AlexSecret/iStock via Getty Images

Many investors will become bearish on a stock when many headwinds are already baked into a stock. Although it is hard to do, it’s important to separate one’s sentiment around a company from the valuation of its stock. This is especially important when it comes to cyclical companies, and successful investors are able to apply “second level” thinking when it comes to spotting long-term value.

This brings me to Leggett & Platt (NYSE:LEG), which is a Dividend King that operates in a boring and cyclical industry, and has weathered through multiple economic cycles.

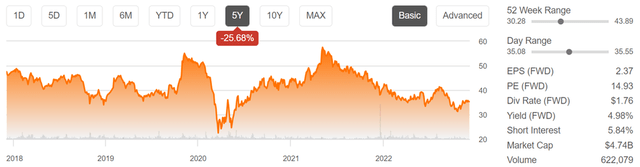

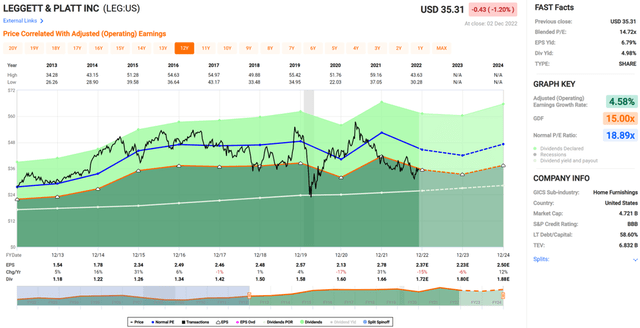

LEG is currently trading in the bottom half of its 52-week price range, and near the bottom of its 5-year range, with investors willing to pay as much as $57 for the stock in 2021. This article highlights why now may be an opportune time to layer into LEG for potentially strong income and returns.

Why LEG?

Leggett & Platt is one of the oldest companies in America, having been in business for well over a century. It’s best known for manufacturing bedding products, including mattress springs and specialty foam, as well as adjustable beds, bedding machinery, steel rods, and drawn wire. LEG also manufactures furniture and flooring products as well as seating and comfort systems for the automotive industry, and specialty products for aerospace clients.

Given the cyclical nature of LEG’s business, it’s no surprise that it’s seeing some challenges during the current economic headwinds beset by high inflation. This is reflected by LEG’s third quarter (ended in October) sales being down by 1% YoY on a currency neutral basis to $1.3 billion.

This was a result of an 8% price increase that was largely offset by volume declining by the same amount, as LEG saw demand softness in residential end markets due to the housing slowdown brought upon by significantly higher mortgage rates over the past year. While revenue was relatively flat, commodity price inflation hampered margins, resulting in EPS declining by 27% YoY.

Notwithstanding a near term challenging demand environment in the consumer business, LEG is seeing slivers of opportunity as automotive production forecasts remain dynamic, with current industry forecast for global production growth of 5% this year.

Demand is also improving on the aerospace side, and LEG is positioned to benefit from tailwinds from the U.S. Infrastructure Bill, as end-marked demand in hydraulic cylinders is strong with backlogs in heavy construction equipment market remaining at elevated levels. This signals LEG’s expansion into this burgeoning industry, supported by LEG’s recent acquisitions, as noted during the recent conference call:

We completed 2 acquisitions in August and 1 in October. In late August, we acquired Pacoma Hydraulic Technology, a leading global manufacturer of hydraulic cylinders, primarily for the heavy construction equipment industry. With sales of approximately $65 million in 2021 and operations in Germany, China and the U.S., Pacoma is the next step in executing our strategy to pursue profitable growth in the engineered hydraulics component industry.

In August, we also acquired a small textiles business that converts and distributes construction fabrics for the furniture and bedding industries. In early October, we acquired a small Canadian-based distributor of products used for a version control, storm water management and various other applications. We welcome the employees from all 3 businesses to Leggett & Platt.

Meanwhile, LEG maintains a strong BBB rated balance sheet. While its net debt to EBITDA ratio of 2.6x appears to be somewhat elevated, I would expect for this ratio to trend down as EBITDA returns to a more normalized level.

Importantly, LEG remains a Dividend King with over 50 years of consecutive annual raises, including the 5% raise earlier this year. LEG currently yields a high 5% supported by a 65% payout ratio. LEG also appears to be attractively valued at the current price of $35.31 with a blended PE of 14.7, sitting well below its normal PE of 18.9 over the past decade. I see potential for a reversion to the mean valuation after interest rate hikes subside and the housing markets return to a more even footing.

Investor Takeaway

Leggett & Platt remains a compelling Dividend King stock for investors looking for income and capital appreciation. Its recent acquisitions into the hydraulic cylinder industry should bear fruit in the near future as U.S. Infrastructure Bill tailwinds kick in, and its consumer products business should normalize after interest rate hikes subside. Finally, those bearish on the stock may be overlooking LEG’s fundamentally strong assets and its long-term growth potential. LEG is a buy for high income and potentially rewarding total returns.

Be the first to comment