Maksim Labkouski

Published on the Value Lab 31/10/22

Lazard (NYSE:LAZ) has both asset management and advisory, and within advisory lots of businesses like restructuring and sovereign engagements that can be countercyclical. It is more built than most banks to weather the cycle, and it is proving that with continued record quarters. There are challenges despite proven resilience, and building backlog has become a difficult task. In asset management, an uncertain environment could very well persist and put pressure on AUMs. We think Lazard’s businesses could get very dangerous if the solutions engineered by central banks don’t produce results.

Q3 Notes

Let’s start with the Q3 discussion from its recent release a couple of days ago.

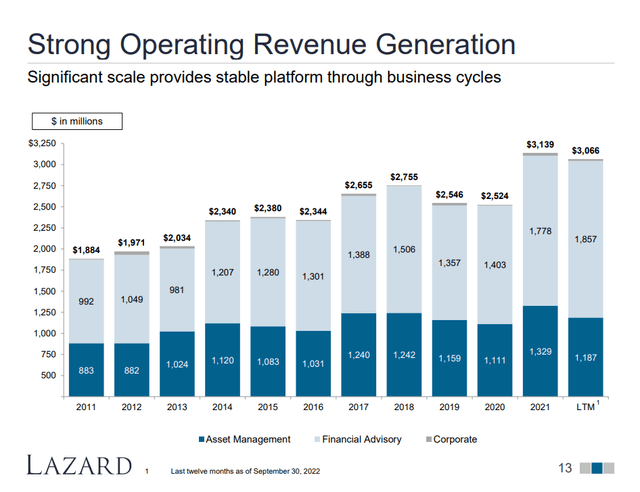

- Revenue increased a few points from the year before, comprehensive of pressures on the asset management business, which was by far the weaker of the two. Financial advisory grew almost 20% while asset management declined 15%. On an LTM basis, the asset management revenues are retreating to almost a COVID-19 level.

LTM Revenue Figures (Q3 2022 Pres)

- AUMs declined 27% YoY and 9% sequentially. While part of this was driven by flows, the big pressure has been the declines in any currency other than the dollar. 66% of their asset management assets are held in non-dollar assets, and the dollar has appreciated on a coarse estimate based on our broad coverage by between 15-20% against other currencies. So the majority of the AUM declines are a technical effect, and indeed sequentially the net outflows were more than 2/3rds accounted for by currency effects rather than actual outflows. The business is proving rather resilient, in line with the outflows experienced during the worst of the COVID-19 depths. This is a good gauge for fear in the markets.

- The operating revenue growth in the financial advisory business was being driven by a good pace of deal closures in Europe, particularly in the healthcare and renewable transition space. There is a pickup in the dialogue in restructuring and sovereign engagements, but these don’t seem to have resulted in anything yet. Desperate efforts to deal with the oncoming troubles are definitely supporting engagements in implicit liability and other risk management through active acquisitions. We’ve seen similar European strength with other peers that have strong European franchises.

- In general, sponsors who have the incentive to make strategic moves to shore up their business’ situations have been a better source of business than financial sponsors. Lazard has structurally been much less exposed to financial sponsor-based business than its peers, and therefore, has proven more resilient in that regard to the total shut-down of leveraged finance markets upon which financial sponsors rely – an area that could stay shut down for a while if inflation doesn’t seem to go away.

We were way underweighted a few years ago. We’re more balanced today, but we never have gone nearly as far as some of our competitors with regard to commitment to sponsor activity.

Kenneth Jacobs, LAZ CEO

Bottom Line

The alarming thing that we need to absorb from the call is how much emphasis management is putting on the concept that deal completion is driving current results, not actually new engagements, which have materially slowed down. After commenting that execution has been keeping the velocity of fees high, Jacobs gave the following indications of what’s to come:

And my guess is the real challenge for everyone right now is building backlog into the first part of next year and later into the year. And that doesn’t only apply to Europe. It applies to the United States. And I think that’s the challenge at the moment that we’re all facing.

Kenneth Jacobs, LAZ CEO

Dialogue grows as customers look to map out their options, but new engagements don’t necessarily rise. Pulling the trigger requires some assurance from the market that things will go well, and there’s none of that now while we still don’t know if central bank actions will work on inflation without destroying the economy. We believe we may be approaching a peak in inflation from the cost-push side, but it takes time for that to digest into final prices, which have every reason to stay sticky. Commodities are down at least, which are high transmission into the economy. Overall, Lazard is exposed to a part of business that is very macro-exposed, despite higher exposure to countercyclical elements like restructuring compared to some peers. Asset management diversifies away some of the volatility of financial advisory, but not enough. This is very levered to markets’ view on central bank policy and inflation dynamics, which will be clarified this week not in the 75 bps rise that is almost surely coming, but in what the Fed says about its plans in response to inflation.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment