deberarr

Investors are going through a painful bear market this year due to a perfect storm, which has been formed by persistently high inflation and the increasing risk of an upcoming recession. During bear markets, some stocks with solid fundamentals are punished along with the weak ones. This is certainly the case for Life Storage (NYSE:LSI). This high-quality REIT has an impressive growth record, with sustained business momentum and ample room for future growth. As it has been punished by the broad market sell-off, it is currently trading around its 52-week lows, at a nearly 10-year low price-to-FFO ratio. As soon as market sentiment improves, the stock is likely to recover strongly from its 52-week lows.

Business overview

Life Storage is a leading owner and operator of self-storage properties, with 1,114 stores in 36 states. It serves both residential and commercial customers and operates in a niche market, which offers the advantages of low capital expenses and rich free cash flows. In contrast to most REITs, which post lackluster free cash flows due to their high capital expenses, Life Storage has posted excessive free cash flows every single year in the last decade.

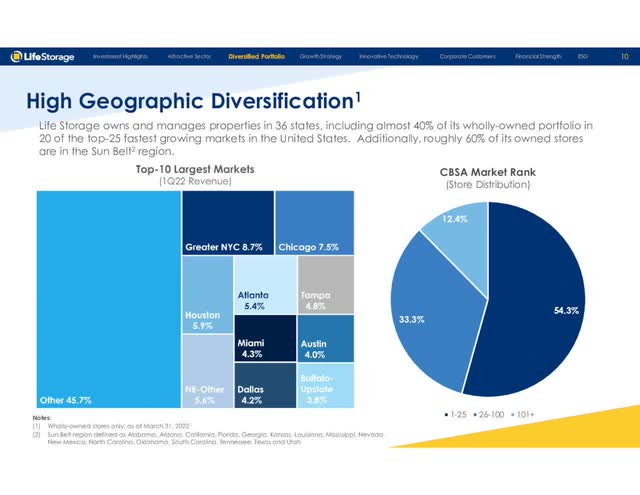

In addition, thanks to its expansion to the West Coast six years ago, Life Storage has a broad geographic diversification.

Life Storage Business Model (Investor Presentation)

Notably almost 40% of the properties of the REIT are located in 20 of the top 25 fastest-growing markets in the U.S. while approximately 60% of its properties are located in the Sun Belt region, which is characterized by superior economic growth.

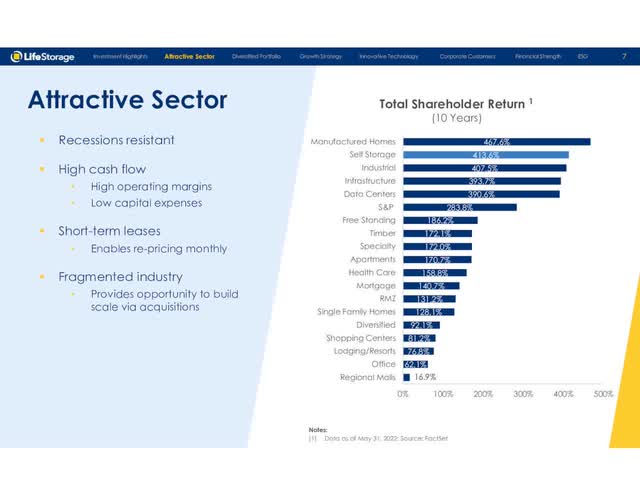

The merits of the niche market of self-storage space are clearly reflected in the impressive returns of self-storage REITs over the last decade.

Total Return of Self-Storage REITs (Investor Presentation)

During the last decade, self-storage REITs have outperformed the S&P 500 by a wide margin, as they have offered a total return of 414%, which is much higher than the 284% total return of the S&P 500.

It is also worth noting that Life Storage seems to have superior pricing power within its niche market. While its peers raised their rent per square foot by 9.0% on average in 2021, Life Storage raised its rent per square foot by 15.7%. The strong pricing power of Life Storage is especially important in the highly inflationary environment prevailing right now.

Thanks to its strong business model, Life Storage has exhibited an admirable performance record. The REIT has grown its funds from operations [FFO] per unit by 10% per year on average over the last decade and over the last five years. More importantly, it has consistently grown its bottom line, with a decline only in one out of the last ten years. The REIT has also proved essentially immune to the coronavirus crisis, as it has posted record FFO per unit in each of the last three years (including this year). This is in sharp contrast to other REITs, which have not recovered from the pandemic yet.

Moreover, Life Storage enjoys relentless business momentum. To be sure, in the second quarter, the REIT grew its revenue by 19% over the prior year’s quarter thanks to an eye-opening 20% increase in rental rates. The trust posted double-digit growth of same-store revenue in 32 of its 33 major markets and thus proved that it is extremely resilient to inflation, as it can pass its increased costs to its tenants.

Thanks to its impressive revenue growth, Life Storage grew its FFO per unit by 37.5%, from $1.20 to $1.65, and thus exceeded the analysts’ estimates by $0.12. It is remarkable that the REIT has not missed the analysts’ consensus for 20 consecutive quarters. Moreover, thanks to its bright outlook, Life Storage has raised its dividend twice this year, once in the first quarter and once in the third quarter, for a total raise of 26%.

Furthermore, in the second quarter, Life Storage raised its guidance for its annual FFO per unit for a second consecutive quarter, from $6.04-$6.14 to $6.27-$6.33. At the mid-point, the new guidance implies 24% growth over the prior year, to a new all-time high. Even better, as management has repeatedly proved conservative in its guidance, Life Storage is expected by analysts to post FFO per unit of $6.37 this year, more than the upper limit of its guidance. Overall, the REIT has proved immune to all the headwinds facing other REITs, namely the pandemic, the surge of inflation to a 40-year high as well as the latest economic slowdown.

Valuation

Due to the 29% decline of its stock price, along with the broad market, Life Storage is currently trading at a nearly 10-year low price-to-FFO ratio of 16.2, which is much lower than the 10-year average of 18.6 of the stock. It is also important to note that the REIT is expected by analysts to continue growing its bottom line meaningfully in the upcoming years. Therefore, the stock is trading at only 14.3 times its expected FFO in 2024.

The cheap valuation of Life Storage has resulted from the ongoing bear market of the S&P 500 and the effect of high inflation on the valuation of stocks, as inflation reduces the present value of future cash flows. However, the Fed has proved that it is determined to restore inflation to its long-term target of 2%, even at the expense of economic growth. Thanks to its aggressive interest rate hikes, the Fed will almost certainly achieve its goal. When inflation begins to subside, the valuation of Life Storage will probably revert towards its historical average and hence the stock is likely to enjoy a significant valuation tailwind.

Dividend

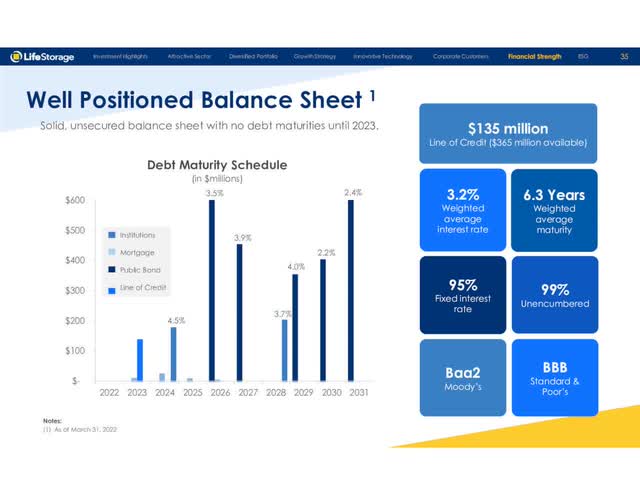

Life Storage is currently offering an above-average dividend yield of 4.2%, with a healthy payout ratio of 58%. In addition, the REIT has a solid balance sheet, with investment credit ratings from S&P (BBB) and Moody’s (Baa2).

Life Storage Balance Sheet (Investor Presentation)

Moreover, Life Storage is well protected from the aggressive interest rate hikes implemented by the Fed, as 95% of its debt is locked at fixed interest rates. Furthermore, its interest expense consumes only 23% of its operating income while its net debt (as per Buffett, net debt = total liabilities – cash – receivables) stands at $3.2 billion. As this amount is only 35% of the market capitalization of the stock and less than 6 times the annual FFO of the REIT, it is undoubtedly manageable. To cut a long story short, Life Storage is offering an above-average dividend yield and can easily continue raising its dividend for many more years.

Risk

The primary risk for Life Storage is the adverse scenario of persistently high inflation for years. Even in such an extreme scenario, the REIT is likely to maintain decent business performance thanks to its ability to raise rental rates significantly year after year. However, in such a case, the valuation of the stock is likely to remain under pressure due to the impact of inflation on the present value of future cash flows. Therefore, the stock is suitable only for the investors who are confident that inflation will begin to subside next year. On the bright side, as the Fed is determined to restore inflation to normal levels, the adverse scenario is unlikely to materialize.

Final thoughts

Bear markets are painful for investors, as they are usually combined with extremely negative market sentiment. However, bear markets are ideal for investors who can tolerate short-term pain and remain focused on the long run. It is during bear markets that investors can purchase shares of solid companies at bargain prices. This rule certainly applies to Life Storage. Those who purchase Life Storage around its 52-week lows are likely to be highly rewarded in the long run thanks to the reliable growth trajectory of this high-quality REIT and its bargain valuation level.

Be the first to comment