JHVEPhoto

What Is The Fundamental Backdrop For Amgen (NASDAQ:AMGN)?

We recently discussed this with our lead fundamental analyst, Lyn Alden.

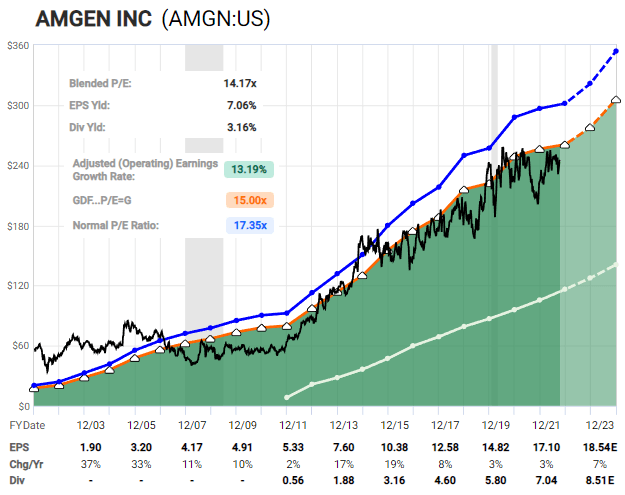

With AMGN, investors get a yield that is (similar) to a 10-year Treasury yield (US10Y), along with a decade of consecutive annual dividend growth that of course a Treasury does not offer.

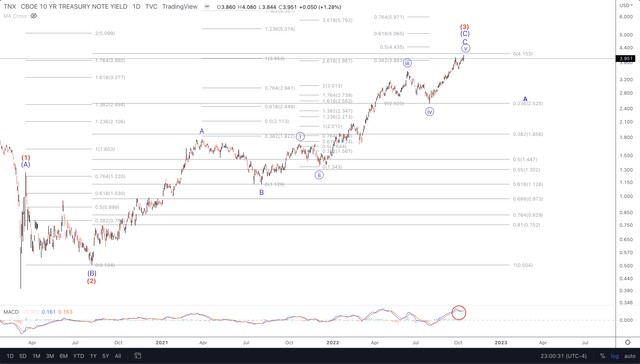

A brief technical look at TNX: the 10-year is in focus as of late. There is some Fib price cluster resistance right here at the 4.00% area. Strongly above there without an immediate reversal points to 5%. Breaking below 3.5% would be the first sign of a reversal of sorts. A typical pullback in this larger structure would target 2.5% initially, the .236 retrace of the larger move up. The possibility is also there for a quick poke above 4% to 4.15%, because that would then align the .236 retrace with the circle wave ‘iv’ low.

Lyn’s comments continue here:

Normally I would say that the equity investor also has to put up with higher volatility in exchange for these better expected returns, but in recent years long-duration Treasuries have had as much volatility as a basket of large cap dividend-growing healthcare stocks.

FastGraphs

What About Healthcare Reform Risk?

Lyn also addresses this question:

One of the biggest background risks for healthcare stocks is the possibility of drug pricing reform, but given the rather split US government that is likely going to get more split in November, I don’t expect any major drug price reform for at least the next 2+ years and probably a lot longer than that. They can potentially pass rather mild reforms.

The Technical Setup

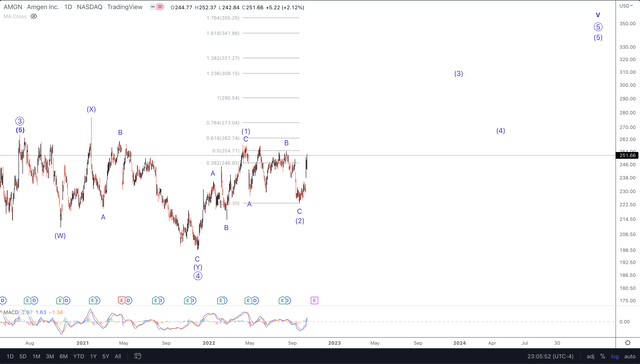

We are viewing AMGN as having completed the initial rally and correction up off the low in December of last year. That key low is our Primary wave 4. Primary wave 5, in time, should target $320 – $355.

Our expectation is that the low at $223 should hold and that the next move up in the third wave will be to the 1.236 to 1.382 extension of this initial rally up.

Why Elliott Wave?

This is a brief excerpt by Avi Gilburt from the Education section on our website:

If you are interested in a methodology which will open your minds and eyes as to how markets really work, then let’s move right into the overview.

Back in the 1930’s, an accountant named Ralph Nelson Elliott identified behavioral patterns within the stock market which represented the larger collective behavioral patterns of society en masse. And, in 1940, Elliott publicly tied the movements of human behavior to the natural law represented through Fibonacci mathematics.

Elliott understood that financial markets provide us with a representation of the overall mood or psychology of the masses. And, he also understood that markets are fractal in nature. That means they are variably self-similar at different degrees of trend.

Most specifically, Elliott theorized that public sentiment and mass psychology move in 5 waves within a primary trend, and 3 waves within a counter-trend. Once a 5 wave move in public sentiment has completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply the natural cycle within the human psyche, and not the operative effect of some form of ‘news’.

This mass form of progression and regression seems to be hard wired deep within the psyche of all living creatures, and that is what we have come to know today as the ‘herding principle’, which gives this theory its ultimate power.

Risks and Conclusion

Should AMGN move back below the $223 low it would have us revise the near term bullish outlook. The $260 – $270 region overhead will be the next resistance area which could also turn the price lower, even to test support at $223.

However, our primary scenario is that $223 is a key and pivotal low and should hold going forward. This setup is currently about $20 above support and potentially has +$65 to +$85 of upside plus the dividend.

With the 10-year Treasury at a possibly an important inflection point and the rising dividends consistently paid by AMGN, we have a favorable view of this into 2023.

STOCK WAVES: Where fundamental analysis meets technical analysis for highest-probability investment opportunities!

“Thus far, the best stock-picking service I’ve seen–and I’ve been doing this for 35+ years! (Gunfighter)

“Stock Waves has produced more gains in the past month(+) than many sites do in years or decades.” (Keto)

“The amount of trades I’ve been able to take resulting in 100%+ returns is nothing short of amazing. If you do not have Stockwaves, you are only doing yourself a disservice.” (dgriff617)

Click here for a FREE TRIAL.

Be the first to comment