phive2015

Introduction

Leatt (OTCQB:LEAT) is among the companies on my shortlist and I’ve already discussed it with the members of my Marketplace service in June. Today, I want to talk about this company in front of a wider audience and hopefully receive some constructive criticism as I’m eager to see if I’m missing anything.

Overall, I think that Leatt is a leader in its space but it seems questionable whether the good financial results from 2021 can be sustained. I might open a small position if the results of the company for Q2 2022 don’t show a decrease compared to last year. Let’s review.

Overview of the business and financials

Leatt was started in South Africa and is involved in the design and manufacturing of motorcycle safety gear and its main product is the Leatt-Brace. The start of the story of this product dates back to 2001 when Dr. Christopher Leatt witnessed the death of a fellow motorcycle rider on the weekend his son started riding. He filed the first patent in 2003 and today the Leatt-Brace is an injection molded neck protection system that is designed to prevent potentially devastating injuries to the cervical spine and neck. The patent is owned by Dr. Christopher Leatt through South African firm Xceed Holdings and Leatt holds the exclusive global manufacturing, distribution, sale, and use rights. Dr. Christopher Leatt is also Leatt’s chairman.

Leatt also sells helmets, body armor, guards, hydration systems, and apparel. The company’s focus at the moment is on the off-road motorcycle market and in 2010 it launched its body armor range. In 2014, Leatt launched its helmet range.

Leatt

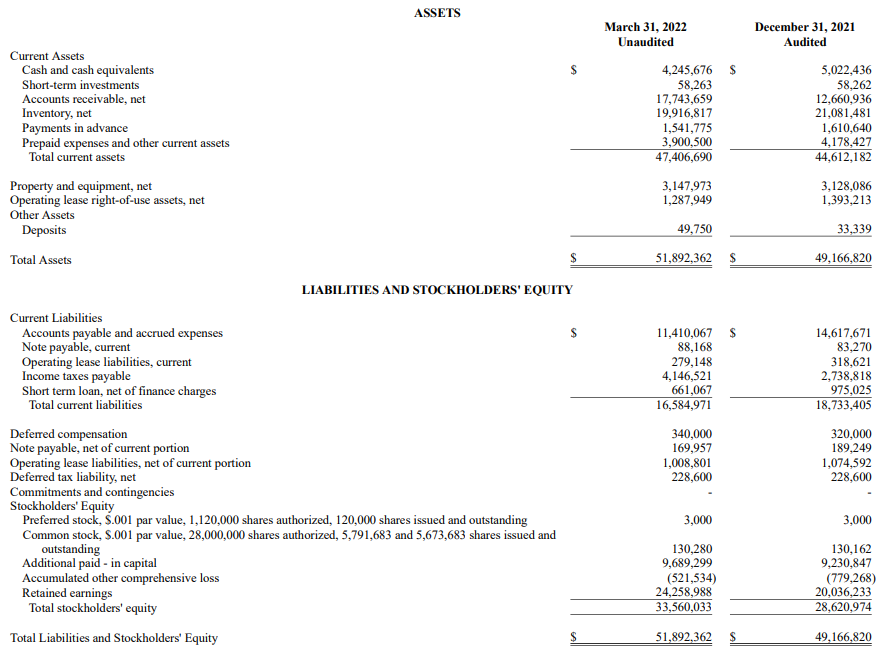

The company has a global network of 55 distributors worldwide and has sold over 800,000 neck braces to date. According to its 2021 annual report, there are around 850 active distributors and dealers who stock Leatt products in the USA as well as about 250 active dealers in South Africa.

Leatt’s products are made mainly in China through outsource manufacturing arrangements and the company is building manufacturing capacity in Thailand and Bangladesh. However, it’s unclear when this new manufacturing capacity will enter production.

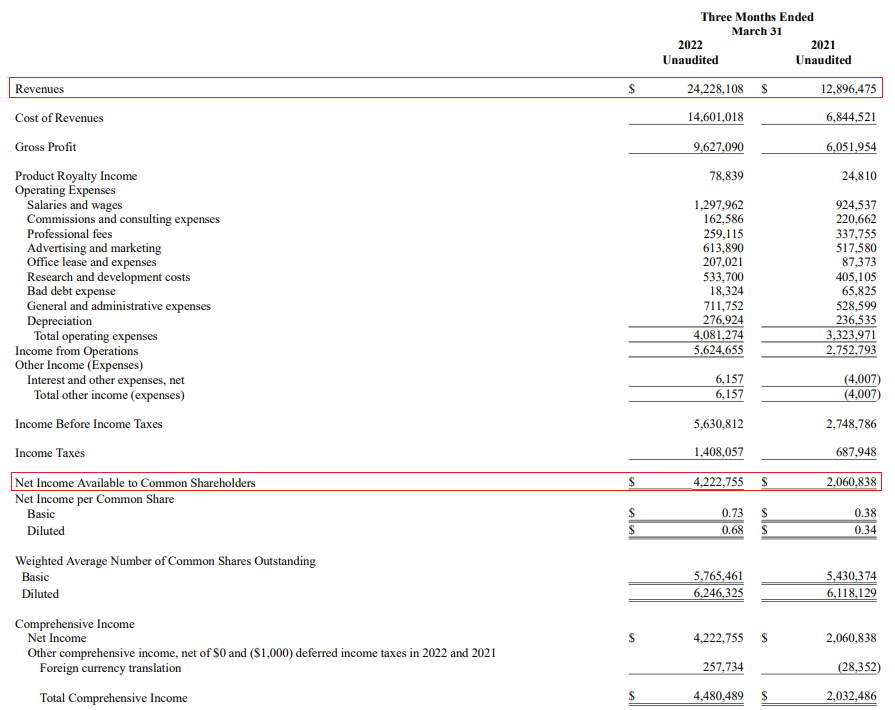

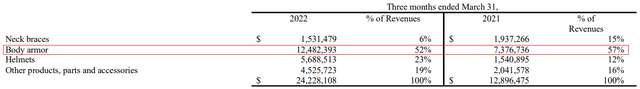

Overall, Leatt is a relatively small firm – it had 57 full-time employees and 41 independent contractors as of the end of 2021. However, it has been growing rapidly and you can see this reflected in its financials. In Q1 2022, revenues almost doubled and reached $24.2 million. The net income, in turn, came in at $4.2 million, which is also more than double compared to the same period of 2021. And keep in mind this was accomplished during a period of supply chain disruptions in China.

Leatt

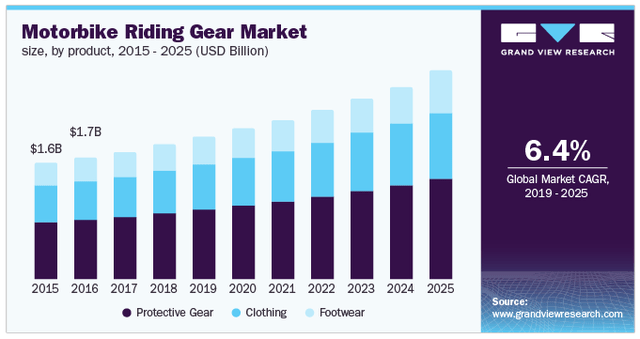

The gross margins are high for an apparel/equipment company and I think this is thanks to the outsourced nature of its manufacturing operations. What I find really unusual about this company is that revenue growth was almost flat for several years before rising above 20% in 2017 and reaching almost 90% in 2021. According to data from Grand View Research, the global motorbike riding gear market seems mature which means that Leatt has to be getting market share at the expense of some of its competitors.

Looking at the breakdown of revenues by product in Q1 2022, we can see that the growth is currently being driven by body armor sales.

According to Leatt, there is strong demand for its upper body and limb protectors. In my view, there are four red flags here and the first one is that we can’t tell how long the strong demand for these products will last. The company doesn’t provide any sales guidance.

The second red flag for me is that Leatt looks expensive using some traditional fundamental valuation ratios. The company has an asset-light business model and it’s valued at 4.2x P/B as of the time of writing. As of March, Leatt had only $4.2 million of cash in the bank as cash flow from operating activities was minus $0.7 million in Q1 2022. The reason behind this was a $5.1 million increase in receivables. Sure, negative cash flow is now normal for companies that are growing fast but I like to invest in firms with high cash-flow conversion ratios.

Leatt

Third, I’m concerned that most of its products are manufactured in China as the country is notorious for making knockoffs. Sure, Leatt theoretically holds the IP rights but try defending yourself in a Chinese court.

And the final red flag for me is that Leatt is listed only on the OTC market, where volume is pretty low – you rarely see more than 5,000 shares changing hands in a day. This means that it would be hard to open a large position and then exit it without creating significant share price volatility. Leatt has not revealed any plans to uplist to NASDAQ or another large US exchange in the near future.

Investor takeaway

Leatt has been showing impressive growth and it’s trading at an annualized P/E ratio of about 7.85x. If the company manages to keep growing this fast, I wouldn’t be surprised if it books EPS of over $3.00 in 2022. However, it’s impossible to tell how much room there is for sales to grow or if this pace can be sustained. Also, I’m concerned about the low trading volume, the focus on China, and the high P/B ratio.

Overall, I rate Leatt as a speculative buy. The company looks cheap but a lot can go wrong with an investment here. In my view, risk-averse investors should avoid this stock.

Be the first to comment