peshkov/iStock via Getty Images

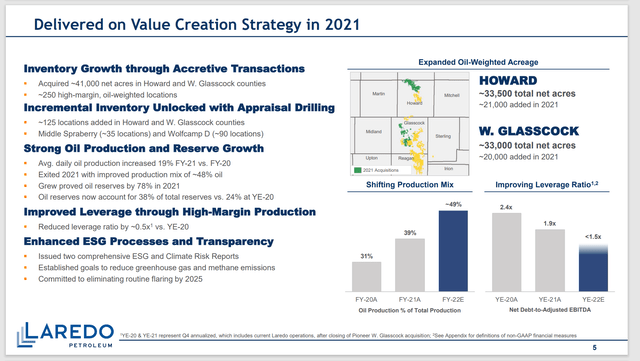

Laredo Petroleum (NYSE:LPI) has been acquiring acreage that was more profitable than the acreage that the company already had. Now market prices of commodities may slow that strategy. But oil and gas always moves in cycles.

So that strategy is still viable for the long term. But the short term may change the emphasis to operations. The commodity pricing is far stronger than I thought it would be when I first began the article. So the acquisition strategy could well be on a short-term hold until prices back off somewhat.

Fortunately, there is enough of the newly acquired profitable acreage to keep management busy for years. Meanwhile, the improvements in efficiency and the higher commodity prices make the legacy acreage more profitable than it has been in some time. Both of these should enable the stock price to outperform well into the future.

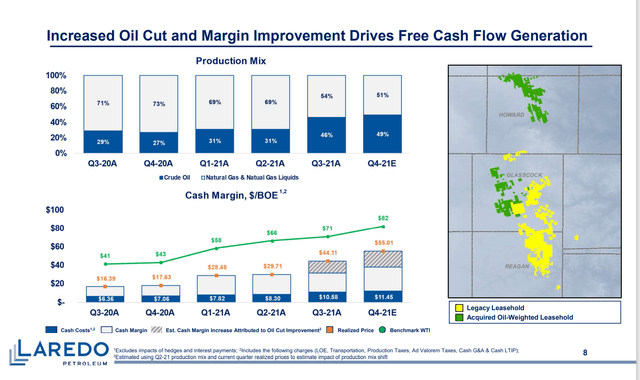

Laredo Petroleum Effect Of Drilling On Acquired Acreage (Laredo Petroleum January 2022, Corporate Presentation)

Management has a drilling strategy commensurate with the acquisition strategy. That strategy has been to drill on the newly acquired acreage because it is very profitable while maintaining the legacy acreage. The acquisitions already “jump started” the move to a larger percentage of oil production. This has led to an accelerated improvement in the margin as shown above from both the new strategy and improving commodity prices. In effect, the company receives a double boost that has a larger effect than much of the industry that solely benefits from rising commodity prices.

To maximize the benefits of the new acreage, management is likely to control costs so that costs remain the same as the legacy acreage where possible. Then some costs like transportation costs are higher for oil. But those increased costs should be overwhelmed by an improving margin from the larger oil percentage produced to increase profitability.

What is left undiscussed so far is that the increasing margin combined with tight cost control should lead to a superior profitability at various pricing points. This superior profitability should become apparent during the next corporate downturn.

Management also has greater flexibility to vary the percentage of oil and natural gas produced. In the long run, that should lead to adequate (or better) profitability under a wider variety of industry scenarios. Flexibility is often the key to surviving in commodity industries. This company has acquired a fair amount of flexibility.

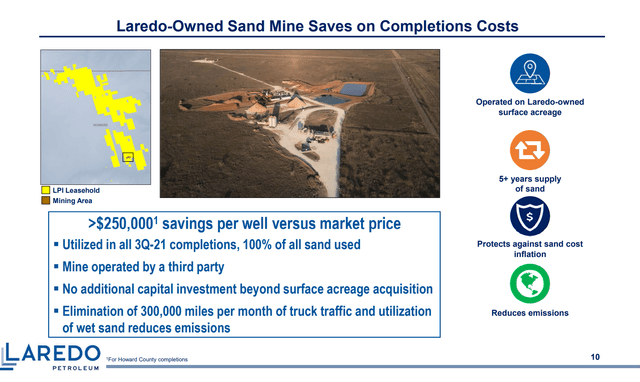

Laredo Owned Sand Mine Saves On Completion Costs (Laredo Corporation January 2022, Corporate Presentation.)

The emphasis on a company owned sand mine still demonstrates that many companies have far greater potential returns elsewhere than focusing upon sand quality. Investors can expect well design improvements and longer wells or other innovations in the near future. Sand quality is generally something that adds production life to the well towards the end of the producing life of the well. The discounted return on that potential improvement clearly is not competitive with other production improvements.

The good news for consumers is that the cost to produce oil is likely to continue to decline. We could potentially be in for a generation of low oil costs as the current technology progression continues.

For oil companies, the above slide appears to signal a continuing trend of cost reductions. That probably means the current round of high prices is unsustainable. All everyone has to do is be patient and allow the market to work out the current imbalances. In the meantime, the currently strong commodity prices are an attractive lure for an industry that tends to show little restraint at increasing production.

The main difference between this recovery and the last two appears to be the lack of inexperienced (and speculative) money. After two major loss periods, the inexperienced crowd appears to be somewhat disenchanted by the forward price curve of oil ((Good!)). Should outside money come pouring into the industry, that probably will signal the beginning of the next cyclical downturn.

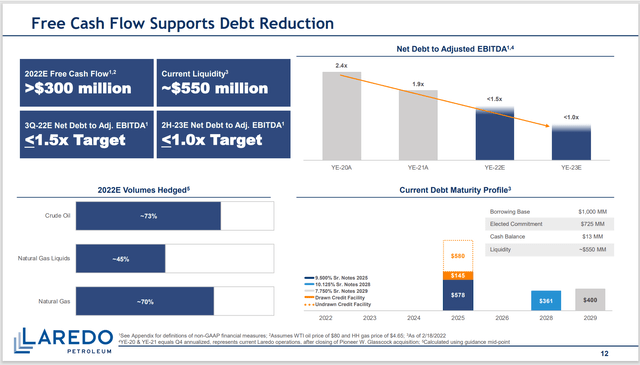

Laredo Petroleum Debt Reduction And Hedging Guidance (Laredo Petroleum Corporate Presentation March 2022.)

Many have been upset that management is not taking advantage of the currently sky-high oil prices by not hedging. For as long as I have followed this industry, very few managements that time hedging are able to time the program successfully. Had management not hedged for fiscal year 2020, the result could have been disastrous. The source of discontent is the low futures curve that causes Laredo to realize prices significantly below the posted prices.

Most likely that situation will change soon enough. A company like this one that hedges all the time designs the program to be revenue neutral while reducing cash flow volatility. Some managements also use the hedging program to justify a minimal return on their capital investments. As much as Mr. Market may hate the hedging program right now, he loved it back in fiscal year 2020. Almost no one forecast 2020 the way it unfolded. That is really the key to the hedging program.

This industry has notoriously low visibility. Things can change literally overnight by way of things that were not foreseen when the capital budget was being planned. Clearly the safety provided by the hedging program can be justified simply by reviewing fiscal year 2020.

In the meantime, management has increased liquidity so that it can continue shopping for deals. Small deals are likely to be available because small “bolt-on” acquisitions are only attractive to nearby acreage holders. The competition for that acreage is less which results in a discounted price even during times of strong commodity pricing.

This management began the acquisition of acreage at far lower prices than is currently the case. There still seems to be a fair amount of acreage on the market. But stronger commodity pricing makes a significant deal less likely. Investors should hope for management to remain disciplined because there is always another cyclical downturn “around the corner” in this industry. If the bargains are not there now, they will likely be back during the next downturn.

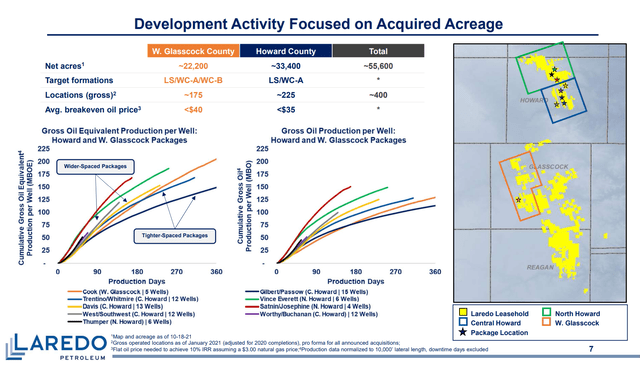

Laredo Development Activity Focused Upon Acquired Acreage (Laredo Petroleum Corporate Presentation January 2022.)

In the meantime, management will drill the most profitable acreage first. The good news shown above is that these wells produce 100,000 barrels of oil usually within 6 months. That level of production often results in a payback of less than one year at current commodity prices. Therefore, management can often drill 2 wells in the same fiscal year with the same capital money. That ability accelerates the move towards a higher percentage of oil production.

The bigger news for shareholders is that the acreage profitability appears to be compatible with the far more expensive areas of the Permian (like Reeves County). The cheaper acreage allows for greater corporate profitability and a lower corporate breakeven cost.

Laredo Petroleum Increasing Percentage Of Oil Production (Laredo Petroleum March 2022, Corporate Presentation)

Laredo is likely to show a material profit improvement in the current fiscal year due to the greater amount of oil produced and a lack of integration costs that occurred in fiscal year 2021. The current price appears to indicate that the market could incur some considerable upside surprise about that profitability. The stronger natural gas prices have sharply increased the value of the legacy production as well. Most likely this company is in for a record year of profits unless commodity prices collapse.

That should benefit common shareholders significantly. This company will benefit both from the higher oil percentage of production as well as stronger commodity prices. Mr. Market may not be expecting those results.

Be the first to comment