Andrey Deryabin/iStock via Getty Images

Li-Cycle Holdings (NYSE:LICY) recently reported lower-than-expected Q3 results with both its revenues and EPS missing estimates. Given the significant fall in prices of Cobalt and Nickel, the company had to book an unfavourable non-cash fair market value (FMV) pricing adjustment of $(7.3) mn relating to unsettled tons from prior-period black mass sales. As a result, the company’s reported revenues were $(2.0) mn which missed the consensus estimates by $12.59 mn. The company’s GAAP loss per share of 16 cents also missed consensus estimates by 4 cents. The company’s adjusted EBITDA loss widened to $31.6 mn in Q3 2022 compared to a $5.3 mn loss in the same quarter prior year driven by higher operating expenses related to growth and expansion of the company’s Hub and Spoke network. Adjusted EBITDA was also unfavourably impacted by the non-cash FMV pricing adjustment which impacted the revenues.

I don’t think Li-Cycle’s quarterly revenues and earnings should matter that much to investors. Li-Cycle is poised to significantly ramp up its revenues over the next couple of years and what really matters is how well the company is progressing with expanding its capacity and positioning itself for the upcoming boom in the market for Lithium recycling over the next few years.

Li-Cycle ended its third quarter with $649 mn in cash and cash equivalents. The company raised investment proceeds of ~$50 mn from LG Chem (OTCPK:LGCLF) and LG Energy Solution, Ltd. and $200 mn in convertible debt from Glencore (OTCPK:GLCNF) (OTCPK:GLNCY) last quarter. This strong cash position gives the company ample liquidity to invest in its current project pipeline.

Company Presentation

Investment by strategic partners like Glencore and LG also indicates validation by leading industry participants on the company’s technology. The company also continues to win battery material commercial contracts with global customers. The Q3 awards included significant energy decommissioning projects from a leading US energy provider and global battery manufacturer. The company was also selected as a global Lithium-ion battery recycler for an emerging electric vehicle OEM.

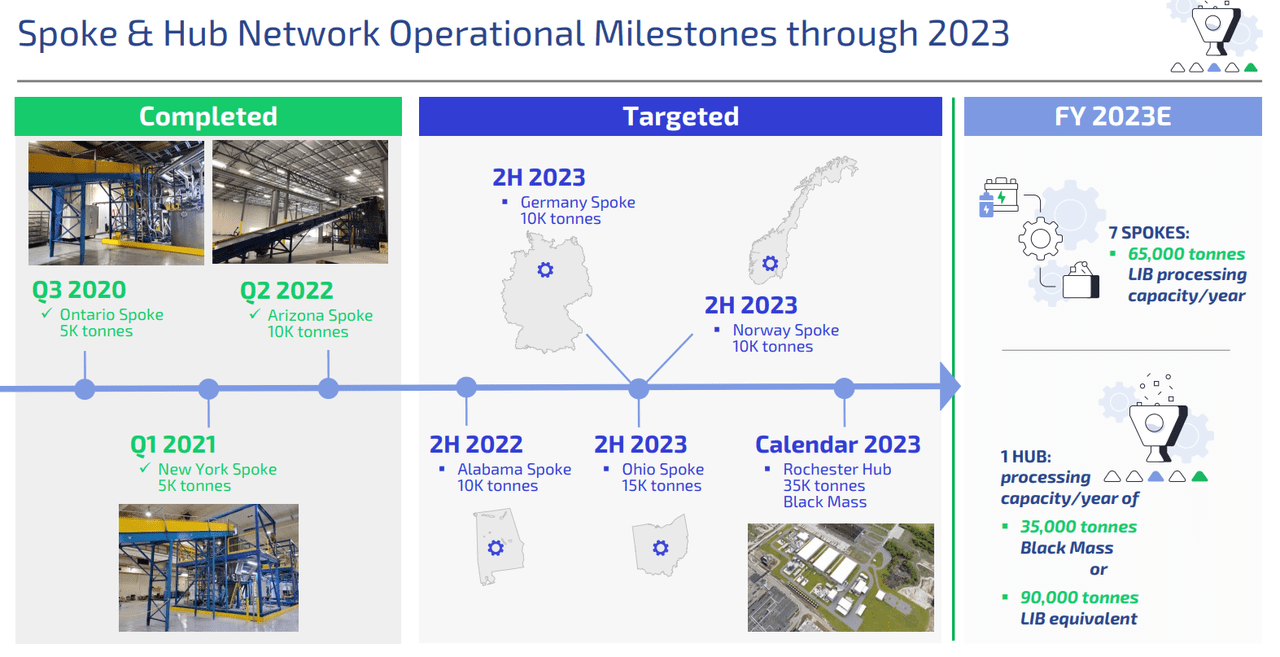

Operationally there were some challenges and a couple of quarters of delay in timing to enable spoke optimization projects at Arizona and Alabama caused the company to reduce its black mass production target to between 3,500 tonnes to 3,800 tonnes versus the previous 6,500 tonnes to 7,500 tonnes. The company’s Arizona and Alabama facilities are the first of their kind to process entire EV battery and Stationary Energy storage battery packs without the need for dismantling. According to management, they temporarily slowed the pace of operations at Arizona spoke and moderately postponed the startup operations at Alabama Spoke in order to make these improvements. This has pushed out the achievement of FY22 production targets by a couple of quarters.

The good news is that since the completion of these optimization projects, Arizona spoke is now nearing target throughput and has been demonstrating higher recovery yield from the black mass. The company intends to leverage the process improvement and key lessons learned from Arizona Spoke for Alabama spoke (planned to start up toward the end of Q4 2022) as well as future spoke locations in Norway and Germany ( anticipated to start in the second half of 2023.)

On the Rochester hub timeline, the company has commenced EPC work and its building work is expected to be completed in early 2023. Final mechanical, piping, electrical and instrumentation works are expected to be completed by early 2024 and management is expecting final commissioning around the same period.

While the stock has corrected post its results as investors didn’t like the delay in Spoke optimizations, such hiccups are not uncommon when we are dealing with a company which is scaling rapidly in a fast-growing market (e.g., Tesla (TSLA) still continues to face similar problems with production ramp up.)

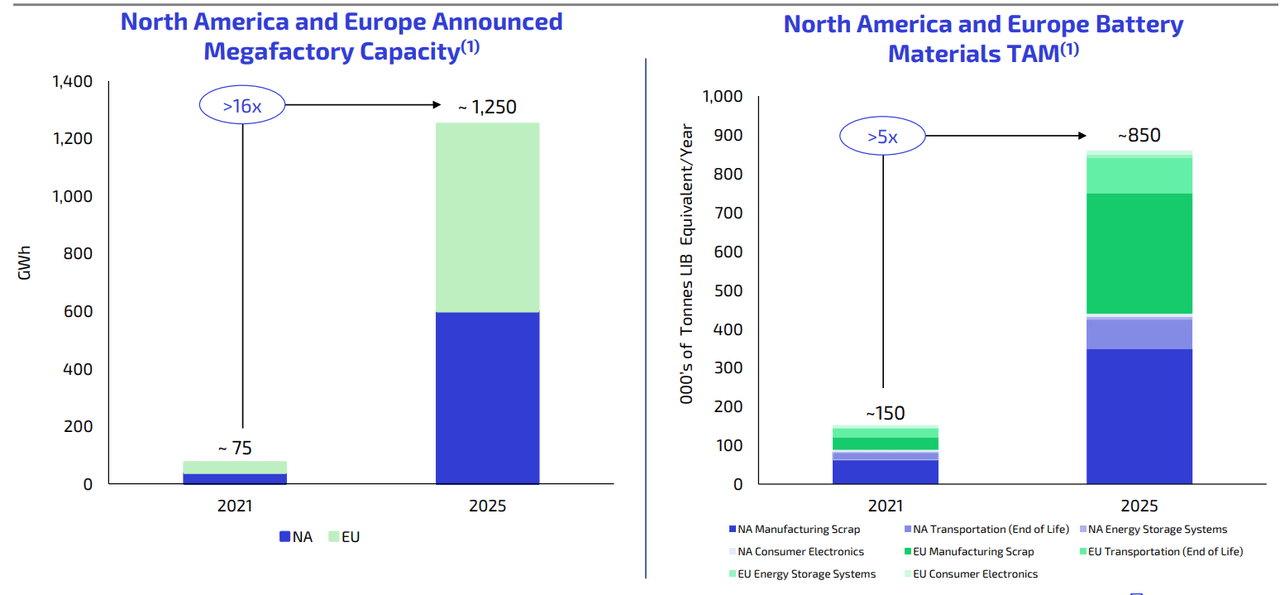

According to consensus estimates, the company’s revenues are expected to scale from $37.93 mn in FY22 to $750.44 mn in FY2025. What matters in such rapid growth cases is if the company’s long-term growth story is on track. That certainly seems to be the case here and the company’s long-term opportunity keeps getting better with its TAM continuing to increase and the government policies continuing to provide support.

Strong Investment Fundamentals Driving Secular Demand Growth (Company Presentation)

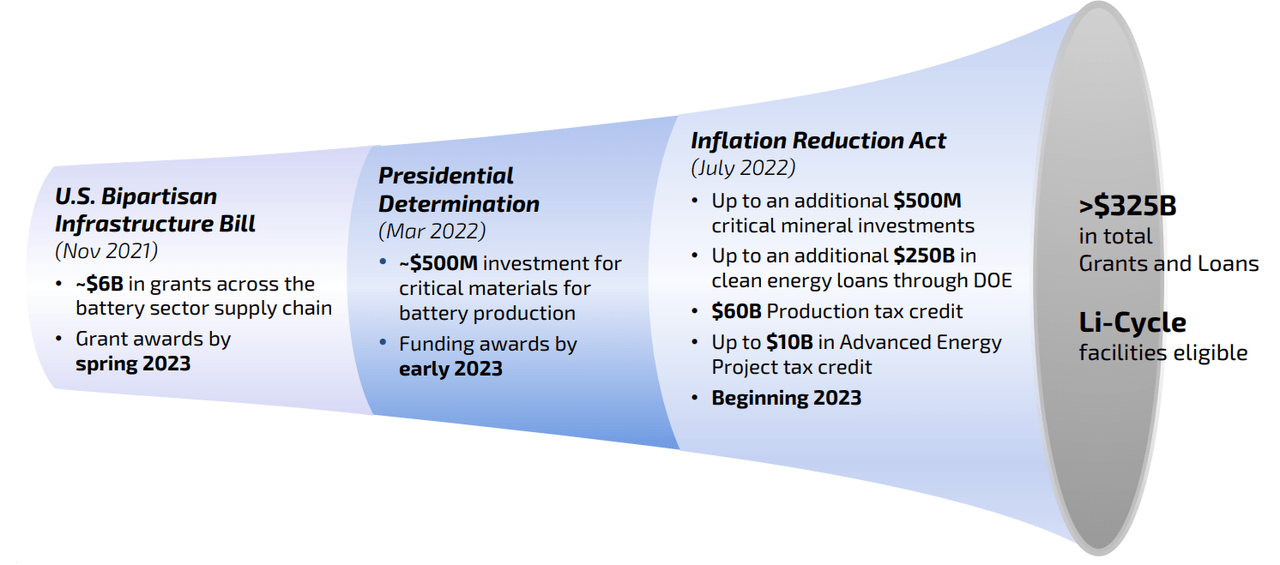

Growing Government Support to Enable Domestic Supply of Critical Battery Materials (Company Presentation)

With most of the major Lithium reserves situated outside of the U.S. and its European allies, it is in the best interest of the government of these countries to encourage Lithium recycling. So, looking forward, I expect a favourable policy environment to continue.

Li-Cycle has a big opportunity ahead of it. While Lithium recycling is somewhat of a commoditized business, the company’s differentiated technology, which provides higher yield and leaves lesser waste, provides it with some advantages. This combined with the backing from strong strategic partners like LG, Glencore, Traxys etc. puts the company in an advantageous position and increases its chances of success. I believe the company’s long-term prospects are intact and investors willing to wait for the company’s operations to scale over the next three to four years may consider taking a position in the stock post recent correction.

Be the first to comment