ArLawKa AungTun/iStock via Getty Images

Introduction

Legal & General (OTCPK:LGGNY) is a well-established company with a leading position in the UK and with a well-renowned brand, whose stock performance has been somewhat puzzling. In fact, while the company grows and improves its results over the years, the share price has been stuck in a range almost for 10 years. In this article, I would like to outline a few points I like, pointing out that this trading pattern offers also some opportunities that go along with a hefty and growing dividend.

The company

Although it is still often seen as an insurance company, Legal & General has four main divisions:

- Legal & General Investment Management (LGIM), focused on asset management with a deep expertise in Defined Contribution (DC) and Defined Benefit (DB) Pensions. The AUM is around £1.3 trillion and in the first half of the year it reached an operating profit of £200 million. LGIM ranks 11th in the world from an AUM point of view. Around £468 billion of its assets (36% of AUM), are international assets.

- Legal & General Retirement Solutions (LGRI), a multi-national manager of institutional Pension Risk Transfer business whose operating profit in 1H22 was £560 million. In the UK it is the market leader and in the U.S. it is among the top ten industry players, with annuity assets of £78.8 billion. The annuity portfolio is enhanced through the supply of alternative assets from LGC.

- Legal & General Capital (LGC) that originates alternative assets for L&F and third parties to generated attractive shareholder returns. Its operating profit in 1H22 was £263 million. LGC invests across four main asset classes (Specialist Commercial Real Estate, Clean Energy, Housing and SME Finance) to generate attractive risk-adjusted shareholder returns and to create alternative assets. Moreover, it is also increasingly attracting third party capital investment directly and through collaboration with LGIM to meet the growing client demand for alternative assets.

- Legal & General Retirement & Protection solutions (Retail), that is among the leading providers of UK retail retirement solutions with operations also in the UK and the US life insurance & income protection business. Its operating profit in 1H22 was £332 million. The UK retail retirement business offers Workplace Savings, annuities, income drawdown and lifetime mortgages (LTM). Legal & General’s Retail manages also a portfolio of Fintech business investments.

While holding a leading position in the UK, the company is also growing in the U.S. and internationally. In 2020, Legal & General sold its general insurance business to Allianz and declared that is used the funds to reinvest in its core businesses of asset management and pension funds.

To get an idea of how L&G has performed in the past years, since 2007, L&G has more than quadrupled in size its annuity book, it has focused more and more on asset quality, it has experienced actual default losses of just £25 million, and none since 2008.

L&G is able to deliver domestic and international growth and over the long-term it can offer predictable value creation. In fact, it has a very long duration business with client retention being around 30-40 years, with earnings driven by a growing stock of accumulated assets.

First Half Results

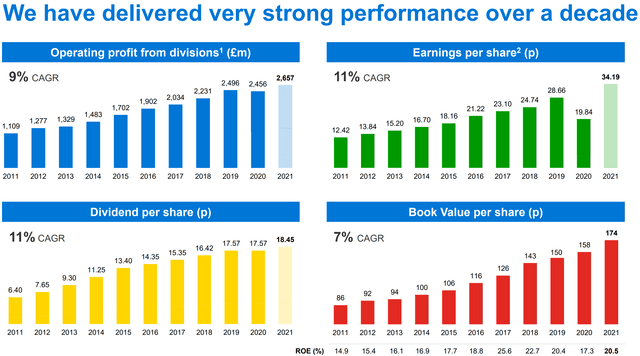

When I look at Legal & General I see a revenue that over the past ten years has had its ups and downs. However, as I look at the operating income, the net income, the EBITDA, the EBIT, the EPS, the cash flow yield, the dividend per share, the book value and the return on equity, I see a company that steadily grows. Let’s take a look at the slide below taken from last year’s results presentation that shows four graphs that sum up the overall trends for all the metrics I listed.

We see an established track record of consistent and profitable growth: between HY11-HY22 L&G delivered 11% CAGR in EPS, 11% CAGR in DPS, 8% CAGR in Book Value per Share and a 20% ROE thanks to its highly synergistic and growth-oriented business model.

Legal & General 2021 Results Presentation

The more I look at these trends, the more I am convinced of the health of this company. In particular, I think a sign of Legal & General’s strength is that it was one of the few companies in the Finance sector that didn’t suspend nor cut its dividend during the pandemic. Another fact that investors should take into account is that the EPS is not supported by a decreasing number of outstanding shares.

Probably, one of the reasons why Legal & General stock hasn’t performed according to its results is because of the low interest environment we saw up until now. In fact, L&G is linked both to interest rates and market movements. For example, a 100 bps interest increase adds a £450 million pre-tax profit. Since 2015 the company has gotten ready for rising rates and it has now built a portfolio ready to benefit from the new environment. However, while interest rates are rising, the bear market we’re in is dragging down portfolio values. For L&G a 25% drop in the market subtracts around $500 million to the pre-tax profit. With the Bank of England interest rate at 1.75% and the market down between 15%-20%, so far rising rates are impacting more than the bear market. However, there is the chance that the market will fall more and this could have an impact on L&G too.

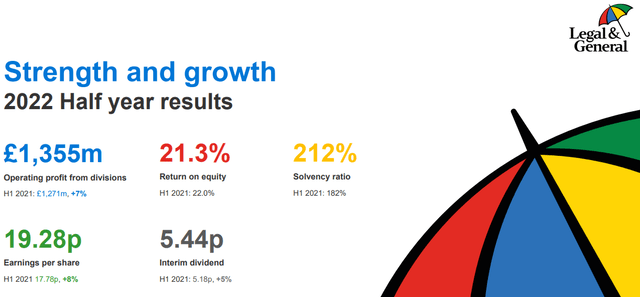

So far, however, the company has kept on performing well, publishing improving results YoY for the first half, as shown below.

L&G 1H22 Results Presentation

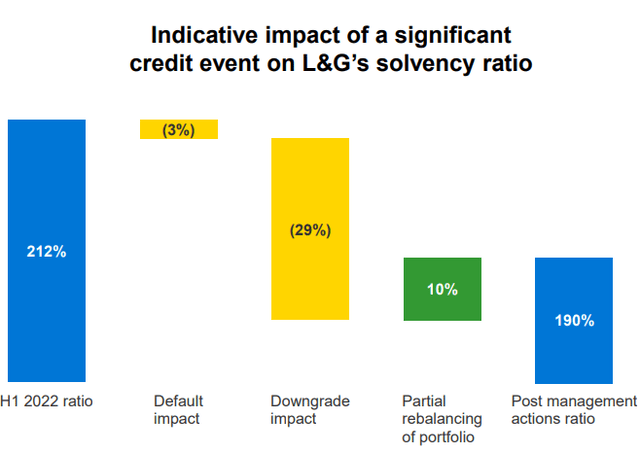

Beside the operating profit, the EPS and the dividend, I really like that L&G keeps on having a ROE above 20%. Furthermore, its solvency ratio has spiked up to 212% thanks to increased interest rates. This was a number that caught a lot of attention during the Q&A of the last earnings call. In fact, it means that L&G has a lot of buffer to absorb any kind of shock, as shown in the slide below that highlights how even a big credit event would still leave L&G’s solvency ratio around 190%.

L&G 1H22 Results Presentation

This led some analysts to ask L&G’s management if the company has any plan to use the extra capital for shareholder return or new investments. This is what Jeff Davies, the CFO, replied:

Our preference, if we can still deliver a 20%-odd return on equity is to continue investing in a very attractive high growth businesses and just relentlessly pursue that. Yes, we’re clearly ahead of plan and the plan had 5% dividends and we actually haven’t had to pay anything other than that right now. So, and if we continue on the trajectory, then there will be debates at the Board about what’s the right dividend policy and what should we do about share buybacks.

Investments and Dividends

There are some trends that the company is exposed to and that are driving its growth. I would like to highlight the three most important ones for me:

- Ageing demographics that offer tailwinds for LGRI, LGIM and Retail

- Globalisation of asset markets, favorable for LGIM

- Welfare reforms that push people to take responsibility for their own financial security through insurance, pensions and savings. This offers clear tailwinds for two divisions: Retail and LGIM

In particular, demographics is playing a major role, as it was highlighted in the earnings call:

Demographics is now trending. The world continues to get older, driving demand for pension de-risking and retirement solutions. A global $57 trillion opportunity. Only 10% available DB schemes have completed buyouts. So we’ve just scratched the surface. Asset Management continues to globalize and consolidate. The tough space is in the middle, but LGIM is in the global top dozen and internationalizing fast in this $129 trillion global marketplace.

I expect L&G to keep on benefitting from these trends. This leads to one question: what is L&G going to do with its expected 2025 operating profits of at least £600-700 million and fee-generating third party capital of £25-30 billion?

One of the most alluring aspects that lead people to invest into L&G is its dividend of close to 8%. If we take a look at its growth, the company is increasing it by 5% compared to the 8% EPS growth. This is what the company is doing when it states that it is widening the jaws between EPS and DPS. In fact, L&G believes that it is able to deploy capital at a high rate of return, thus creating even more value for the shareholders.

I think this could be the key that may lead to a share price that starts to move according to the EPS. If the company becomes focused on investing with a ROE above 20%, we should see some real compounding over time which, sooner or later, won’t be overlooked anymore by investors.

Conclusion

With a 7.29 PE, 32% below the sector average, and a Price/Book of 1.26, well below its main insurance peers, I see the company undervalued by around 30%, an assessment that can also be found according to a discounted cash flow model. I have a tiny investment in the company as I don’t mind the yield while waiting for some appreciation. Furthermore, the stock is now trading near the low end of its usual range and this may provide some extra margin of safety for those who are used to picking up shares of LGGNY below $15 and then sell them near $20.

Be the first to comment