ferrantraite

A Quick Take On Lemeng Holdings Limited

Lemeng Holdings Limited (LIAI) has filed to raise an undisclosed amount in an IPO of its Class B shares, according to an F-1 registration statement.

The firm operates a demand-side programmatic digital advertising platform in China.

Topline revenue growth is slowing, and the firm is generating higher losses and cash use.

I’ll provide a final opinion when we learn more IPO details from management.

Lemeng Overview

Beijing, China-based Lemeng Holdings Limited was founded to provide mobile app advertising to app developers and brand advertisers in China via its demand-side platform.

Management is headed by Founder, Chairman and CEO, Baohua Feng, who has been with the firm since inception in September 2014 and was previously General Manager at Beijing Fenghua Herui Technology Co. and prior to that in senior roles at other technology-oriented companies.

-

The company’s primary offerings include:

-

Programmatic advertising

-

Agency vertical media resources

-

Data management

-

Tencent/Baidu cooperation

As of June 30, 2022, Lemeng has booked fair market value investment of $7.6 million as of June 30, 2022 from investors including Baohua Feng, Lemeng Bros., HB Global and Longwin Lightenbright Investment Management Co.

Lemeng – Customer Acquisition

The company focuses its marketing efforts in the industries of mobile apps, banks, telecom companies and game advertising support.

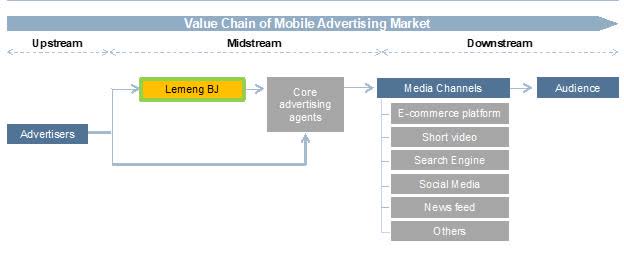

The chart below shows how management views the company’s position in the mobile advertising market:

Company Market Position (SEC Filing)

Selling expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

|

Selling |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

0.8% |

|

2021 |

0.6% |

|

2020 |

0.6% |

(Source – SEC)

The selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of selling spend, dropped to 10.0x in the most recent reporting period, as shown in the table below:

|

Selling |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2022 |

10.0 |

|

2021 |

42.6 |

(Source – SEC)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

LIAI’s most recent calculation was 17% as of June 30, 2022, so the firm is in need of improvement in this regard, per the table below:

|

Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

8% |

|

EBITDA % |

9% |

|

Total |

17% |

(Source – SEC)

Lemeng’s Market & Competition

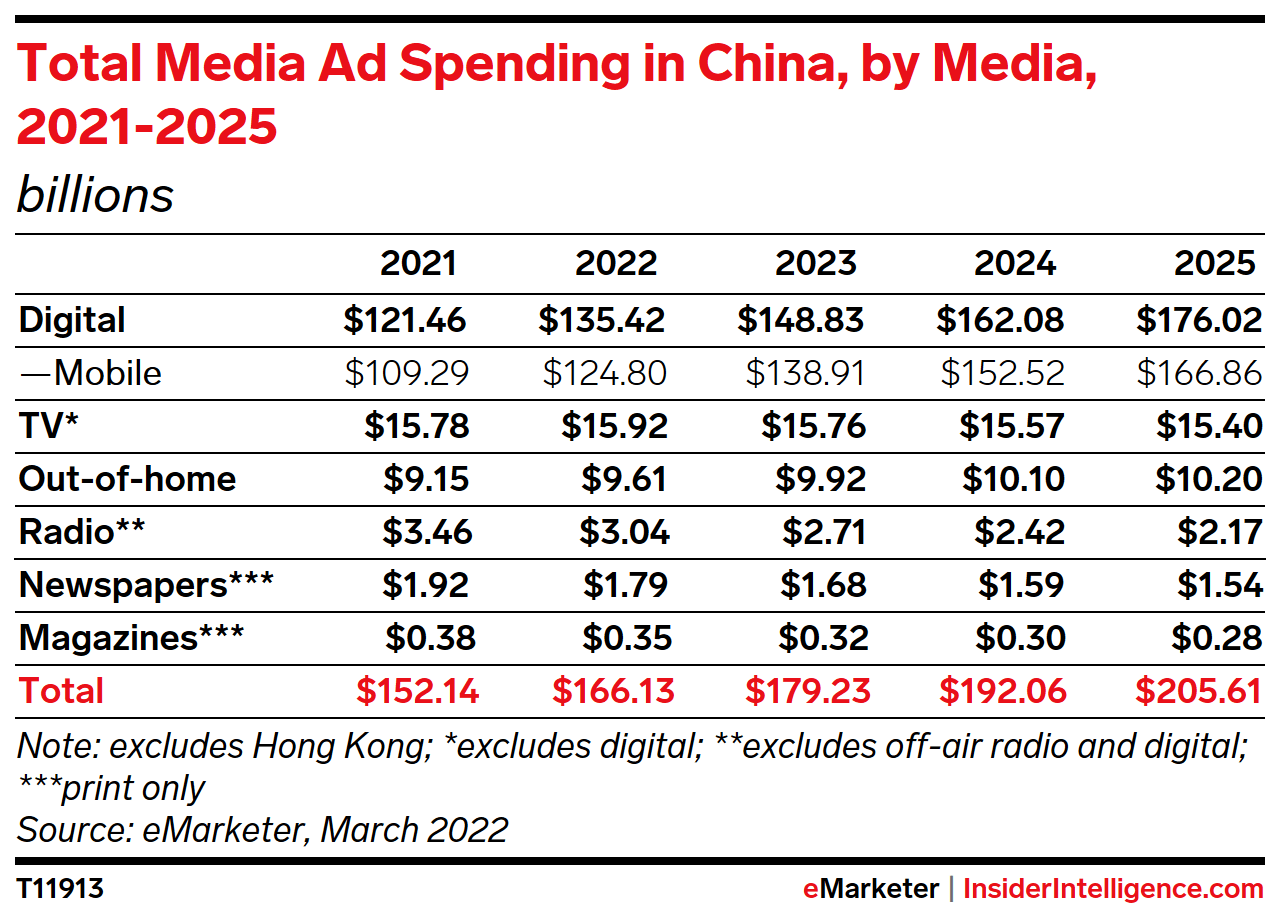

According to a 2022 market research report by eMarketer, the Chinese advertising industry was an estimated $152 billion in 2021 and is forecast to reach $206 billion by 2025.

Digital media ad spending is expected to grow in 2022 by 11.5%, its lowest growth rate since the start of tracking the metric.

The main drivers for this expected growth are a drop in traditional channel usage and growth in digital channel advertising by most companies.

Also, the chart below shows the historical and projected future growth trajectory of various elements of the Chinese media advertising market:

Chinese Media Ad Spending (eMarketer)

Lemeng Holdings’ Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue, but at a decelerating rate

-

Decreasing gross profit and gross margin

-

Reduced operating profit and margin

-

Increasing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$37,911,560 |

8.2% |

|

2021 |

$82,584,146 |

31.5% |

|

2020 |

$62,803,063 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$4,058,758 |

-11.1% |

|

2021 |

$10,532,191 |

19.3% |

|

2020 |

$8,825,601 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2022 |

10.71% |

|

|

2021 |

12.75% |

|

|

2020 |

14.05% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2022 |

$3,245,480 |

8.6% |

|

2021 |

$6,556,811 |

7.9% |

|

2020 |

$7,194,836 |

11.5% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$1,511,864 |

4.0% |

|

2021 |

$7,327,812 |

19.3% |

|

2020 |

$6,626,203 |

17.5% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$(1,352,528) |

|

|

2021 |

$(1,926,960) |

|

|

2020 |

$(1,385,579) |

|

(Source – SEC)

As of June 30, 2022, Lemeng had $238,918 in cash and $12.3 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022 was negative ($2.1 million).

Lemeng Holdings Limited’s IPO Details

Lemeng intends to raise an undisclosed amount in gross proceeds from an IPO of its Class B shares.

Class B shareholders will receive one vote per share, and Class A shareholders will be entitled to 20 votes per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

We currently anticipate using approximately 50% of the gross proceeds from this offering for working capital and general corporate purposes, including product development, sales and marketing activities, expansion of existing and future market. In addition, we may also use 30% of the net proceeds to acquire or invest in technologies, solutions or businesses that complement our business; however, as of the date of this prospectus we have not identified any acquisition targets and are not engaged in any related negotiations. We intend to use the remaining net proceeds to repay short-term financings and long-term debt. If the underwriters exercise their overallotment option, we anticipate using all of such proceeds for working capital and general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said it was not aware of any legal actions against the company as of June 30, 2022.

The sole listed bookrunner of the IPO is The Benchmark Company.

Commentary About Lemeng’s IPO

LIAI is seeking U.S. public capital market investment for its general corporate expansion plans and potential acquisitions.

The firm’s financials have shown increasing topline revenue but at a decelerating rate, reduced gross profit and gross margin, lowered operating profit and margin, and higher cash used in operations.

Free cash flow for the twelve months ended June 30, 2022 was negative ($2.1 million).

Selling expenses as a percentage of total revenue have risen as revenue has increased; its selling efficiency multiple dropped to 10.0x in the most recent reporting period.

The firm currently plans to pay no dividends and to reinvest any future earnings back into the company’s growth plans.

There are restrictions on the payment of dividends under Cayman Islands law.

The company’s Rule of 40 results have been disappointing and in need of substantial improvement.

The market opportunity for digital advertising in China is large and expected to grow materially through 2025.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

Management says the firm’s auditor (Friedman LLP) books are subject to PCAOB audits, so the company is presently at risk of potential future delisting under the HFCA.

Additionally, post-IPO communications from managements of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a very different approach to keeping shareholders up-to-date about management’s priorities.

The Benchmark Company is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of 40.2% since their IPO. This is an upper-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook as a public company is the uncertain nature of Chinese regulatory pronouncements and the new government’s generally less business-friendly activities.

When we learn more information about the IPO, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment