gguy44

Introduction

I first covered Leggett & Platt (NYSE:LEG), a manufacturer of bedding, furniture, flooring and textiles, as well as specialty products for the automotive and aerospace industries, in early February 2022, after noting that the stock had nearly completed its round-trip from exuberant 2021 highs. In mid-March, I published a follow-up article focused on the company’s long-term performance since before the dot-com bubble.

As an internationally diversified manufacturer of primarily discretionary products, the company has faced a number of headwinds since the outbreak of the pandemic in early 2020. Leggett & Platt reported its second-quarter results in late August and lowered its full-year revenue and earnings per share (EPS) forecasts (midpoint -2.8% and -6.4%, respectively). In the conference call, management shared several key insights that help understand the company’s positioning in this challenging environment. In this article, I will discuss Leggett & Platt’s recent performance, potential implications for my investment thesis, and my expectations as a long-term oriented shareholder.

Supply Chain Headwinds, A Difficult Labor Market, And Deteriorating Consumer Sentiment

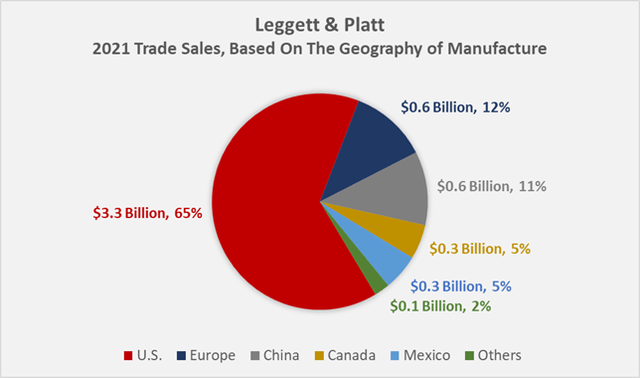

Most companies still face supply chain headwinds due to extensive outsourcing, just-in-time manufacturing and other efficiency measures introduced in recent decades. However, Leggett & Platt still manufactures predominantly in the U.S. (Figure 1). As a result, supply chain issues have been and continue to be far less noticeable than might otherwise be expected.

Price inflation for raw materials (resin and other oil derivatives) is more of a concern, as are increased transportation costs. However, the company’s steel rod business serves as an important counterbalance to increased raw material costs and is understandably thriving in this environment at present. Much of Leggett’s steel-based business is contractual, but margins – which have increased recently – are naturally beginning to normalize as the price of steel softens. At the same time, input costs in Leggett’s Bedding Products segment are also beginning to normalize as the cost of energy appears to stabilize and the company has implemented several cost reduction programs.

Last quarter’s results were impacted by operational issues at one of Leggett’s U.S. facilities, which appear to have been largely resolved in recent months.

Overall, I would not overstate input cost inflation, although Leggett’s relatively low gross margin (20% on average since 1999) suggests that the company is at a competitive disadvantage. Strong sales growth against the backdrop of a high single-digit rate of inflation suggests that the company does indeed have good pricing power. After all, Leggett & Platt is the leader in most markets and has to fend off only few large competitors (p. 3, August 2022 company update).

Figure 1: Leggett & Platt’s geographical production footprint (own work, based on p. 90 of the company’s 2021 10-K)

In addition to input cost inflation, the company’s current performance is primarily impacted by secondary effects in the supply chain from Leggett’s raw material suppliers and OEM customers who are unable to ramp up production to normal levels due to incomplete parts inventories or lack of labor availability. Of course, the difficult labor market is also a problem for Leggett & Platt, but CEO Dolloff noted in a response to an analyst’s question that the company’s spending on excess labor costs is declining (p. 8, Q2 2022 earnings call transcript).

As a vertically integrated manufacturer of bedding products (48% of estimated 2022 net retail sales, p. 4, August 2022 company update), it is hardly surprising that management is confident in the stability of its supply chain and well-protected against future disruptions. This enables the company to increase its market share in difficult times, when competitors with an emphasis on out-sourced manufacturing scramble to establish redundancies in what is looking to become an increasingly deglobalized world.

Striking a less optimistic tone, it is important to remember that Leggett’s business is dependent on the housing market. Leggett’s management has cited a weakening housing market as the primary reason for the somewhat uninspiring recent performance of its Furniture, Flooring & Textile Products and Bedding Products segments. Since I own both Leggett & Platt and The Home Depot (HD) – which I recently discussed – I can see my portfolio taking a double hit in this regard. However, in the spirit of full disclosure, I want to emphasize that I still only own a very small position in HD and consider my portfolio to be well diversified.

Leggett & Platt’s Specialized Products segment, with its focus on the automotive and aerospace industries, is understandably particularly affected by the secondary effects mentioned above, and the recovery from the pandemic is far from complete. The industry forecast for global automotive production has stabilized since April, and demand for fabricated duct assemblies has returned to pre-pandemic levels, but significant growth is lacking. Management has been very open in its communication and continues to expect a normalization to 2019 demand levels by 2024. Aircraft backlogs are near their peak, but management also saw year-over-year volume growth. The U.S. forklift end market – and therefore Leggett’s hydraulic cylinder business – also remains strong, and the market is currently looking at a 22-month backlog.

However, it should not be forgotten that several economic indicators continue to trend negatively, such as the Purchasing Managers index, Moody’s business confidence indicator, and the Baltic Dry index, which of course must be viewed in a nuanced manner as it also signals deflation in commodity prices. For this reason, and given the consensus that the U.S. (or most likely the entire world) is headed for a recession, management’s current forecasts are subject to some uncertainty, but the continued strength of the recovery of Leggett’s industrial segments – as opposed to its consumer-facing business units – leaves a generally positive impression. For the full year, management expects volume growth in the Specialty Products segment to be in the low double-digit range.

Consumers appear to be increasingly focusing their spending on services and other areas, to the detriment of durable goods manufacturers like Leggett & Platt. Tyson Hagale, president of the Bedding Products segment, noted that the company has seen signs of a slowdown since late last year, first in the low-price segment and later and to a lesser extent in the mid- and high-price segments (p. 10, Q2 2022 earnings call transcript). For the full year, management expects a low double-digit volume decline in the segment. Consumer price inflation has also put pressure on the low-price segment of the Home Furniture group, while the mid- and high-price segments remain strong, but this is mainly related to the high backlogs the company is currently working through. Leggett’s CEO remains optimistic, however, and expects at least stabilization at a reasonable level when inflation eventually stabilizes and moderates.

Finally, the currency-related headwind from the strong U.S. dollar is also reflected in the sales figures for the quarter and the half-year and, in addition to the lower sales volumes (as described above), is another reason for the guidance revision.

Leggett & Platt’s Shareholder Returns, Free Cash Flow Management, And Leverage

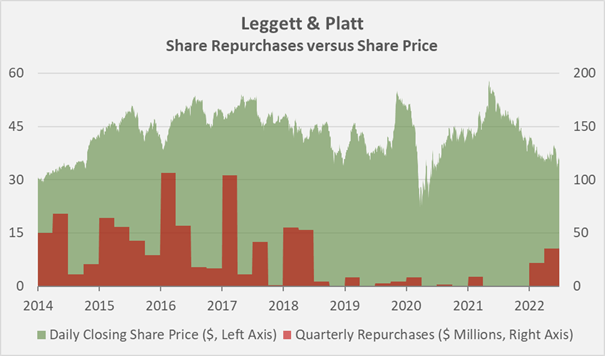

On August 9, 2022, Leggett & Platt announced its 51st consecutive annual dividend increase – up 4.8% to $0.44 per share. This is a very respectable track record for a cyclical company. The company also engaged in share repurchases, retiring one million shares during the quarter (i.e., 0.75% of shares outstanding at the end of Q2 2022). Year-to-date, Leggett has retired 1.6 million shares for $57 million, an average price of $35.6 per share. Management acted opportunistically, as evidenced by the more aggressive buybacks in the second quarter, and for the most part refrained from buying back shares at high valuations in 2021 (Figure 2) – as was the case with several other companies, such as The Home Depot ($14.8 billion) and Lowe’s (LOW, $13.0 billion).

Figure 2: Leggett & Platt’s share repurchases each quarter since Q1 2014, compared to LEG’s share price (own work, based on the data found in the company’s quarterly and annual cash flow statements, and the daily closing price of LEG)

The decision to opportunistically buy back shares and the continued emphasis on a growing dividend are a strong sign of management’s confidence in the company’s future. Of course, wary investors might view the emphasis on shareholder returns as irresponsible in the context of a potentially severe downturn. However, management was also very confident when confronted with the question of how Leggett would proceed in a sharply deteriorating economy (p. 10 f., Q2 2022 earnings call transcript). Moreover, the company has exited the pandemic in remarkably good shape. In my first article, I pointed out that Leggett’s strong resilience and excellent management were the main pillars of my investment thesis. In the Q2 2022 Q&A session, management pointed out that the unique situation in early 2020 has resulted in improved capabilities that will help the company more easily navigate difficult situations in the future.

Leggett & Platt’s management is well versed in improving the business internally, as the cyclical nature of the business does not typically lead to significant long-term sales growth. Cash flow growth has therefore had to come from supply chain and manufacturing optimizations, as well as improved working capital efficiency (p. 13, August 2022 company update) and cost reductions. Leggett was able to achieve $90 million in permanent cost savings in 2020, for example, which put the company in an increasingly comfortable position. However, if the company does face a severe recession, the CEO still sees room for more radical cost cutting. In addition to the levers already mentioned, the vertical integration of the beddings products business should also be seen as an important step towards strengthening Leggett’s operations in the long term. The acquisition of Elite Comfort Solutions (ECS) in 2019 was certainly a bold move ($1.25 billion), but marked a final major step in that direction, and the more recent acquisition of Kayfoam in the second quarter of 2021 helped expand Leggett’s footprint.

In the context of working capital accounts, Leggett’s management definitely stands by its words. Working capital has normalized significantly following atypical destocking and restocking in 2020 and 2021, respectively. Since the fourth quarter of 2021, the company has adjusted its inventory levels in line with the aforementioned slowdown in bedding sales. Management believes the company is very well positioned to respond quickly to future changes in consumer demand, whether up or down, and currently expects operating cash flow of $550 million to $600 million and capital expenditures of $130 million for the full year. Thus, free cash flow is in line with the expectations I discussed in my second article on the company, resulting in a very acceptable interest coverage ratio (based on pre-interest free cash flow, which as a proxy excludes a beneficial tax shield effect). For 2022, management expects net interest expense of $80 million and dividend payments of $230 million, which also puts the company in a comfortable position from a payout ratio perspective.

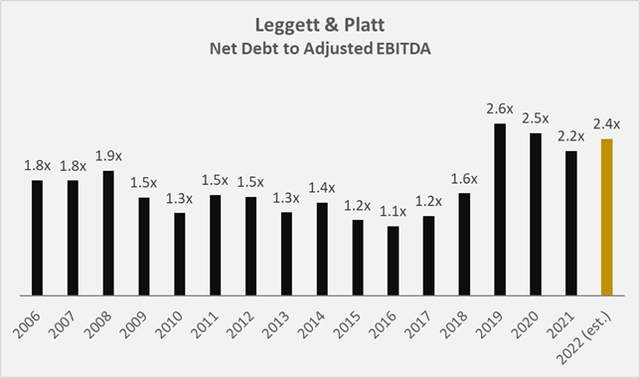

Finally, in terms of debt, management has acted in a very disciplined manner in the past, also in order not to violate the covenants related to its credit facility. The bold acquisition of ECS in 2019 was well digested, and the company focused on deleveraging and largely refrained from buying back shares until recently. This is exactly the behavior a long-term investor focused on capital preservation would like to see.

The leverage covenant associated with the company’s revolving credit facility ($1.2 billion, maturing in September 2026, currently undrawn, p. 39, 2022 10-Q2) was changed from gross debt to net debt in May 2020 and again in September 2021 from a metric perspective to 3.5 times net debt to EBITDA from 2.5 times previously (p. 94, 2021 10-K), leaving more room for short-term liquidity needs. However, the changes should not be seen as a sign of desperation and a tight liquidity situation, given Leggett’s current and historical leverage levels (Figure 3) and the investment grade credit rating.

Figure 3: Leggett & Platt’s historical net debt to EBITDA, adjusted for goodwill impairment charges (own work, based on the company’s 2007 to 2021 10-Ks, the second quarter 2022 8-K and most recent full-year guidance)

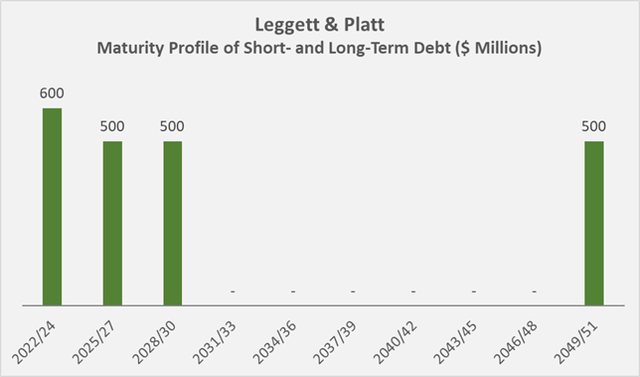

Management also took a very forward-looking approach to long-term debt at the end of 2021 when it refinanced its 3.4% senior notes with $500 million of 3.5% notes due in 2051. As a result, the company’s current maturity profile appears very manageable (Figure 4, weighted-average interest rate of 3.74%). In hindsight, the refinancing at essentially the same interest rate was an excellent deal, especially given the maturity of the bonds and compared, for example, to the recent debt refinancing of consumer products company Newell Brands (NWL), which I have reported on several times in the past. The company refinanced its 3.85% notes at interest rates of 6.375% ($500 million, due 2027) and 6.625% ($500 million, due 2029), understandably putting more pressure on the company’s free cash flow and making thoughts of a dividend increase a distant prospect.

Figure 4: Leggett & Platt’s nominal debt maturity profile at the end of 2021 (own work, based on the company’s 2021 10-K)

Conclusion And Future Expectations

LEG is a stock for patient investors and buying requires good timing. Some may argue that market timing is impossible – and for the most part I agree – but cyclical companies should not be bought during times of economic expansion and/or general optimism.

Leggett’s stock price reflects the current expectation of at least a mild recession quite well, in my opinion, and I consider the stock a solid investment in the mid-$30 range. Management continues to demonstrate its foresight and disciplined approach to capital allocation. The COVID-19 pandemic can be viewed as an acid test that the company has passed with flying colors. It also continues to weather the recent more inflationary environment and other headwinds well, and I do not expect this to change in the long term.

Of course, earnings for a manufacturer of discretionary and durable products will decline in the event of an economic downturn, but the company has the operational and financial resources to handle such a situation. The management team is well versed in dealing with difficult environments, and the fact that the company remains a dividend king despite its cyclicality is also reassuring.

I own a small position in the company in my own portfolio and buy shares here and there in the current price range. I see no reason for a dividend cut, even in the event of a more severe downturn for the reasons stated in the main body of the article. I view LEG as an income-generating vehicle that can keep up with inflation in the long-run, while I do not expect it to be a high-flyer in terms of total return.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment