Solskin

Investment Summary

Following previous analyses on Laboratory Corporation of America Holdings (NYSE:LH) [See: here, and here ] I advocate the company’s most recent set of numbers further corroborates the buy thesis on this name. Investors are treated to double-digit return on invested capital and equity in LH whilst multiples now trade at respectable levels after re-rating to the downside in FY22.

Investors can now buy the stock 12-14x forward earnings, below 5-year average forward P/E of 26.3x. With investors shying away from top-line growth stories and drifting into bottom-line fundamentals instead, the investment opportunity for LH is rife in my opinion, seeing its strengths down the P&L below the top-line. There is risk the market will overshoot any punishment of LH’s dwindling Covid-19 revenue. However, at the minute, this looks to be well expected and thus well priced into the stock. Looking ahead, we believe LH should trade at $244, and see further upside beyond $249 with the right momentum. Net-net, I rate LH a buy, price target $244.

Exhibit 1. LH 6-month price evolution

LH Q3 numbers illustrate top-line sensitivity to Covid-19

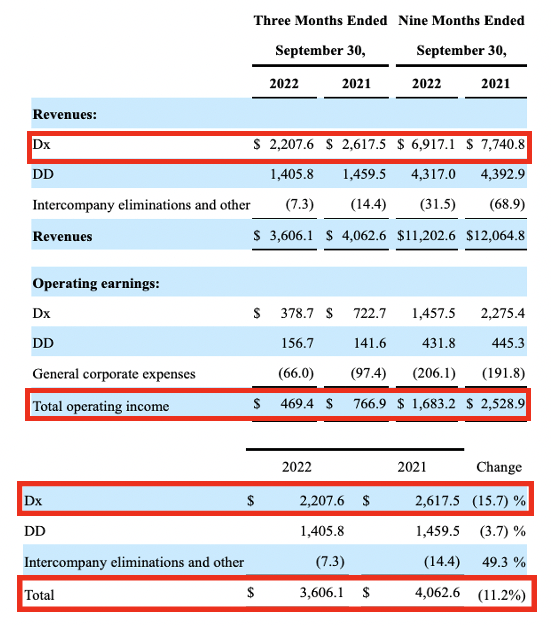

The sensitivity of LH’s top-line to Covid-19 test demand was recognized heavily by the company in Q3. Most notably, quarterly revenue declined 11.2% YoY to $3.6 Billion (“Bn”). Chief to the downside was the substantial YoY decrease in Covid-19 test volume. In total, in Q3 FY22, Covid-19 testing revenue for LH was down 70% compared to this time last year. The wind-back highlights a headwind looking ahead, as a previous medium-term growth lever is now removed.

Given the distribution of revenue is heavily skewed towards diagnostics for LH, the absence of Covid-related revenue was felt in this segment most. In fact, Diagnostics (“Dx”) segment revenue clipped $2.2Bn [$24.8/share] – a 15.7% YoY decline – as total volume contracted 10.3% YoY, and price/mix benefit also decreased 540bps. Aside from this, drug development revenue came to $1.4Bn [$15.80/share], a decline of 370bps YoY [with ~340bps of forex headwind baked into this result], whereas the central lab division saw a 980bps YoY decline from the same challenges. Ex-Covid testing, each of these segments saw far more respectable results.

The pullback in Covid-revenue also came through the P&L vertically. As seen in Exhibit 2, the YoY decrease to diagnostics resulted in a 47.5% net-outflow of operating income. Dx operating margin therefore dipped by c.10 percentage points to 19.9% of turnover. Total operating income decreased 38.7% YoY to $469.4mm [including $65mm of amortization charge].

Exhibit 2. Sensitivity of LH’s top-line to Covid-19 test volume revealed in Q3 with significant step-back in turnover tied to dwindling test/volume demand.

Note: Data and Image taken and adapted from LH Q3 FY22 10-Q. ( Data: LH Q3 FY22 10-Q)

Moving down the P&L, capital expenditures (“CapEx”) tightened from $118mm to $104mm [$1.17/share], with management projecting a FY22 CapEx margin of 350bps. Net-net it saw an inflow of $270mm [$3.04/share] of FCF for the quarter, leading to realized TTM FCF of $1.47Bn [$16.60/share]. Investors also realized $65mm in total dividends for the period and the company repurchased $400mm worth or 1.5mm of its own common shares. It still has ~$800mm in capital authorized under this repurchase agreement.

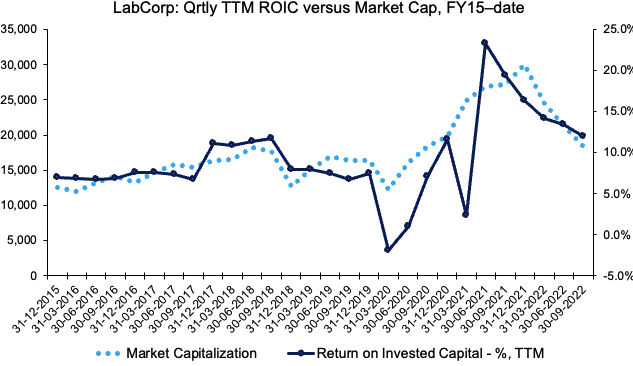

Profitability trends continued to revert back to range in Q3 FY22 for LH following a period of outsized performance, as seen in Exhibit 3. Return on invested capital (“ROIC”) has been tightly dispersed with the company’s market value since FY15, hence a return to longer-term range has been coupled with a pullback in the LH market cap. Looking ahead, this is a key number for investors to watch for LH in my estimation.

LH also delivered a return on equity (“ROE”) of 17% from Q3 FY22 earnings, above its 7-year quarterly average of 15.1%. LH is also priced at 2x book value, meaning the investor ROE is 7.55% if paying this multiple. Breaking down the ROE further, we see that its net margin has contracted back to pre-pandemic ranges of 9.8% [from a high of 20.9% in Q4 FY20], whilst asset turnover has crept upward to 0.75x, and leverage has remained flat. Hence, the upside in ROE has been realized as a function of return on existing capital for LH over this time, versus earnings upside.

Exhibit 3. Tight dispersion and covariance between market cap and ROIC for LH

Note: All figures in $mm and/or [%]. (Data: HB Insights, LH SEC Filings)

The importance of these profitability measures cannot be understated in LH’s case in my estimation. Given that a substantial portion of its last 3-years of revenue continues to diminish, it’s top-line currently remains unhedged to this downside risk. However, LH’s ability to compound capital at its [double-digit] long-term rate of return suggests it can overcome this hurdle by growing NOPAT-level earnings, thereby adding value in this regard. More weight is placed here given the trailing return comfortably outpaces LH’s WACC of 8.21%.

Technical factors also supportive

Seeing as there’s a number of variables at play with LH’s earnings structure the market has been quite active on this stock YTD. I specifically wanted to gauge how the latest revenue downside has been perceived by the market, and what this means in terms of valuation/price distribution. Technical studies are therefore essential in understanding LH’s price visibility outside of fundamentals and strength of the order book.

As seen in the chart below, price action as tipped bullish since October with shares now trading above the EMA after crossing below this mark back in August. Long-term trend indicators [on-balance volume, momentum] also suggest a continuation of this trend with both measures curling up at the same time in unison with price distribution.

Exhibit 4. Shares turning off 52-week lows in October with trend showing heavy support from OBV and momentum studies

Question then turns to what price levels we can expect from this latest upside move. As seen in the chart below, tracing fibonacci levels down from the August high indicates the stock has already retraced ~50% of the downside, and is currently testing this level once more. In order to really confirm the bullish trend, we’d need to see the daily bars break above the $231 level where the next test would be $239, followed by a target to $249, or ~78.5% of the August high. Therefore, technical price targets lie at $239 and $249. This is beneath our previous price target of $279-$289.

Exhibit 5. Currently testing the 50% retracement level from the August high where bars must break through in order to register price objective of $239.

Valuation and conclusion

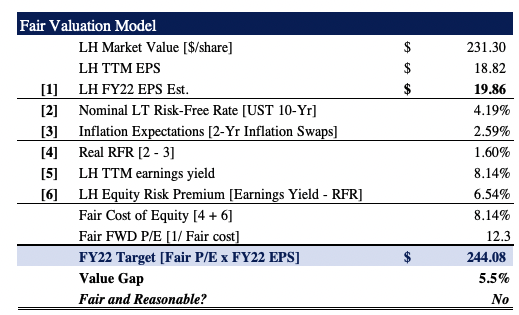

The remaining LH investment debate hinges on valuation, and the marriage between fundamental and technical drivers to the stock. We’ve projected FY22 EPS to pull-back by ~30% YoY to $19.86. As seen in Exhibit 6, this lends investors an equity risk premium of ~6% in LH [LH earnings yield spread over real risk-free rate]. For perspective, this rests in-line with the yield on many high-quality corporate bond issues, placing questions on the prospective risk/reward symmetry.

We therefore believe the stock should trade at 12.3x forward earnings, slightly behind the 14.1x forward P/E the market has it priced at. With our FY22 EPS forecasts and the model observed below this suggests LH is worth $244, which, coincidentally is the arithmetic mean of the two technical targets identified above. Whilst the value gap is relatively small in percentage terms, it aligns with previously outlined analysis, thus we reiterate the buy call on this name.

Exhibit 6. Fair value of $244 which is arithmetic mean of technical price targets identified above

Data: HB Insights Estimates

Net-net, I reiterate LH is a buy on valuation, backed by a coupling of fundamental momentum and favourable chart studies. Shares look to be fairly valued at $244 apiece, corroborating previous analyses we’ve conducted on this name. Rate buy, $244 price target.

Be the first to comment