davidrasmus/iStock via Getty Images

Introduction

Ever since launching my Bears and Resources MP service, I’ve been looking for short selling opportunities for my stock portfolio. What I’m looking for is loss-making businesses with no significant moats combined with low short borrow fee rates. One company that I think fits these criteria is Draganfly (NASDAQ:DPRO). Let’s review.

Overview of the latest developments

I’ve written 2 articles on SA about Draganfly, and my conclusion was that the company looked overvalued from a fundamentals point of view. Here’s a quick overview of the business in case you haven’t read them. Draganfly started producing drones in 1998 and prides itself as the world’s oldest commercial drone maker. Today, the company also offers contractor engineering services for military contractors and its offering includes flight services, and AI and data solutions. Looking at flight services, Draganfly focuses on the mining, agriculture, and forestry sectors.

In March 2022, the company received some media attention thanks to a new order for medical response and search and rescue drones for delivery to a non-profit organization in Ukraine. The deal includes a total of 10 drones and the order size can be increased to 200 drones. However, I calculated that those 200 drones will likely cost only about $6 million.

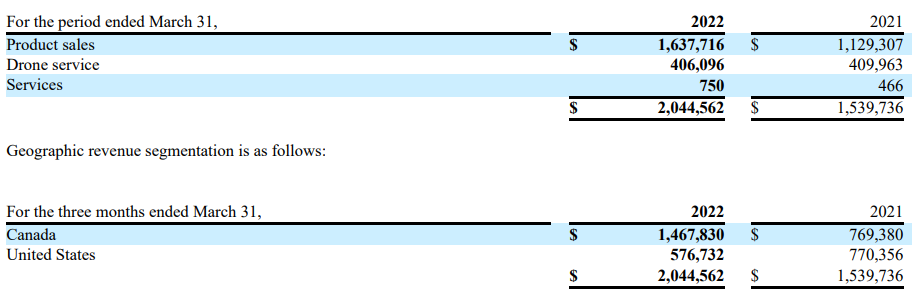

Turning our attention to the financials, I think that this company is a good example that having a first-mover advantage sometimes doesn’t matter. Despite being for over 20 years in the drone business, Draganfly’s Q1 2022 revenues stood at just C$2.44 million ($1.59 million) and most of them came from Canada. The majority of this sum came from product sales that include internally assembled multi-rotor helicopters, industrial aerial video systems, civilian small unmanned aerial systems or vehicles, and wireless video systems. Services revenues, in turn, consist of fees charged for custom engineering, drone as service work, and training and simulation consulting.

Draganfly

Yes, you could argue that revenues rose by 32.8% year-on-year, but this increase is largely due to higher sales coming from Dronelogics, which is a small drone company that Draganfly bought in 2020. Draganfly recognized that the drone market was impacted by lower-priced consumer products and the purchase of Dronelogics was its answer to this challenge as this firm is a reseller of lower-priced, third-party drones as well as other third-party products such as light detection and ranging (LiDAR) sensors.

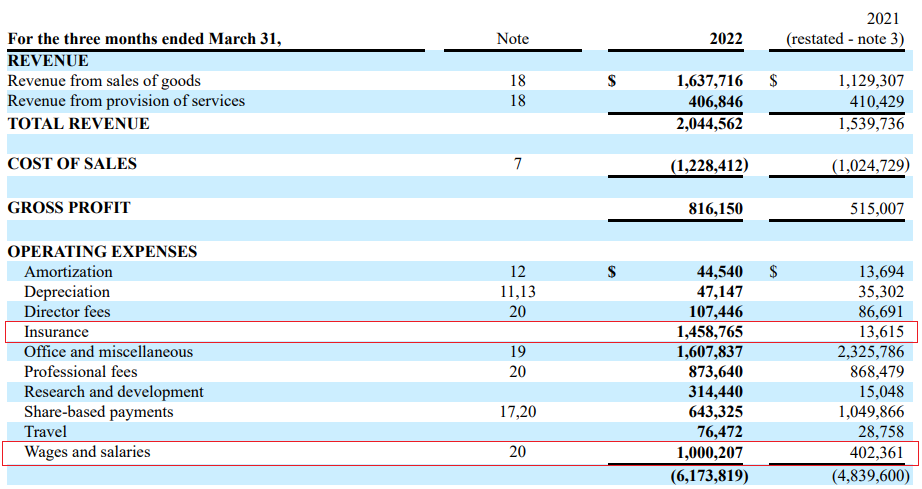

The operating loss of Draganfly is widening despite the higher revenues as SG&A expenses rose by 27% in Q1 2022 to C$6.08 million ($4.72 million), mainly as a result of higher directors’ and officers’ insurance costs and salary expenses.

Draganfly

Overall, I find the financial performance disappointing considering Draganfly announced in January a minimum C$9 million ($6.98 million) manufacturing agreement for an AI consumer companion robot drone. The deal was inked with a company named Digital Dream Labs and it included an initial delivery of 10,000 drones starting in 2022, with 50,000 units over the life of the initial agreement. There is no mention of this agreement in the Q1 2022 financials, so it’s unclear what’s happening with this order.

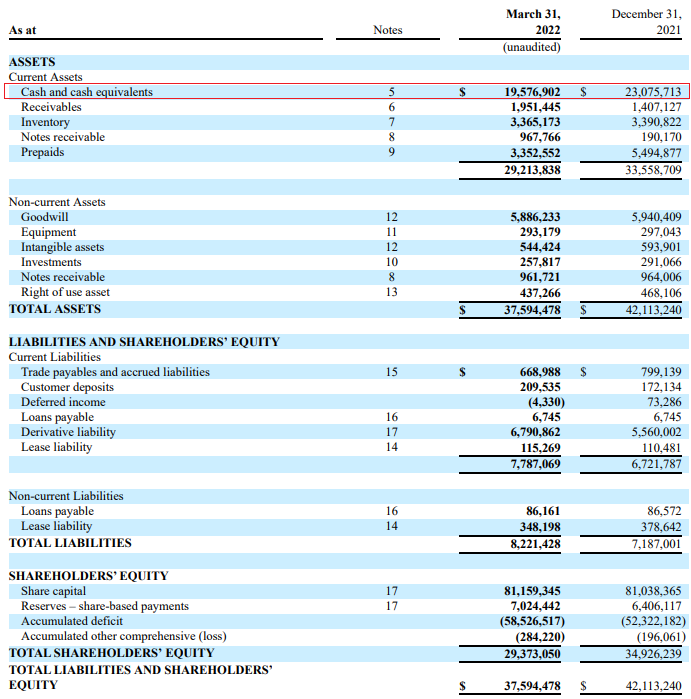

Turning our attention to the balance sheet, the situation is deteriorating as funds used in operating activities in Q1 2022 were C$3.89 million ($2.71 million) and Draganfly had just C$19.58 million ($15.18 million) in cash and cash equivalents as of March. At this rate, the company could run out of cash by the end of 2023.

Draganfly

So, what’s ahead for Draganfly? Well, the company recently announced the launch of a new long-range LiDAR system and said during its Q1 2022 earnings call that it wants to become the number one or number two player in the North American drone space in the coming years. Yet, these goals seem overly ambitious. In my view, Draganfly just doesn’t have the orders or resources to grab a significant market share in the North American drone market. Its deal with Digital Dream Labs was its largest order to date, and I find it concerning that there are no updates about that contract. In addition, quarterly revenues are still below the $2 million mark, and it seems that most of the sales growth is coming from the resale of third-party drones through Dronelogics. Draganfly has an intellectual property (IP) portfolio of 23 issued patents but just how valuable are they considering there is no organic growth coming from its own products? And what happens to that Ukraine order if the conflict with Russia ends next month?

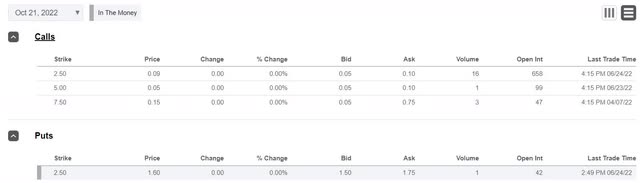

Overall, I think that Q1 2022 sales were weak, and I don’t expect revenues for the full year to surpass the $10 million mark. Also, the increase in expenses is concerning, and it seems that Draganfly will continue to burn through its cash reserves for the foreseeable future. I think there is a risk of significant stock dilution by the end of 2023 unless Draganfly can achieve its growth ambitions. Taking into account the company’s underwhelming financial performance over the past several years, I’m skeptical about the prospects of the business, and I’m bearish. Investors can take advantage of this by short selling the stock, and data from Fintel shows that the short borrow fee rate stands at 5.72% as of the time of writing. I think that this is a good level. It’s usually a good idea to hedge the risk with some call options, but unfortunately, the lowest available strike price here is $2.50.

Turning our attention to the upside risks, I think there are several major ones. First, Digital Dream Labs could follow through with its order, which is likely to provide a boost to the share price. Second, if the drones sent to Ukraine perform well, Draganfly could receive more orders for its products from other customers. Third, sometimes the share prices of microcaps increase for spurious and unknown reasons, and it’s possible that this happens here in the future. Such an event has the potential to lead to significant losses for short sellers, so it could be a good idea to set a stop-loss price. Its level depends on your risk tolerance and for me personally, it would be around $2.00 per share

Investor takeaway

The revenues of Draganfly increased in Q1 2022 mainly thanks to Dronelogics and I find it concerning that there is no news about the order from Digital Dream Labs. In addition, SG&A expenses rose by 27% and the operating loss widened. If the cash burn rate doesn’t decrease, Draganfly could run out of cash by the end of 2023.

Overall, I think that the business of Draganfly isn’t worth much in its current state and the company looks like a good candidate for my first short position as the short borrow fee rate is below 6%. However, there are no put options with a strike price of below $2.50 per share, so it could be best for risk-averse investors to avoid Draganfly.

Be the first to comment