SimoneN

Investment Thesis

Encore Wire Corporation (NASDAQ:WIRE) has a long runway for growth, given the robust demand in the data center, EV, and green energy sectors. The global data center industry is expected to grow by $615.96B through 2026 at an impressive CAGR of 21.98%, with 35% attributed to the North American market. In addition, the US EV market is expected to grow tremendously from $28.04B in 2021 to $137.4B in 2028 at a CAGR of 25.4%, with the US renewable market projected to grow from 826B kWh generation in 2021 to 1170B kWh in 2027 at a CAGR of 6%.

Combined with WIRE’s elevated inventory levels of $121.42M in FQ2’22, representing an increase of 4.3% QoQ and 38.1% YoY, we expect to see improved sales ahead indeed as demand continues to outstrip supply.

Though there are some concerns about the drastic fall in copper prices thus far, we must also remind investors that current levels still represent notable increases from pre-pandemic levels by over 25%. Thereby, further contributing to WIRE’s improved financial performance over the next few quarters during a bear market condition, if not years, once the macroeconomics improves by 2024, leading to a potential bull run market between 2009 and 2019.

WIRE Is Bound For Success Post Reopening Cadence

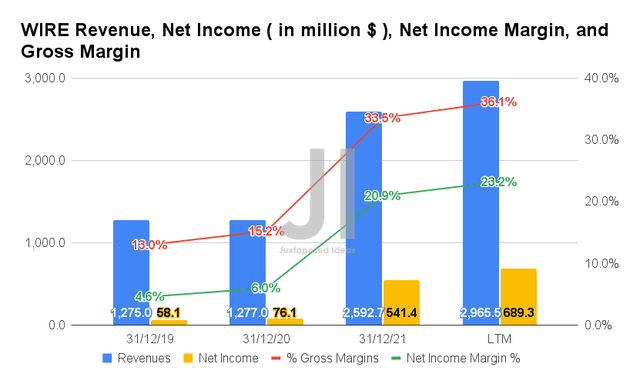

In the last twelve months (LTM), WIRE reported excellent revenues of $2.96B and gross margins of 36.1%, representing YoY growth of 14.2% and 2.6 percentage points, respectively, despite the rising inflation and global supply chain issues. This has directly contributed to its improved profitability, with net incomes of $0.68B and net income margins of 23.2% at the same time, indicating an increase of 25.9% and 2.3 percentage points YoY, respectively.

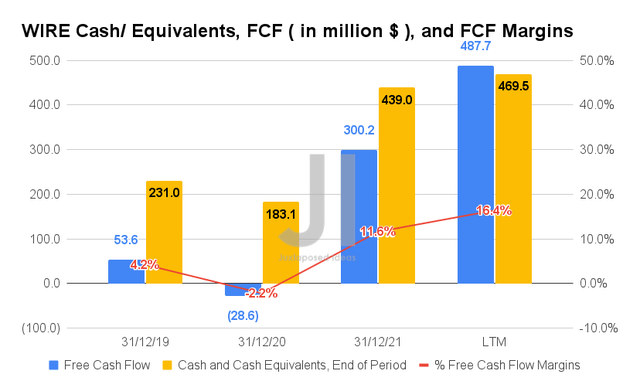

Therefore, we are not surprised by WIRE’s improved Free Cash Flow (“FCF”) generation, with an FCF of $0.48B and an FCF margin of 16.4% in the LTM, representing an excellent increase of 62.4% and 4.8 percentage points YoY, respectively. With further investments in its business and 1.1M of shares repurchased by H1’22, the company continues to report robust cash and equivalents of $0.46B in the latest quarter. Thereby, indicating its massive liquidity ahead, despite the worsening macroeconomics and its zero reliance on debts.

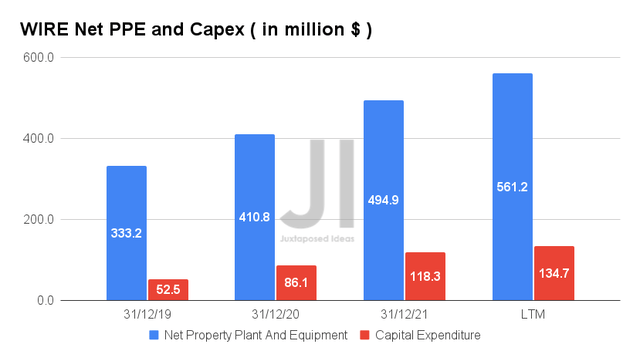

WIRE’s management also took the chance to re-invest into the business, with increased capital expenditures of $134.7M to net PPE assets of $0.56B in the LTM. A total of $170M in Capex is also planned for FY2022 indicating an increase of 43.7% YoY, with another $170M planned in 2023 and $100M in 2024. Thereby, further expanding the company’s production capacity and output, which will prove to be top and bottom lines accretive as copper prices continue to be elevated compared to pre-pandemic levels.

Copper Prices

Trading Economics

On the other side of the world, there are reports of a 26% YoY increase in copper imports for August in China, possibly attributed to the lower prices compared to 2021 highs. However, we are more optimistic, since the country is expected to install a record high of 157 GWs of green energies from wind turbines and solar panels in 2022, representing a notable increase of 25% YoY from last year’s previous record. In addition, a total of 1,200 GW of wind and solar installation in China is planned by the end of the decade. Fun fact, the US government planned 207 GW of solar energy and 73.4 GW of wind energy installation over the next five years.

As a result, given that China is the largest importer of copper, accounting for 60.7% of global needs in 2021, with the first eight months of 2022 already reporting an 8.1% increase YoY, we expect to see current copper prices holding for a little longer. Thereby, contributing to WIRE’s sustained performance ahead.

WIRE’s Fundamental Performance Remains Intact For Now

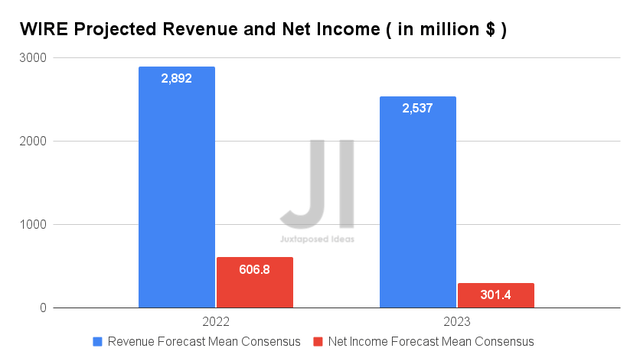

Over the next two years, WIRE is expected to report an adj. revenue and an adj. net income growth at a CAGR of 18.80% and 50.90%, respectively, between FY2019 and FY2023. It is apparent that consensus estimates are very optimistic about its forward execution, given the improvement in its net income margins from 4.6% in FY2019, 20.9% in FY2021, and finally settling at 11.88% by FY2023.

In the meantime, WIRE is expected to report revenues of $2.89B and net incomes of $606.8M in FY2022, representing stellar YoY growth of 11.54% and 12.07%, respectively, despite the tougher YoY comparison. With projected net income margins of 20.98% in FY2022, it is unlikely that we will see a drastic fall in its stock valuations to pre-pandemic levels. For FQ3’22, analysts are projecting revenues of $0.69B and EPS of $6.82, representing a YoY decline of -3.24% and -19.92%, respectively. However, it is important to note that this fall is only attributed to the lower copper prices, instead of the company’s fundamental performance.

The recently lifted solar tariffs, $369B in forward government spending for climate and energy initiatives, and the relaunch of auto tax credits from 2023 onwards will also boost consumer demand ahead for the US market. Combined with the elevated oil/gas prices due to the worsening geopolitical scene and the upcoming winter, we expect to see WIRE report excellent growth ahead indeed.

So, Is WIRE Stock A Buy, Sell, or Hold?

WIRE 5Y EV/Revenue and P/E Valuations

WIRE is currently trading at an EV/NTM Revenue of 0.70x and NTM P/E of 5.61x, relatively in line with its 5Y EV/Revenue mean of 0.75x though down from its 5Y elevated P/E mean of 15.27x. The stock is also trading at $118.85, down -21.6% from its 52 weeks high of $151.65, though at a premium of 44.9% from its 52 weeks low of $82.

WIRE 5Y Stock Price

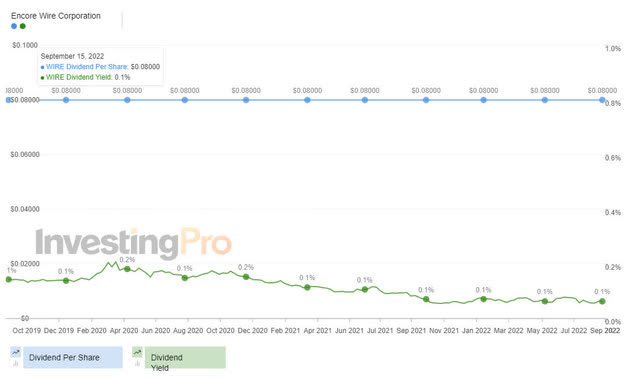

WIRE Dividend Payout & Yield

In the meantime, investors looking for attractive dividend payouts should look elsewhere, since the WIRE management has stuck to its previous quarterly dividend payouts of $0.02 over the past two years, despite the massive growth in its profitability. However, we are less concerned, since the stock will likely be an outperformer over the next decade, as the world continues to race ahead in its digital transformation post-reopening cadence.

Consensus estimates also remain bullish about WIRE’s prospects, given their price target of $190.00 and a 59.87% upside from current prices. Therefore, those that have missed the recent July bottom may choose to add more at the next dip around $100s, speculatively around early October 2022. The stock will continue to decline moderately over the next two weeks, since the August 2022 CPI of 8.3% is likely to trigger a 75 basis point hike in the Fed’s upcoming meeting on 20 September. That would lead to an increasingly pessimistic stock market, with the S&P 500 Index already falling by -17.73% from the start of the year to the time of writing.

Be the first to comment