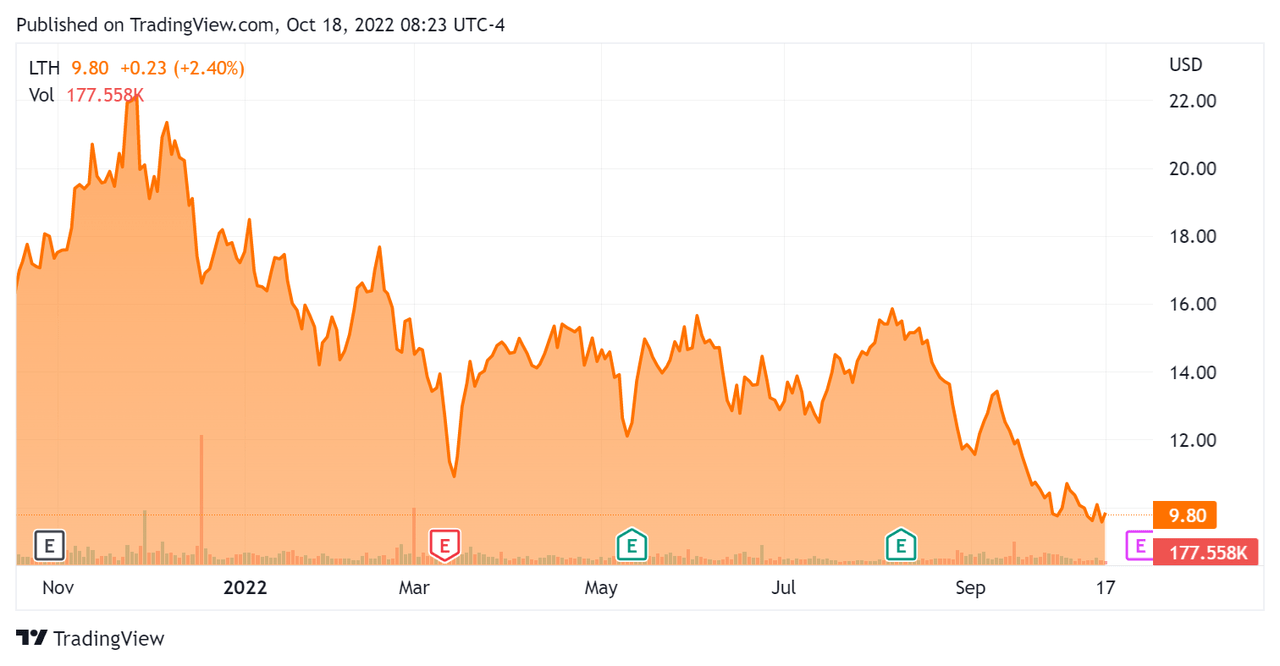

Since its IPO, LTH’s stock price has fallen 40% vs. the U.S. S&P 500 index’s drop of around 18%, as the chart below indicates:

Stock Price Since IPO (Seeking Alpha)

Valuation And Other Metrics For Life Time Group

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.61 |

|

Revenue Growth Rate |

55.0% |

|

Net Income Margin |

-24.4% |

|

GAAP EBITDA % |

-10.0% |

|

Market Capitalization |

$1,860,000,000 |

|

Enterprise Value |

$5,770,000,000 |

|

Operating Cash Flow |

$73,340,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.11 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Xponential Fitness (XPOF); shown below is a comparison of their primary valuation metrics:

|

Metric |

Xponential Fitness |

Life Time Group |

Variance |

|

Enterprise Value / Sales |

3.85 |

3.61 |

-6.2% |

|

Revenue Growth Rate |

69.4% |

55.0% |

-20.8% |

|

Net Income Margin |

1.6% |

-24.4% |

-1607.4% |

|

Operating Cash Flow |

$40,140,000 |

$73,340,000 |

82.7% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Life Time Group

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the firm’s results for U.S. states that emerged from the pandemic earlier than others, which have produced strong growth, ‘already surpassing 2019 monthly dues revenue levels.’

Notably, the firm is also taking advantage of the increased consumer interest in the game of pickleball and has 235 courts with plans to have 450 by year-end and over 600 by the end of 2023.

On the cost-reduction side, management has agreed to sell & leaseback 5 properties to reduce its asset base, raising gross proceeds of $200 million, with ‘discussions underway’ to complete another deal by year-end which would generate another $300 million in gross proceeds.

As to its financial results, total revenue rose 43% year-over-year, while average revenue per center membership grew to $639 from $525 in Q2 2021.

Total operating expenses rose 20.9% excluding share-based compensation and a one-time gain from a sale-leaseback deal.

Center operations expenses grew by 27.3% due to a combination of increased staffing costs and growing usage by members versus the prior year period.

For the balance sheet, the firm ended the quarter with cash and equivalents of $61.3 million and is expecting a total of $500 million in sale-leaseback gross proceeds by the end of the year.

Over the trailing twelve months, free cash used was ($386.3 million) due to capital expenditures of nearly $460 million. Long-term debt was $1.8 billion.

Looking ahead, for full year 2022, management expects total revenue to be around $1.825 billion at the midpoint of the range and adjusted EBITDA of $70 million at the midpoint.

Regarding valuation, the market is valuing LTH at a slightly lower EV/Revenue multiple than XPOF.

A material risk to the company’s outlook is continued labor cost inflation as it hires additional personnel, especially for the summertime periods.

A potential upside catalyst to the stock could include a pause in future interest rate hikes or continued success in shedding its properties in sale-leaseback deals, reducing its debt load in the process.

Life Time Group is a company that may present a slow but steady opportunity as it adjusts its approach to financing its business away from its existing asset-heavy configuration.

While I’m Neutral on LTH in the near-term, the stock is one to put on a watch list for future consideration.

Be the first to comment