ChamilleWhite/iStock via Getty Images

Introduction

Blue jeans- everyone has a pair that have been in their drawer for a decade. And they’re probably made by Levi Strauss (NYSE:LEVI), the company named after the inventor of this garment. While the business is based on jeans and denim clothing, it has branched out in casual & sport/comfort wear, with brands such as Dockers & Beyond Yoga. As the inventing company of such a famous garment, Levi Strauss has a steady stream of revenues. The company has bounced back from the pandemic fast attesting to product demand. Over the years, margins and profits have increased, while the company maintained a tight balance sheet. The business is very stable, but at 17x earnings is probably slightly overvalued, and doesn’t have a great dividend history to boot.

Financial History

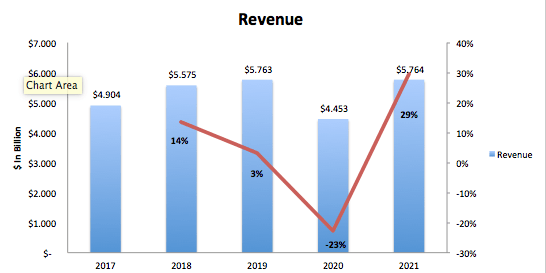

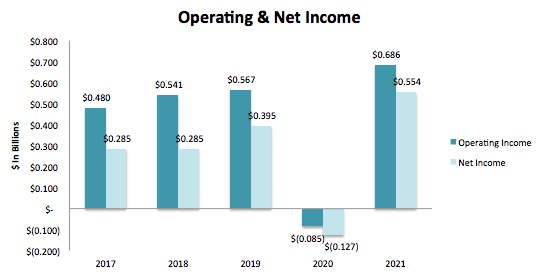

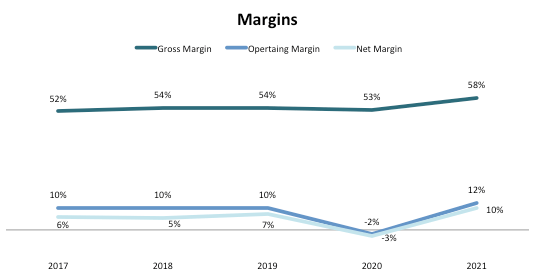

Levi Strauss Revenue (SEC.gov) Levi Strauss Operating & Net Income (SEC.gov) Levi Strauss Margins (SEC.gov)

As can be seen above, Levi Strauss has seen very steady low single-digit top-line growth except for the height of the pandemic in 2020. Revenue has grown at a CAGR (excluding 2020) of 4.12%. This very steady growth rate and the fact that after 2020 the company completely bounced back shows the strong underlying demand for Levi Strauss products. Looking at operating and net income shows the same trend. Operating income has grown at a rate of 9.34%, while net income has grown by 18.08% (again excluding 2020). This bottom line growth can be attributed both to increasing sales and expanding margins. The gross margin has increased by 6% over the last five years helping to operating, and net margins increase. This shows that Levi Strauss has been able to control costs well too.

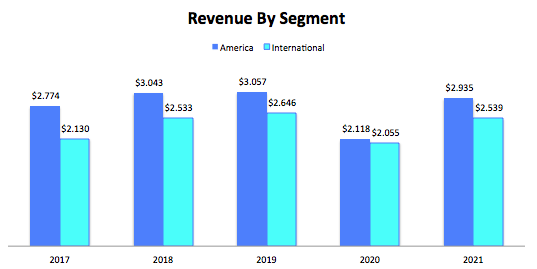

Levi Strauss Revenue By Segment (SEC.gov)

Diving deeper into the segments shows the company has steady domestic operations and a growing international business. While the America sales are a bit skewed in 2020 and 2021 due to the reporting break-off of the Beyond Yoga brand, the numbers show that $3 billion in domestic sales can be relied on year to year. On the other hand, International revenues have grown by about 20% since 2017. Most of this growth comes from Europe, where sales grew by 5.37% per year. Overall, the past financial history shows Levi Strauss is a very stable business with great underlying demand.

2022

Over the past six months of 2022, the company has continued to see good growth. Revenue has grown by about 19% year-to-year, powered by 22% growth domestically and 10% internationally. Also to note is Other revenue grew by 73%, showing the reporting break of Beyond Yoga has helped the company focus on enhancing the brand. This growth has translated down the P&L. Gross margin was steady at 57%, operating income has grown 9%, and net income is up 18%. These results show a healthy business and should post growth this fiscal year.

Balance Sheet

As of the most recent quarter, Levi Strauss has a good looking balance sheet with proper liquidity and leverage. The company has current and quick ratios of 1.53x and 0.88x, which is good liquidity for a retail business. The business’ leverage is also low and manageable at 2.32x. This balance sheet, paired with the consistent income statement, shows just how stable Levi Strauss is.

Valuation

As of writing, Levi Strauss trades around the $17 range. At this price level, the company has a P/E of 12.59x and a P/BV of 3.99x. The company also offers a dividend yield of 2.14%. Taken altogether, I think the company is slightly overvalued, but if the market trends keep pushing this stock down, it could be a buy.

Conclusion

Levi Strauss is a consistent, well-run business. Blue jean demand from the world famous Levi Strauss & Co. will always be high. But at the current valuation and dividend history, I wouldn’t be a buyer of this stock. With such a slow-growing company, I want either a large margin of safety or a consistent dividend. At 17x earnings, the discount isn’t there, and with only three years of dividends, the history isn’t established.

Be the first to comment