Different_Brian/iStock via Getty Images

Introduction

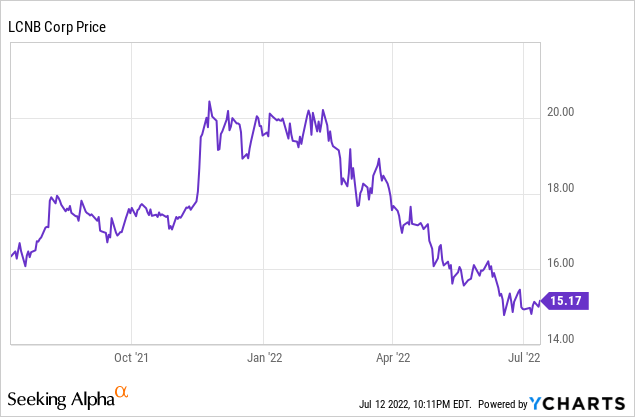

LCNB (NASDAQ:LCNB) is a small bank operating in certain areas of Ohio. Last time I looked at the bank I liked the dividend yield of in excess of 4% in combination with a robust loan book with very few loans past due. The share price has now fallen by approximately 15% since that previous article was published, so I wanted to have another look at the bank as its dividend yield has now increased to in excess of 5%.

The quarterly results were more than alright and LCNB’s dividend remains hedged

My first stop when looking at a bank traditionally is the most recent income statement as that provides a good overview of how the bank is actually performing. Dividends are paid from earnings so having a solid earnings potential is likely one of the most important factors contributing to a healthy dividend policy.

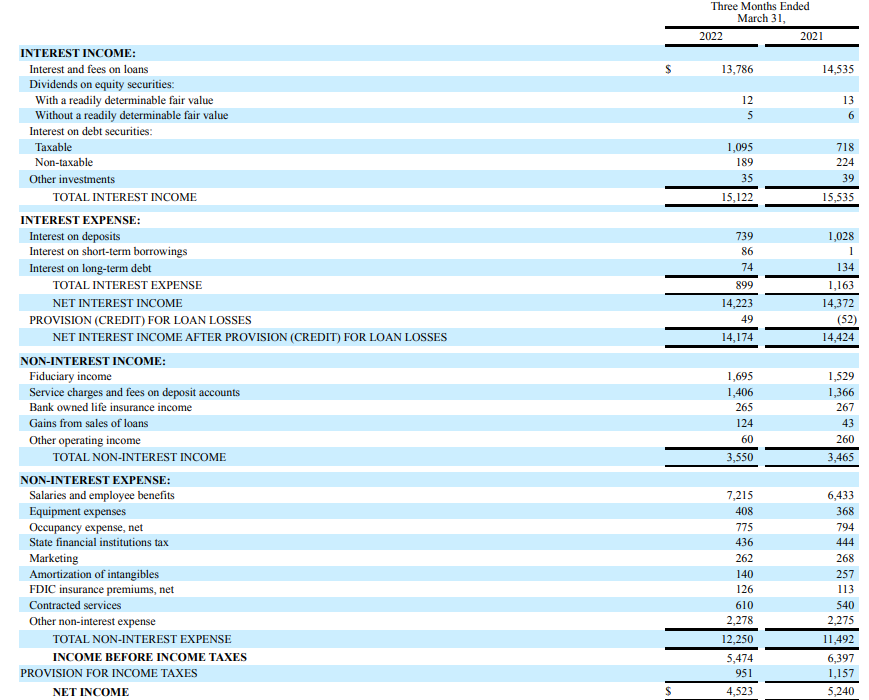

In the first quarter, LCNB’s interest income decreased just slightly, by a few hundred thousand dollar to $15.1M. Fortunately the interest expenses also decreased by in excess of 20% resulting in a net interest income of $14.2M which is just about 1% lower than in the first quarter of 2021, so that’s pretty good.

LCNB Investor Relations

It’s not difficult to understand the operating expenses continue to increase and we indeed see an increase in the non-interest expenses to $12.25M, an increase of approximately $750,000 compared to Q1 of last year. That’s entirely contributable to the higher salaries paid by LCNB as the bank saw its wage bill increase by about $0.8M.

The combination of a slightly lower net interest income and a slightly higher net non-interest expense (up from $8M to $8.7M) caused the pre-tax income to decrease to $5.5M. That includes a $49,000 loan loss provision (compared to a $52,000 credit recorded in Q1 of last year). The net income was $4.5M for an EPS of $0.38. As the current quarterly dividend is still $0.20, the coverage ratio remains very strong considering the payout ratio is just under 53%. So looking at LCNB from an earnings perspective, the dividend appears to be safe. Especially considering the total amount of nonperforming assets continued to decrease.

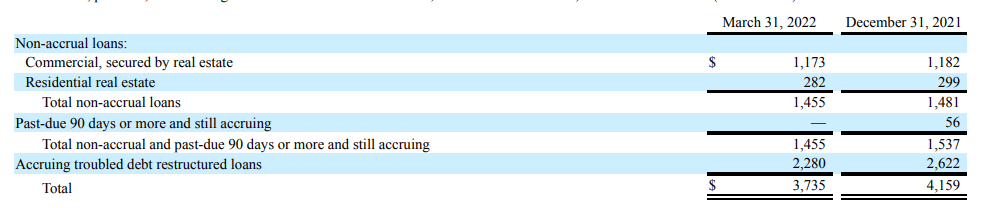

LCNB Investor Relations

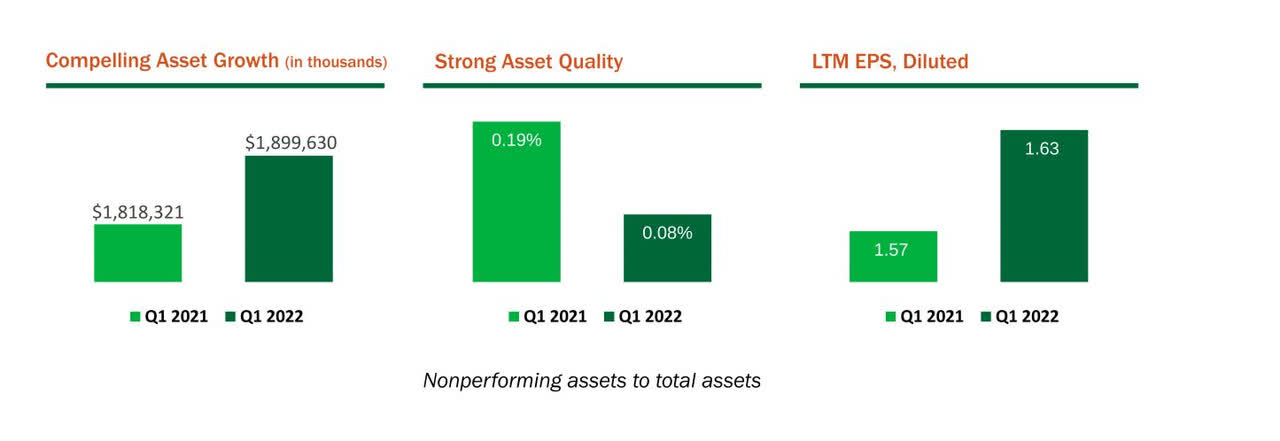

The total amount of non-accruing and past due loans came in at $3.74M, a decrease of 10% in the first quarter. As most of the non-accrual loans are secured by real estate (either CRE or residential real estate), LCNB will likely be able to recoup most of the investment.

LCNB Investor Relations

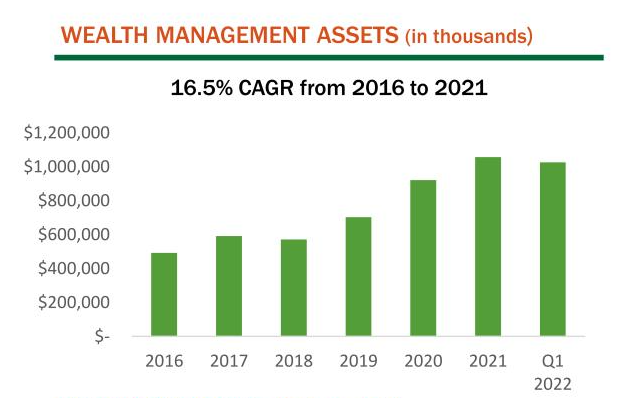

I also like the focus on the wealth management division and the assets under management increased to almost $1B. That sounds negligible but further down the road this could become ‘sticky’ revenue: if LCNB does a good job the AUM will continue to increase which will have a positive impact on the non-interest income. The fiduciary income is approximately $1.5M per quarter.

LCNB Investor Relations

The exposure to securities available for sale had a very negative impact on the book value

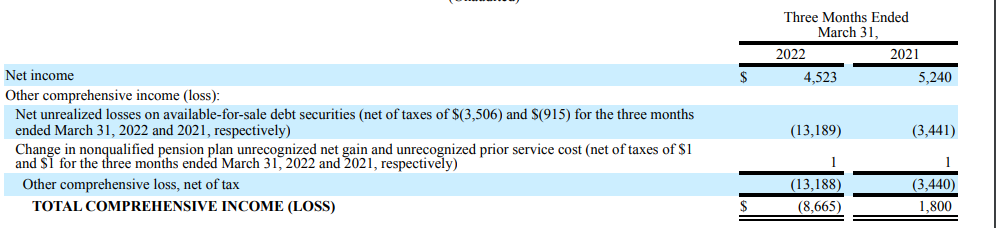

So everything is looking good at first sight: the bank is trading at less than 10 times earnings and the healthy dividend makes LCNB attractive from both an income as well as a fundamental perspective. There’s just one element bothering me: the value destruction in the ‘securities available for sale’ portfolio.

As interest rates fluctuate, the fair value of this portfolio changes. As these securities are marked as ‘available for sale’ the valuation increases and decreases don’t have to be recorded on the normal income statement, but they do show up on the comprehensive income statement.

LCNB Investor Relations

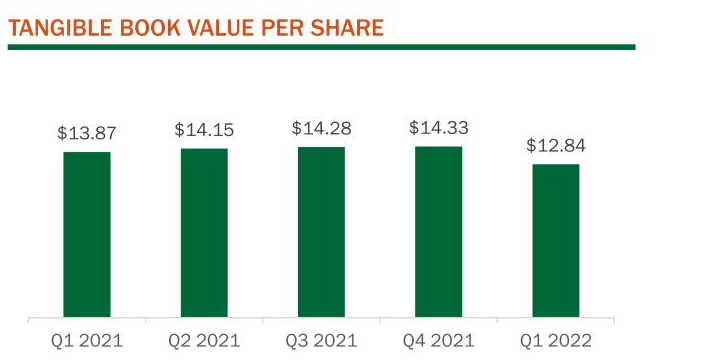

As you can see, the net unrealized losses net of taxes came in at $13.2M and this weighed on the book value and tangible book value of the bank. Whereas the equity value as of the end of FY2021 was approximately $238.6M, this had fallen to just under $207M as of the end of the first quarter of this year. A substantial portion of this decrease is caused by the valuation decrease of the securities portfolio, but there’s more than meets the eye here.

During the first quarter, LCNB has been very active on buying back its own shares: it repurchased in excess of 1M shares and according to the cash flow statement, it spent about $21.1M doing so. That obviously decreases the share count but also the equity value on the balance sheet. The move also wasn’t TBV/share neutral considering the average buyback price was approximately $20/share so at a premium of 30-35% versus the YE2021 TBV. The combination of both has reduced the TBV/share to $12.84.

LCNB Investor Relations

Investment thesis

While the drop in the equity value looks pretty bad, investors should be aware LCNB reduced its net share count by just over 1 million shares and the TBV/share offers a better comparison here. We still see a drop in the TBV/share of about 10%, but at least the decrease remains manageable. I’m not sure the pain is over yet as the interest rates continued to increase and bond-like investments continued to decrease in value throughout Q2, but I expect to see a stabilization soon.

I will wait for the bank to report its Q2 results first before deciding. I like the way the bank is doing business, I am very happy with the strong asset and credit quality, so at this moment it’s just a function of seeing where the TBV stabilizes and how this is offset by the $2M in retained quarterly profits.

Be the first to comment