Sergei Ramiltsev/iStock via Getty Images

Business

L.B. Foster Company (NASDAQ:FSTR), founded in 1902 in Pennsylvania, is a global solutions provider of engineered, manufactured products and services that support infrastructure projects. The company maintains locations in North America, South America, Europe and Asia. 75% of sales are generated in the US, with 12% in Canada and 7% in the UK.

Rail Services (58% Sales): Technologies used to enhance safety, operational efficiency and customer experience. Railway track components, advanced onboard, wayside and on-rail applications. The segment also offers contract project management and aftermarket services. Backlog is historically around $100m.

Precast Concrete (14%): Highly customised, multifunctional buildings and ground precast concrete products that support a variant of infrastructure needs. The company is a leading, high-end supplier of precast buildings in terms of volume, product options and capabilities. Post FY20, operations are conducted from a new facility in Boise, ID to focus on regional growth opportunities and logistical savings associated with manufacturing products in more centralised locations closer to the company’s customer base. Backlog is historically $70m and a good part is in buildings and restrooms for state projects (Pre VanHooseCo Acquisition)

Steel Products (30%): Corrosion protection coatings and measurement systems for transportation of liquids and gas pipelines, and steel fabrication solutions for bridges and commercial waterfall irrigations systems.

Main raw materials include steel, aggregate, epoxy and electronics. FSTR sources materials from both domestic and foreign suppliers with no dependency on a single supplier. Sourcing-wise, the biggest issue is identified on the Protective Coating division which is dependent on two suppliers for epoxy coating.

Based on the new strategy, Precast Concrete and Rail Technologies are key areas of growth given product portfolios and unsaturated markets. Playbook also outlined the need to divest in the Piling Business which had become increasingly commoditised and working capital intensive. Proceeds from this divestment were used to pay down RCF allowing for financial flexibility to pursue strategic objectives.

FSTR competes in a highly competitive market mainly on product availability, quality, service and price. Management claims that no other company offers the same product mix to various markets but there are companies that compete in each product line.

Infrastructure Spending

The Great American Outdoors Act (Jul-20): Addresses the multi-billion dollar deferred maintenance backlog at US national parks and public lands. The program provides up to $1bn per year for five years to restoring federal lands. FSTR manufactures concrete buildings for national state, and municipal parks such as restrooms, concession stands and other protective storage buildings, as well as sound walls, burial vaults, bridge beams and other customer products for applications in a wide range of infrastructure projects.

Consolidated Appropriations Act (Dec-20): $2.3tr which combines Covid-19 relief and an omnibus spending bull for 2021, which includes $14bn in relief for transit infrastructure as well as $86.7bn in omnibus spending allocated to the US department of Transportation. Funding for transportation and rail generates opportunities within multiple lines of business within the Rail Services segment. Precast Concrete and Steel products are also benefited.

American Rescue Plan Act (Mar-21): Provides $30.5bn in grants for transit agency operating expenses and $1.7bn to Amtrak to support its rail network as part of Covid-19 relief efforts. As described previously, rail spending benefits Rail services segment.

Infrastructure Investment and Jobs Act (Nov-21): A program dedicated to transportation infrastructure inklings repair of bridge nationwide, rail safety and efficiency support, modernisation of highways and expansion of public transit, investment in passenger rail service and improvement of ports, waterways and water systems. Multiple lines of business are benefited from this program.

…we’re seeing quite a bit of bidding activity and quoting activity related to the Infrastructure Jobs Act from just over a year ago. But we’re not rolling that through our facilities yet, but we do anticipate that to happen coming in the first quarter, second quarter of next year – 3Q22 Earnings Call

Capital Allocation

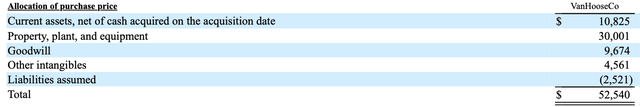

Management is trying to transform the business into technology-focused, high-growth infrastructure solution company which would allow to access a wider market in the UK and western Europe. Based on this strategy, management completed the divestment of trackable business in Canada for $7.8m and Piling Products division for $23.9m. Piling Products division generated $60.8m and $59.2m in FY21 and FY20 respectively. Proceeds were used to partially finance the $52m VanHooseCo acquisition (7-7.5x Forward EBITDA) in Aug-22.

VanHooseCo generated $28m in sales in FY21 and expected to be margin accretive for the precast segment. The question here is who pays $52m for a $28m sales business that looks marginally profitable.

VanHooseCo serves the commercial, industrial and residential infrastructure markets. 95% of VanHooseCo customer base is nongovernment hence it balanced out existing client portfolio which is more weighed towards government and private investment projects. Acquisition also adds insulation capabilities to the current precast portfolio among other valuable IP.

Based on the 3Q22 results, acquisition price includes $30m PP&E and $9.7m goodwill. However, the asset base includes investment on a second facility (Knoxville-Lebanon) that is coming online post acquisition date. Management expects to see revenue growing, with the addition of the new site, in the following quarters with gross profit margin reaching 28% and EBIT margin reaching 25%. WC needs is similar to the legacy business at 20% of sales. Ongoing maintenance capex needs should be close to $1m (3% of sales) going forward.

VanHooseCo generated $6.4m sales and $397k EBIT in 3Q22. So it is definitely a wait and see acquisition, particularly in a tricky macro environment. State projects are generally viewed as more stable sources of revenue in downturns but commercial and industrial activity could be impacted. If management assumptions are any close to reality, then price is not unreasonable.

Risks & Concerns

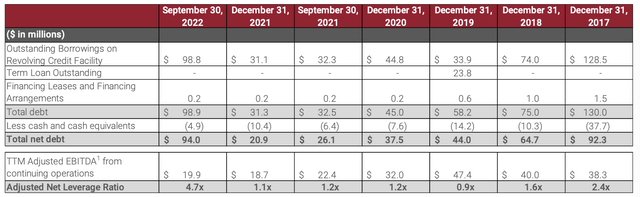

Leverage: In Aug-22, management amended the credit facility to obtain approval for the VanHooseCo acquisition and temporarily modify certain covenants to accommodate the transaction. Maximum leverage ratio through Dec-22 is 4.0x. As of Sep-22, gross leverage ratio was 3.3x but cash generation should support deleveraging by yearend. Floating debt also adds an extra layer of risk that should be monitored. Long term, management targets a leverage ratio at 2.0x. Worth noting that FSTR holds $6.2m cash in various locations outside the US, with an intention to repatriate in case cash balances in Canada and the UK exceed projects’ working capital needs.

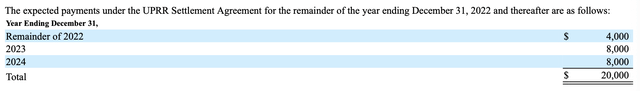

Union Pacific Settlement: In Mar-19, FSTR entered into a settlement agreement with UPRR to resolve a pending litigation. Under the settlement, FSTR and CXT subsidiary should pay UPRR the aggregate amount of $50m without pre-judgment interests, which began with $2m immediate payment and the remaining $48m paid in instalments over a 6-year period ending in Dec-24. Additionally, commencing in Jan-19 and through Dec-24, UPRR agreed to purchase and has been purchasing from the company a cumulative total amount of $48m of products and services, targeting $8m of annual purchases. In 3Q21, FSTR divested its Piling Products division and the target annual purchases reduced to $6m until Dec-24.

Inflation: FSTR has faced significant inflationary headwinds across most of the business that adversely impacted margins in the 1H22. In 3Q22, mitigation efforts slightly improved margins, particularly within the precast business, with margins improved both YoY and sequentially. According to management, inflation including labor rates is expected to continue to put pressure on margins across the business. Projects signed in 2021 and 1Q23 will be gradually delivered hence new contracts should come with improved margins.

“So much of those type of projects could have a long gestation period, Chris, where they go 6 months to a year. So we booked a number of those jobs in 2021, and we were helped with very little ability to increase our price. So we just had to work them through the backlog. And we did that in the fourth quarter and first quarter and second quarter of this year. So we feel very good where we’re sitting today. We were able to go get price where we need it and work off that backlog that was we call constrained. So the future looks very good in that business for us.” – 3Q22 Earnings Call regarding Precast Segment

Midstream Pipeline: The Coatings and Measurement business unit continues to be affected by the ongoing depressed level of infrastructure investment in the midstream pipeline markets despite rising energy prices. Demand remains depressed compared to historical levels as pipeline projects continue to be deferred.

Valuation

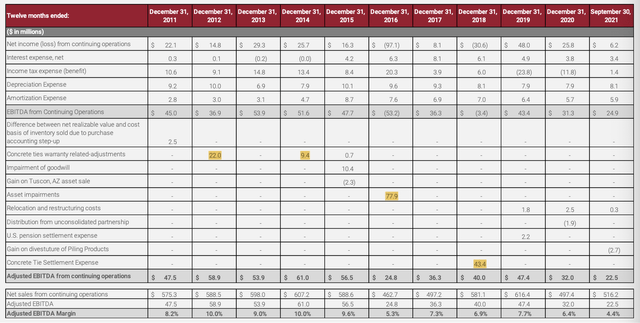

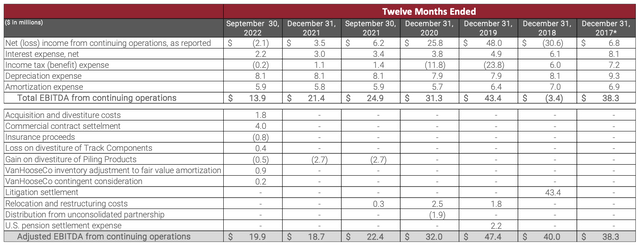

During the CMD presentation in Dec-21, management announced FY25 Sales target at $600m of which $100m will come from organic growth and $150m from acquisitions. Management sees 21% gross profit margin and 8% EBITDA margin as attainable. Based on the last 10-year history and excluding one-offs, FSTR was able to deliver 8% Adj.EBITDA margin hence such a target doesn’t sound unrealistic. Tables below summarise the adjusted items over that period and makes me a bit more comfortable about the special nature of these items.

FY21 Investor Presentation 3Q22 Investor Presentation

Despite the low margins, FSTR rarely posted operational losses while FCF excluding the lumpy working capital was generally positive. In a base case scenario where FSTR generates $550m sales, 7% EBITDA margin and $6m capex, it should make $20m FCF by taking into consideration settlement payments and ignoring share-based compensation given the relatively steady share count (partially matched with buybacks). In case management achieves $600m sales by FY25 and 8% EBITDA margin, then $30m FCF will not be unrealistic. At current price level, FSTR should offer more than 70% upside.

In Aug-22 and Sep-22, insiders W. Thalman (CFO) and J. Kasel (CEO) acquired shares at $11.5 to $15.2 price level. Opening a position at a lower price level builds some further confidence.

At current price level ($9.7), FSTR trades at 1.0-1.1x TBV. Multiple does not provide a discount to the tangible value but at least protects the downside for a massive decline and a permanent capital loss.

All things considered, infrastructure spending coupled with the yet to deliver VanHooseCo acquisition and the potential deleveraging, offer an interesting investment thesis that is not straight-forward by simply looking the reported numbers. At least a thesis, worth monitoring for signs of margin recovery and market normalisation.

Be the first to comment